In this article, a former CFO outlines five practical pillars that help FP&A professionals evolve from...

Introduction: Rethinking the Role of FP&A

Prior studies (e.g., Oesterreich et al. 2019, Stoller 2021), as well as recent expert discussions, including those around GenAI, point to an important development. Finance professionals will remain valuable business partners only if they combine deep operational and commercial understanding with strong digital capabilities. In particular, the ability to work with data, structure insights, and challenge assumptions is becoming increasingly central.

But what does it truly mean to be a valuable partner?

From a financial decision-making perspective, value is created when we succeed in selecting the most beneficial among a range of realistic alternatives. This is where FP&A plays a critical role not only in supporting decisions but in actively expanding the decision space and shaping how choices are made.

The Foundation: a Structured Decision-Making Process

Every sound business decision follows three core steps:

Definition of alternatives

FP&A helps ensure that the scope of options is complete, diverse, and meaningful. These options may be structured into scenario buckets or decision paths, but the essential point is that all relevant perspectives have been considered.

Evaluation of alternatives

Using both financial and non-financial dimensions, FP&A evaluates the implications of each option. This includes cost-benefit analysis, return on investment, risk trade-offs, and strategic alignment.

Selection and execution

FP&A supports decision-makers by ensuring that the data and insights provided form the foundation of the final decision.

While all three stages are important, the quality of the entire process is often determined by the first step, which is when the comprehensiveness of the alternatives sets the tone.

What Makes an FP&A Business Partner Truly Valuable

The idea of the finance business partner has existed for decades. But to be truly valuable today, an FP&A professional must integrate three essential capabilities:

Operational understanding: the ability to interpret how value is created across functions, teams, and geographies.

Market perspective: insight into what drives customer value and how shifts in the external environment affect strategy.

Credibility and structure: the skill to present independent, structured alternatives with clarity and confidence.

This combination allows FP&A to move from simply validating plans to becoming a fully embedded contributor to decision-making.

From Supporter to Challenger: Qualities the FP&A Role Must Embrace

In many organisations, finance still supports validating plans, adjusting numbers, or preparing reports. However, this limits the value that FP&A can provide.

With access to data and a cross-functional view of both operations and commercial dynamics, FP&A is uniquely positioned to identify what the business may not yet see.

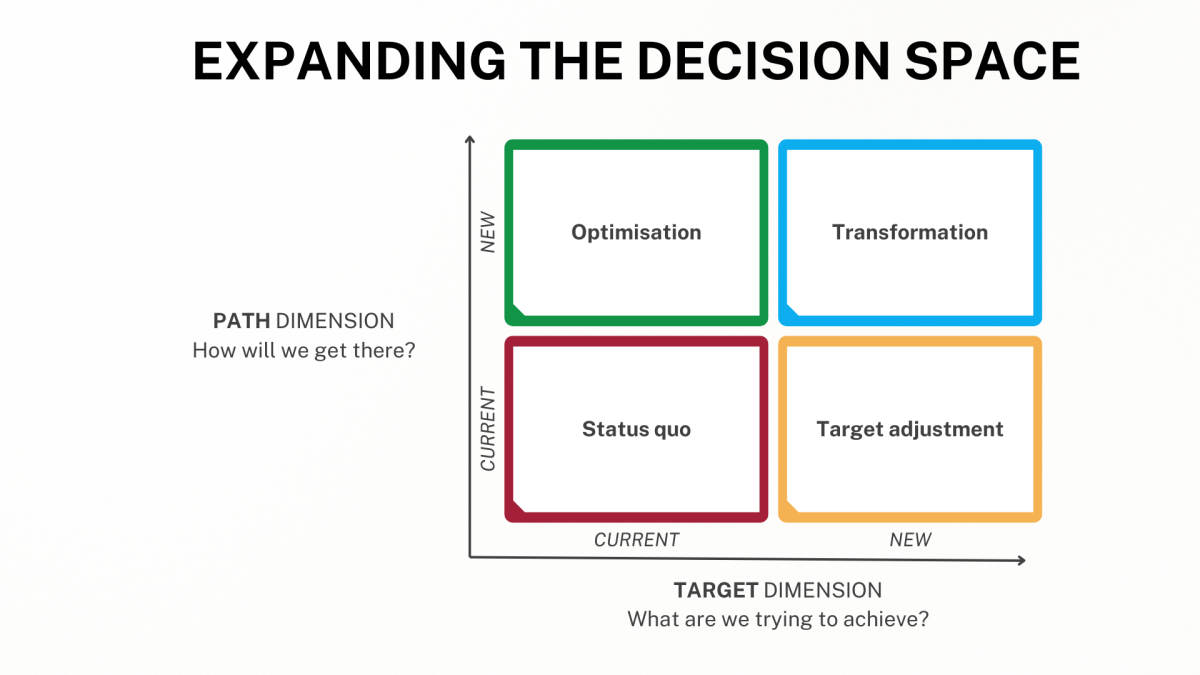

Conceptually, alternatives can be derived by exploring two key dimensions. The first is the target dimension, which questions what we are trying to achieve, and the second is the path dimension, which focuses on how we plan to get there. As shown in Figure 1, this matrix structures strategic choices into four categories — status quo, optimisation, target adjustment, and transformation — by challenging both the “what” and the “how.” This structured approach helps FP&A teams guide leadership toward more comprehensive and creative solutions.

Figure 1: Expanding the decision space: target and path dimensions

By questioning both what we aim to achieve and how we aim to achieve it, FP&A broadens strategic options and enhances decision quality. Source: Figure by author.

These alternative paths can include cost structure improvements, such as working capital optimisation or supply network realignment. However, they can also extend to revenue-side changes such as entering new markets, repositioning offerings, or exiting products or regions at the right moment.

Because FP&A is not embedded in daily operations, it can offer a broader view, providing structured and objective alternatives based on data, logic, and business understanding.

Enabling the Challenger Role Key Conditions

For FP&A to go beyond mirroring the business, several key enablers must be in place:

Governance

Finance must be seen as a critical voice in decision-making. This means involving FP&A early in strategic discussions, with clear expectations that challenge and alternative thinking are welcomed.

Transparency and understanding

Beyond access to data, FP&A must have a deep understanding of the operational and market context. Without this, the insights offered remain abstract or disconnected from real business needs.

Mindset and skills

Finance teams must be encouraged and equipped to think critically, speak constructively, and act independently within the organisation. This is not only a technical challenge but a question of culture and leadership.

FP&A evolves from a reactive reporting function to a proactive and strategic influence when these conditions are met

Strategic Impact through Alternatives

FP&A creates its highest value when it challenges the business not for the sake of criticism but to expand the decision space and structure the decision-making process. This role requires clarity, courage, and a company culture that supports honest dialogue.

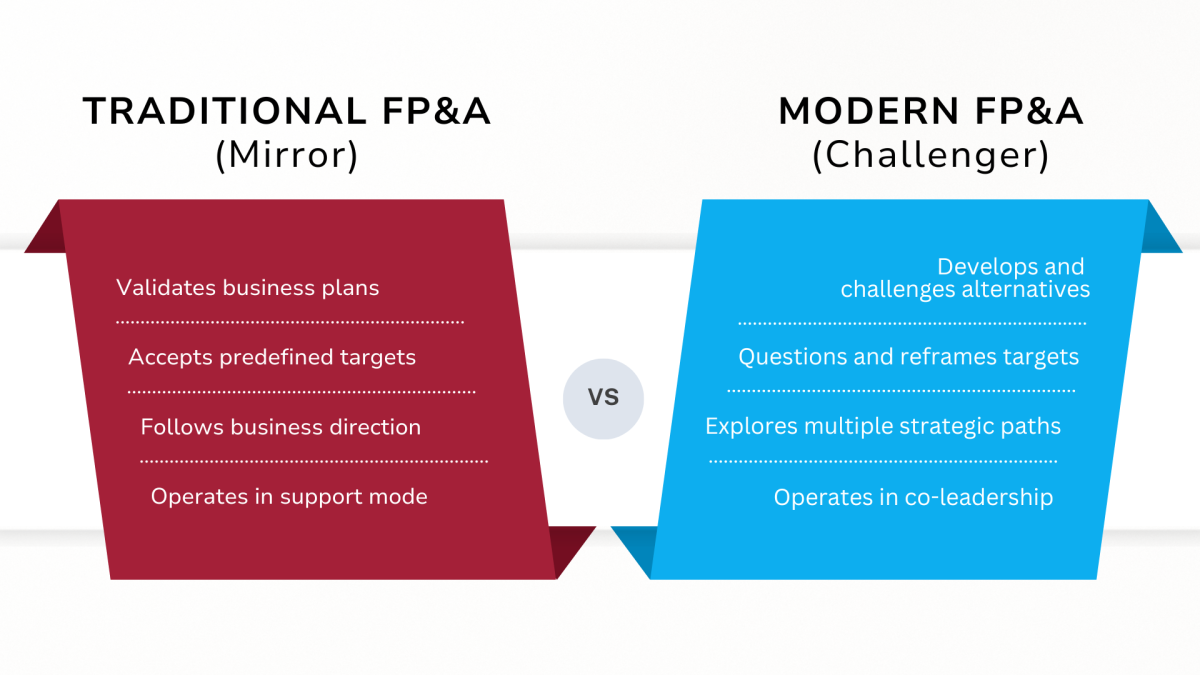

FP&A can and should be more than a support function. It can serve as a compass guiding the organisation through structured thinking rooted in data, operational understanding, and a strategic perspective. Figure 2 illustrates this mindset shift from a traditional “mirror” role focused on validation to a modern “challenger” role that proactively shapes strategic outcomes. This transformation enables FP&A to co-lead decision-making alongside business leadership.

Figure 2: Expanding the decision space: from traditional FP&A (mirror) to modern FP&A (challenger)

The shift from validating and supporting to questioning and co-leading enables FP&A to shape strategic outcomes.

FP&A helps leadership make better choices with greater impact at the right time by showing what is possible, not just what is planned. This can be clearly seen in the following practical example.

Practical Application of Expanding the Decision Space in Investment Cases

Consider a common scenario to demonstrate how FP&A can expand the decision space in practice. A business unit proposes a new machine investment to increase manufacturing capacity. The request is presented to FP&A for financial evaluation.

From a broader perspective, it is important to distinguish between the proposed business case target, which is a capacity increase at a specific location, and the underlying objective, which is to fulfil forecasted or projected customer demand. At an even more fundamental level, profit maximisation is the financial target behind such decisions. Capacity expansion is only one possible path toward this objective and should be evaluated against other alternatives in terms of cost, flexibility, and strategic alignment.

In a traditional setup, as defined in this article, FP&A would validate the business case assumptions, assess financial returns, and request additional clarification for specific figures if needed.

However, the challenger role of modern FP&A encourages a broader analysis by questioning both the underlying objective and the proposed path. It includes assessing whether the demand assumptions are reliable and whether a new machine is the most effective way to meet that demand. The following section outlines several options FP&A may explore, structured according to the decision space framework.

Methodological Note

The order in which the options are presented, from status quo to transformation, reflects an increasing degree of deviation from the originally proposed business case. This structure follows a natural cognitive flow, helping FP&A teams understand the business logic before gradually challenging it.

However, the process does not need to follow this sequence. In some cases, beginning with a fundamental review of the underlying objective may be more effective, especially when strategic uncertainty is involved. Starting with transformation-oriented thinking can help frame the discussion at a higher level before diving into operational adjustments. Both approaches are valid and can be used depending on the context and stakeholder dynamics.

Before transitioning to the individual options, it should be acknowledged that a clear distinction between the four categories may not always be possible. The classification depends heavily on how the target and the path are initially defined in the business case. Nevertheless, the following overview provides a useful structure to frame the thinking process and illustrate how FP&A can broadly approach investment evaluations.

Status quo (current target, current path)

The business case is evaluated as submitted. To meet projected demand, a new machine of the same type is acquired. FP&A performs a financial review based on the provided data, including return on investment, payback period, and scenario analysis.

Optimisation (current target, new path)

Review of operational efficiency: FP&A investigates whether the current machine is already running at full shift capacity and whether existing resources are optimally scheduled.

Assessment of organisational improvements: Consider whether setup or preparation work can be organised outside of machine runtime to improve effective utilisation.

Outsourcing evaluation: Analysis of whether specific steps in the process could be outsourced, allowing the company to convert fixed costs into variable ones and defer capital investment.

Target adjustment (new target, current path)

Challenge of investment rationale: Market review and analysis of sales forecasts to determine whether the proposed capacity increase is truly required. Additional customer commitments may be necessary.

Product and segment assessment: Review whether the product linked to the investment is still strategically attractive or whether the company should focus its resources on more promising segments using the same infrastructure.

Strategic fit evaluation: Assessment of whether the investment is aligned with broader corporate strategy, taking into account long-term positioning and capital allocation priorities.

Transformation (new target, new path)

Use of alternative technologies or internal assets: Evaluation of other machines or production technologies within the company that may have unused capacity, even if they are not fully optimised.

Location shift: Exploration of whether another manufacturing site within the group has available capacity and can more cost-effectively fulfil the operational need. However, this can be classified as a transformation only if the original target was location-specific, as it implies redefining both the goal and the delivery model.

External partnerships or outsourcing: If the process is not part of the company's core value proposition, FP&A considers collaboration models or outsourcing as a flexible and capital-light alternative.

Conclusion

In this example, FP&A does more than validate a predefined investment plan. By actively expanding the decision space across both the target and the path, finance contributes critical insight, reveals hidden options, and improves overall decision quality.

When FP&A challenges the business not for the sake of criticism but to broaden strategic options, it helps leadership make better choices with greater impact at the right time. This role requires clarity, courage, and a company culture that supports honest dialogue.

FP&A evolves from a support function to a proactive and strategic influence when governance, transparency, and the right mindset are in place. It can serve as a compass guiding the organisation through structured thinking rooted in data, operational understanding, and strategic perspective.

The shift from validating and supporting to questioning and co-leading enables FP&A to shape strategic outcomes. This is how finance becomes a valuable business partner by structuring decisions, expanding what is possible, and enhancing alignment with strategy and operational constraints.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.