The Middle Eastern FP&A Board hosted a digital session on 24th May 2021 discussing the power of FP&A scenario planning. The discussion touched on the following topics:

The Middle Eastern FP&A Board hosted a digital session on 24th May 2021 discussing the power of FP&A scenario planning. The discussion touched on the following topics:

Best practice scenario planning and use of technology

Forecasting in uncertain environments

Scenario management: quick, multidimensional and collaborative

Evolution of FP&A scenario planning – A case study

FP&A recruitment in the Middle East

Forecasting vs Scenario planning

FP&A is no longer just a reactive part of an organisation. It has now become a proactive partner in the business planning process. The modern FP&A is responsible for running multiple scenarios to equip the business decision-makers with a rich data set. This in turn helps business leaders to zoom into the future world from different visions and perspectives shaping the future actions and overall direction.

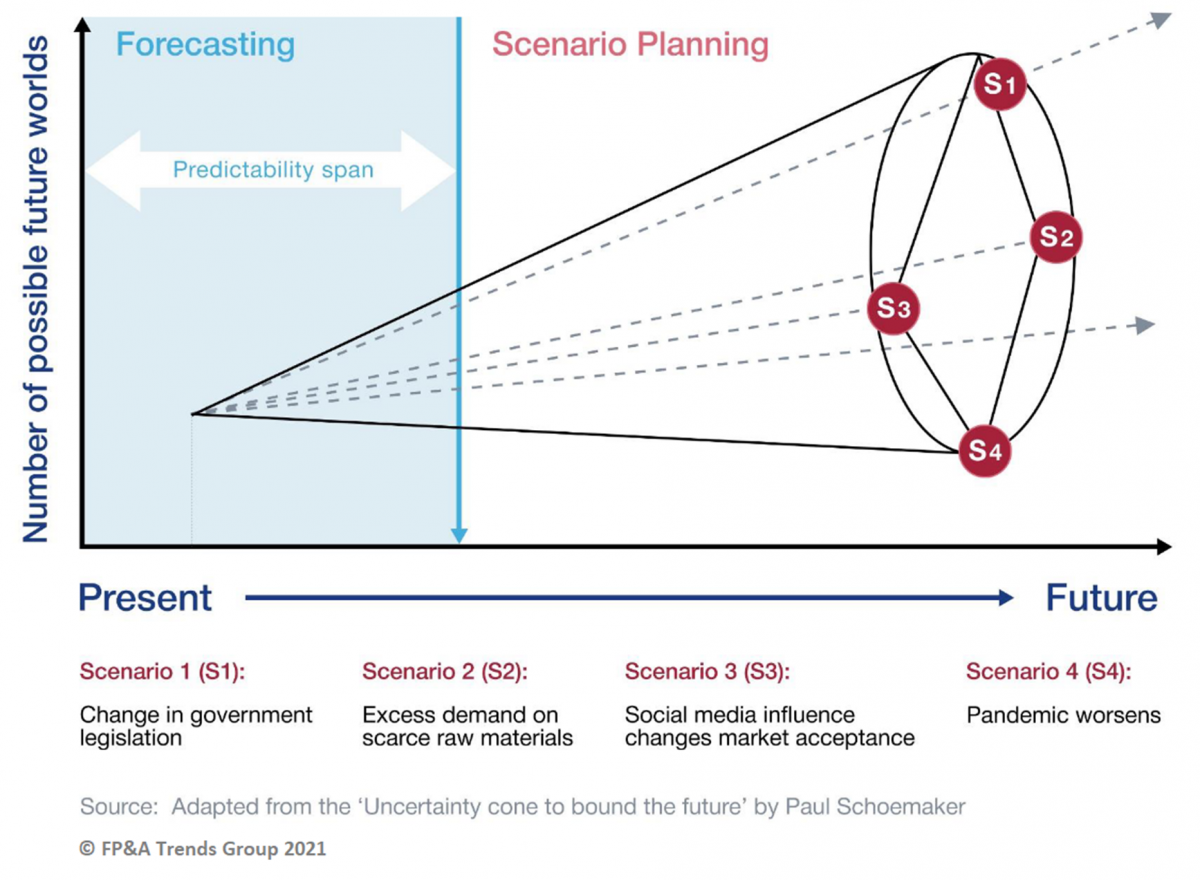

An interesting view on this topic was shared by Paul Schoemaker who introduced the “Uncertainty Cone” (the image below) to illustrate the difference between ‘Forecasting’ and ‘Scenario Planning’:

‘Forecasting’ can be defined as an act of assessing the organisation’s performance over a set period in the future. Paul Schoemaker calls this period the predictability span. The forecast drivers are believed to be reasonably predictable over this timeline.

Anything farther than that falls under ‘Scenario Planning’ which evaluates what the world would look like under different scenarios.

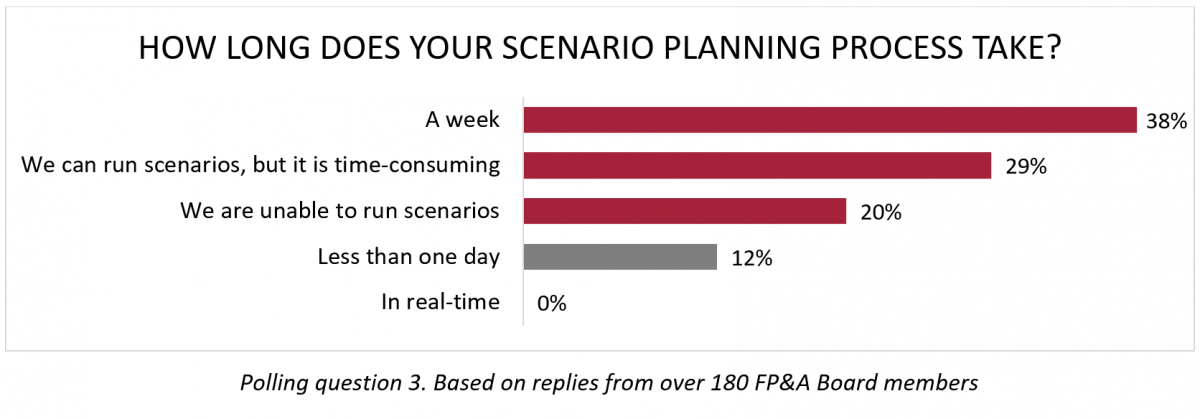

Scenario management also distinguishes itself from traditional forecasting exercises. It is highly driven by demand-based drivers whereas traditional planning stems from negotiated budgets. The method of actual modelling for these two activities also reflects the same. Another differentiator between them is the amount of time taken to complete each activity. Where traditional planning takes between 1-3 months, scenario management is expected to be finished in a few days, at the most, if not hours.

Technology in Scenario planning

Based on the presentation by Arun Sadagopan, Director – MEA at Jedox

During the past year, most businesses across the entire world lead by their FP&A teams have come to terms with another layer of planning beyond the standard forecasting exercises by doing something known as ‘Crisis Planning’.

Regardless of the industry, the fundamentals used for scenario planning is heavily driven by

Scope identification

Setting up clear objectives and focus points

The time frame for an end-to-end activity invading decision making and execution

An enterprise performance management tool can leverage organization’s capabilities for planning, analytics and reporting for various facets of the business including Sales, HR & Procurement in addition to Finance.

Such tools use key business and value drivers as a basis for creating different scenarios. The data used to model these scenarios should pass the health checks. It should be time-sensitive and sourced from different systems. In this case, technology unlocks the value chain focussing on

Real-time collaboration

Integrated planning, budgeting and reporting

Creating value-based forecasts

Forecasting in uncertain environments

Based on the presentation by José Nazario, FP&A and CCAR Director – Global Consumer Banking at Citibank

After the 2008 financial crisis, governments across the world, especially in the US, introduced new regulations to keep the financial system more stable. Regular stress testing is an important aspect of this which has allowed banks across the world to better prepare for future uncertain events. Banks operating in the US, including Citibank, need to run these stress tests scenarios every quarter. This mainly includes running 8 scenarios:

6 internal scenarios:

One internal base scenario

One internal stress scenario

Four sensitivity scenarios

2 external scenarios (for submission to authorities):

One base scenario, and

One severely adverse scenario

So, how does Citibank achieve this?

By using a combination approach between 2 systems:

RUBY forecasts the total Citi balance sheet (~$2 Trillion USD), Revenue and Expenses for the next 60 months. Ruby is a complex tool that produces forecasts for the whole company in less than 1 hour, which previously would take more than a week to forecast for only a defined set of planning units. It is a single source of the forecasted balance sheet which executes about 200 complex econometric models and 8600 products globally.

Citi Risk looks at credit risks and potential costs to the bank.

Both systems are driven by a complex group of models with a plethora of internal and external drivers. The exercise is heavily defined by the continuous engagement between FP&A, business, treasury & risk teams. The output of this exercise is then used for submissions to the external authorities.

What results did Citibank manage to achieve? It has helped them to identify current/future risk, relevant scenarios and their corresponding business implications. It has also allowed the bank to meet the regulatory requirements and better prepare for any future recessions making the business resilient.

Scenario management: do’s and don'ts

Based on the presentation by Aravinda Tiwari, Senior Director (Finance, Business Transformation & Org. Effectiveness), IQVIA

Scenario planning and its management require a specific work approach:

Define scope, issues and time horizon

Define key drivers

Collect and analyse data

Develop scenarios

Apply scenarios

Maintain and update

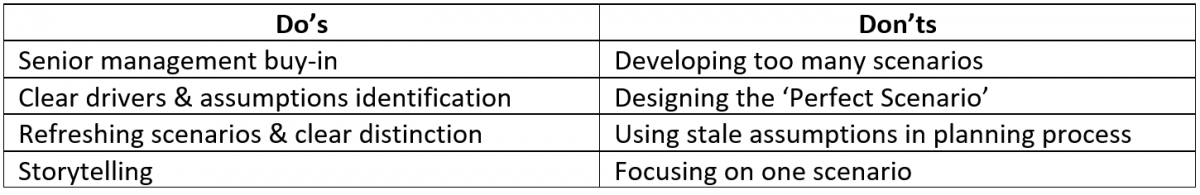

What’s important to note is that there is no perfect scenario. A good approach is to develop a minimum of 2-4 scenarios and taking it further by assigning task force and adjusting budgets and forecasting numbers for each scenario. Regular updates should be part of the process to ensure that scenarios stay relevant.

The key do’s and don’ts for scenario planning are as follows:

Evolution of FP&A Scenario Planning: A Case Study

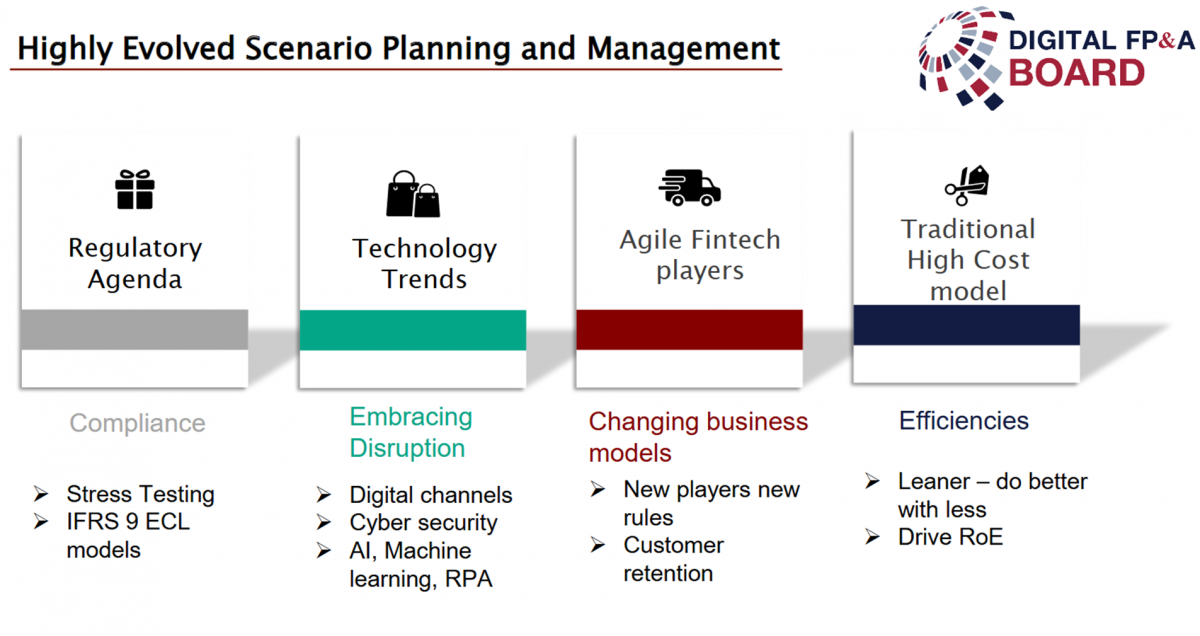

Based on the presentation by Ramkumar Balasubramaniam, Head of Finance, Middle East at Barclays

Scenario Planning in today’s world has evolved quite a bit compared to how it used to be earlier. The approach used now has multiple facets:

Strategy

Drivers

Financial Risks, and

Non-Financial Risks

The methodology has now become more susceptible to internal and external changes. A good example of this was witnessed during last year and a half while the world was accepting COVID-19 as the new reality. At Barclays, an important goal during COVID was to help affirm the idea that the bank exists to serve real people, to support real businesses, to develop real economies and to contribute to real communities. The bank attained this by using a firm-wide integrated approach encompassing employees, business & customers.

Some of the new ways of doing the traditional planning exercises were impacted by

Significant impact on profitability and credit management

New customer relationship models

Accelerated adoption of digital channels

Embracing diversification

Operational resilience and business continuity management

Introducing new commercial operating models

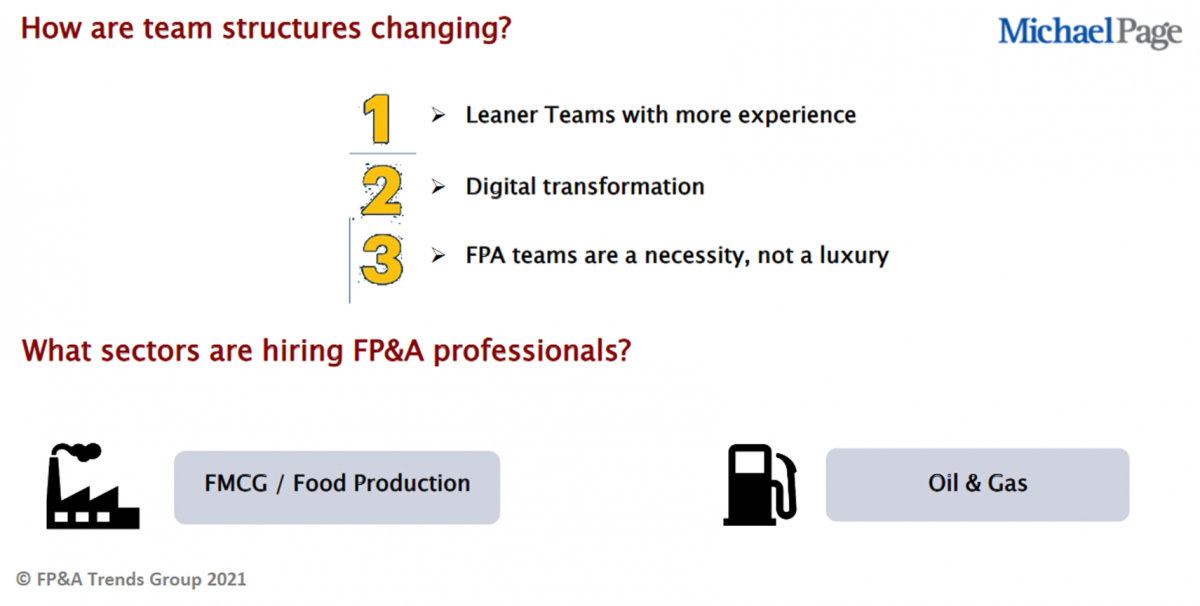

Latest trends in FP&A recruitment in the Middle East

Based on the presentation by Bindita Baksi, Consultant – Finance and Accounting at Michael Page

Bindita shared an overview of the latest trends in the job market for FP&A professionals and the ongoing opportunities.

Employers are looking for specific skills for these roles which include the following:

scenario planning

proactive risk management

business transformation

business partnering

communication skills

Conclusion

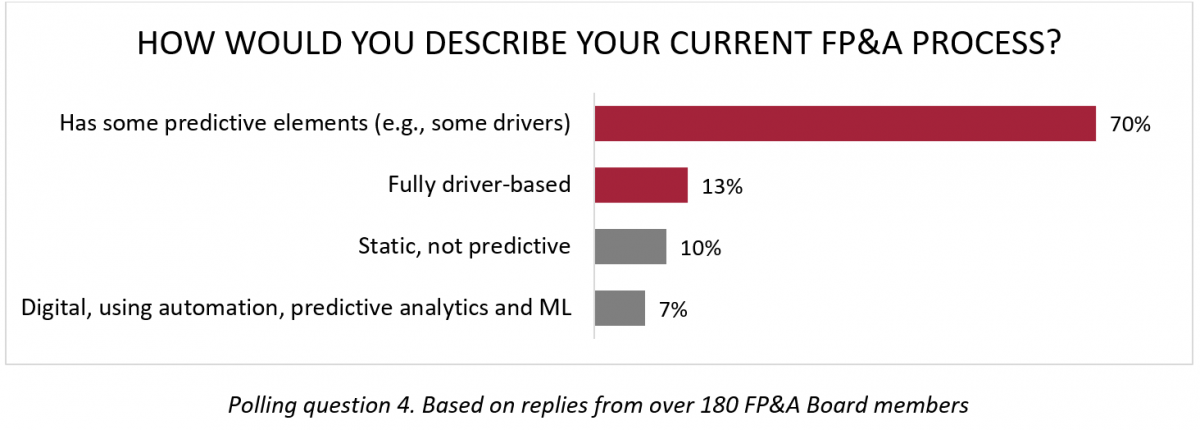

FP&A teams across the globe have evolved quickly to keep up with the changing world especially in the last year. Scenario Planning has increasingly become an important aspect of the planning exercises for almost all businesses. The capabilities, however, need to be further evolved to make them seamless and less time-consuming compared to what they are now.

Nevertheless, we are witnessing a major shift in how FP&A teams work and the agility expected of them. An improved scenario planning methodology can play an important role in keeping FP&A professionals relevant in times to come.

We are very grateful to our global partners and sponsors, Jedox and Michael Page.