Svetlana Sigalova tells us about the explosive growth Moderna has undergone. She speaks about the challenges...

As businesses become more digitally driven, Financial Planning and Analysis (FP&A) professionals must adapt to new technologies and tools to stay ahead.

As businesses become more digitally driven, Financial Planning and Analysis (FP&A) professionals must adapt to new technologies and tools to stay ahead.

In recent years, we have seen a rapid shift towards digitalisation in all aspects of the business. As more companies adopt digital technologies, it has become increasingly important for FP&A professionals to adapt and evolve their skills to keep pace with the changing landscape.

In this article, we will explore the impact of digital transformation on FP&A and discuss how professionals in this field can leverage new technologies and tools to drive better outcomes for their organisations.

The Evolution of FP&A in the Digital Age

The role of FP&A has undergone a significant transformation in recent years because of digitalisation. In the past, FP&A was primarily focused on traditional financial reporting and analysis, with little emphasis on technology or data analysis.

Today, however, FP&A professionals are required to have a much broader skill set, including proficiency in data analytics, Business Intelligence, and emerging technologies such as Artificial Intelligence/Machine Learning. The demand for these skills will only grow as more companies advance digitalisation.

The Impact of Digital Transformation on FP&A Processes

Digital transformation profoundly impacted FP&A processes, enabling professionals to work more efficiently and effectively. With the advent of cloud-based FP&A technology and real-time data analytics tools, FP&A professionals can now access critical financial information in real-time, enabling them to make better decisions faster.

In addition, digital transformation has enabled FP&A professionals to automate many manual tasks associated with financial analysis, such as data entry and report generation. This saves time, reduces the risk of errors, and allows professionals to focus on higher-level tasks such as Strategic Planning and analysis.

Leveraging New Technologies and Tools for FP&A

FP&A professionals must adopt new technologies and tools to stay ahead of the digital age. This includes investing in the following:

- cloud-based financial management software,

- real-time data analytics tools, and

- Business Intelligence platforms.

By leveraging these technologies, FP&A professionals can gain deeper insights into financial data, identify trends and patterns, and make more informed decisions. In addition, these tools enable professionals to collaborate more effectively with other departments, such as sales and marketing, to drive better business outcomes.

The Role of FP&A Professionals in Digital Transformation

As companies continue to adopt digital technologies, the role of FP&A professionals will become increasingly important. These professionals will be responsible for leveraging new technologies and tools to drive better business outcomes while ensuring that the organisation’s financial processes are secure and compliant.

To be successful in this role, FP&A professionals must develop a deep understanding of emerging technologies and be proactive in their adoption. This may involve investing in training and development programs to build new skills and staying up to date on the latest trends and developments in the field.

The Digital Transformation Benefits and Opportunities for FP&A Professionals

Another impact of digital transformation on FP&A is the ability to identify new opportunities. With the help of Machine Learning algorithms, businesses can analyse large datasets and identify previously unseen patterns. This allows FP&A professionals to spot new opportunities for growth and make data-driven decisions that can lead to increased profitability.

The increased adoption of cloud-based technologies is also transforming how FP&A professionals work. Cloud-based platforms offer increased flexibility, accessibility, and scalability, enabling FP&A teams to work remotely and collaborate seamlessly with other departments. It allows businesses to reduce costs and increase productivity while maintaining data security and integrity.

What Can Digital Transformation Bring to FP&A?

As FP&A professionals, we have to understand the following opportunities that digital transformation may bring to our industry. I outline a few considerations for embarking on this transformation journey.

1. Enhanced Efficiency

One of the key aspects of digital transformation is automation. FP&A professionals can leverage automation tools to streamline manual tasks such as data entry and report generation. By implementing robotic process automation (RPA), organisations can achieve greater efficiency, reduce errors, and free up time for strategic analysis and planning.

However, while implementing digitisation initiatives, organisations may encounter challenges such as resistance to change, data integration issues, and the need for clear communication. Understanding the importance of stakeholder buy-in, conducting thorough testing of automation processes, and continuous monitoring for improvements become the most important factors for embracing it successfully.

To make the most of digitisation, FP&A professionals can:

- Identify and prioritise manual tasks that can be automated to enhance productivity.

- Ensure strong change management practices and effective communication to facilitate smooth adoption.

- Establish clear metrics to measure the impact and success of automation initiatives.

2. Advanced Analytics and Data-Driven Insights

Digital transformation empowers FP&A professionals with advanced analytics tools, enabling them to extract valuable insights from large datasets and make data-driven decisions.

For instance, utilising Predictive Analytics models allows us to forecast financial performance based on historical data, market trends, and other relevant factors. Nevertheless, we do not have to forget the crucial requirements for this move. Implementing advanced analytics requires a solid foundation of data quality and skilled resources. Organisations may face challenges in data integration, data privacy, and the need for data literacy among FP&A professionals. That is why the role of a data scientist is becoming increasingly popular.

In order to ensure that organisations can operate the relevant data, the business has to invest in data management capabilities to ensure data accuracy, consistency, and availability. Simultaneously, encouraging continuous learning and upskilling of FP&A professionals in data analysis and interpretation also becomes highly important, as you will need specialists who can work with the available data. Collaborating with IT departments within an organisation will allow you to create a robust data infrastructure that can use advanced analytics and provide insights.

Indeed, digital transformation also fosters collaboration between FP&A and other departments, contributing to more holistic and accurate decision-making. Given that perspective, it is important to remember that collaborative decision-making requires strong communication channels, developing communicative skills, building trust, and a shared understanding of business goals.

Challenges may include resistance to cross-functional collaboration, siloed data, and the need for process alignment. Overcoming them may require facilitating regular cross-functional meetings and encouraging open dialogue to align strategies and goals, as communication is the key here. It will help business leaders foster an internal collaboration and knowledge-sharing culture.

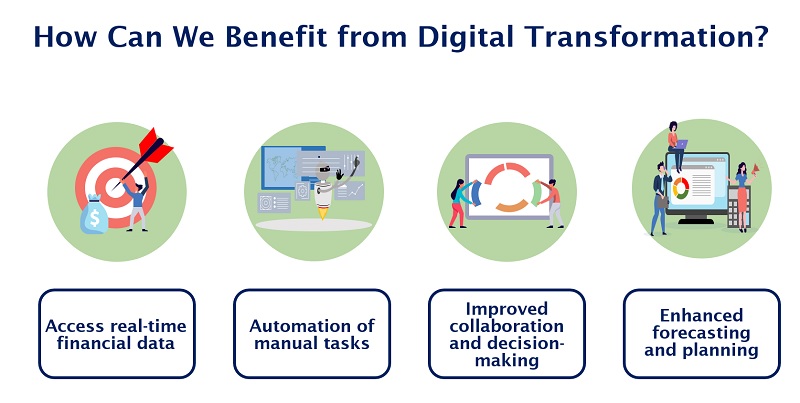

How Can We Benefit From Digital Transformation in Practice?

Figure 1

Let us take an in-depth look at an example. Consider a retail company undergoing a digital transformation by implementing cloud-based financial management software and real-time data analytics tools. To illustrate my points below, I am outlining how it can benefit the organisation.

1. They Can Access Real-Time Financial Data

With the new technology, FP&A professionals can access real-time financial data from various sources, such as sales transactions, inventory levels, and customer data. They no longer have to wait for manual reports or rely on outdated information. Consequently, it enables them to make faster and more informed decisions. For example, suppose the company wants to analyse the sales performance of a specific product category. FP&A professionals can use real-time data analytics tools to gather relevant data quickly, analyse sales data, and assess the profitability of different products. It allows them to make data-driven recommendations on pricing strategies, inventory management, and marketing campaigns.

2. Automation of Manual Tasks

For instance, data entry from multiple systems can be automated, reducing the risk of errors and saving valuable time. Suppose the company needs to generate monthly financial reports for various stakeholders. With the new technology, FP&A professionals can automate the report generation process, pulling data from different sources and generating accurate reports in a fraction of the time it would take manually. In that case, they can free up their time to provide strategic recommendations to improve financial performance.

3. Improved Collaboration and Decision-Making

Let us consider a company’s plan to launch a new product line. One of the main benefits of digital transformation is that FP&A professionals can collaborate with the sales and marketing teams by sharing real-time financial forecasts, pricing models, and sales projections. What is the result? Indeed, digital transformation facilitates collaborative decision-making, where all teams can align their strategies, assess the financial viability of the new product line, and make informed decisions based on accurate and up-to-date financial data.

4. Enhanced Forecasting and Planning

FP&A professionals can leverage historical data, market trends, and predictive modelling to generate more accurate and timely forecasts with the help of advanced analytics tools. Implementing it can contribute to more sound and informed decisions about future investments, resource allocation, and strategic initiatives.

For instance, suppose the company wants to expand its operations into a new market. FP&A professionals can use advanced analytics tools to analyse historical financial data, market conditions, and customer demographics of similar markets. Considering these insights, the FP&A team can generate accurate forecasts, estimate the potential revenue and costs associated with the expansion, and evaluate the project’s financial feasibility.

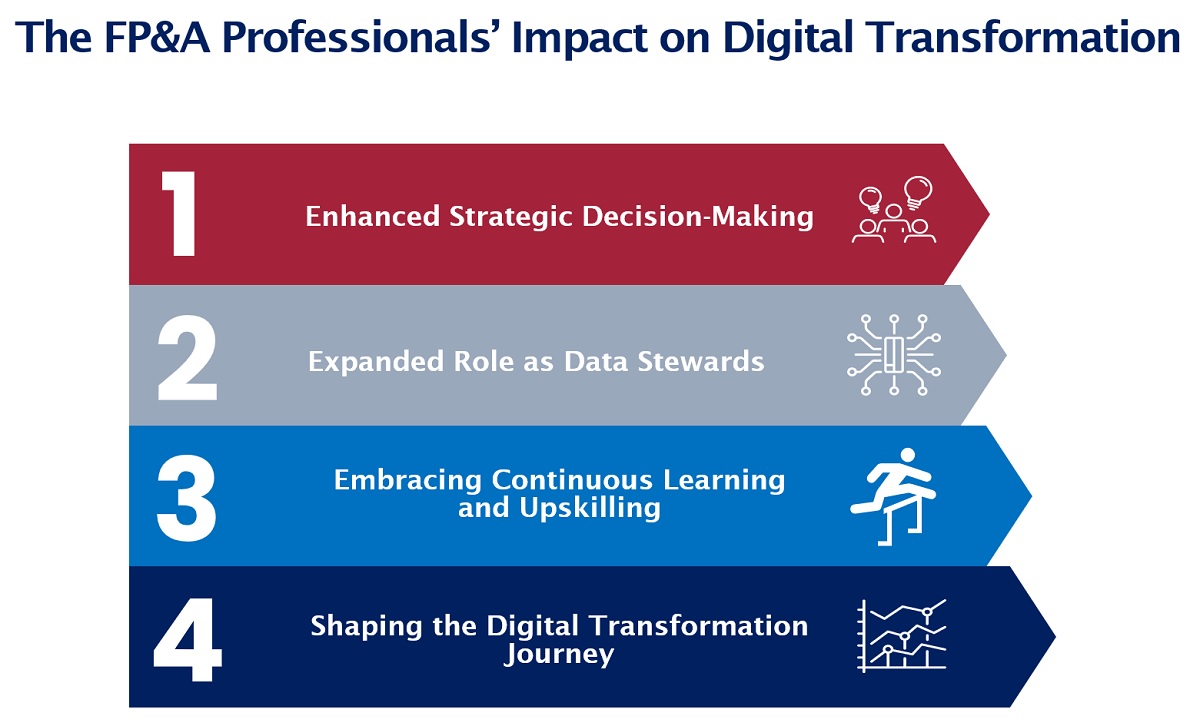

Future Implications and the Impact of FP&A Professionals

Figure 2

Digital transformation will continue to reshape the FP&A profession, presenting opportunities and challenges. Here are some thoughts on how ongoing digitisation will impact the field and how FP&A professionals can make a difference:

1. Enhanced Strategic Decision-making

As digital technologies provide real-time insights and predictive capabilities, FP&A professionals will be crucial in driving strategic decision-making. They will contribute by leveraging data-driven insights to identify growth opportunities, optimise resource allocation, and assess investment risks.

2. Expanded Role as Data Stewards

With the increasing importance of data in decision-making, FP&A professionals will assume a broader role as data stewards. They will ensure data integrity, establish data governance frameworks, and implement robust data security measures. By taking ownership of data quality and governance, FP&A professionals can build trust in the accuracy and reliability of financial information.

3. Embracing Continuous Learning and Upskilling

Professionals must prioritise continuous learning and upskilling to thrive in the digitised FP&A landscape. They should stay abreast of emerging technologies like Artificial Intelligence/Machine Learning and learn how to use data visualisation tools. By expanding their skill set, FP&A professionals can harness the full potential of digital tools and drive better business outcomes.

4. Shaping the Digital Transformation Journey

FP&A professionals have a unique opportunity to shape the digital transformation journey within their organisations. They can actively contribute by championing the adoption of digital technologies, advocating for data-driven decision-making, and collaborating with IT and other departments to drive digital initiatives. FP&A professionals can influence the direction and success of digital transformation efforts by becoming catalysts for change.

Conclusion

In conclusion, digital transformation profoundly impacts FP&A, requiring professionals in this field to adapt and evolve their skills to keep pace with the changing landscape. By leveraging new technologies and tools, FP&A professionals can drive better outcomes for their organisations while ensuring that financial processes are secure and compliant. As we continue to move towards a more digitally-driven business environment, the role of FP&A professionals will only become more critical. Digital transformation in FP&A can bring significant benefits such as real-time access to financial data, automation of manual tasks, improved collaboration, and enhanced forecasting capabilities. These advancements enable FP&A professionals to provide more accurate insights, support data-driven decision-making, and contribute to the organisation’s overall success.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.