In this article, the authors outline why in-person Business Partnering may not be sustainable in modern...

Despite advancements in supporting executive-level decisions, Financial Planning and Analysis (FP&A) leaders face tough competition for decision-maker mind share as data and analytics (D&A) capabilities outside of finance increase. Demonstrating excellence as an FP&A leader now more than ever requires their function to disperse its capabilities across the decision-makers’ community via technology-centric Business Partnering.

Over the past decade, FP&A leaders have added dashboarding and Predictive Analytics to their repertoire. Such a shift has positioned them as trusted right-hands to their CFOs, the C-suite, and senior business leaders, allowing for decision-making support across the enterprise. This progress occurred due to advancements in core FP&A activities. It was led by teams that have embraced digital financial planning, streamlining performance reporting and utilising Predictive Analytics to better anticipate risks and opportunities.

However, FP&A’s evolution didn’t occur in a vacuum: other enterprise functions have simultaneously progressed, creating a very different landscape for decision-making. The accessibility of D&A, including on-demand performance reporting and the proliferation of specialist D&A in other functions such as IT and operations, has created competition and even conflict for performance insights. FP&A used to serve as the main source of financial performance insights. However, now it is one voice among many jockeying for decision-makers’ attention, which raises the risk of profit-eroding decisions.

Next-Level FP&A Leadership Embraces a New, More Technology-Centric Vision

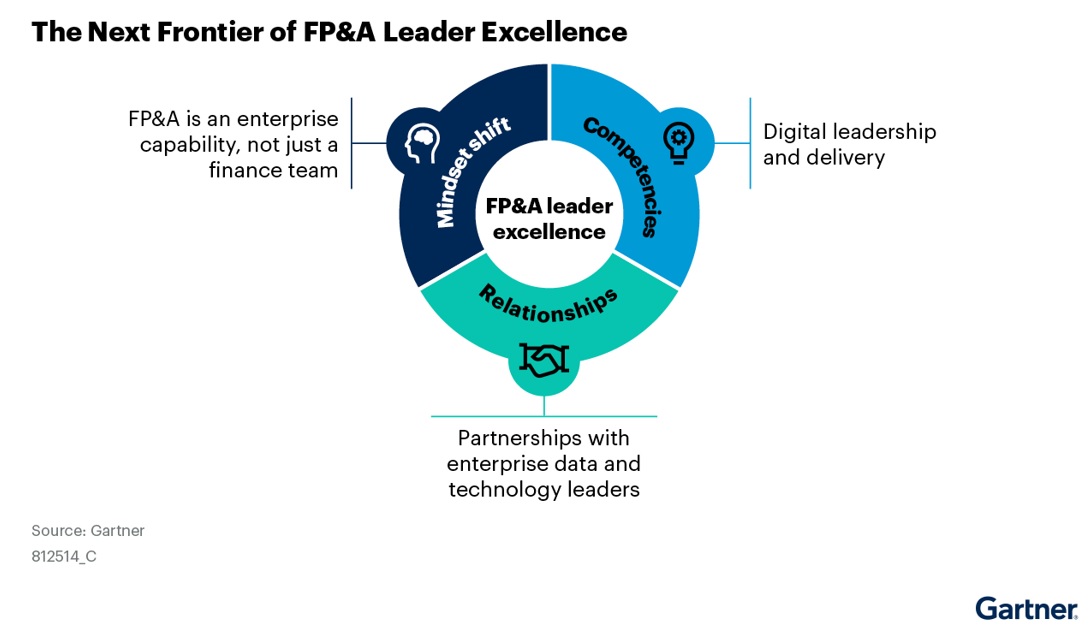

To remain relevant and justify further investments in the function, FP&A leaders need a clear plan to compete and win in the increasingly complex data and decision-making background. The next stage of FP&A’s evolution requires a bolder, more aggressive personal vision to fulfil their CFO’s expectations. Gartner, Inc. conducted research to identify a new vision for FP&A leaders along with the mindset, competencies and relationships necessary to achieve it (see Figure 1).

Figure 1: The Next Frontier of FP&A Leader Effectiveness

Principle №1: Adopt a New Mindset that Treats FP&A as an Enterprise Capability

To better reach the decision-making community beyond the C-suite and senior business executives, FP&A must shift from perceiving themselves as internal consultants to foremen of a digital-first enterprise capability. This new mindset underscores the importance of getting used to FP&A staff treating in-person Business Partnering as the exception, not the norm. Instead, it implies investing in building and managing a portfolio of decision support tools that transfer FP&A acumen to every decision-maker across the enterprise. It’s an investment that encompasses the enterprise-level view in planning and forecasting, understanding Key Performance Indicator (KPI) relationships and modelling P&L statements and balance-sheet impact of decisions to optimise performance.

As the FP&A function has been priding its strong in-person partnerships for a long time, FP&A leaders may be hesitant to shift to a primarily digital model of disseminating insights. However, the FP&A function must recognise and realise that the in-person model of Business Partnering has capacity limits when it comes to the influence of FP&A’s counsel.

Principle №2: Improve Personal Digital Acumen

Strong planning process leadership, communications, influence, and knowledge of D&A are the cornerstones of FP&A leaders’ experience. Nevertheless, it is imperative to build new digital competencies to achieve the new FP&A vision, especially in technology, data science and agile delivery.

The fundamental FP&A skill set translates well to this vision. Three skills stand out and apply to this mindset especially well:

Financial planning software acumen

It can help leaders assess the adequacy of FP&A’s current technology for tool-enabled insight delivery and develop other technology implementation methods, including agile ones.

D&A experience

It provides leaders with a strong foundation to develop a baseline knowledge of data science.

Planning process leadership

It allows leaders to identify which currently underserved decisions would benefit most from new tools.

Additional competencies, such as advanced technology literacy, finance product management and working knowledge of data science, are also critical to streamlining this change in the FP&A function. Yet, it’s not enough to experiment with or tweak these competencies. FP&A leaders must take a more deliberate, active learning stance to try out more uncomfortable areas that stretch their new skills.

Principle №3: Extend Relationships Beyond the C-Suite

To broaden FP&A’s reach, it’s increasingly important to cultivate and leverage collaborative relationships – beyond budget owners – with technology and data leaders throughout the enterprise. FP&A leaders need to take a new approach to relationship building and forge technology- and data-oriented relationships with senior management inside and outside the finance function. To do so, they should adjust the amount of time spent with various partners in their organisations. FP&A leaders should spend more time with the following roles for the reasons specified:

IT data architects

While finance leaders feel like they are doing the right things to succeed, new data from Gartner’s recent CxO-CIO Digital Leadership Survey indicates that fewer than 20% lead in a manner that will produce better results. The FP&A leaders must be responsible for resourcing tool co-creation teams that will work with IT data architects to build a new model for decision and planning support.

Technology vendors

99% of finance leaders said they would buy at least one Artificial Intelligence (AI)/Machine Learning (ML) capability from an external vendor. However, finance functions have historically struggled with this approach. 75% of finance buyers reported a high degree of regret from their digital technology purchases. Advanced technologies, like AI/ML-enabled planning software, require time to calibrate, and the use cases may change with the technology roadmap. These are not set-and-forget technologies, so continuous vendor engagement is required to avoid disappointment.

Controllers and other stewards of data

Spending more time on it helps us ensure there is a sufficient version of truth in financial information leaving the finance department. This approach will cultivate trust in financial information, increasing the likelihood that decision-makers will use FP&A insights.

On the other hand, they should spend less time with business unit leaders, as the technology-first delivery model will sustainably address most of these decision-makers’ support needs. They should also spend less time with FP&A analysts because FP&A leaders will have less daily work related to managing reporting and analytics due to a greater digital emphasis.

How To Start Right

To get started, FP&A leaders can convene a working group to identify the business’s support needs that could benefit from technology and task tech experts to prototype and pilot decision support tools. A Gartner healthcare client piloted ML with one material, diagnostic-resistant problem area – identifying and tapping new and effective business drivers. The use of ML generated a 42% increase in a new office’s revenue over ten years, building momentum for additional ML projects.

FP&A leaders can also incorporate objectives around digital skills development, a decision support tool delivery and improving decision-makers’ financial literacy into FP&A staff performance goals. Once, a Gartner client needed to account for rapid changes in the operating environment without slowing the speed of business by waiting for custom FP&A scenarios. Their FP&A leader and team placed KPI-based “guardrails” and preloaded recommendations into decision support tools for operating decisions that occur daily or weekly. As a result, the organisation optimised inventory levels, keeping the company aligned on a path of superior return on invested capital and profitability. This enabled the business to lower inventory while sales increased, making it an industry gold performance standard.

By making these functional changes to their vision, mindset, competencies and relationships, FP&A leaders can turn business planning and decision support into a source of organisational advantage, with better influence and results for the enterprise.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.