So why are we as finance professionals so slow to adopt digital transformation when there are...

Our FP&A teams are overwhelmed with routine tasks, and it's clear we need to allow them to focus on high value activities such as generating insights, making decisions, and driving action. Automation is one way to achieve this.

The FP&A Trends webinar addressed key questions related to automation in FP&A. Where to start? What technology to use? How does the approach to automation change depending on the size of the organisation and the industry in which it operates?

This article provides an overview of the topics and cases presented and discussed by the expert panellists in the "Maximizing the Value of FP&A Through Automation" webinar, as well as the results of our polling questions.

Using Automation to Drive Value Creation

Kevwe Ijatomi, Finance Director at Google Cloud, outlined the main reasons for automations, and shared different approaches to automation with several practical examples.

The main aim of automation is pretty straightforward: to allow FP&A teams to become better partners for the business, by reinvesting the time saved on routine tasks into solving the next business challenge.

Figure 1

Figure 1

Approaches to automation differ from business to business. Some see automation as a way to drive costs out of business and focus solely on low-hanging fruit. Others, meanwhile, see automation as a strategic imperative, cultural trait or a part of the business’s DNA.

Regardless of the approach you choose, it All Starts From The TOP. Executive Support explains why you need automation.

Diverse types of knowledge are required to face the challenges that automation poses. Teams need to work closely and collaboratively to address them together. For automation to be successful:

IT/Data Engineering & Finance should function as ONE collaborative team.

It is important to Identify Higher Value Activities before starting the automation journey so your business has a clear plan for using the additional FP&A capacity freed up through automation.

You should Encourage Learning and a growth mindset in your organisation to build the necessary skills for performing these high-value activities.

Which FP&A Areas Are Automated in Your Organisation?

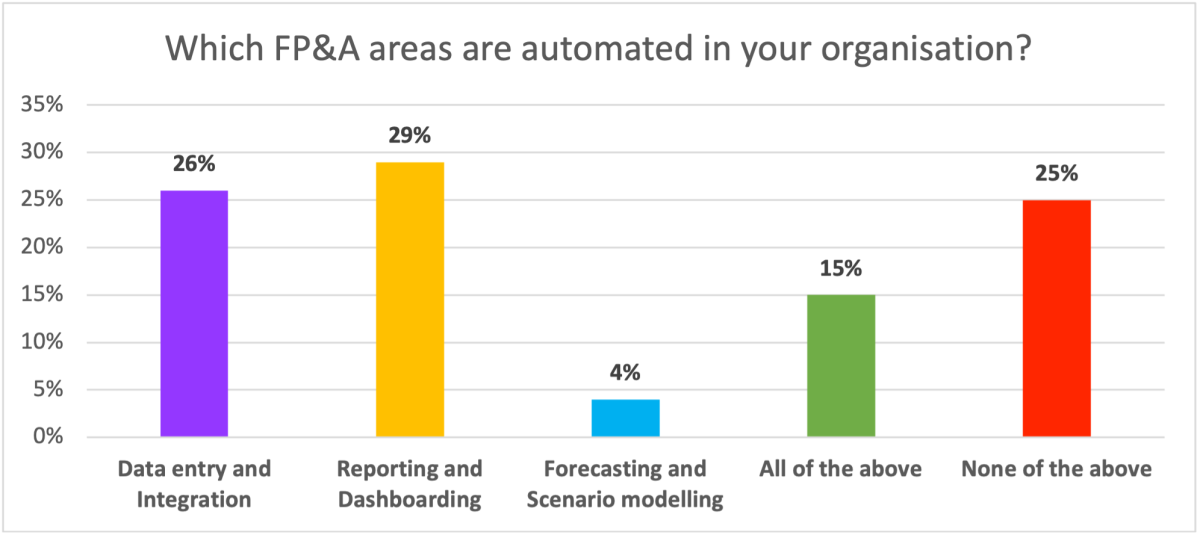

During the webinar, attendees from the FP&A industry took part in a poll and shared which areas are already automated in their FP&A process. 29% of the FP&A teams reported having their dashboarding and reporting automated, while data entry and integration were automated in 26% of the teams surveyed.

Figure 2

Reasons Why Companies Seek Automation and Main Changes Companies Go Through

Chris Light, Head of Business Operations at Causal, shared with us the main reasons for automation and the benefits it can bring.

FP&A teams often do not enjoy manual work and see many flaws in existing planning and analysis processes, such as:

Inefficient and inconsistent planning processes

Manual data transformations

Data and security risks

Non-existent collaboration across the organisation

Annual budgets

Solving #REFs and other spreadsheet issues

Automation will allow organisations to have:

A single source of truth

Automated reporting and analytics

Seamless collaboration between teams

Easy Scenario Planning and rework

Permissions and audit trail

Time for analysis and recommendations

There are some challenges on the way to automation:

Accessing siloed and inaccessible data sources

Defining the scope of each project/phase

Improving existing processes and models

Change management

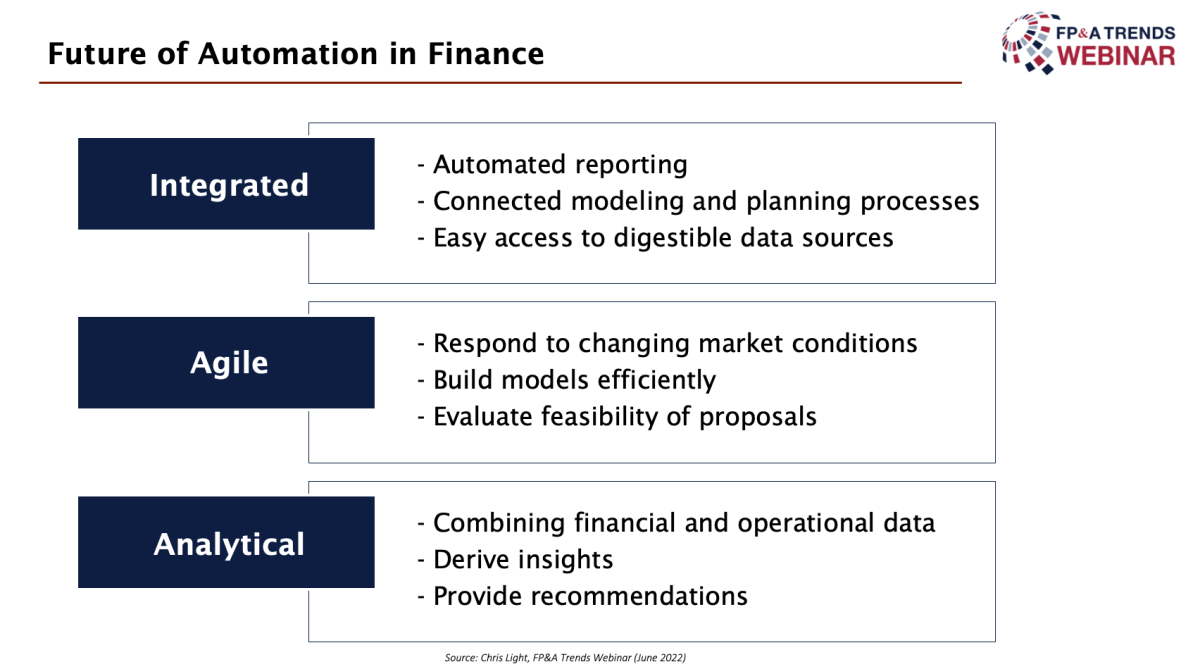

The era of automated finance is fast approaching, and it is Integrated, Agile and Analytical. This leads to finance teams acting as strategic Business Partners, helping to drive the business forward.

Figure 3

Finance Automation to Manifest the Mission

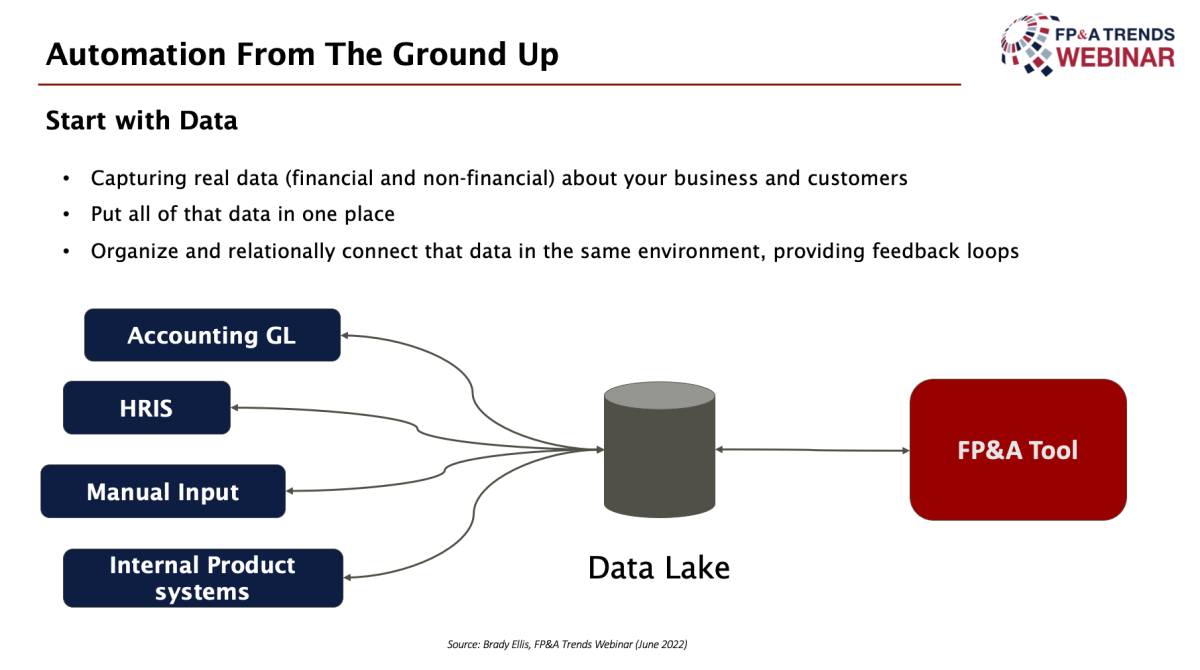

Brady Ellis, VP, Head of Finance at Branch Insurance, presented a case study where very small financial teams, thanks to automation, managed to understand and analyse their insurance business in a complex way.

With the ultimate goal of driving costs down and offering less expensive insurance to their customers, the finance and accounting team relied on automation to put their routine tasks on autopilot.

The entire process began with the sales team collecting data on lead creation in Google Sheets, and ended with a well-established automated headcount planning tool and sales projection tool. All of this can only be achieved with the support of the operations and IT teams.

Figure 4

Once you have your data environment situated, empower your team by:

Aligning your accounting team with the automation environment

Empowering finance professionals to understand the data layer and how to plug it into your tool.

In a year, the Branch Insurance FP&A team has grown from one to three members and the following amazing results have been achieved in automation:

FP&A monitoring work is almost entirely automated!

Scenario modelling with daily actuals provides near-instant insights into business units

Fully functioning one and five-year strategic plans with robust scenario modelling set up in six months using a new, extra-flexible FP&A tool

This set-up allows the company to react immediately to external changes and disruption by building new models and scenarios in a matter of days.

Conclusions

The path to automation is not one that finance can travel alone: collaboration is key. To succeed, you will need both business and technology partners. Start small, look for wins and share them across the organisation to inspire and drive change.

We would like to thank our global sponsor, Causal, for their great support with this FP&A Trends Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.