Following on from the success of the 21st London FP&A Board, we had the pleasure of attending the 8th London FP&A Circle which shares the latest professional trends and developments with the UK FP&A community, open exclusively by invitation to senior and mid-level finance practitioners.

Following on from the success of the 21st London FP&A Board, we had the pleasure of attending the 8th London FP&A Circle which shares the latest professional trends and developments with the UK FP&A community, open exclusively by invitation to senior and mid-level finance practitioners.

Hosted by Michael Page at their Holborn office, over 90 finance professionals explored the issue of scenario planning within FP&A. The meeting was sponsored by Unit4 Prevero.

Introduction to Scenario Planning

Scenario planning plays a critical role within organisations, by helping them plan for external volatility. This is increasingly becoming a core part of the FP&A professionals’ toolkits.

The FP&A Circle explored the topic from the perspective of the FP&A maturity curve, the implementation journey at Go Compare and insights from academia. We concluded with group discussions around the applicability of the concepts to the attendees’ organisations.

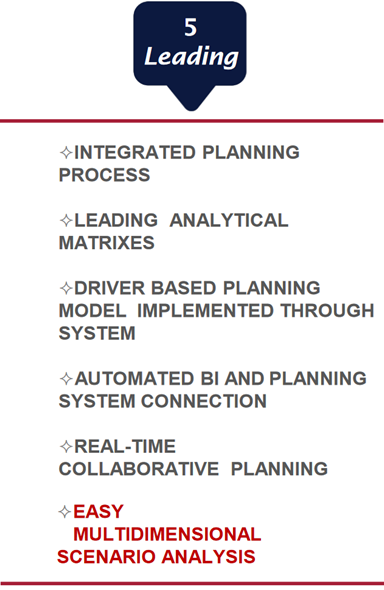

Figure 1: Scenario planning is a component of L5 of the FP&A maturity curve

Scenario planning has evolved from a strategy exercise in the 1970s to a core part of the FP&A function today

Pierre Wack is often referred to as the godfather of scenario planning, and pioneered this approach in the 1970s at Shell. Pierre described the practice of scenario planning as the use of alternative stories about the future with improbable and dramatic twists.

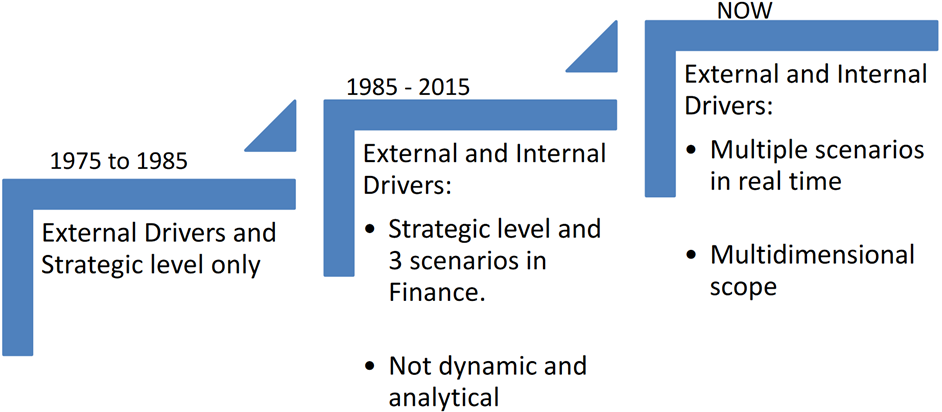

Figure 2: The evolution of scenario planning

It was a purely strategy team exercise with very little involvement from finance. It included the analyses of external drivers and modelling potential disruptions in the world.

By the mid-1980s, organisations started to combine internal data to answer questions such as “what if revenue increased by 20%?”. Finance became more involved in this process.

In the present day, scenarios are driven in real time, across many dimensions with increasing levels of granularity within the data sets. Increasingly, this task is becoming finance-led, rather than being the domain of the strategists.

Part of the reason for this shift is that the span of predictability is decreasing. At a recent FP&A Board event in Dubai, we discussed the short horizons but with the need to maintain rolling forecasts. Therefore, multiple scenarios are required to validate the twelve-month forecasts.

Lastly, scenario planning is task that is carried out by organisations at the top of the FP&A maturity curve.

Go Compare - volatile external environment has driven the transformation of their FP&A function

Go Compare launched in 2006, and with the help of a crazy opera singer, they have gone on to disrupt the market. Now, they have over 40 products, each with a unique commercial model, and their own commercial arrangements.

The organisation is constantly changing, and continually tweaking, striving to improve. They have had to automate their budgets to free up finance time to work with the business, who are continually coming up with new ideas. Finance need the space to test and challenge.

They have achieved this over a period of 18 months. The company started with an initial definition and build of core models, before embarking on development. At the Circle meeting, Rhodri de Lloyd, FP&A Manager at GoCompare, shared their insights on how to successfully implement scenario planning in an organisation. Now, if the CFO asks, they can generate a forecast and scenario in 30 minutes with a full audit trail of assumptions, across a multitude of scenarios to flex multiple variables.

Questions from the audience

- What type of data does Go Compare buy in?

- Car insurance sales data (as an indicator of potential new premiums), softer metrics such as average best premiums and government data on e.g. energy provider switching

- How did Go Compare achieve automation?

- Key to success was that everyone (board and management) wanted to do this. They worked with cross functional teams of business owners, BI experts and data scientists, alongside finance

- What is the current composition of the Go Compare FP&A team?

- All qualified accountants, but they had to go through an upskilling process

- How do you approach identifying the right scenarios?

- Explore all of them as possible, what actions are appropriate in more than one scenario?

- Scenarios are not an answer, it’s a thinking tool and a framework

- Are Monte Carlo simulations used at Go Compare?

- They run some simulations, but not that often

Challenge the mental models of the world that people have

Gill Ringland and Patricia Lustig, two thought leaders and authors, showed FP&A Circle members a couple of images – a 16th Century Japanese map of the known world with dragons on the outside; and a modern-day map of the whole world. Neither is particularly useful, but it is reflection of how we saw the world at each point in time – ‘mental models’.

Similarly, scenario planning can be used to ensure that FP&A is tracking the right things, through a combined view of the world.

To illustrate the value of scenario planning, an example of a startup estate agent was cited. Prior to the last house price crash, they ran scenarios on what would happen if people couldn’t get mortgages. As a result, they were prepared and managed to come out of it better than their competitors

Scenario planning can also be used to challenge the leaderships’ thinking about existing models. In the case of a railway rolling stock leasing company, they went through a number of scenarios. The process challenged their view that favourable ‘rail conditions’ in a high GDP market were best for their business, and instead realised that they were a risk and assets management business. This allowed them to re-align their performance metrics.

The next worked example was MAN group, who started out as a sugar business before diversifying into derivatives and insurance. A futures trade by the sugar division nearly killed the organisation. As a result, they wanted to know if scenario planning could help them avoid these disasters.

They used a set of scenarios developed for London 2020, sent off teams into separate rooms and asked them to decide which scenario they through they were in – they all had different answers.

As a result of the scenario planning process, they divested the sugar business, and then they aligned the performance metrics of the remaining divisions with the derivatives division. MAN have now moved from FTSE350 to FTSE100.

Opinions and thoughts from participants’ own experiences

Introduced to the FP&A circle event was a group discussion. Asked to give their insights into scenario planning based on their experience and on the presentation, participants formed groups and wrote down their thoughts. Below is a collection of these quotes and ‘global’ themes amongst them.

Introduced to the FP&A circle event was a group discussion. Asked to give their insights into scenario planning based on their experience and on the presentation, participants formed groups and wrote down their thoughts. Below is a collection of these quotes and ‘global’ themes amongst them.

“Fragtech is the New World”

The pace of technological change, coupled with global fragmentation and volatility, suggests we are living in a ‘Fragtech’ world, evolving from the ‘Globetech’ world where technological integration was delivered with global integration.

- In a fragtech world, how do you plan for such rapidly changing technology?

- In Fragtech but operate in slow globe model, which is OK for Financial Budget as P&L is lag indicator.

- We didn’t anticipate globalization

- Brexit

- Geographical locations throw complexity into the model

- Technology doesn’t help to develop or detect disruptions

- There is not always one fit/solution for the whole company

- All in infancy in FP&A technology

“It always comes down to data”

In an increasingly data driven, and insight led, world, where data is seen as the oil of the 21st century, the nature and integrity of data, is crucial.

- Should have driver based planning where interdependencies are reflected in the model

- Understanding of “quadrant movement” can help companies plan what steps need to be taken to prepare for possible outcomes

- How to deal with insufficient market data to build long term scenarios

“Leadership, skills and culture govern transformation”

The age-old adage of getting ‘buy in’ remains crucial, with some participants noting this amongst all others.

- Leadership and cultural change key

- Difference between internal reality and external reality

- All or nothing chance to measure success

- Most people are still using excel and are in a volatile state, even though they recognise the journey they need to be on

- You need a clear vision and investment & support from the board to make FP&A a success

- Everyone at different stages of maturity & change

Conclusions from Larysa

- Driver-based planning is the number one priority to get right, but it is not as prevalent as it should be. There is high penetration in China and parts of the USA, but Europe is lagging behind. Hardly anyone has a flexible system – could this be the reason behind low adoption?

- The current environment is incredible, because of the shortening span horizons, forecasts alone do not work anymore.

- Majority of finance teams are involved in strategic planning, this was rare 5 years ago.

Conclusion from event

It appears there is a great appetite for scenario planning amongst FP&A, general finance and, indeed, non-finance professionals. Yet the challenges are, investment, technology, cultural change, developing the driver based model and getting data of sufficient quality to lay the foundation for scenario planning.

We hope you will join the conversation at the next FP&A Circle event, as we continue to discuss these challenges and share how we overcome them, as we all look to fulfil the potential of FP&A to become the strategic advisory unit, the bedrock of business decisions, and the ultimate trusted advisor.