Successful FP&A digital transformation in startups requires a user-centric, flexible approach that bridges the gap between...

Strategic planning has always been challenging, but in 2025, many FP&A professionals found it nearly impossible to forecast confidently. Between February and May, I witnessed more revisions — and revisions of those revisions — to plans and earnings projections than at any point in my 30-year career.

FP&A teams faced pressing questions:

- What immediate changes are necessary to ensure business continuity?

- How do we plan amid numerous unknown variables?

- Can we develop a robust strategy for long-term transformation while addressing immediate volatility?

Here’s how some of the best responded:

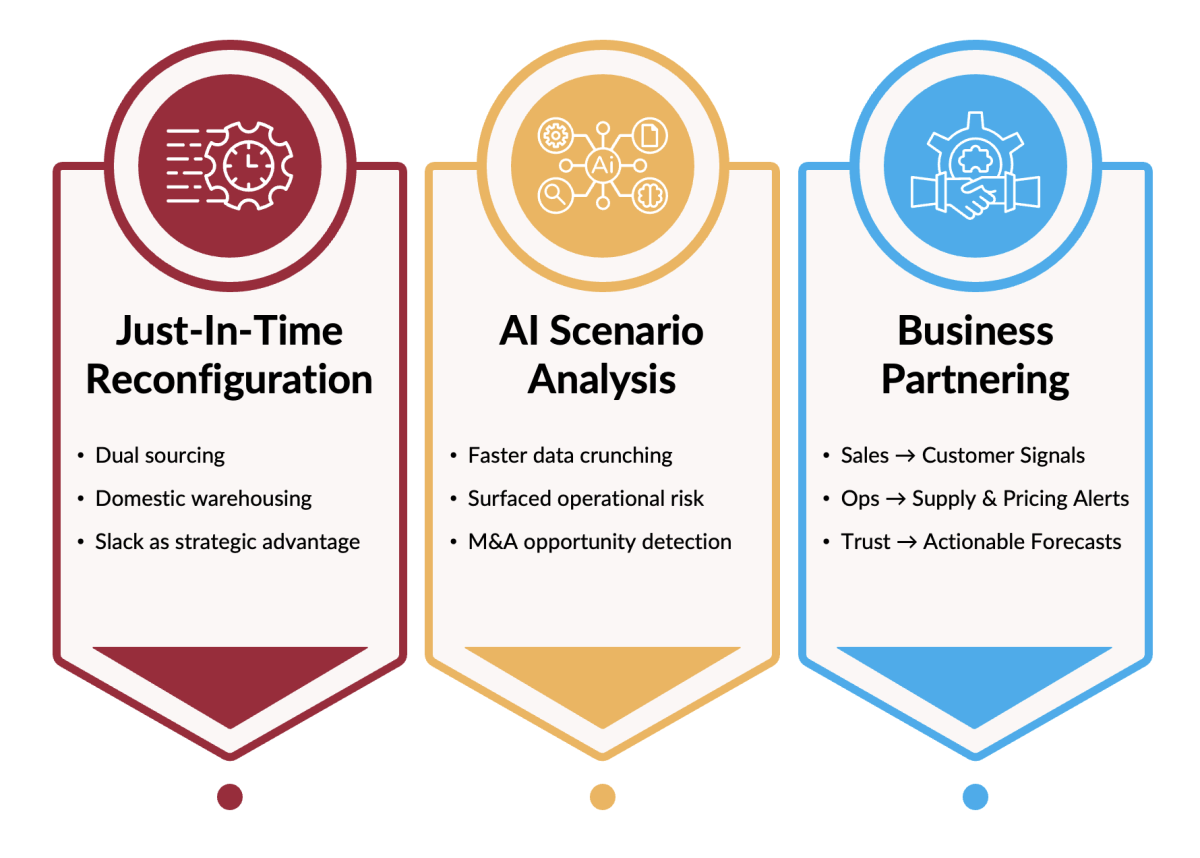

1. Adjusting Just-In-Time (JIT)

Supply chain instability and financial market volatility have prompted organisations to re-evaluate their reliance on the Just-In-Time (JIT) model. According to McKinsey’s 2024 Global Supply Chain Leader Survey [1], 73% of companies have implemented dual-sourcing strategies, and 60% are regionalising their supply chains. FP&A teams have been instrumental in these shifts, recommending the stockpiling of raw materials, expanding domestic sourcing, warehousing finished goods, and introducing redundancies into previously lean processes.

While these strategies may increase costs, they help maintain competitiveness in a landscape where most firms face similar constraints. The idea echoes a concept introduced by author and risk thinker Nassim Taleb in his book Antifragile [2] — the notion that some systems actually benefit from volatility and stress. Building slack and redundancy can help systems not only survive shocks but also improve because of them. This principle now applies to corporate operations.

As these structural shifts took hold, traditional forecasting models became inadequate. Dynamic scenario planning — powered by AI — took centre stage.

2. AI Scenario Analysis

The adoption of AI and Machine Learning tools for financial planning has surged. While specific figures for Q1 FY25 are not publicly available, industry trends indicate a significant increase in the use of AI-driven scenario modelling capabilities. Companies like Microsoft Azure, AWS, Oracle, and IBM have reported heightened demand for these tools, reflecting the growing reliance on advanced analytics in FP&A functions.

FP&A teams have leveraged these tools to rapidly iterate forecasts in response to shifting inputs, from raw material costs to geopolitical disruptions. AI has enabled teams to analyse more data faster, leading to deeper insights

Two major outcomes have emerged:

- Previously hidden risks surfaced. Economic stress tested assumptions and exposed operational fragilities that FP&A leaders addressed in collaboration with partners.

- M&A and integration opportunities emerged. Data patterns revealed competitive advantages and inefficiencies, helping teams build stronger business cases for vertical integration or strategic acquisition.

What began as a response to chaos evolved into a lever for proactive, board-level strategy, reshaping corporate trajectories in real-time.

No amount of technology can replace the human intelligence embedded across an organisation. During this period, effective FP&A leaders didn’t operate in isolation. They collaborated closely with Sales, Operations, and other cross-functional teams.

Sales provided the voice of the customer, while Operations identified sourcing risks and pricing pressures. These perspectives were essential to building accurate, actionable plans. In return, FP&A translated this insight into models that shaped strategic direction.

Beyond technical input, these partnerships built organisational trust. One finance leader at Walmart mentioned that open communication during uncertain times helped frontline employees focus on their roles rather than fear the unknown. That alignment may have contributed to Walmart’s stronger-than-expected Q1 performance, which showed sales and operating income increases despite macroeconomic headwinds.

Figure 1. Levers for Strategic Planning in Uncertain Times

Conclusion: The New Role of FP&A

The disruption of 2025 has made one thing clear: strategic planning is no longer a linear, annual process — it is now a continuous, adaptive function. The FP&A teams that are succeeding aren’t just forecasting numbers but shaping strategy in real time through technology, data, and partnership.

As companies rethink JIT, embrace AI and deepen cross-functional collaboration, the role of FP&A is expanding from financial stewardship to strategic leadership. The lessons learned during this period won’t just prepare us for the next disruption — they are actively rewriting the playbook for how modern businesses survive, compete, and grow.

FP&A professionals who rise to this challenge won’t just be supporting strategy — they will be defining it.

Sources:

- McKinsey & Company. Supply Chain Risk Survey: Insights from global supply chain leaders. 2024. Available at: https://www.mckinsey.com/capabilities/operations/our-insights/supply-chain-risk-survey

- Taleb, Nassim Nicholas. Antifragile: Things That Gain from Disorder. New York: Random House, 2012.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.