On 3 December, we had an interesting debate on why extended planning and analysis (xP&A) is...

In this London FP&A Circle meeting, we look at FP&A Integration and how to harmonise the planning process with the help of insightful case studies.

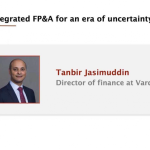

FP&A is all about managing the value of the company through understanding, describing the value through models, supporting decision making, telling the story, and communicating to the stakeholders. Integrated FP&A involves harmonising the three levels of planning - Strategic, Financial and Operational levels.(Figure1) This is done both horizontally (cross-functional) and vertically (top-down and bottom-up), using integrated processes, people and platforms that connect all parts of the business.

Figure 1

The case studies presented some real-world examples of implementing and applying integrated FP&A.

Philip Morris Case Study

Adam Salem, Head of FP&A at Philip Morris International, demonstrated how moving from a single product to a multi-category business created much more exposure to supply chain shortages.

Moving all product lines from unique individual processes to harmonised processes.

Getting all functions working together to set directions for the next steps.

The implementation focuses on people and processes before integrating new systems, so as to avoid carrying over any process deficiencies.

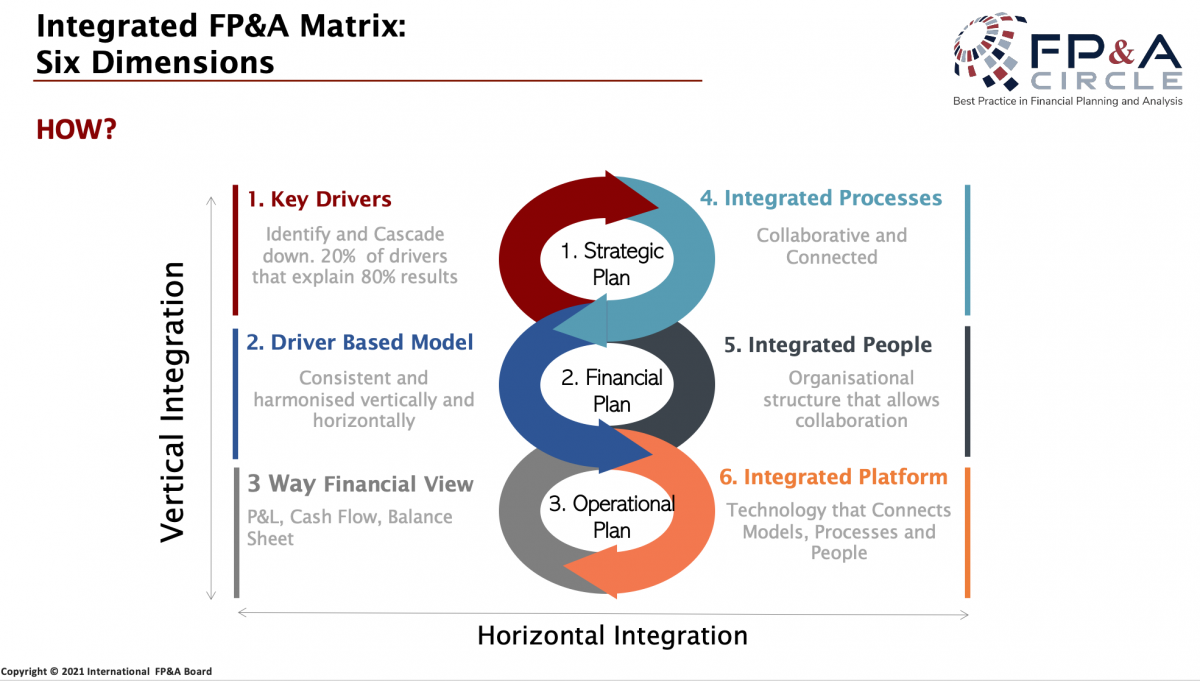

Adam also defined 8 golden rules for Integrated planning (Figure2).

Figure 2

He implemented a medium-term Integrated Business Planning process which is a monthly forecasting cycle applying a bottom-up process. By checking demand and supply the team reviews the gap between where they are versus where they should be in terms of performance. Every month, you look at the actual demand against the forecast it piloted in a couple of locations which they are looking to scale up.

The key learnings from this case study were that the process should be piloted first before system integration. Mindset changes are also fundamental; the focus should be on closing performance gaps, rather than on reviewing past performance.

Adam’s advice is to ensure you have management support, to be ready to be agile, to adjust as you go, and to really focus on the processes. Everything else should gradually follow. For success, you need Senior Management supporting the project, as well as buy-in from the local management where the solution is being piloted.

Raizen Case Study

Demetrio Magalhaes, Finance Director at Raizen, shared an experience with an IPO that was one of the largest deals ever in Brazil. He explained how FP&A supported the deal, which involved a JV between Shell and Cosan, and how it brought value to the transaction.

Raizen is a complex organisation involving multiple businesses from soil to consumer. The challenge was managing the investor relations communication between both the buy and sell sides of the capital markets.

The integrated reporting models needed to be both robust and flexible to run sensitivity analysis. There were several workstreams to enhance existing models, as well as to prepare a proprietary evaluation model. Prices in the commodity markets were one of the core drivers of the organisation that were examined.

Key steps to prepare the proprietary model occurred in 3 stages: Preparation, Development and Deployment involving multiple stakeholders with sell-side analysts being the most important stakeholder.

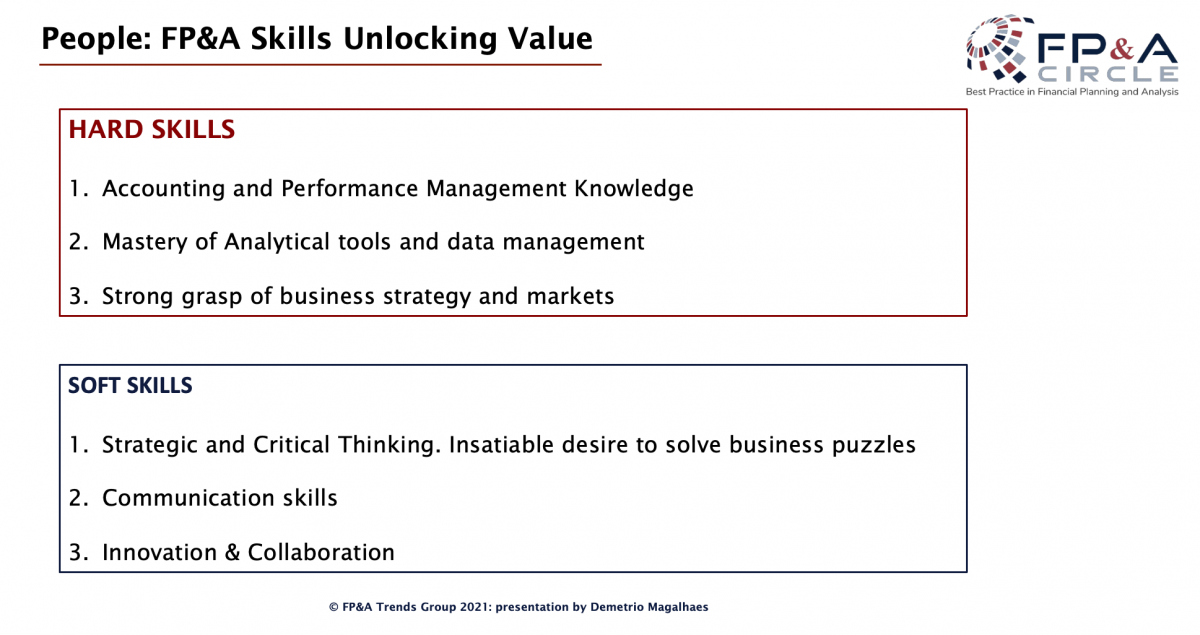

The key enabler for implementing the model was having people with the 6 critical skills necessary for a successful FP&A department – and, in this case, for a successful IPO. (Figure 3)

Figure 3

It is important to create a team that would be able to deliver a required combination of both hard and soft skills, as shown above. The teams need to be integrated in order to create something new together.

Critical parts of a dedicated, high-quality team include FP&A people and processes, solid integrated planning, flexible and accurate models, and fast access to reliable data.

No magic, but it required a lot of work to convince the market of the strategy and growth plans of the largest IPO in Latin America in 2021 -- an incredible result.

Reflecting on this success, Demetrio concluded by emphasising the importance of:

1. Implementing robust and flexible models and systems

2. Ensuring integration:

Ensure all data along the company is solid

Ensure appropriate communication and alignment internally

3. Hiring and developing the right people with the right skills

How Technology Can Unify the Planning Process

Oliver Sullivin, Head of FP&A Solution Consulting at Unit 4, gave his insights into achieving a more connected, harmonised and unified planning process. He began with the idea of being disconnected across multiple levels: as people, in processes and in the data.

Technology plays a huge part in bringing these elements together by providing a unified environment. With a harmonised, well-managed workflow that creates visibility in the overall process, people get the right things done at the right time. A representation of the organisation can be viewed from both top-down and bottom-up.

Look at the strategic objectives and working down to the management plans and operational activities which cannot be done well if there is no visibility across the organisation. Look at the dimensions where (regions), what (products), across time (when) and resources to deliver (who). The systems need the data to be organised and that can only happen if processes and data are unified.

An integrated environment enables you to see how issues arising in one area of the business will impact other areas. This is required for connected decision-making, based on a comprehensive suite of relevant KPIs from unified processes and connecting silos.

Technology supports collaboration. But the unification supports effective decision-making by bringing everything together, making data and information readily available and easy to consume. This enables the FP&A team to run scenarios and on-the-fly simulations to evaluate the implications when flexing drivers and run rates.

So how to start? Take an iterative approach: start somewhere and look at immediately apparent opportunities where FP&A can make an impact. You can always return to refine the process later on.

Enterprise agility is enabled by the fact that updating scenarios in an integrated system doesn’t require updating data from multiple sources (e.g., disconnected spreadsheets). Instead, it can be run from one system where a version can be cloned and updated to run a number of changes to drivers and to evaluate the new planning assumptions.

Projects and changes in FP&A never end, but you can start the journey to create a platform for effective planning. Solutions can be delivered so that businesses can start to manage financial planning effectively.

In Summary:

Integrated FP&A is a journey on which we adapt and learn as we go. It is critical for decision-making, involving processes, people and technology at many different levels.

There is never a perfect solution, and it’s good to start with pilots on a smaller scale. That way, you can see how the integration works with the checks, and ensure you get the processes right before rolling out the technology. When introducing new systems, it’s important to find a balance between engaging too early and too late.

Models must be flexible in order to run sensitivities and scenarios. For example, you can have different views even on discount rates. You need to have solid, robust assumptions and the base scenario before introducing what-if simulations.

By getting a business case with quantifiable benefits, the decision-makers will have confidence in agreeing to invest in tools that enhance your planning processes.

We would like to thank our global sponsor Unit4 for great support with this Digital FP&A Circle.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.