The COVID-19 pandemic has forced many companies to revise their strategies and budgets in preparation for the "new normal". In times of such unprecedented uncertainty, complexity and risk, Scenario Planning and Predictive Planning processes came to the forefront of the management teams and FP&A professionals.

The COVID-19 pandemic has forced many companies to revise their strategies and budgets in preparation for the "new normal". In times of such unprecedented uncertainty, complexity and risk, Scenario Planning and Predictive Planning processes came to the forefront of the management teams and FP&A professionals.

The Digital UK & Ireland FP&A Board looked at the key factors that are needed for the successful implementation of Scenario Planning and Predictive Planning.

This article provides an overview of the related case study and topics presented and discussed by the SME panellists, as well as the results of our polling questions.

From Driver Based Forecasting to Scenario Planning: Medtronic (EMEA) Case Study

Medtronic’s journey towards Scenario Planning started in 2017, not so much triggered by volatility but more by the FP&A team’s willingness to become a much better and efficient partner to the business. This was in response to the internal survey that showed that FP&A teams spent over 40% of their time on producing forecasts and less than 15% on business partnering activities. The teams were questioning the value of the time spent ‘on all this forecasting’.

After careful consideration on how to extract much more value from forecasting activity while spending significantly less time on it, it’s been decided to

adopt a driver-based approach to forecasting, model strategic levers and resource allocations;

build an integrated FP&A eco-system through standardising, centralising and integrating core FP&A processes in the FP&A Centres of Expertise.

Fast forward to 2021, the team has achieved massive progress on the expenses forecast, which is fully driver based today. The full process can be run in a couple of days by 5 people when it used to be weeks with 40 people involved. Individual expense scenarios (e.g. travel) can be run at a granular (e.g. employee) level in a couple of minutes. Equally, key revenue scenarios have been identified and can be modelled quickly.

Reflecting on the lessons learnt, Nahuel Rozas Delpit, Finance Director, Head of FP&A EMEA at Medtronic, stressed that it’s important to recognise that it’s going to be a long journey involving re-definition of the FP&A team mandate from mainly a producer of financial information to a strategic business partner. He identified the following two Critical Success Factors:

Creation of the Integrated FP&A eco-system (re-thinking how data should be organised and governed and re-design of the end-to-end processes and systems). Digitalised smooth and fast scenario planning and reporting processes are only a visible tip of the iceberg.

Strong Change Management, starting from the Leadership team whose support and sponsorship is paramount, as well as the FP&A teams so they are able to fully own and execute their new mandate.

Medtronic’s further ambition is to continue to develop Agile Thinking within the FP&A teams and have capabilities to easily build very simple scenarios but relying on very rich reliable detailed data set at their fingertips.

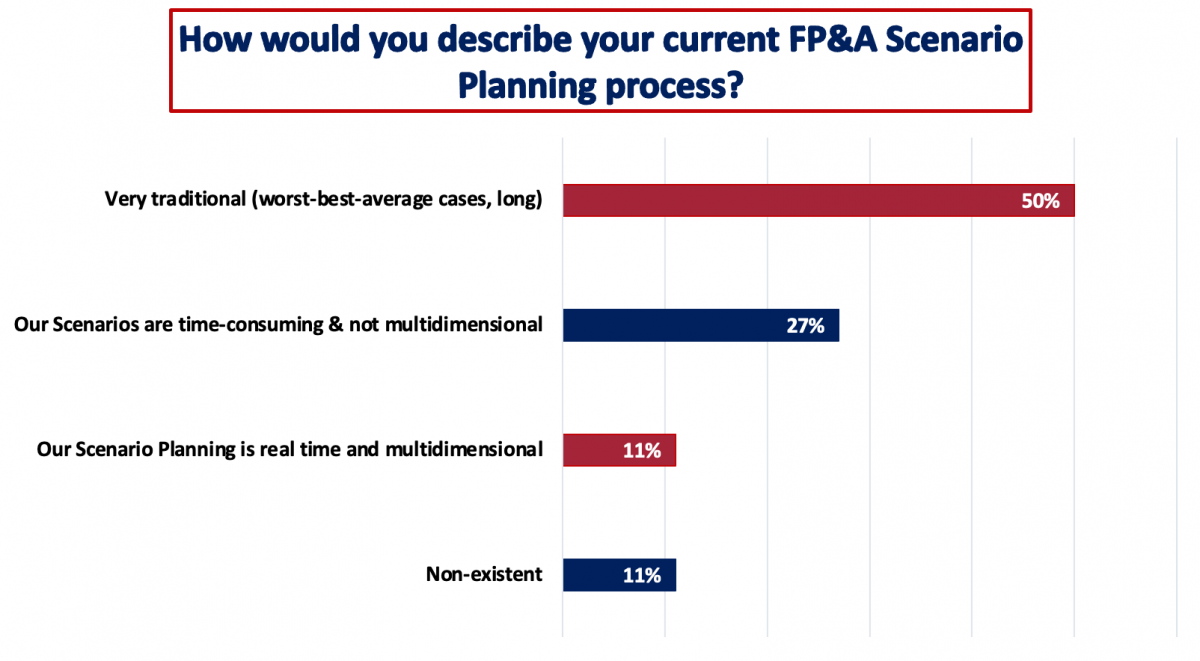

Figure 1

Figure 1 demonstrates the results of the first polling question and as we can see half of the participants are still very traditional. All panellists agreed that it’s important to just get started on the journey of maturing Scenario Planning process, and it is encouraging to see that many companies are moving in the right direction.

FP&A Teams and Skills Required in Uncertain Environments

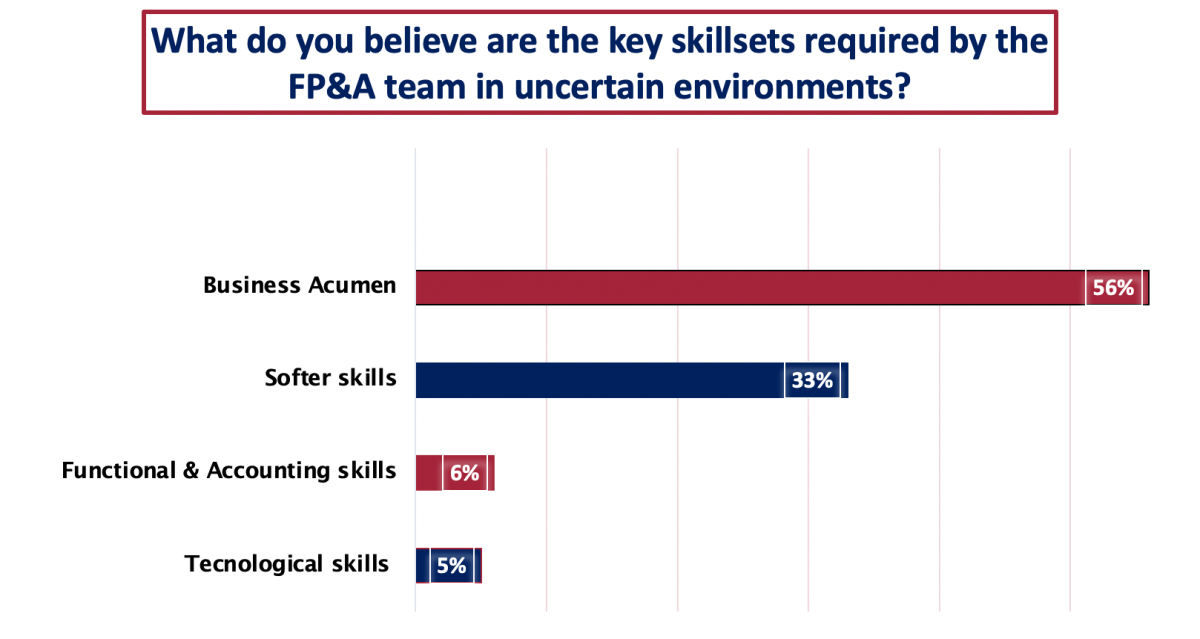

Abby Obomighie, Group FP&A Director at Spectris plc, believes that for an FP&A team to be agile and ready to support the business in a highly uncertain and volatile environment, it needs to balance and continuously develop both technical (finance and accounting, data analytics, new technologies etc) and ‘human’ or soft skills such as collaboration and relationship building, communication etc). Leadership’s commitment to creating the right environment/culture is a critical success factor in developing such agile high performing FP&A teams.

All participants were then asked to vote and the results of the poll are shown below (Figure 2) :

Figure 2

How to Start Your Predictive Analytics Journey?

Predictive Analytics (PA) has been around for quite a long time, but its adoption in the Finance community has been relatively low. Partly, this is because people don’t know where to start and how to use it effectively.

There are three elements to the journey: mathematics, technology and people. Whilst the mathematical element is not new and a couple of known methods (regression analysis and time series) dominate the algorithms used in PA, the increased availability and low cost of technology, driven by Open Source, gives us the ability to work with large volumes of data. But not only that, it can handle many more variables at a time. Tanbir Jasimuddin, Finance Director at Vardags, has provided a few interesting examples and useful resources such as Kaggle.com, an online community of data scientists and machine learning practitioners, with lots of educational resources on PA, Machine Learning and related topics.

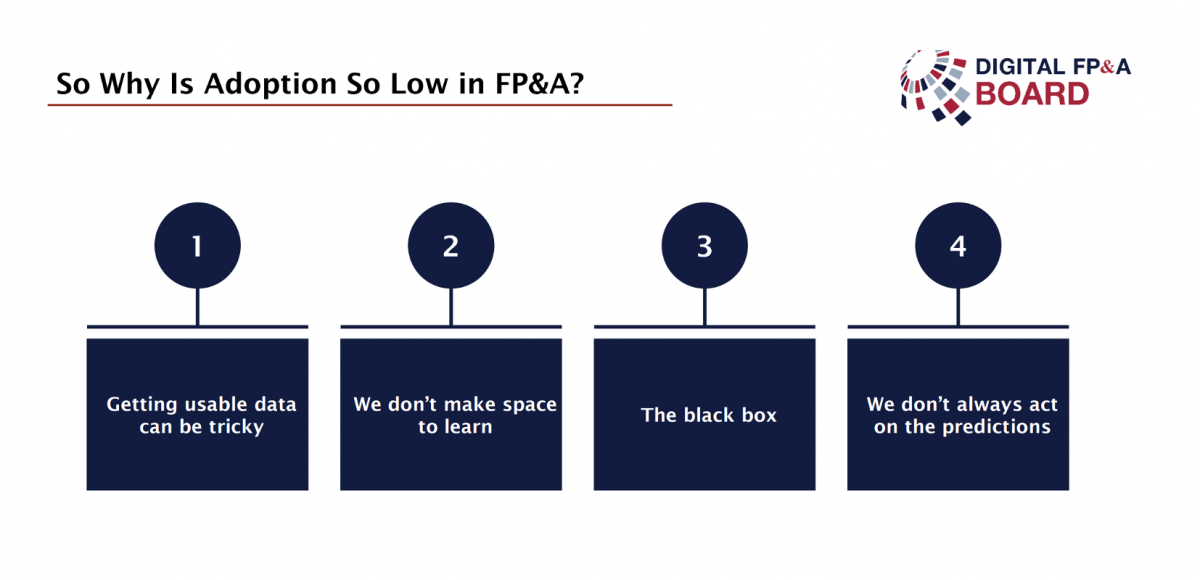

Reflecting back on why adoption of PA in the Finance community (the People element) is relatively low, Tanbir has identified four key reasons (Figure 3) :

Figure 3

In order to increase the adoption of PA, FP&A professionals should:

develop a growing mindset and be comfortable with the data and outcomes being ‘almost right’ rather than ‘precisely wrong’

be comfortable with not having visibility of all the underlying algorithms and rely on technology (having tested the models)

invest time in continuous development getting off the hamster wheel of BAU activities

encourage the business and themselves to actually act on predictions.

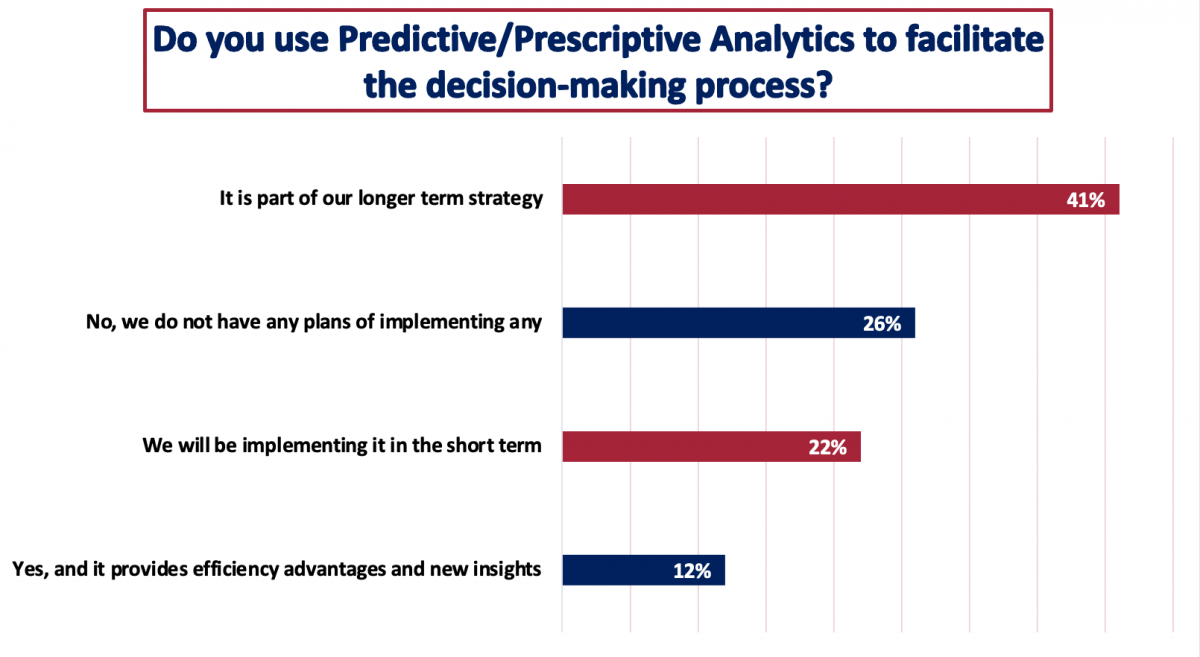

We had the next poll (Figure 4) and it was great to see that 63% of participants and their companies are planning to start using PA in the short or longer term.

Figure 4

The Role of Technology for Scenario Planning and Predictive Planning

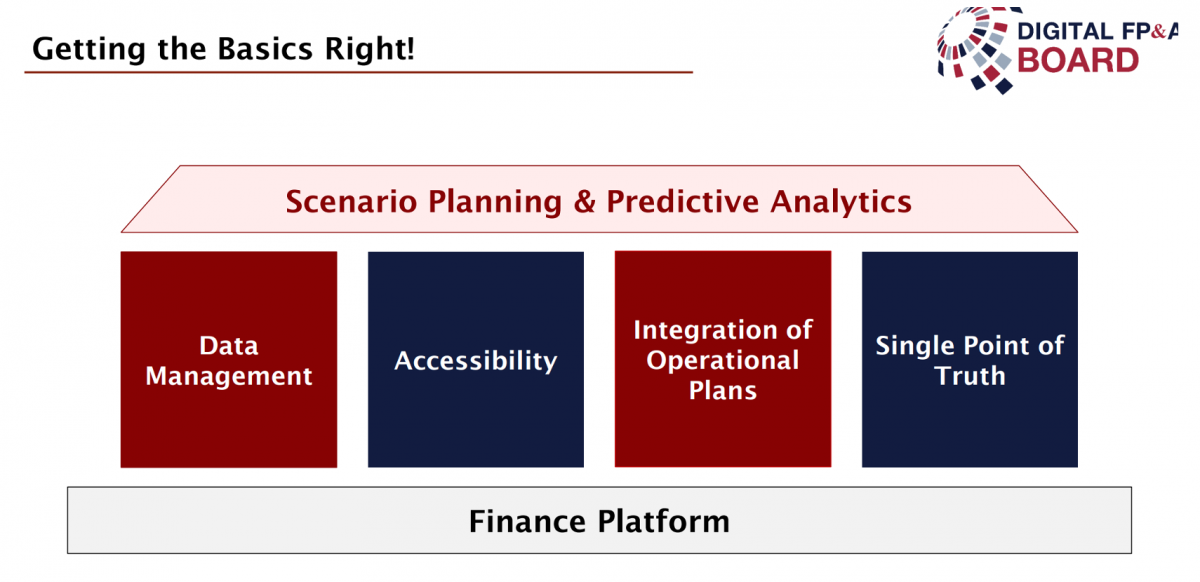

Before starting the session about the role of Technology, Alexander Hermes, Principal Consultant at CCH Tagetik, a Wolters Kluwer company, was keen to stress the importance of getting the Basics right and ensure the four components shown below (Figure 5) are in place.

Figure 5

Alex then talked us through a case study of creating an integrated planning process at a manufacturing company where operational plans have been integrated with the corporate financial plan. Different measures and drivers in operational plans could be switched on and off to produce various scenarios.

Once all the basics are in place, Machine Learning (ML) models can be used by the business users, to try and re-create the past using the actual data, and in the process identify the key variables/business drivers. Once identified, these models can be used to help plan future outcomes.

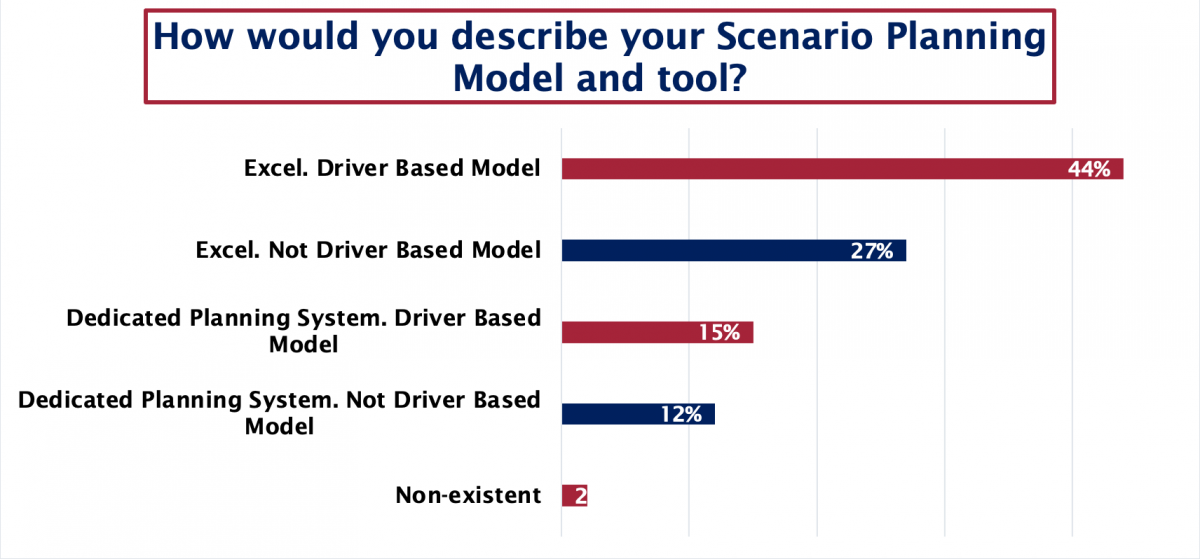

The final poll showed that unfortunately the majority of participants is still relying on Excel as their key planning tool (Figure 6), which might be due to various reasons, e.g. a perceived high cost of implementation, past failed implementations due to not having the basics right prior to implementation, a lack of growth mindset etc.

Figure 6

Conclusions

It’s not a fast and easy journey, patience is important. Be humble, be agile, test, fail, learn, adjust. But when you get started, the journey is exciting!

FP&A professionals need to find time to learn and develop, otherwise they’re continuously going to be fighting the latest fire. So, make that time, experiment, fail fast and learn from it and keep pushing forward!

The Digital UK & Ireland FP&A Board was sponsored by Wolters Kluwer, we are grateful for their continued support. We also would like to thank Hans Gobin for facilitating the meeting and our panel of experts for their time and valuable contributions.

To watch the full recording of the session, check out this link.