In an ever-changing environment, dynamic and data-driven Scenario Planning is of critical importance. That means moving...

Integrated FP&A is key to driving continuous real-time planning and agility. In the latest Digital FP&A Board session, an international panel discussed this process through two real-life case studies from Länsförsäkringar, the largest insurance provider in Sweden, and Clariant a company in the speciality chemical market.

Integrated FP&A is key to driving continuous real-time planning and agility. In the latest Digital FP&A Board session, an international panel discussed this process through two real-life case studies from Länsförsäkringar, the largest insurance provider in Sweden, and Clariant a company in the speciality chemical market.

This article looks at the key concepts and definitions of both integrated and agile FP&A. Through the two case studies, we explore how to connect integrated FP&A from a finance view to deliver continuous and real-time planning through an operational and technology view.

What Is Integrated and Agile FP&A?

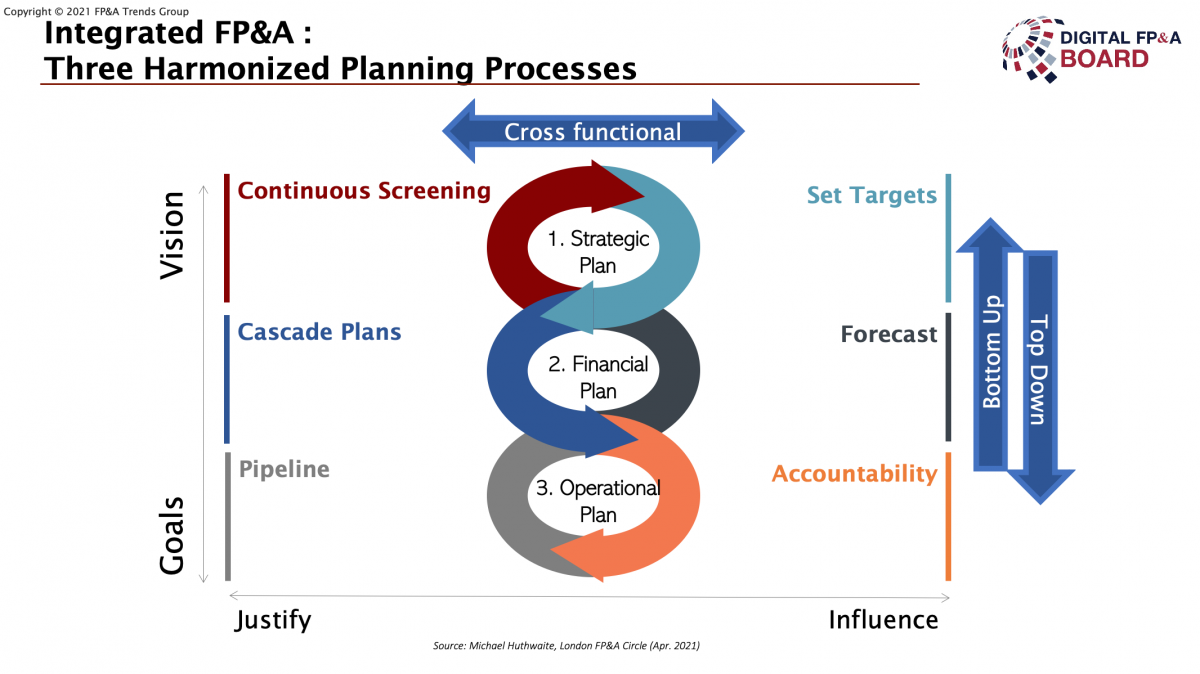

Integrated FP&A involves both horizontal and vertical harmonisation of 3 planning processes: strategic, financial and operational (Figure 1). It enables continuous as well as real-time planning, which is the basis for agility. This kind of planning is a dynamic and open-ended approach, unlike traditional, fixed horizon forecasting, which is tied to a fixed calendar of budgeting activities. This approach advances FP&A agility for the business to manage uncertainty and react quickly to changing market conditions. In turn, an agile FP&A function enhances the organisation’s ability to manage shareholder value.

Figure 1

In the webinar, Jiles Loreal, a thought leader from IMA, defined agility in this way: “Agile is a software development life cycle that focuses on iterative, incremental delivery by self-organising, cross-functional teams.”

This approach is adaptive, collaborative, customer-focused and result-orientated. Although originating in the software industry, it is being adapted to business processes across different functions and industries globally. Agile development presents an innovative opportunity for the finance organisation to increase efficiency and value delivery.

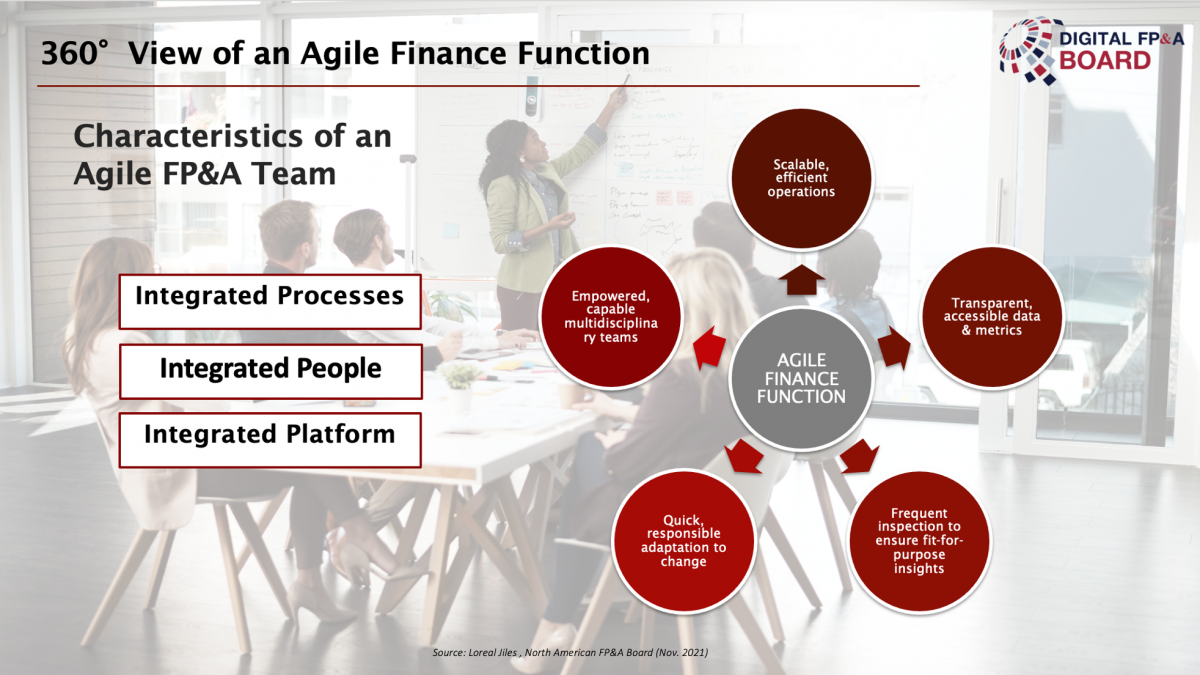

Through Gartner’s 360° view on agile finance function, Loreal explained the need to stay laser-focused during agile finance transformation in order to reap the maximum business value. Loreal emphasised that the key objective of this transformation is for the FP&A team to regularly and efficiently deliver insights to support strategic decisions. This is achieved through data-driven forecasts with actionable recommendations, thereby preparing for and responding to change. By deliberately using a multi-disciplinary structure, the organisation is encouraged to collaborate; regular engagement between finance and their customers establishes the iterative and incremental cadence in planning. This shifts the finance function from data stewardship to real-time value creation and strategic support. Loreal shared the characteristics of an agile finance function in the diagram below (Figure 2).

Figure 2

To deliver agility, the FP&A team should leverage RPA to automate reporting, data analysis, and risk and opportunity screening. This allows the team to deliver more real-time, actionable insights in an efficient way.

Länsförsäkringar – the FP&A Integration Journey

Jonas Ekgren, Head of Business and Capital Planning at Länsförsäkringar, shared his experience in delivering FP&A integration.

Jonas pointed out that the integration is not just within the FP&A function, but also with the business. The rationale for integration was to leverage cross-functional competencies to deliver organisational agility. Before the integration journey, FP&A at Länsförsäkringar was dispersed across the organisation. They began their transformation journey by first taking an inventory of the functions and competencies that support strategic development. The company leveraged these competencies to drive coordination, standardisation, and alignment of processes, definitions and systems. This brought everything under one roof, for a more connected and standardised integrated approach to planning. Länsförsäkringar also used areas such as M&A and procurement, which has the highest level of integration competencies, as spearheads to promote integration across the organisation. One of the benefits of integrated FP&A is transparency, which drives co-operation at the individual level, and the business engages FP&A on ongoing business development.

Technology also played a role in Länsförsäkringar’s journey. Automation allowed forecasts to be done more frequently and at the lowest level, thereby promoting continuous planning and in turn agility. According to Jonas, this is taking automation to the extreme. For FP&A teams to be agile, they do not have time to carry out administrative tasks of creating, distributing and consolidating templates.

Jonas summarised the key success factors in their journey as follows:

Competence;

Standardisation and automation;

Considering FP&A as a team, not a team of teams;

Focusing on value-add areas;

Persistence and patience.

Clariant - Real-Time Collaboration to Continuous Planning from Operations and Technology View

The second case study came from Robert Vultier, former Procurement Director at Clariant, and Rainer Fischer, Project Lead of E2E Clariant Initiative. The two presented Clariant's transformation journey in implementing real-time planning and pricing.

Robert began by explaining why Clariant needed a new approach to its cost forecasting. Clariant is a complex business operating in a volatile market. As raw materials account for 50% of their sales, there is a high necessity at Clariant to translate the impact on the raw material pricing on the rest of the value chain, as well as provide transparency to the stakeholders in the value chain. Their first forecasting tool in 2008 was manual and cumbersome. Due to the lack of transparency and the time it took (6 weeks) for Clariant to see the cost impact, Clariant was losing out in the market.

To remedy the situation, in 2015 Clariant's stakeholders from sales, marketing, operations, procurement, and FP&A developed a vision of the end-to-end pricing process based on real-time cost forecast. Their biggest challenge to delivering this vision was finding the suitable enabler and calculation engine to model the complex value chain and process the simulation.

In 2020, just before COVID-19, Clariant partnered with Mibcon NDC to co-develop the solution. It promoted real-time, two-way flow of the impact from supply change to sales, and back from sales and pricing to supply change. This was a game-changer for Clariant, because:

in addition to transparency and speed, Clariant could now simulate multiple scenarios in real-time;

Clariant turned the raw material market into information for the cost impact on the finished goods.

This transformation enhanced pricing decision support by making forecasting a pro-active process, i.e. being agile in a volatile market. This means enhanced margin management. FP&A became a true business partner and no longer just a service function.

Rainer summarised their key success factors as:

Top management support;

Process redesign to promote governance;

Cross-functional collaboration.

The next stage of their journey is to develop their capability to deliver sustainability initiatives, such as lowering their carbon footprint and considering materials that were previously out of scope. Clariant is also looking at full business modelling to predict sales quantity and prices. This means developing agile FP&A for fast, fact-based pricing.

Conclusion

The two case studies give us a glimpse of what is feasible with integrated FP&A. They also demonstrate the future of the profession.

The key takeaways from the panellists include:

Integrated FP&A is a sustainable way for different parts of the organisation to collaborate to support agility.

The importance of competencies in developing integrated FP&A. Integration means working together and sharing competencies.

Organisations should leverage technology to advance analytical capability.

Integrated FP&A promotes higher transparency of a single truth. This, in turn, drives higher speed in obtaining insights and qualified decisions. This also enables the organisation to be more collaborative, and therefore more agile. Integrated planning means planning is a continuum and not an individual process.

Integration is not a single aspect process but one that encompasses the processes, resources and applications. They must be in a close-knit relationship for successful implementation.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.