Forecasting is one of an FP&A department’s most important activities. We believe that we can produce...

On the 23rd of February, I had the pleasure of participating in a global webinar from Australia where the subject under discussion was Planning for Uncertainty: Building Blocks of Agile FP&A with speakers from the United States and Sweden.

The Context: where we are?

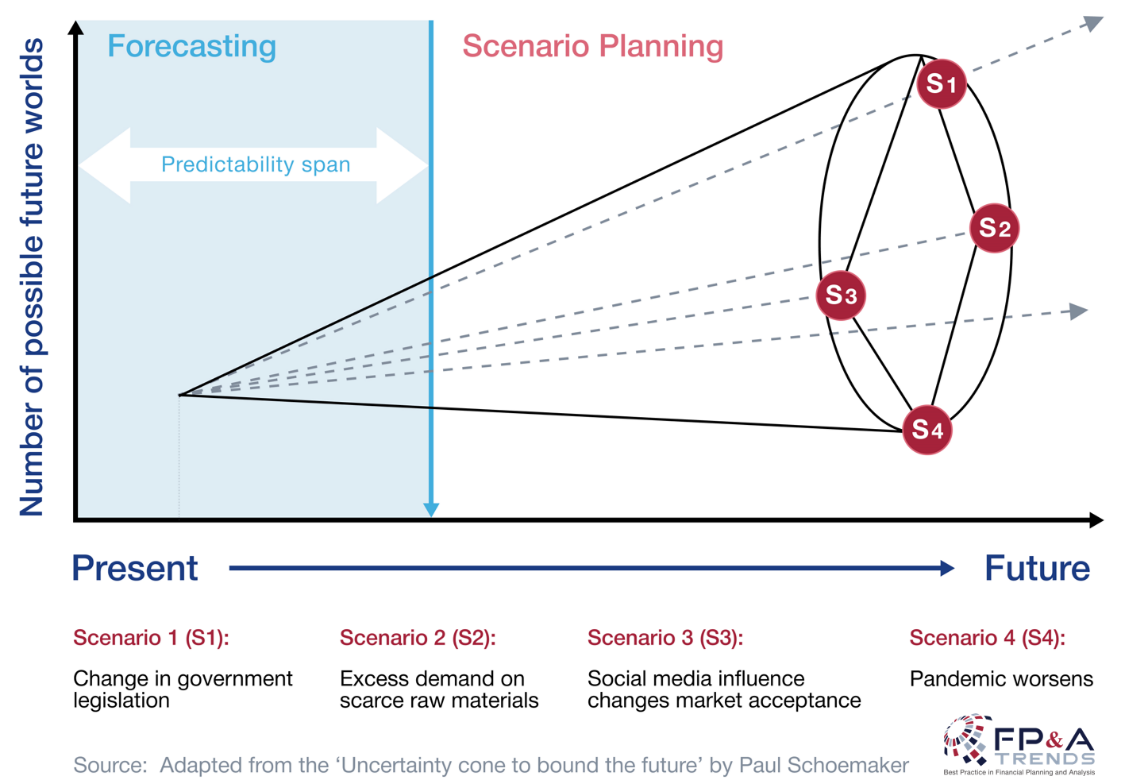

Traditional planning methods such as budgeting and forecasting do not work in the current environment. We need to consider different scenarios that are quick and multi-dimensional. Therefore, organizations that implemented analytical methods such as integrated FP&A, artificial intelligence (AI), machine learning (ML) for FP&A are in better shape in this uncertain world. The below picture is the best description of the current uncertain environment from an FP&A point of view.

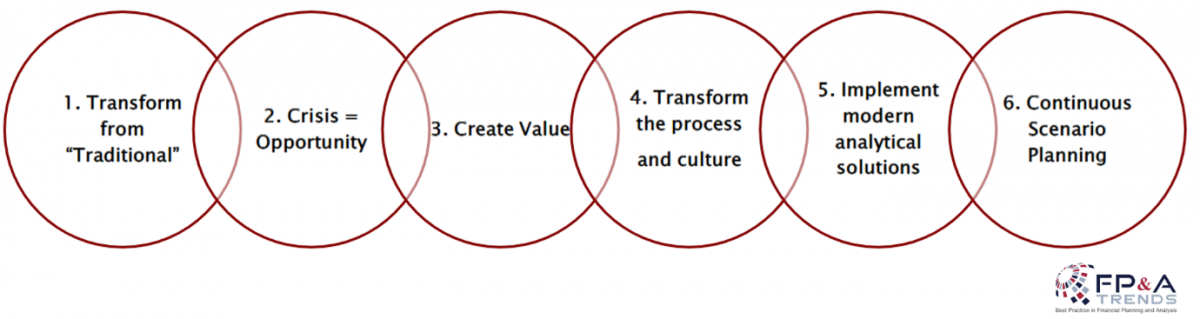

6 Building Blocks of Agile FP&A

How to manage uncertainty from One to Three Dimensions?

Based on the presentation by Michael Huthwaite, Corporate Finance Director at Walmart.

One Dimension. We do not have complete certainty or complete uncertainty. It is always a spectrum. There are several approaches to handle uncertainty:

deterministic where we can use different methods such as driver-based planning or rolling forecasts. The scenario logic is about optimization of the drivers (e.g. price, volume…).

probabilistic approach when the certainty change people tend to gravitate to this approach. In this case the methods are Monte Carlo simulation or artificial intelligence (AI).

Influencing approach is applied when we go further out into uncertainty. The idea is to look for the “black swan”, things that are game-changers, you look to break down barriers. The scenario logic is to re-write the rules.

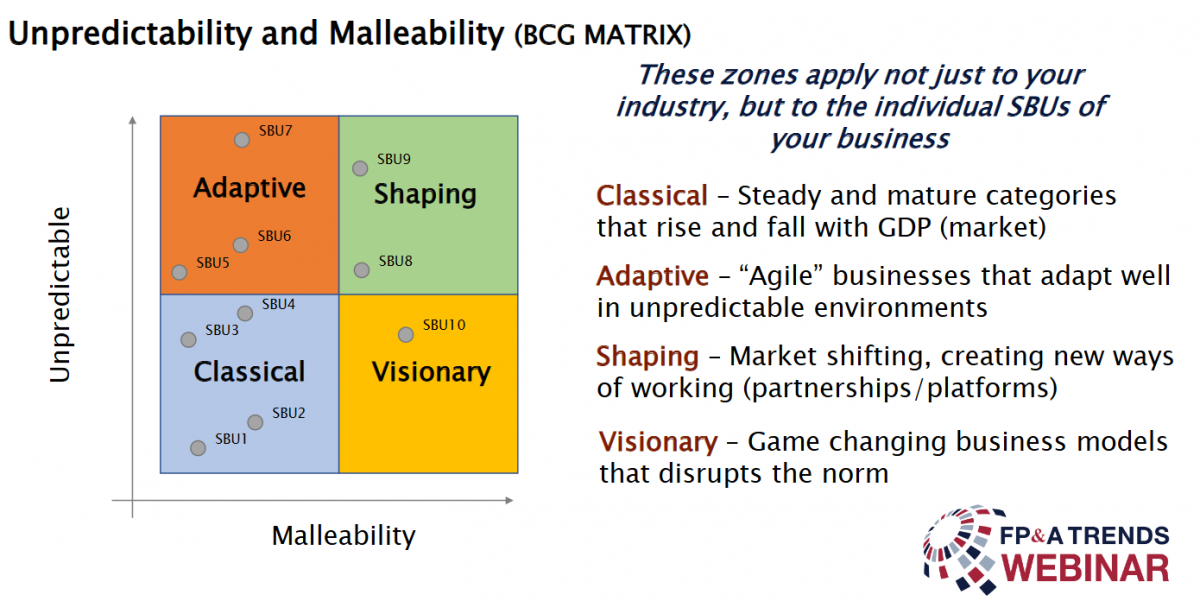

Two Dimensions. In this case, rather than only uncertainty, we have unpredictability and malleability (please refer to the BCG Matrix below). With these 2 dimensions we have 4 zones: classical, visionary, shaping, and adaptive.

Three Dimensions. Not all zones share the same value creation opportunity. We have 4 zones where we can create value:

Classical – ideally, anyone wants to stay in the classical zone, but it is really about value preservation. There is a little value creation opportunity.

Adaptive – although we think that there is a lot of value creation there, there could be much more.

Shaping – there are a lot of opportunities to create value for your company, but you share the outcome with other companies.

Visionary – in this zone you will find the biggest opportunities in an uncertain environment.

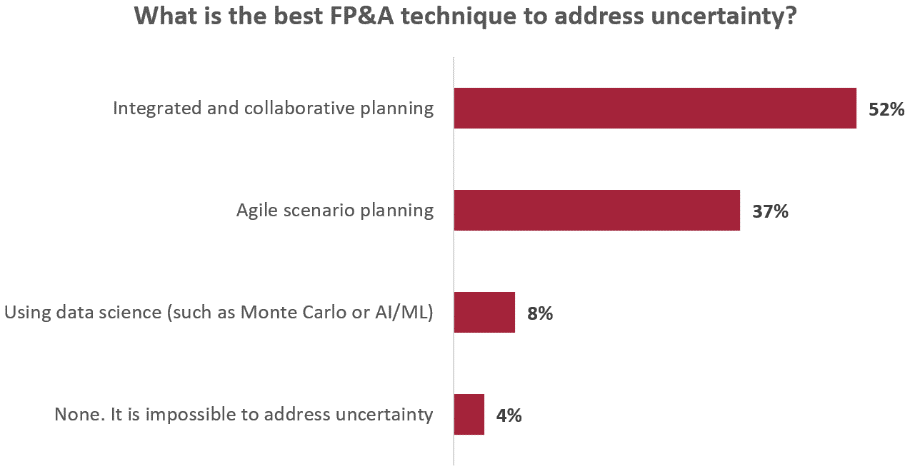

Make sure that you have the strategic business units in all the area of the zones and realise that the biggest opportunities are in the visionary and shaping zone. One of the polls conducted during the webinar showed the need to have modern planning and techniques:

Case Study: How Volvo is planning for the “Next Normal”?

Based on the presentation by Johan Hoff, SVP Region Europe North & Central at Volvo Financial Services.

In March 2020 everything stopped. For Volvo, production stopped, and customers started to request postponement in payments. Like for most companies, cash has become critically important and costs as well.

How Do You Plan in This Environment?

Volvo identified 4 phases. Their FP&A department took action and planned activities in each phase.

Stop

Expense management and all project stopped

Adjust governance

Connected onboard data

Dashboards with data science team

Restart

Focus supply chains

Execute on downturn plans

Ramp-up (“new normal”)

Transform in focus

Approval governance

Key learnings from uncertain environment

Be prepared for a downturn

Design your qualitative narrative

Never waste a good crisis as there are always opportunities for those they are prepared

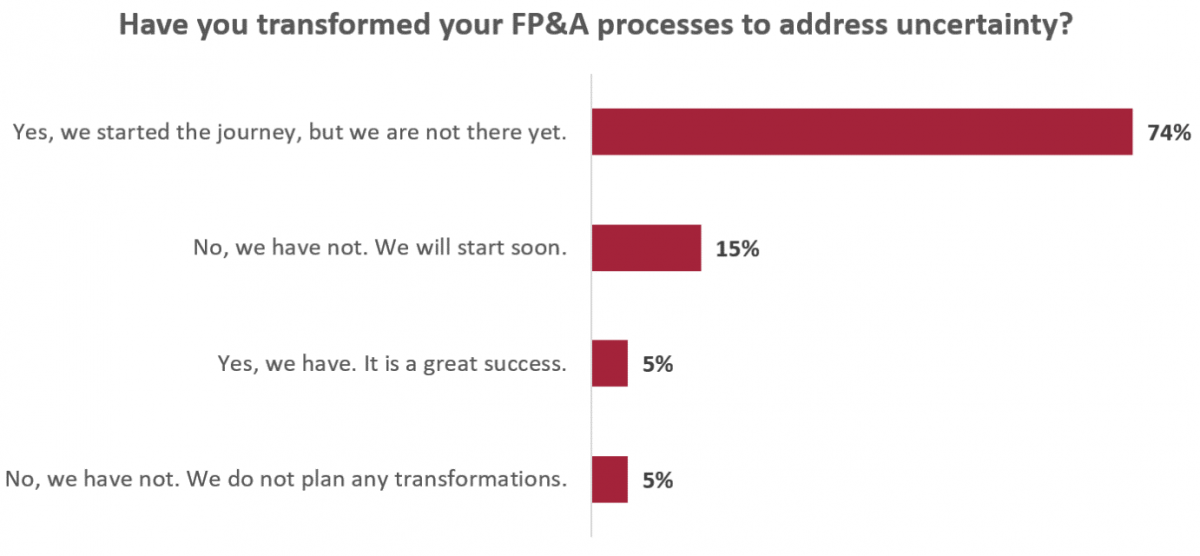

It is great to see that 74% started the journey, but they are not there yet. Continuous improvement approach is required in this environment.

How can we use technology for scenario and continuous planning?

Based on the presentation by Shane Hansen, Chief Financial Officer at Planful

The world is changing, and it is our responsibility as finance professionals to deal with many changes and plan for the uncertainty. This requires re-forecasting, what if scenarios and bringing actionable recommendations.

During this critical time there is an enormous amount of frictions such as how to manage the top line, expenses, and the planning processes. It is possible to eliminate these frictions by building valuable teams, leveraging powerful tools and technology.

What is the solution?

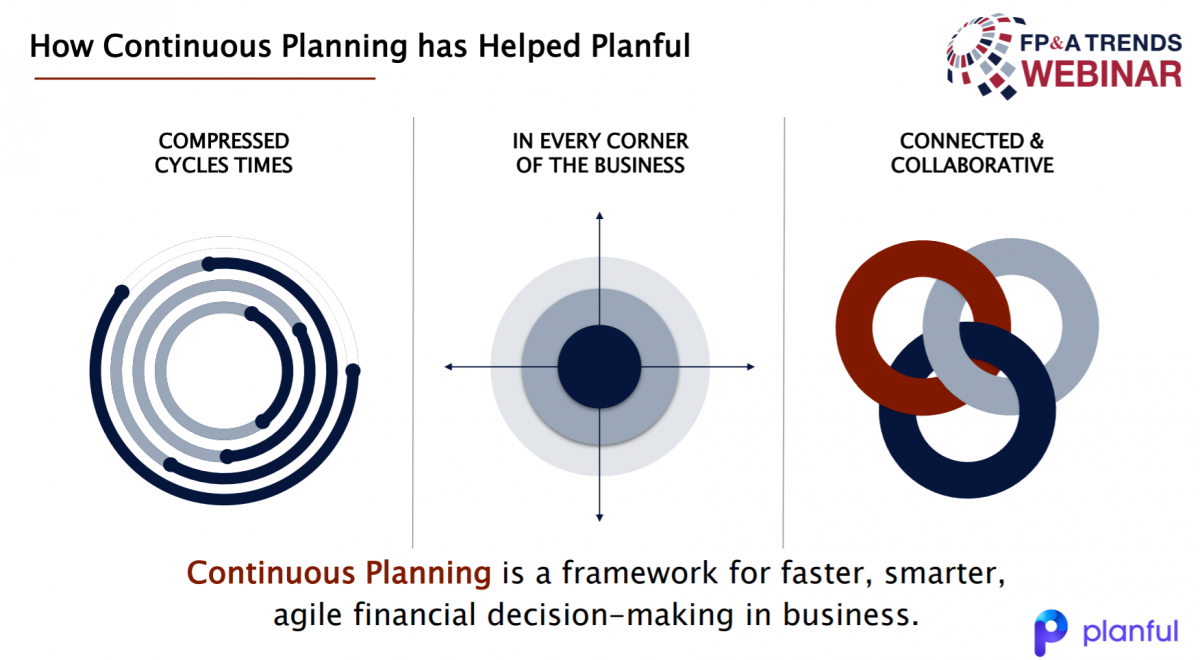

A method that works well at Planful is continuous planning. It is not about a product or platform, but it is about capabilities/mindset shift. Continuous planning is a framework for faster and more accurate financial decisions making.

Having automated model in their platform, Planful was able to significantly compressed cycles times, eliminated errors and increase the speed of the information around every corner of the business in the world. Planful was able to build a connected and collaborative environment that helped to plan in this uncertain world.

So what?

Continuous planning leads to continuous improvements such as improved accuracy, increased automation, improved transparency, agile scenario planning, frictionless processes.

The basics is to invest in people, create the proper processes, and then investing in the right tools so you can make the right decision. When you add uncertainty in this equation you really need to rely in this framework even more. Over the last ten months, Planful was able to increase automation, eliminate most of the errors in their models and reports.

Conclusions

Uncertainty brings opportunities. With a great mindset that drives continuous improvements, you can plan in these unprecedented times. If the world is changing faster than ever, businesses must adapt more quickly and frequently.

We would like to thank our global sponsor Planful for great support with this FP&A Trends Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.

kondosfpa

April 23, 2021