In a world in which increasingly little can ever be taken for granted, the core capabilities...

Accelerated by the pandemic, the global landscape is changing very quickly, making FP&A skills more relevant than ever to drive value to the organisations utilising a combination of technological, data-driven skills and soft skills.

On December 2021, the Global FP&A Trends group hosted an insightful webinar, which presented the theme of Key Skills and Capabilities for the Next Decade within the FP&A Function.

This article will look into how the Role of FP&A will exist in 2030 from different perspectives, including an interesting transformational Case Study. Finally, advice from the SAP will outline how technology can support these new sets of skills.

FP&A Team Roles

The International FP&A Board made the FP&A Maturity Model back in June and it has been updated recently. Hans Gobin, International FP&A Board Ambassador and host of the webinar, gave a quick update on the critical roles which are in high demand within FP&A teams of leading organisations.

The Data Architect is the bridge between IT and finance. They have a helicopter view of how everything fits together. The Data Architect has a deep understanding of systems, architectural processes, and strategy, which allows them to design the best-in-class infrastructure to underpin the company’s strategy.

The Data Scientists use their skills in predictive technologies such as Artificial Intelligence and Machine Learning to uncover drivers and business trends that are used in the Planning Model, which helps executives in the decision-making process. Their skillset includes a high-degree knowledge of scientific, mathematical, statistical and Machine Learning techniques.

In terms of the skills of the FP&A team, Hans presented the evolution from the “I”-shaped team, which is made of experts within their own fields (The Architect, the Data Scientist, The Analyst), to a “T”-shaped team in which there are specialists in one area but generalists in all the others, so they know their business and how other members of their teamwork (Figure 1).

Figure 1

Top FP&A Skills

The FP&A Role has evolved significantly over the years with the addition of new skills, from the hard accounting and reporting skills of the past to Business Partnering, data-driven skills and Scenario Modeling today. Thus, new skills will be added to the FP&A Role in the future: collaboration, Scenario Planning and a higher focus on influencing and Storytelling skills.

This FP&A skills addition and improvement is very well reflected in the evolution of the planning process. Paul Barnhust, Director of Finance at Digicert, explained how the Traditional Approach to planning is moving to a Scenario Management Approach.

The term Financial Planning and Analysis is evolving to the broader concept of Scenario Planning, with a rolling planning window opposed to a fixed annual 12-month focus; planning will be a single integrated strategic financial and operational model with on-demand frequency versus 3–5-year corporate plans. The Scenario Planning approach is also highly technological with automated and advanced analytical systems that allow an output within 1 to 3 hours, versus the old planning model driven by manual Excel spreadsheets that would require weeks or even months to consolidate. Finally, the new approach to planning allows multiple scenarios with supporting documentation that facilitates decision-making.

Figure 2

Finally, Paul highlighted the key skills FP&A should develop, keeping in mind that technical skills will become a baseline and the value creation will come from having:

- Storytelling ability: by being able to go beyond the analysis and connect the data with the plan to influence decision making.

- Influencing ability: this is about answering two questions: Will it be worth it to the business? and Are we capable of executing the plan? By having a response to these two questions, we will be able to think above the analysis FP&A carries out and think about the potential benefits for the organisation.

- Understanding business in-depth: the FP&A role should have an in-depth knowledge of the business, be willing to sit down with the customer, and be laser-focused on creating value for the organisation.

Transformational Skillset Change – CPG Europe Case Study

Karen Albertsen, Head of Finance Benelux and Nordics at CPG group, presented the business case about how they merged factories across Europe while setting up a standard costing template in the ERP, and how this impacted the transformation of the FP&A skill set.

CPG group embarked on a deep business transformation by moving from a standalone to a more integrated manner by merging factories across Europe.The company developed a Costing Template where they allocated primary and secondary cost centres in a standardised way within the ERP of CPG and has generated two main benefits:

- Insights. Higher levels of data standardisation have led to a higher variety of insights into data. Information is presented with a higher level of detail; it can be sorted by product, product line, production order, etc and allows faster decision-making.

- Automation. Manual labour is no longer an issue, which frees up time for value-added activities for the business team.

Figure 3

Additionally, the Costing Template implementation required skill set changes to the FP&A team, starting from the removal of transactional processing that was required in the past to prepare a costing analysis that could take up to two weeks. Now, the ERP is doing it automatically, so the team can concentrate on Analysis and develop their Business Acumen to understand the business in-depth and facilitate their Storytelling and Influencing skills. Finally, Albertsen remarked upon the importance of understanding other functions to act like a real Business Partner.

FP&A of 2030

Anastasia Kagiampini, Senior Director FP&A at Revlon, brought a dilemma to the session: What is the right balance between Fact-Based Analysis and Judgment, and how can balancing the two guide the FP&A skills journey to 2030?

Kagiampini showed the soft skills of the 360º Leader highlighting that a CFO, Senior FP&A Leader must be a Change Agent, which means that there won't be a new normal anymore. Change is a constant, so it is necessary to embrace it, accept it and move on. Secondly, she mentioned Partnering externally and internally, which is critical to accelerating decision-making by influencing other groups. In order to get to that ideal 360º skill set, Kagiampini made the following recommendations:

- Raise your hand and get out of your comfort zone, expand your curiosity and embrace new projects.

- Be ready to fail. No matter if you come up with an idea and it is not accepted by management. The willingness to do new things and to think differently far outweighs the risk of not being successful.

- Explore & Expose, in terms of being curious and ready for transformational challenges.

How Technology supports the Development of FP&A Skills for 2030

On average, only 35% of the time is spent on Driving Actions and Insight generation, with most of the time dedicated to non-value activities like Data Collection and Validation or Information Generation.

Eric Schmidt, VP SAP, highlighted the importance of Technology in the generation of insights and the FP&A skill sets required going forward. Today’s disruptors are insight-driven, and Analysis will only be as good as the decisions derived from that Analysis. Insight is the path to transformation, and there is a need to take advantage of the technology on the following different angles:

- Evolving Decision making: The way we are making decisions is changing; it is evolving very quickly to predictive capabilities and algorithms that will make decisions for us.

- Harness diverse sources of data: Operational, Transactional, external and sentimental data all need to come together to make decisions. The business and IT need to work together to remove the siloed information in the company and combine all these different data sources.

- Developing smart workflows: The business needs to push the information to the people that need it at the right time in the right context of their job.

- Align agile planning cycles: it is all about a higher level of detail, higher frequency and accuracy and information needs to be ready in a very short period of time.

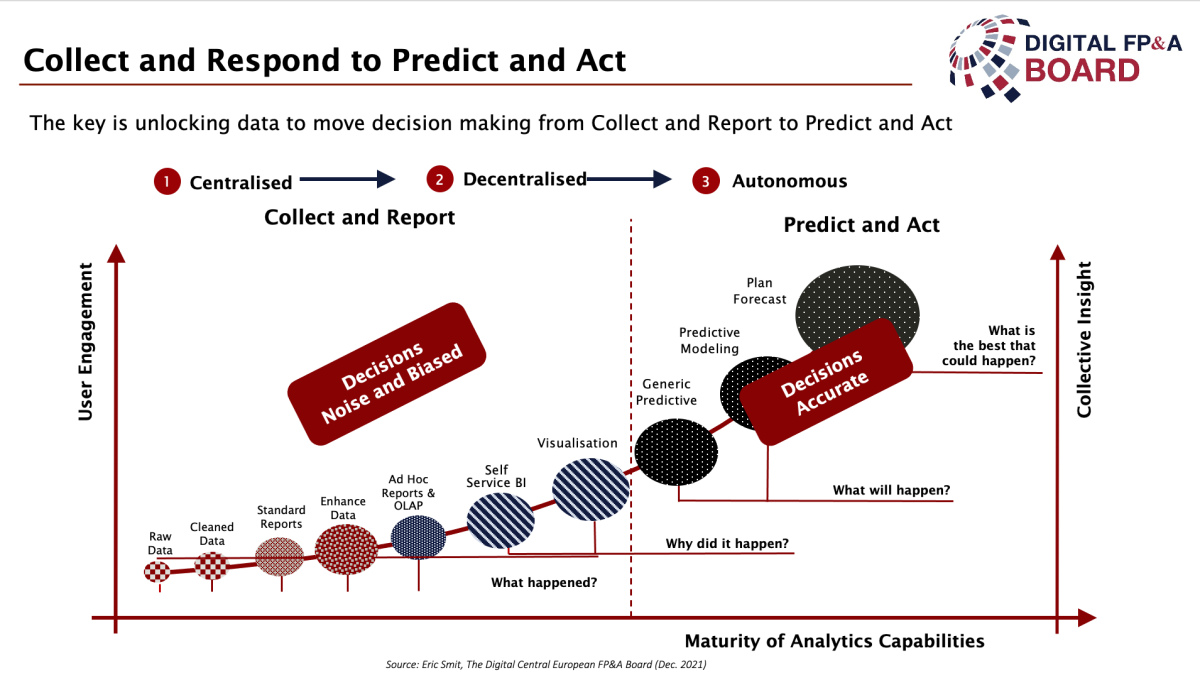

This transformational journey derived from the need of insights leads to the Maturity Curve, where we are moving from a Collecting and Reporting phase, that explains what happened and why it happened (in the past) by treating the raw data from different phases until the data is organised in a visual user-friendly mode, to a Predicting and Actionable phase, that answer questions like What will happen in the future?

Figure 4

Conclusions

We as an organisation need to figure out how we drive value creation which is a combination of improving our ability to influence decision-making and gathering accurate data that support the elaboration of insight.

On one hand, it is clear that it is necessary to review the environment of the organisations by identifying where the drivers are and where we can add value to the organisation in a constantly changing world. Secondarily, our teams and technology need to be aligned with that set of drivers.

Moving into 2030, it is key to find those well-prepared FP&A professionals with a balanced profile of soft skills like Storytelling and Influencing and a more technological and Analytical experience.

Technology should support FP&A beyond the numbers being a key tool that helps in the Storytelling process and facilitates the influencing process to the financial audience.

We would like to thank our global sponsor SAP for great support with this Digital FP&A Board.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.