In many companies, the processes and tools to manage profit and loss (P&L) are quite developed...

On the 9th December, I had the pleasure of participating in a global webinar where the subject under discussion was Rethinking Traditional Approaches to Cash Flow Management with speakers from the United States, Germany and Canada (Figure 1).

Figure 1

Why is Cash the King for FP&A?

Never take your eyes off the cash flow because it’s the lifeblood of business (Richard Branson)

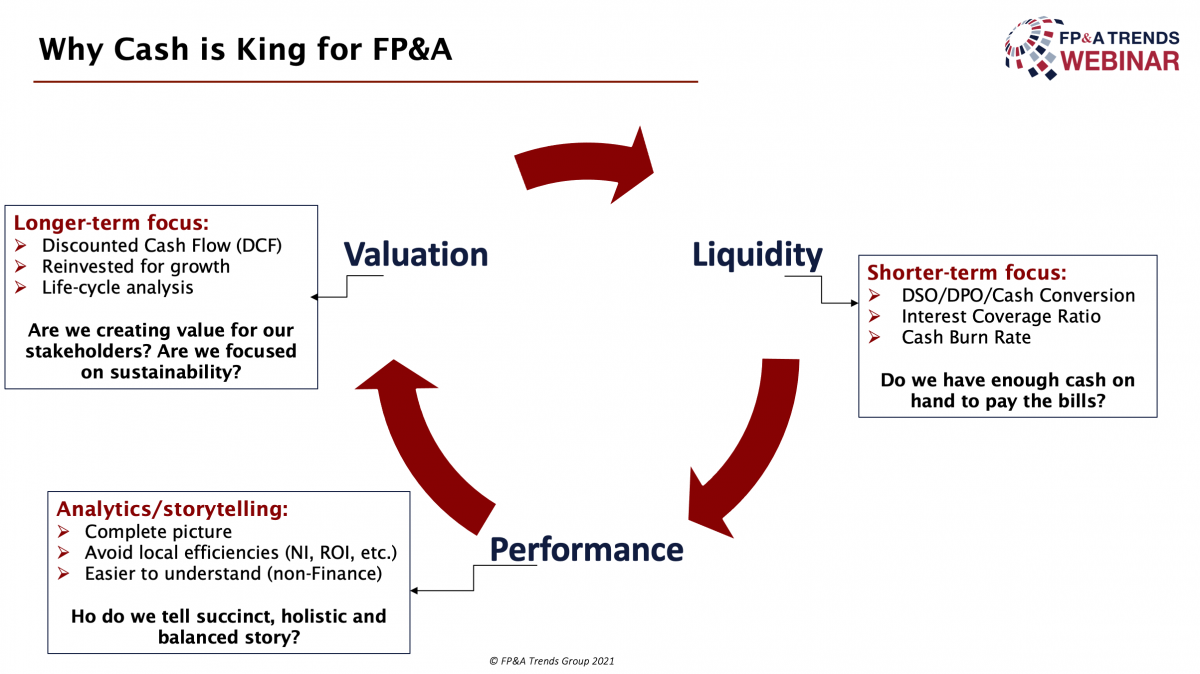

Nowadays cash flow is a trend topic and especially in FP&A where we are generally focused on P&L forecast and management. When we talk about cash flow there are three main pillars: liquidity, valuation, and performance. (Figure 2)

Figure 2

On the webinar it was discussed how to rethink the traditional approaches to cash flow from three senior finance speakers:

Why the traditional profit-driven mindset need to be rethought? From Michael Huthwaite, Corporate Finance Director at Walmart

Integrated cash flow planning: how to achieve it? From Garrett Dennie, Vice President of Finance at Linde/Praxair Canada

How technology enables modern cash flow management? From Arif Esa Director Solution Management at SAP

Why the traditional profit-driven mindset need to be rethought?

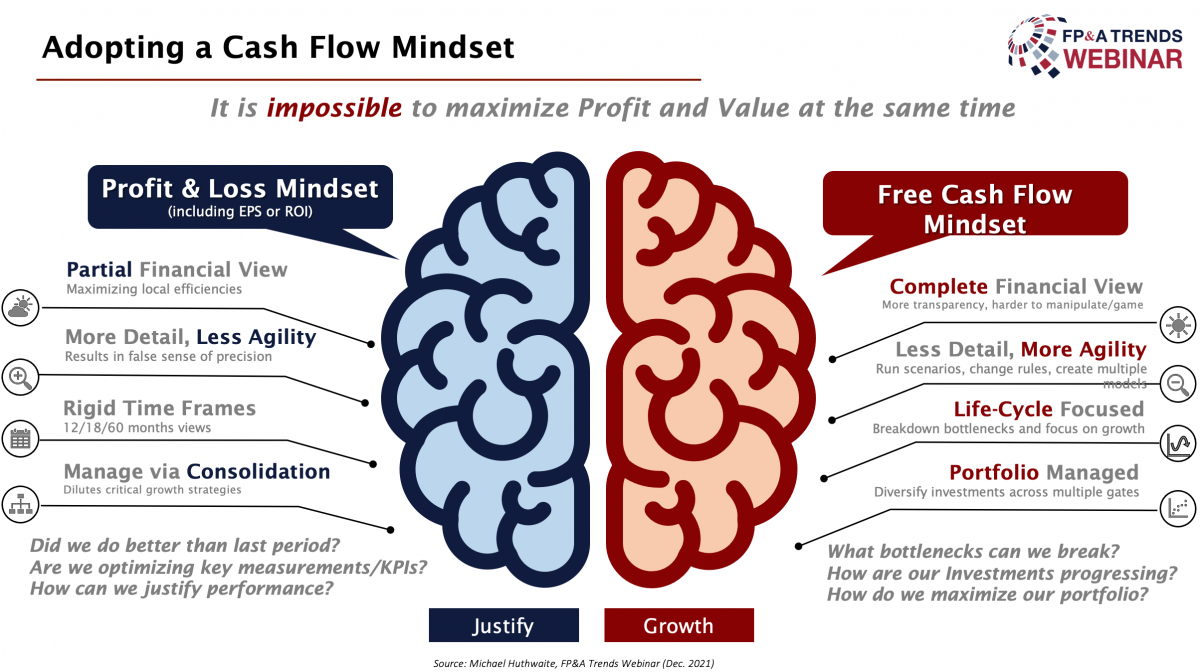

One of the first steps is to adopt a free cash flow mindset where we don’t have a partial view of the financials, which means to look only at the profit and loss. The free cash flow mindset represents a complete financial view. So that’s why cash is really key for FP&A. In addition, the cash flow is harder to manipulate.

When we look at the free cash flow mindset the idea behind is GROWTH rather than a justification story in the P&L mindset.

Michael concludes that it is impossible to maximise Profit and Value at the same time. It is crucial to invest in growth opportunities which are going to hit the P&L and also to generate positive cash flow. (Figure 3)

Figure 3

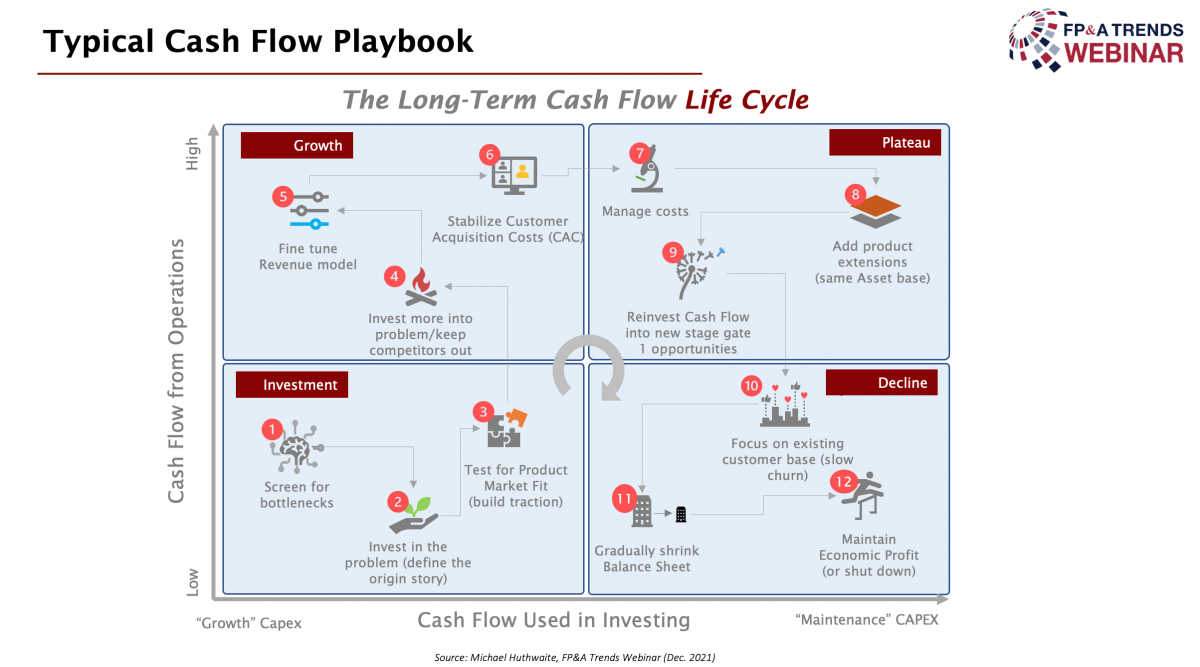

The typical cash flow playbook is represented by the matrix below where we are always investing in the business. (Figure 4) The main question is, are we investing to build the balance sheet that’s growth CAPEX, or are we investing to maintain balance and just replace the depreciation? The quadrant called “growth” is one of the hardest ones for FP&A where we need to focus on the existing customers and it is necessary to invest more into problems/keep competitors out.

Figure 4

It was great to see that 44% of the voters said that Cash flow planning is a key component of FP&A. It seems that in times of uncertainty cash flow seems to be a key component and it is great to see that FP&A can play a bigger role compared to the times where cash flow fallen under Treasury or M&A.

Integrated cash flow planning: how to achieve it?

Most of the time there is a formalised process for P&L and a more informal process for Cashflow. FP&A receives a lot of inputs from different departments and then the Treasury department does their high level forecast on their own. Currently, there is a lack of process and integration and so it is common to say “garbage in - garbage out”.

Forecasting for Cash management is important, and it depends on the different stage of a company:

Liquidity management during the decline and investment phase

Bank management/optimisation

Debt management during the investment and growth phase

Some companies don’t really have an idea on where the cash will sit because of lack of financial skills that can help to manage the cash flow forecast or cash planning. A lot of other companies do a very high level forecasting/planning cash.

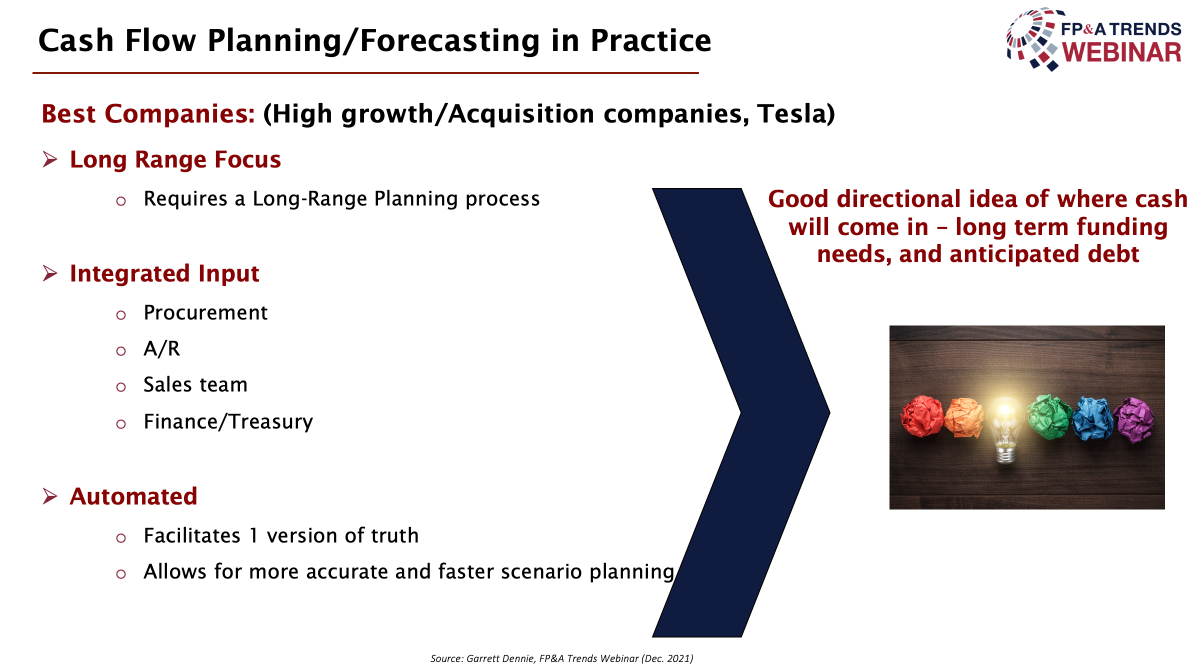

Best Practises: Cash Flow Planning

These companies have a good directional idea of where cash will come in, long term funding needs and anticipated debt

Figure 5

Most companies have a directional idea based on average outflows/inflows - deviations from normal and large swings. The view is more short term rather than long term like in the “best companies” environment. Generally, they are looking at the past and then try to forecast the future. It is Excel based and there is not one version of the truth.

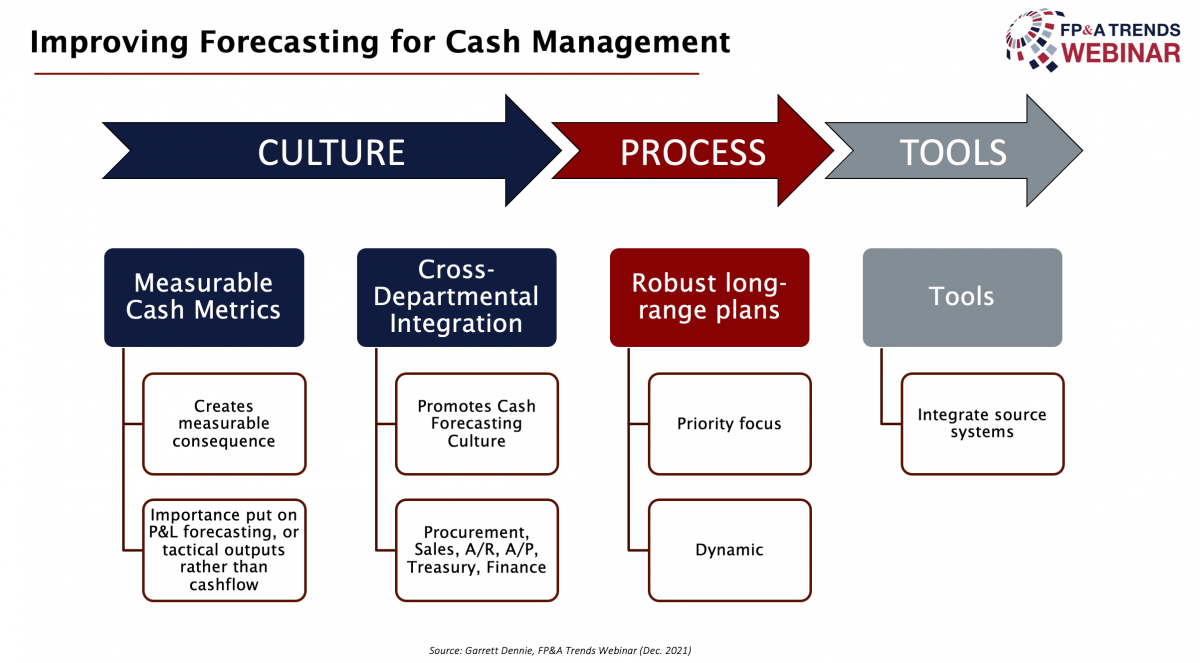

How do we improve Cash Management?

It is important to influence the culture, put in place the process, and the right tools to improve the cash management forecasting/planning within the business. Promote a cash flow culture within the business and share why it is important for the value maximisation of the company. The shift from short to long term view is critical to improve the process of cash forecasting/planning. To facilitate the process improvement tools can help significantly to have one source of truth and scenario. ( Figure 6)

Figure 6

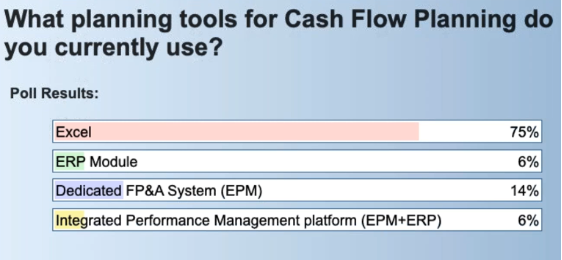

It is not a surprise that 75% of the voters are using Excel as a forecasting tool for cash flow planning/forecast mainly due to its flexibility even if there are a lot of risks (e.g security, manual errors...) (Figure 7)

Figure 7

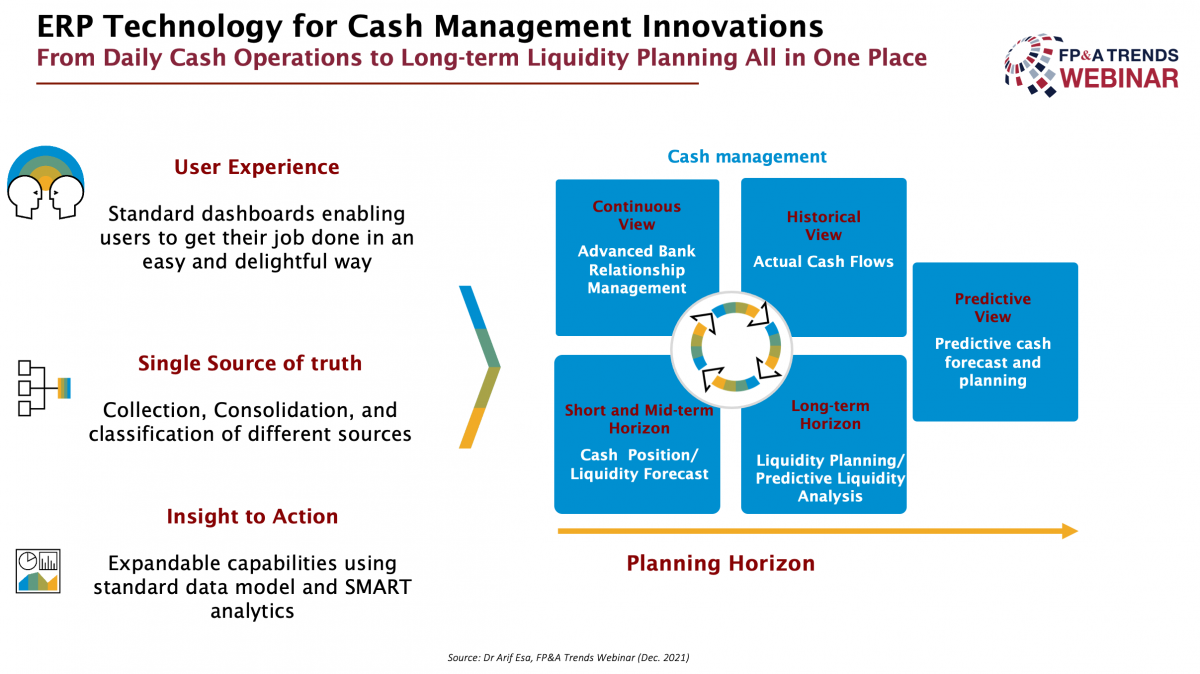

How technology enables modern cash flow management?

In the current world, automation is imperative because it will help to be in compliance. Once we have integration and automation we can have an active working capital which is critical for working capital investment optimisation. If we have the right insights it is possible to have better investment decisions.

User experience: there is a need for culture/mindset change within the teams To enable modern cash flow management we would need to focus on 3 aspects: where they can embrace the cash flow mindset. The main benefit is the increase of productivity for cash managers

Single source of truth: centralisation of all the different inputs. The main benefit is to reduce cost and increase transparency for the business

Insight to action: real time data leads to conscious and tangible impacts (Figure 8)

Figure 8

Conclusions

It is the right time to questioning the cash forecasting/planning process and start to think where the areas of improvements are. FP&A can play a significant role to shift the P&L focus and embrace/integrate the cash management planning into the forecasting/planning process.

We would like to thank our global sponsor SAP for great support with this FP&A Trends Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.