The COVID-19 pandemic has forced many companies to revise their strategies and budgets in preparation for...

Because of Covid 19, businesses have faced unprecedented and potentially life-threatening challenges. This has highlighted the importance of using FP&A Predictive Analytics to stay ahead of the curve and take corrective action on time. At the FP&A Webinar, the panel of three high-profile speakers discussed the challenges, lessons and benefits of Managing Uncertainty with FP&A Predictive Analytics.

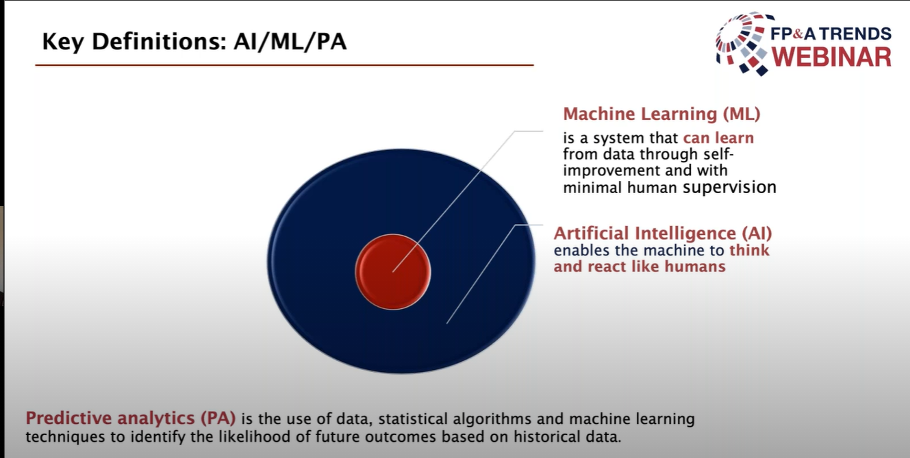

Key Definitions

Larysa Melnychuk, Founder and CEO, FP&A Trends Group & International FP&A Board, kicked off the webinar by introducing the participants. She also shared the basic definitions of Machine Learning (ML), Artificial Intelligence (AI ) and Predictive Analytics (PA), as shown in Figure 1:

Figure 1

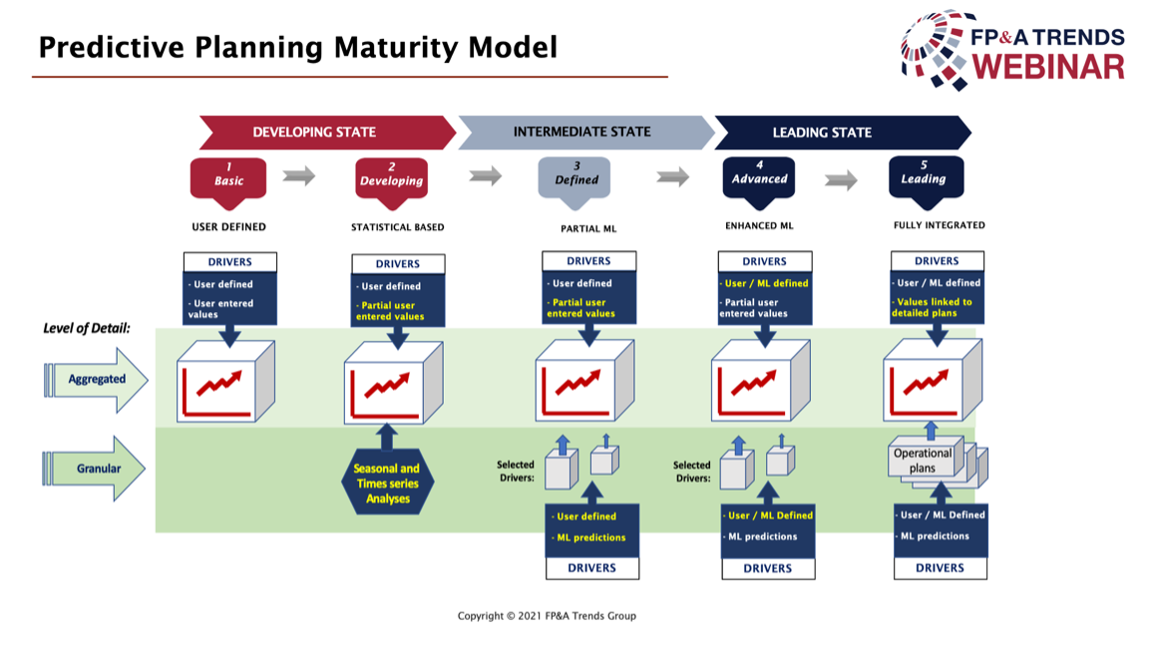

Larysa also touched upon the maturity of organisations moving from traditional planning to predictive planning.

The below picture (fig2) gives a great overview of this process:

Figure 2

The webinar covered professional views on the three crucial aspects of Predictive Analytics (PA):

Human Intelligence (the FP&A practitioner view)

Using PA for Forecasting (the Data Scientist view)

Role of technology in PA (the Technology expert view)

Let’s look at each of these in more detail.

1. Human Intelligence

Frances DeBlasio, VP of Financial Planning and Analysis at Cars.com, began by sharing her experience of human intelligence and how it influences PA. She defined PA as the “resources, tools and processes involved in generating an expected outcome based on certain underlying assumptions”. Frances emphasised that she has always depended on human intelligence and robust processes when building her PA models.

Frances shared her experience at United Airlines following 9/11. Like many of its peers in the industry, the airline faced a crisis of gargantuan proportions. United Airlines responded by using Human Intelligence to understand the cost behaviours. To match the lag in operational cost savings from retiring certain aircraft, they introduced an “inefficient component”. They also prioritised proper communication to the top management, and the need to keep their expectations realistic. Frances recommended continuing to invest in Human Resources and robust processes, whilst starting with a limited scope in ML adoption. This can be increased gradually as the accuracy improves.

2. Using PA for Forecasting

According to Adri Purkayastha, Group Head of AI and Digital Risk Analytics at BNP Paribas Group, adopting ML and deep Learning allows future outcomes to be anticipated more accurately than with traditional data analytics. He reiterated how these technologies can help management to predict the customer segments that would propel long-term profitable growth, and to optimise the costs of acquiring these customers. He also emphasised that the foundation of effective advanced analytics is judgement, which in turn comes from human intelligence.

He further touched upon the tenets for successfully applying ML for FP&A:

Financial planning activities must be intelligently broken down into smaller parts to perform forecasting operations

FP&A analysts and data scientists must share a common ML modelling framework, and work together on a generic computation platform for collaborative solutions

Frequently refreshing data is vital when re-training models to consider the changing environment

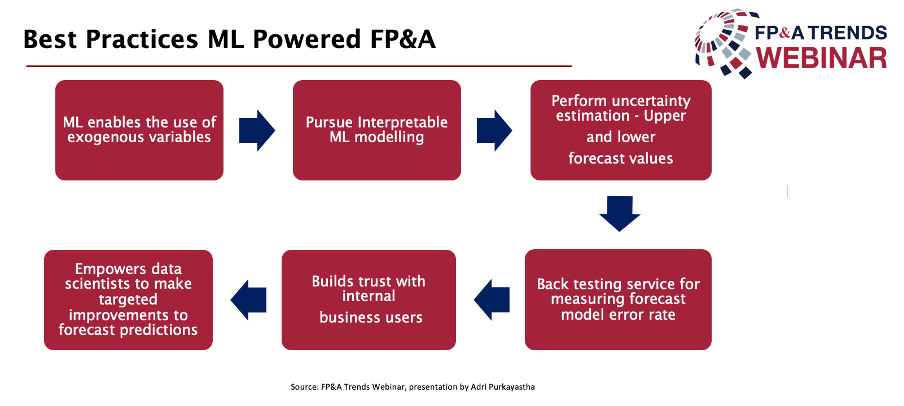

He also explained some best practices in ML-powered FP&A(Figure 3):

Figure 3

Adri concluded with the key components of a human-centred ML system:

an end-to-end system for continuous forecasting

a scalable platform (preferably cloud-based)

linking business metrics to forecasted values

using appropriate UI to support real-time collaboration for scenario planning

3. Role of technology in PA

The final speaker was Francesco Morini, Global Director for Analytics & Innovation at CCH Tagetik. He started by illustrating how the data points and their co-relation must be viewed and understood very carefully. He gave a telling illustration of wrong correlations by presenting a 99.26% between the divorce rate in Maine vs the per capital consumption of margarine. It is obvious that the two are not related, despite what the data suggests. It is therefore important to remember that correlation does not always mean causation, and care needs to be taken to ensure those wrong interpretations don’t lead to wrong decisions.

Francesco suggested that the transition to more complex tools has to be gradual and well planned. Companies must first learn to crawl before they can learn to walk and then finally run. This means initially expanding their horizons to more drivers and operational inputs before progressing to more complex driver-based analysis assisted by ML.

Francesco then detailed the 4 common pain points of practical rollouts of ML/AI:

They are often not easy to use

AI/ML is not integrated properly with FP&A technology

FP&A tools are not integrated effectively with the ERP system

AI/ML are not connected causally with financial and operational drivers

He then argued that the single solution for these complaints is technology.

He concluded by recounting the important pillars of a successful ML system in FP&A. The system should add value to the business user by showing functional value. It can do this by automatically selecting relevant features, tweaking models for the best results, selecting the best model among possible alternatives, and using Native Language Generation technology to put the final numbers into relevant text.

Conclusion:

In conclusion, the panellists listed the success factors for embarking on a predictive analytics journey. First, the right drivers must be identified, sufficient data must be gathered, and the proper testing must be done before decisions are taken. The human intelligence factor is also crucial since new factors keep emerging to change the drivers. Finally, the panel concluded that effectively marrying robust processes with the right technology is essential for the success of a fail-safe PA model.

We would like to thank our global sponsors and partners, CCH® Tagetik, for their great support with this Digital FP&A Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.