The current COVID-19 disruption has led to a historical change requiring adaptability and increased visibility for CFO and the executive team. At the First Pan-Australian Digital FP&A Board, the panel of 7 high-profile speakers discussed how financial planning and analysis (FP&A) can adapt to the "New Normal".

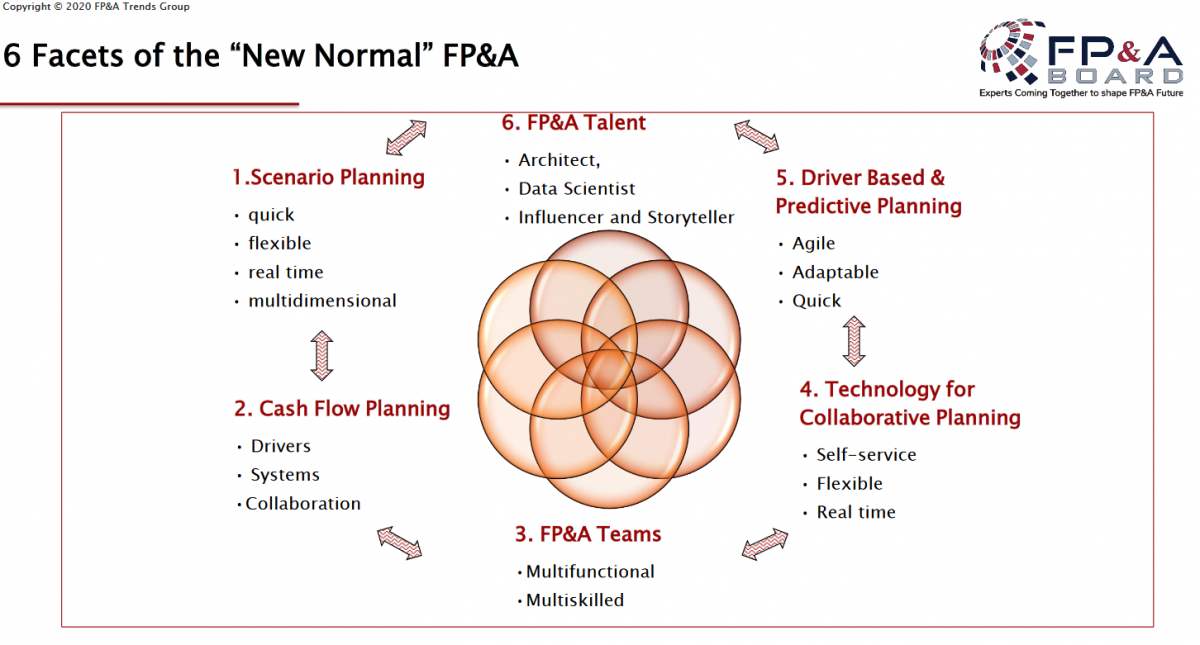

This article will look into the below 6 Facets of the “New Normal” FP&A in more details and will describe three case studies that were presented at the First Pan- Australian FP&A Board.

LEGO Case Study: Quick and Integrated Scenario Planning

The ambient uncertainty requires a different way to do financial planning; it has become a multi-dimensional and dynamic process.

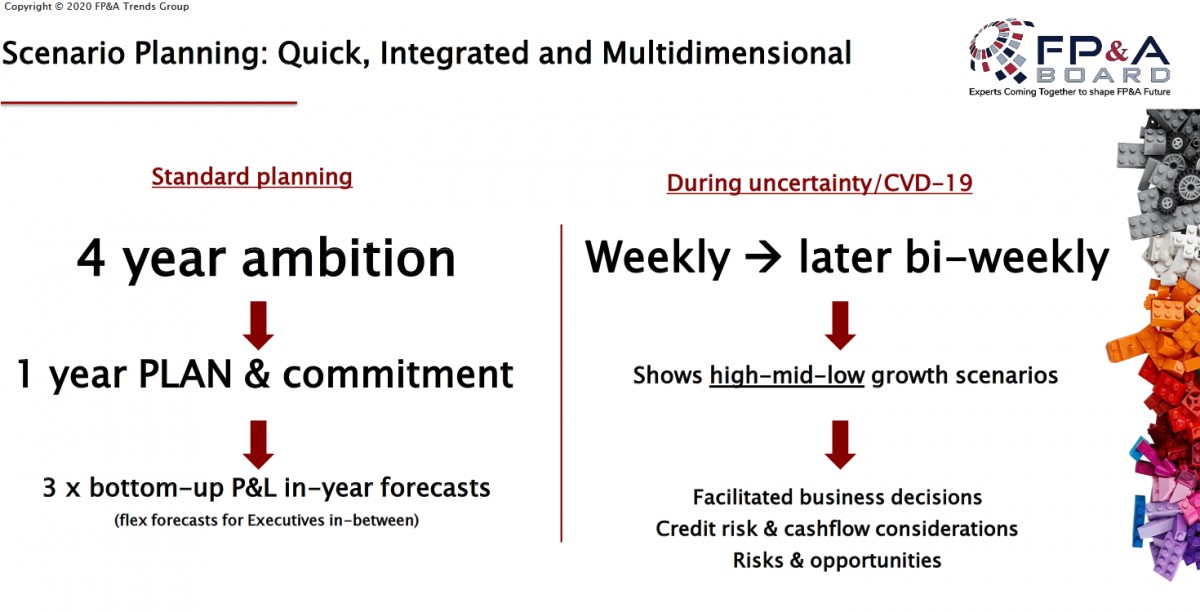

At the Digital FP&A Board, Michael Tweedie, Senior Director, Global Finance at the LEGO group, highlighted the FP&A role in scenario planning and how the LEGO group approaches this activity.

What has the LEGO group achieved?

The LEGO group went from a 4-year ambition plan to 1-year plan with 3 bottom-up forecasts (P&L) while the other 9 months are done based on trends. Initially, the frequency was weekly forecast but now it is done bi-weekly with a High, Medium, and Low scenarios for P&L and cash flow. This helps the company to see what is the best or the worst that can happen.

LEGO group has a global financial planning base. Therefore, it was easier for the company to work on scenarios as a good understanding of the costs base has already been established.

As a result of the increased scrutiny, business decision-making process has been improved especially on the appreciation of Risk & Opportunities. Also, the FP&A department closely collaborated with credit risk to promptly manage customer payments issues.

In LEGO, business agility coupled with the scenario-based financial planning resulted in an acceleration of the e-business strategy. The group was able to make strategic choices such as

reinvesting travel savings into working-from-home equipment,

supply changes to off-set COVID-19 constraints (for example, sending products from Europe to the US)

supporting the Black Lives Matter campaign.

How can you improve scenario planning in your organisation?

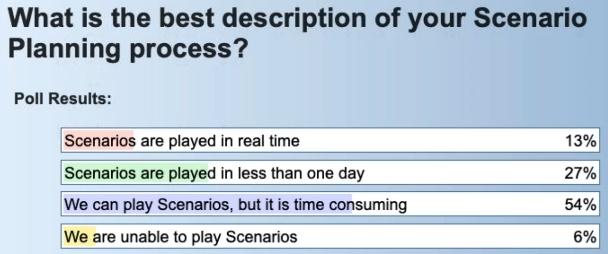

After Michael’s presentation, we conducted the first poll to see how the scenario planning process can be described at other organisations. The results were the following:

How can you improve scenario planning in your organisation? There are several recommendations provided by the International FP&A Board speakers:

Agree with the executives on the assumptions at the start. Key decision-makers will buy in the financial planning process if they can understand and influence the assumptions.

After agreeing on the assumptions, invest time on adjusting different scenarios.

Legend Corporation Lessons: Adapting Cash Flow Planning to the “New Normal”

“Profits are an opinion, Cash is a Fact” (Alfred Rappaport, American Economist)

Above all, cash is also a real measure for most companies.

The second presentation was delivered by Vladlen Potapenkov, Group Financial Controller at the Legend Corporation. Vladlen explained what the New Norm means for Cash Flow Planning:

Changing Demand in term of size and profile

High speed and frequency of forecast

Balance Sheet is the King again

How can organisations adapt?

Sales and Operations Planning is essential at Legend Corporation and during COVID-19 it was suspended. They re-start the planning and managed to improve cross-functional collaborations with customers, market data team. This helped them better understand demand swings by categories and channels.

It is important to accept that any plan can be inaccurate. But we still need to start somewhere. Some useful recommendations:

start at the fundamentals: review your processes and re-establish the responsibilities of the teams

engage with customers to understand the insights into the demand changes

ensure that you have a strong analytical layer such as a BI tool on top of ERP. This would help you combine multiple sources of data and factor them into the scenario-based cash forecast (AP, Sales Orders, Demand Planning- Bill of material).

drive education amongst teams. Usually, non-financial teams cannot differentiate between profit and cash. Education and collaboration will help you achieve a strong cash culture.

create an alignment of targets between Sales, Procurement and Finance. We all know that what can be measured gets done!

drive the Balance Sheet robustness. This is a prime aspect of successful financial planning.

Griffith University Case Study: Building an Effective Team

Michelle Clarke, CFO at Griffith University, noticed that although there is still a lot of uncertainty in the world, we need to continue building FP&A teams which are multifunctional and effective.

What are the important characteristics of an effective FP&A team?

Multi-disciplinary roles (strong structure). At Griffith University, planning and analytics team consists of accountant systems, data analytics, BI specialities, graphic designer, and performance specialists. Teams need the right mix of members, good processes, and norms which promote positive dynamics. To learn more about the five critical FP&A roles, please read this article.

Soft skills. Agile (quick to learn and adapt), very curious (understand people, the business, and the challenge) and collaborative (relationship and problem-solving skills).

Support for the decision-making process. Good FP&A teams are also willing to try different approaches. They can see the big picture and must be able to generate ideas and analyse differently. A good FP&A professional should be able to present a story and not just financials – it is time to learn how to link figures with business.

Collaboration with other departments. FP&A teams must have strong links with business partners and other support functions such as HR.

Compelling direction. A good leader needs to respond to a crisis with a clear direction. This gives clarity.

Shared mindset. For teams, it is important to have a common identity and a common mindset.

Excellence. Leaders must drive this aspiration for excellence and at the same time be self-aware. It is high time to create a leadership legacy.

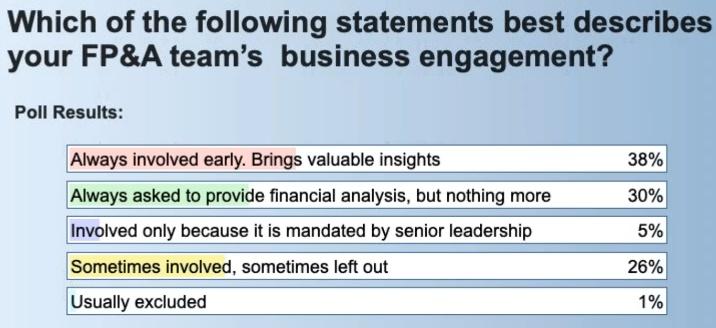

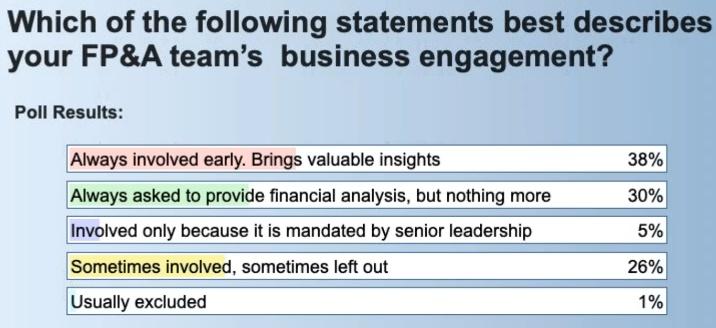

But to be effective, the FP&A team needs to always be involved early. Unfortunately, according to the results of the second Digital FP&A Board poll, this is not always the case:

How Does the “New Normal” FP&A Look Like?

Bryan Lapidus, Director, FP&A Practice at Association for Financial Professionals (AFP), answered this urgent question in his presentation. So, how can we evolve the FP&A function while continuing to deliver our current tasks? This sounds like changing tires while in motion.

First, we need to define the typical services delivered by FP&A. Whereas CFOs are the “stewards” of the company capital, FP&A professionals are key to assist CFOs in how best to allocate the capital and improve the decision-making process.

Key FP&A Services

Integrated planning: turn the strategic plan into the operating plan

Coordination of performance: deliver the right information to the right person in the right format at the right time

Analytics: construct models based on good data and information

Mapping growth of FP&A function

The key skills required to deliver these key services are:

Business acumen – FP&A needs to link the figures & business

Technology – this is the key leverage to be used by FP&A

Personal effectiveness – FP&A should become a trusted partner

FP&A leaders need to think about how they are creating value and remain flexible while delivering insights to the business. At the same time, they also must continue to support their teams and the development of their skills.

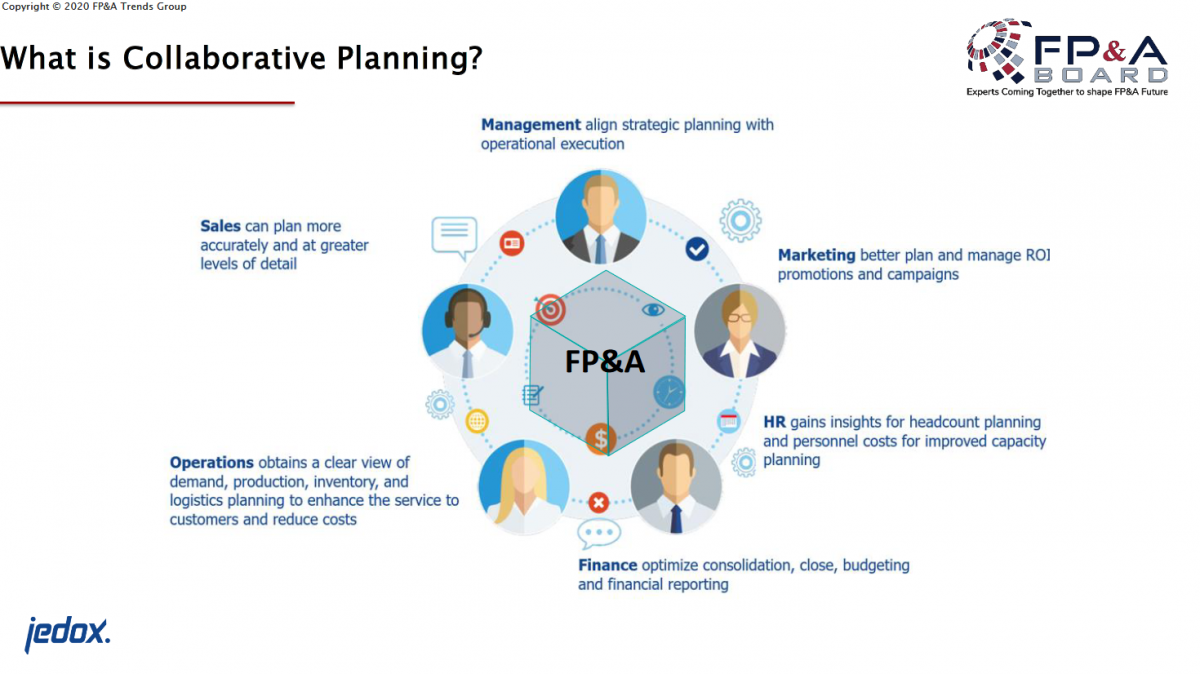

Collaborative Planning: The Role of Modern Technology

In his presentation, David Upton, Director of Strategic Partnerships and Alliances APAC at Jedox, urged FP&A Board members to look at how our business sectors re-invent and how our organisations allocate capital. Right now, it is time to seize the opportunity and implement best planning practices.

What is Collaborating Planning?

FP&A teams are not alone on this journey. They are collaborating with the entire organisation: sales, management, marketing, operations, HR, etc. There is collective thinking. We are witnessing the entire company working with FP&A on improving planning activities.

Currently, we are also seeing a transition to more digital enablers. The speed and scale of a digital tool can help FP&A achieve Collaborative Planning more efficiently.

How does Collaborative Planning work?

Have the master and trusted data in one and unique place.

Use different input to the model (machine learning can enhance the results).

Continue engaging with the business and simplify complexity.

In any company, there is a set of tools used by different departments and FP&A have the role to lead the coordination of these tools and make the Collaborative Planning process a success. According to Ian Croft, Director of FP&A (Australia & New Zealand) at Luxottica Australia and Sydney FP&A Board member, the integrated planning is critical for the retail sector due to the rapid change in the supply chain.

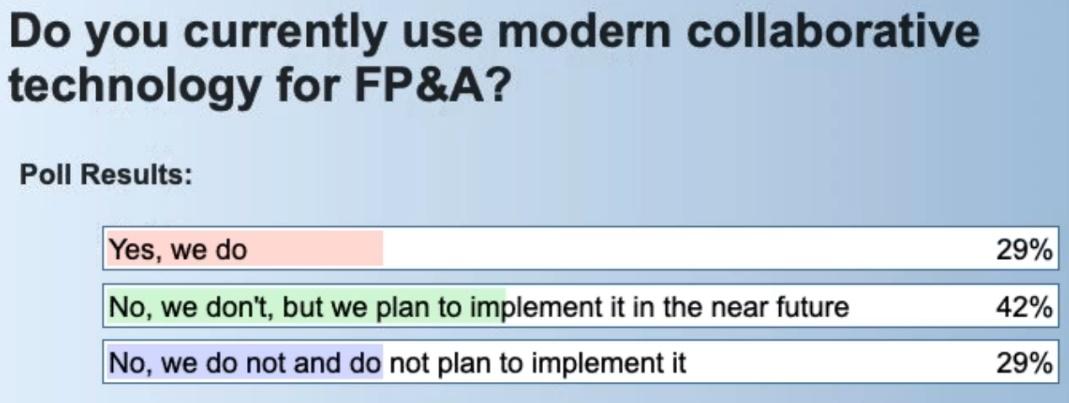

At the Digital FP&A Board, we also asked FP&A Board members to share the current state of collaborative technology in their organisations:

Luxottica Case Study: Driver Based and Predictive Planning

At the Pan-Australian FP&A Board meeting, Ian Croft, Director of FP&A (Australia & New Zealand), Luxottica, illustrated the journey of the FP&A team in Australia towards a driver-based planning approach.

Initially, Luxottica was a vertically integrated company with a very complex structure. All forecast activities were performed in Excel using some basic models. But in the last 6-7 years, the company began a journey towards an aspirational predictive, dynamic and integrated planning forecast and managed to reduce time spent on manual tasks.

The main output of this planning forecast was to understand the customer’s behaviours which are critical for business growth.

What are the main results of this journey?

Best in class forecasting process allowing the business to quickly model new situations

Helped identify opportunities for network efficiencies

Increased confidence from the parent company (additional CAPEX were allocated to Australia)

Quick response to the current COVID situation

How did Luxottica manage to achieve the dynamic and integrated planning?

Have the right team members with the right fundamental skills

Define KPIs that should be responded to

Prototype all systems and processes

Embed changes of roles and responsibilities in the organisational structure

Ensure engagement of both the finance team and wider business

Think simple – it gets more complex as you go

Select the right drivers and test

Define the end-game and stick to it

Think about maintaining and adapting to the changing business needs

Pay attention not only to systems but also to people

According to the results of another poll, the majority of FP&A Board members have a fully driver-based or partially driver-based FP&A process:

What are the Latest Trends in FP&A Recruitment?

At the FP&A Board meeting, Ross McLelland, Associate Director at Michael Page, provided FP&A Board members with an overview of the business responses to COVID-19 for the FP&A sector in Australia.

Based on a survey of 400 organisations in Australia more than 50% of business embarking on business process improvements and only 20% of business are looking at training and development as a response to COVID-19 crisis

How organisations are attracting and retaining FP&A talent?

To attract talents, the business leaders need to create a better environment for FP&A with automation & system improvement. FP&A teams want to add commercial value so value-add tasks and interaction with stakeholders are sought after. Lastly, a better in-house training & development framework is also required to maintain FP&A talents.

Which of the five FP&A roles are in the highest demand?

The demand for FP&A Architects is still the strongest one and it has become stronger in the last 6 months. The demand for FP&A Analysts is still high as this role is being used to bridge the gap between data interpretation and FP&A. Finally, FP&A Storytellers remain in strong demand as well.

Conclusions

The key tool in order to achieve a flexible decision-making process which addresses the uncertainty is a scenario-based financial planning with a multi-dimensional approach including a cash flow forecast.

The financial planning must be agile and simple to use. The FP&A needs to ensure that insights are delivered on time to assist business in the decision-making process.

We are very grateful to our global sponsors and partners: Jedox, Michael Page, and the Association for Financial Professional (AFP) for their great support with the First Pan-Australian Digital FP&A Board.

Many thanks to our panel for sharing their valuable insights and to participants for joining this special event.

Stay safe and connected!