We live in a world of uncertainty. But in that uncertainty lies a great deal of...

Traditional budget and forecast methods are undertaking an incredible amount of change at the moment as a result of the dynamic business environment that surrounds them. At each International FP&A Board meeting, I always ask people to share examples of the main tipping points in their organisations at that time. Most recently, I have been observing significant changes in business models in many organisations around the globe.

Traditional budget and forecast methods are undertaking an incredible amount of change at the moment as a result of the dynamic business environment that surrounds them. At each International FP&A Board meeting, I always ask people to share examples of the main tipping points in their organisations at that time. Most recently, I have been observing significant changes in business models in many organisations around the globe.

Many FP&A Board members say the future can no longer be predicted based on only historical data since we are living in an environment of “Unknown Unknowns”. A lot of changes are needed to provide more insightful planning and forecasting because traditional methods are no longer sufficient for the modern business environment.

Scenario Planning is one approach that allows us to make decisions quickly based on real data. Clearly, this is not a new method, as Scenario Planning has been used widely for years in many strategic planning processes. However, now Scenario Planning is evolving and becoming more critical to effective modern Financial Planning and Analysis (FP&A).

What is Scenario Planning?

Scenario Planning is a thinking method that addresses the many uncertainties that exist within any business environment through the consideration of a number of alternative future events and assessing their potential effects on the company in question.

The trick is that in the modern business environment, Scenario Planning should be done very quickly, preferably in real-time. In addition, Scenario Planning should be multi-dimensional, meaning it needs to be performed for all levels of the organisation, both operational and strategic, with all information being cascaded in a timely manner.

Pierre Wack, the godfather of Scenario Planning, is famously quoted as saying that “using scenarios is as different from relying on forecasts as judo is from boxing”. So what does this mean? It means that in the modern business environment, it is not enough to have one set of plans and forecasts. The reality is that things can change so quickly that we should be in a position where we can adjust key drivers as they change and immediately see the impact on the possible outcomes.

The Evolution of Scenario Planning

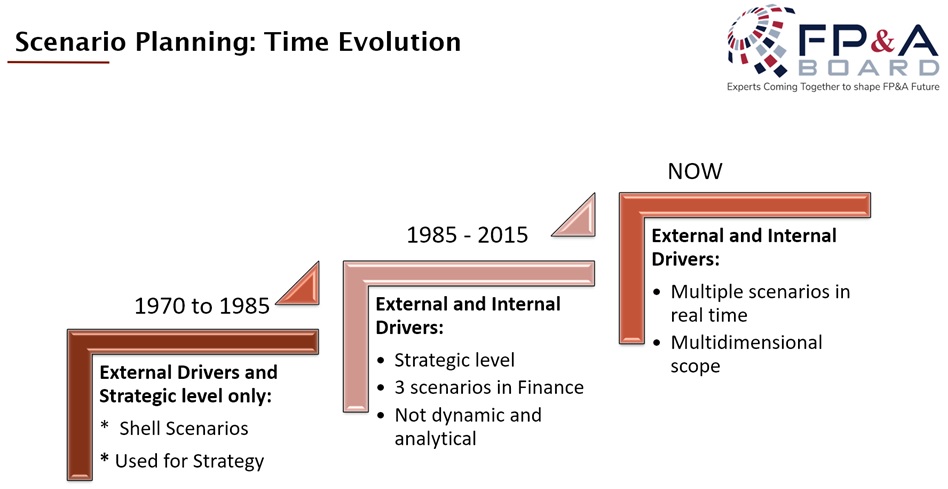

Figure 1. Scenario Planning: Time Evolution

Scenario Planning has been widely used at a strategic level since the 1970’s, mainly looking at external drivers. It was only brought into the finance realm around the mid-80’s where both internal and external drivers were then considered. Traditionally finance and management account teams have worked using three scenarios; the Best case, the Middle case and the Worst case. These were applied and used within any regular budgeting process or re-forecasting quarter. However, the three scenarios were never dynamic. They did not rely upon flexible data or models, so they could not be updated quickly. Normally if an executive asked for a particular scenario to be run, it would take several days or even a week to be generated. This was inefficient. Hence only three scenarios were ever applied.

Now, with technological updates, we can easily use new driver based models to run scenarios in real-time, altering only the key internal and external drivers that underpin the business. Since there are hundreds, if not thousands, of potential drivers in any one business, we need to apply the Pareto principle. We need to be able to identify the 20% of drivers that explain 80% of the business results. The 20% are known as the key drivers to a business and are the ones used for Driver Based Planning.

Modern Scenario Planning is the use of these key external and internal business drivers to generate multiple scenarios quickly that cover all levels of the organisation. With the help of Scenario Planning, we can easily cascade strategy scenarios down through the organisation, by communicating the value of these key drivers. Similarly, Scenario Planning can evolve from bottom to top. For example, suppose a change is made in one particular business unit. In that case, the appropriate key driver can be adjusted in the plan so that the executive team can review the overall impact on their strategic projection.

Limits of Traditional Forecasting

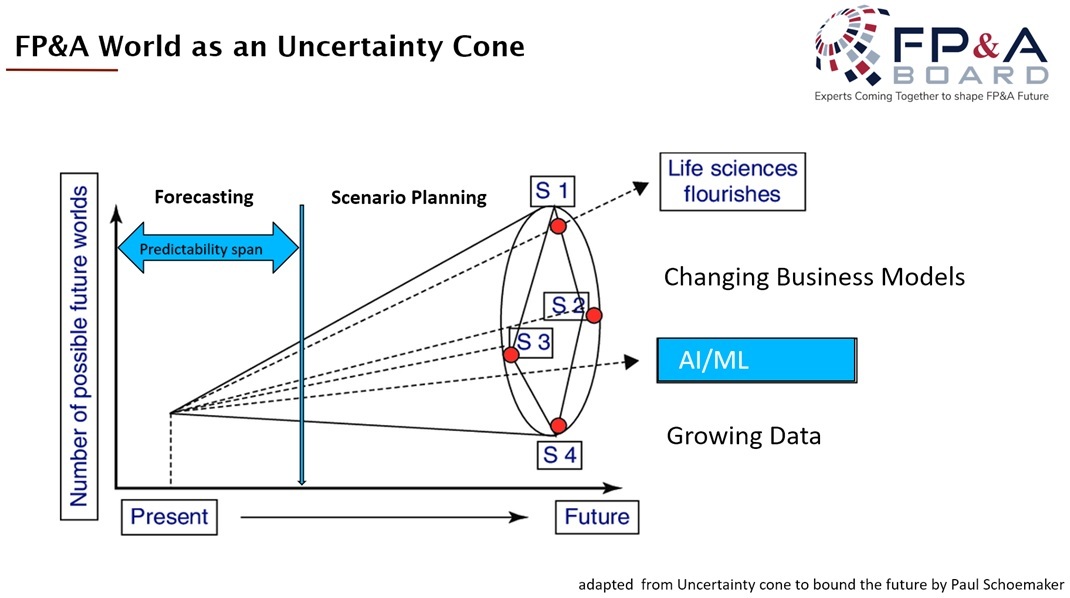

With traditional forecasting, the longer the forecast period, the more uncertainties there will be and our ability to make predictions lessens. The reality is that traditional forecasting is simply not useful at a certain point because it holds too much uncertainty, and therefore we cannot reasonably critique it. The span of our predictability is reducing in the modern business environment, with some companies now only able to predict events two months or even several weeks into the future. This increases the requirement for flexible forecasting. This trend will inevitably continue, and we will become even more reliant on Scenario Planning.

Traditional forecasting methodology assumes a 12-month span of predictability. A normal budget process would set out a forecast for the next 12 months, with an adjustment made every three months. However, this is no longer realistic since we simply cannot predict that far in advance. In the modern business environment, we do not need only to be able to forecast, but we need to be able to re-plan as quickly as possible. FP&A now becomes more about possibility than predictability.

Figure 2. FP&A World as an Uncertainty Cone

I like to apply to FP&A the uncertainty cone that was introduced by Paul Schoemaker (see figure 2). It describes why the environment outside of the predictability horizon should be scanned carefully and why scenario planning should be used in this case.

How Can Businesses Move from Traditional Forecasting to Scenario-Based Planning?

The organisations that are best set up for Scenario Planning are those that can be categorised as a “Leading state” organisation based on our FP&A Analytics Maturity model.

To establish Scenario Planning in a way that enables quick and reliable decisions to be made, an organisation needs the following:

- Key drivers: As discussed the business will need to have identified which of their drivers are the 20% that explain 80% of their results. This can be done using modern technologies rather than time-consuming excel analysis.

- Driver Based Planning models

- Integrated planning processes: These are top-down and bottom-up processes harmonised through drivers, systems, organisational structure and data.

- A modern forecasting system: Excel will no longer be sufficient for this level of planning. An automated forecasting system that can pick up inputs from business intelligence and allows for real-time collaboration with all the main stakeholders in the business is necessary.

A great example of successful Scenario Planning is GoCompare.com. With their new system and Driver Based Planning, the team have cracked the code on Scenario Planning, allowing them to plan in real-time at a multi-dimensional level.

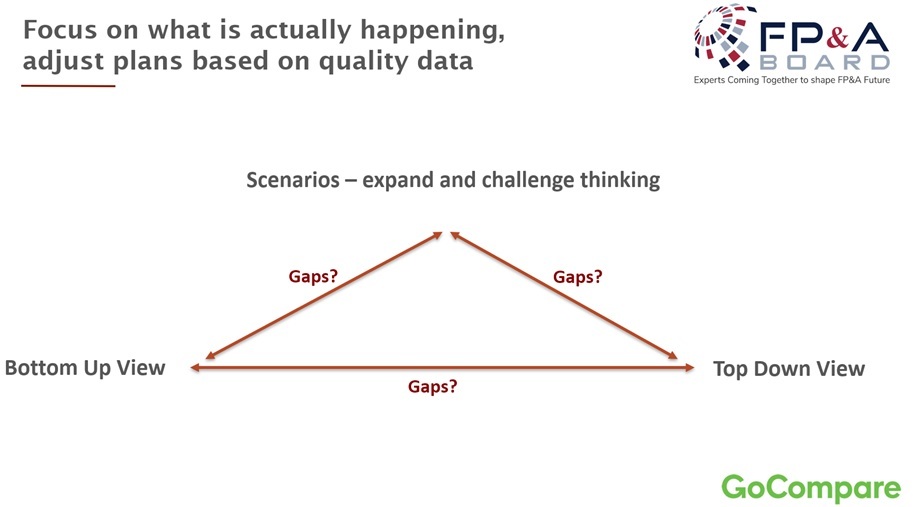

When we deep-dived into the GoCompare.com case study at one of our FP&A Circle meetings, Rhodri de Lloyd, FP&A Manager at GoCompare.com, talked about the gaps that exist in original forecasting between the bottom-up view and the top-down view (see figure 3). Scenario Planning has helped them close these gaps by expanding and challenging thinking.

Figure 3. Focus on what is actually happening

Rhodri also shared that before they had a flexible FP&A system, Scenario Planning was not a useful tool for them. Excel had its limitations. Complex modelling was required, version control was challenging and sharing the outputs was often difficult, meaning stakeholders were not kept involved in a timely manner.

Once they implemented their automated system, they could run scenarios almost on a rolling forecast basis. They now have the ability to produce numerous scenarios at a multi-dimensional level quickly. All assumptions and scenario versions can be traced fully without getting lost in the process, and their multiple system integration allows them to tailor the outputs for each stakeholder, meaning the right information is visible to the key decision-makers.

Lessons Learned from the Pioneers

What we can therefore learn from GoCompare.com is that flexible dynamic systems are fundamental for the success of Scenario Planning. Rhodri’s advice to others that wish to follow in their footsteps is not to underestimate the amount of change effort required. It will take at least 3 to 6 months to build the core models, but this could be longer dependent on the organisation’s size. A project plan is integral to its success, finance will have to be self-sufficient, and the internal business will need to have sufficient skills and understanding to adapt to the new approach. Rhodri’s main recommendation is to use strong quality data, since “your outputs are only as good as your inputs”.

We can also learn from Microsoft, the biggest company in the world, by market capitalisation since we reviewed it at our AI/ML committee summit. To watch their case study, please follow the link.

Microsoft uses Predictive Analytics, Driver Based Planning and Machine Learning for forecasting. Their results are incredible. They are practically forecasting in real-time and at a multi-dimensional level. So the question is, if such a thing is possible for the biggest company in the world, what is the message for those of us in FP&A?

The Future of FP&A

The message is that Scenario Planning is becoming an important decision-making tool for organisations. As we can see from both GoCompare.com and Microsoft, it is already possible for organisations to play scenarios in real-time and at a multi-dimensional level. The role of FP&A in running these scenarios is becoming more important everywhere in the world, and as a result, these FP&A teams are transforming how their organisations operate.

Overall we can see that the success of Scenario Planning and Driver Based Planning requires strong data, an understanding of the key drivers, and access to flexible and dynamic systems. This enables FP&A teams to be able to run a range of scenarios rather than those key three used in traditional forecasting methods.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.