Last week, I joined senior finance leaders at the International FP&A Board meeting in San Francisco, an energizing stop on the FP&A Trends 2025 North American Tour, to explore how FP&A business partnering can thrive in an AI-driven environment. This 12th San Francisco FP&A Board was built on a seven-year journey exploring how FP&A evolves from analytical control toward strategic influence.

The conversation was both forward-looking and human. From Matt Niccolls (Constellation Brands) on AI reshaping forecasting and collaboration, to Dominic Mantua (SAP) demonstrating intelligent AI agents as real co-pilots for decisions, the message was clear: AI isn’t replacing business partners, it’s empowering them.

Sponsored by SAP and DeWinter Group and hosted at IWG Spaces Menlo Park, the session united finance leaders eager to reimagine FP&A, not as back-office support, but as a proactive force shaping strategy.

That spirit of openness and curiosity inspired this reflection on how FP&A can evolve from “insights to impact” in an era where human judgment and machine intelligence are learning to move in sync.

The Shift from Insights to Impact

Finance is at an inflection point. Once defined by control and accuracy, today’s FP&A leaders are called to deliver influence powered by intelligence.

This transformation was a central topic of discussion for the San Francisco FP&A Board. The Theme is global, as finance teams evolve from data gatherers to predictive business partners, shaping decisions.

Where FP&A Stand Today

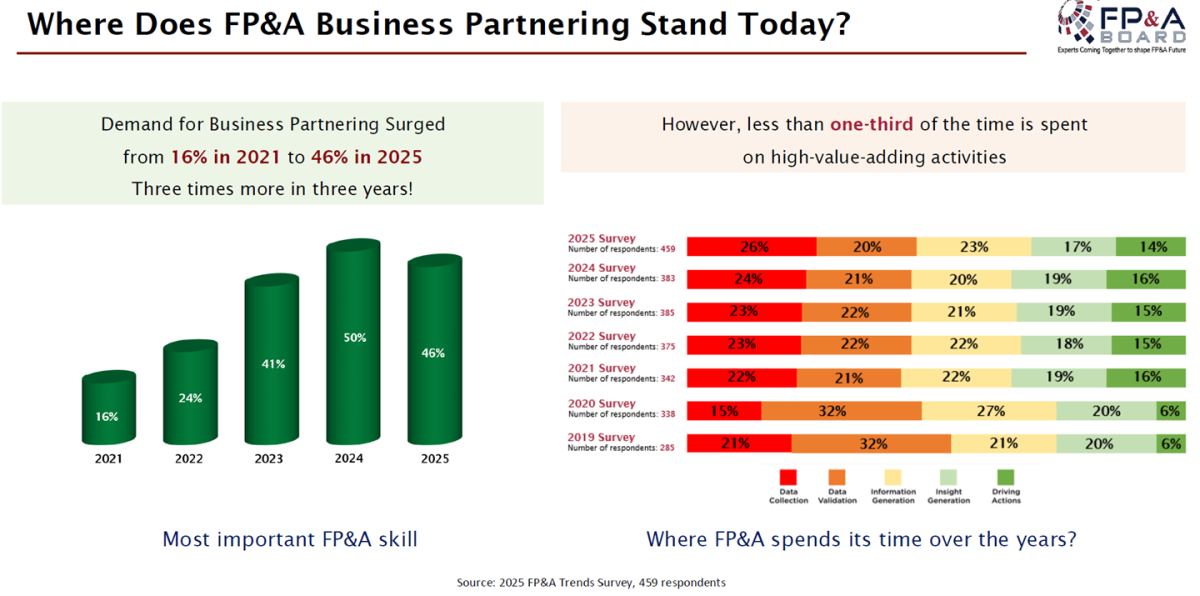

The 2025 FP&A Trends Survey shows that the demand for business partnering has tripled (Yes, tripled) since 2021, but most teams spend under a third of their time on strategic work. Meanwhile, AI adoption increased from 6% in 2024 to 47% in 2025, driven by the rise of Generative AI, according to FP&A Trends Research Paper 2025

Figure 1

The gap is now between finance and technology, but between data potential and readiness. Only 22% have a single source of truth, yet those are three times more likely to produce accurate forecasts. Today’s FP&A maturity is as much about digital fluency and AI readiness as about partnering skills.

Barriers to True Business Partnering

The same five challenges surfaced globally: mindset and culture, data visibility, technology fragmentation, skill gaps, and trust. As one put it, “Technology can enable, but mindset transforms”. Business Partnering is about dialogue, turning insights into influence.

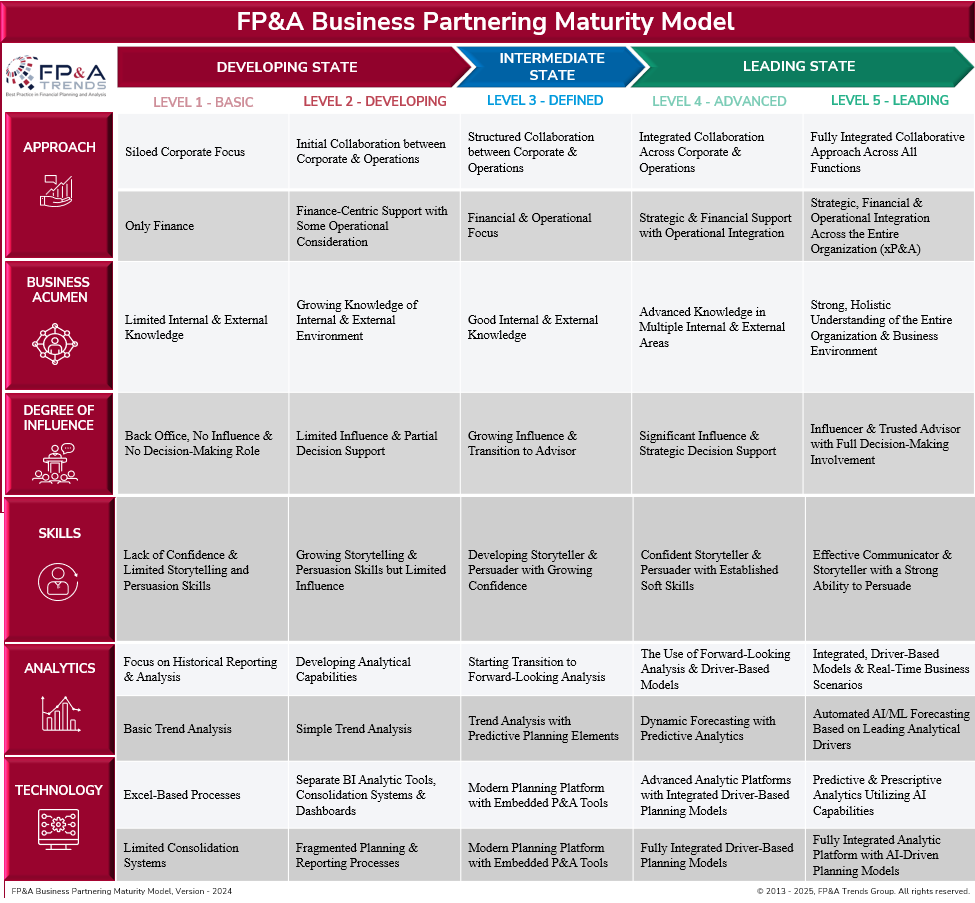

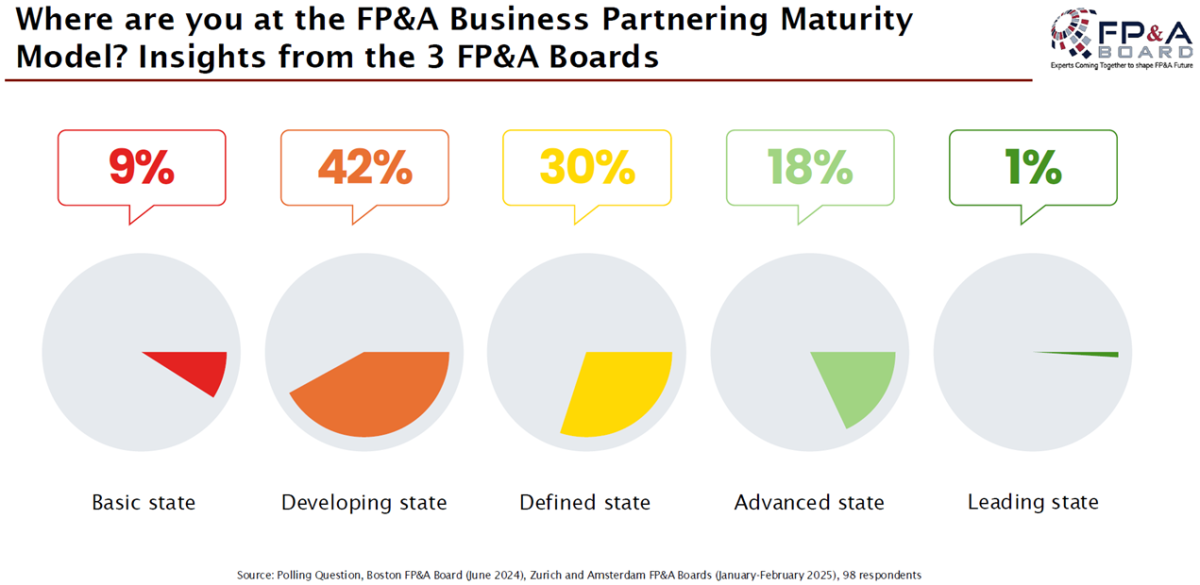

Figure 2

The AI Inflection Point

AI is transforming what FP&A can do and how quickly. The FP&A Trends Research 2025 cites three primary AI roles: productivity, insight generation, and decision support. The FP&A team at the Financial Times uses custom GPTs for real-time narrative and KPIs, freeing time for strategy. Microsoft’s Modern Finance shows similar results: higher accuracy, less reconciliation, and more forward-looking work.

During the San Francisco Board meeting, Matt Niccolls of Constellation Brands said:

"Machine Learning is already outperforming the consensus forecast, shifting the question from “what will happen” to “what does the model not know”.

From Analysis to Infrastructure: The Hidden Revolution

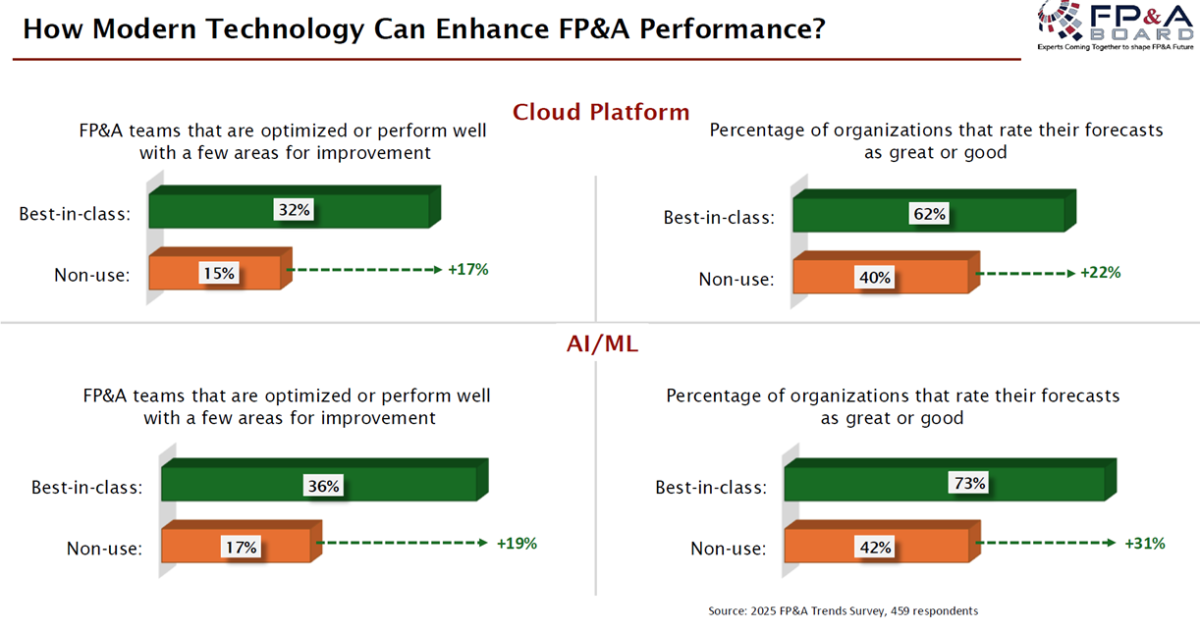

FP&A Trends Insights Paper 2025 highlights that 45% of finance time is still spent on data cleaning, and only 18% of teams use cloud-based planning tools. Modern success depends on a connected “data fabric”, an architecture that unifies distributed data sources for real-time forecasting. Once implemented, companies have reported up to 95% faster forecasts. AI is becoming part of the plumbing, aka cleaning, connecting, and curating data before analysis begins.

Figure 3

Building a Best-in-Class FP&A Partnering Framework

The insights shared across FP&A Boards reveal a new formula for success: technology, talent, and trust.

- Clear Vision and Alignment: Connect financial plans directly to business goals.

- Integrated Data and Systems: Ensure insights are consistent and accessible.

- Leadership and Storytelling: Use narrative to drive understanding and action.

- Curiosity and Business Acumen: Great business partners don’t just answer questions; they ask better ones.

- Continuous Learning: AI is shortening the half-life of finance skills, making learning agility more valuable than tenure.

Making AI Adoption Real

FP&A Trends Research Paper 2025 warns that AI adoption often fails due to resistance to change, a lack of trust, and a lack of necessary skills.

As highlighted by Matt Niccolls, VP Finance at Constellation Brands:

“Whereas Machine Learning has long proven effective, we are still waiting for AI to make a big impact in daily Corporate Finance and FP&A work. Technology is advancing rapidly; further integration into daily FP&A work is likely coming.”

Practical lessons include setting transparent governance, defining the “why”, appointing change champions, and investing in storytelling skills alongside technology.

The FP&A AI Maturity Model: From Automation to Autonomy

The new FP&A AI Maturity Model outlines how teams evolve from automation to autonomy:

- Basic Automation: Macros and dashboards

- Connected Analytics: Shared KPIs and integrated data

- Predictive Analytics: ML-based forecasting

- Agentic AI: Systems that recommend action in real time

- Autonomous Finance: Self-learning models that continuously optimize

Companies like Caterpillar are already operating at Level 4, using self-learning forecasts that update automatically as new data arrives.

Group Work Outputs

Participants worked in small groups to explore how FP&A can advance business partnering in an AI-driven environment. Discussions focused on three themes: defining a best-in-class framework, developing essential skills, and leveraging technology for smarter insights.

Group discussions highlighted the importance of leadership buy-in, trust and influence, as well as the ability to translate data into clear insights aligned with strategic goals. Participants also pointed to agility and continuous learning as vital enablers of long-term success.

Common priorities emerged around trust, communication, data integration, and alignment with strategy — emphasizing that while AI accelerates analysis, genuine progress still depends on collaboration and human judgment.

The Human Edge

Technology accelerates analysis, but people drive outcomes. Effective FP&A business partnering depends not only on analytical and technological capability but equally on leadership, influence, and soft skills. Curiosity, communication, and collaboration enable finance professionals to connect data with strategy and turn insights into action.

The Path Forward

Figure 5

The Future of FP&A isn’t about faster reporting. It’s about shortening the cycle from insights to action. AI handles the volume, but human curiosity, clarity, and courage define value. AI won’t replace FP&A, but those who embrace it will redefine finance leadership.