The key to modern FP&A teams is through empowered organisational governance, underlying a rich collaborative exchange...

This is an exciting time to be in Financial Planning and Analysis (FP&A). Because of Brexit, COVID-19 and ongoing digital transformation, organisations are demanding more than ever from the FP&A function. This culture of expectation encourages FP&A professionals to go above and beyond what has been achieved before.

This is an exciting time to be in Financial Planning and Analysis (FP&A). Because of Brexit, COVID-19 and ongoing digital transformation, organisations are demanding more than ever from the FP&A function. This culture of expectation encourages FP&A professionals to go above and beyond what has been achieved before.

To succeed, professionals must develop key skills required for the FP&A team of the future. They must place data and technology at the core of the operating model, and become strong business partners within the organisation.

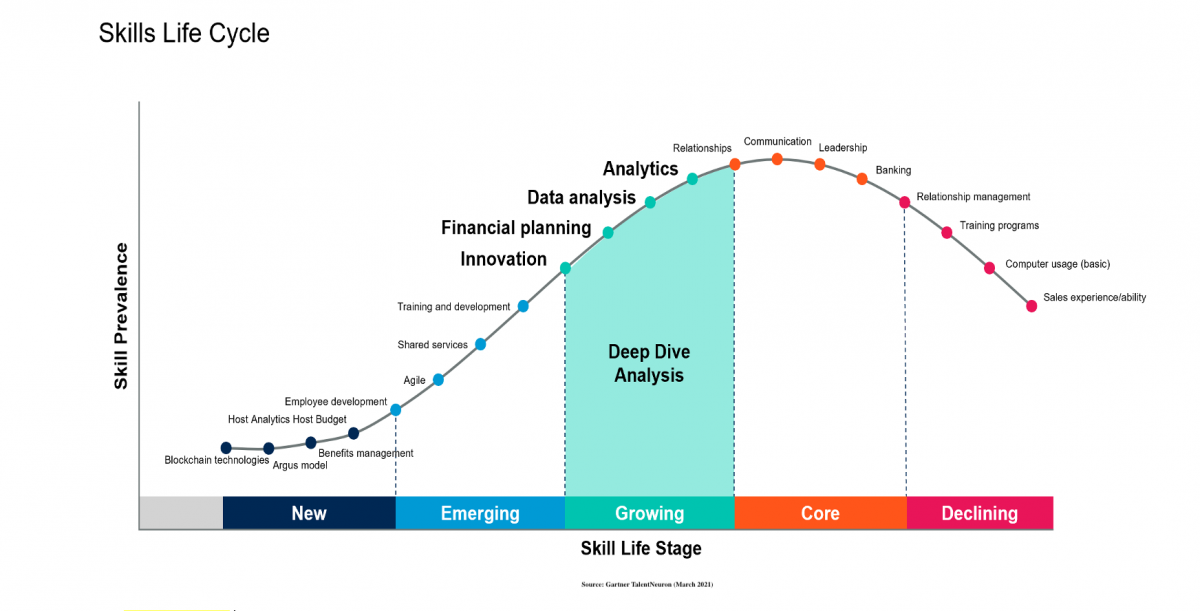

Finance Skills Life Cycle

Recent research from Gartner defines the skills lifecycle. As shown below, the Finance function is maturing rapidly and diversely. The growth of specific skills required to meet the increasing demands is cemented in FP&A and data analytics.

Financial Managers – CFO, Finance Director, FP&A Director, FP&A Manager, Finance Manager

- Skills prevalence – the frequency of skills in job advertisements in the past 4 years.

- Skill life-stage – growth/decline of skills in the past 4 years.

- Skill growth – the increase in the demand for skills in the growing phase in the past 4 years. Gartner calculates this rate to be over 2x.

Analytics and Data Analysis skills are critical for Finance, particularly FP&A. Incorrectly using or interpreting data can impact negatively on revenue or cost, demonstrating the commercial value of analytical skills.

Financial Planning skills are more mature in some organisations than in others. Some are quite progressive in their operating models. But others are still weighed down in lengthy reporting, and end-of-month processes that leave little time for adding value.

For an effective FP&A function, Business Partnering is essential. FP&A manages the data, delivers the reporting and provides the analysis to the business.

Innovation in Finance can be defined in various ways. In the context of FP&A and Business Partnering, responding dynamically to meet changing business demands is crucial. By collaborating with the business, the Finance function can drive performance, becoming that trusted decision support partner the business craves.

The case for reforming talent strategy

The growing number of skills required for the FP&A function of the future demonstrates that traditional recruitment processes are outdated. The talent strategy must be rethought, becoming more skills-based than seen before. HR and Finance must therefore be clear about which skills to prioritise to meet the changing demands, and about how to integrate them successfully to support the CFO.

The focus should be on digitisation. Adopting new technology is the key to enabling efficiency in Finance, and the demand for digital skills is continually increasing. ERPs, BI and Planning tools are already established in many organisations, replacing manual reporting and analysis. Growth in machine learning, robotics and AI will support the Finance function, improving process efficiency and driving value.

Without digital skills, FP&A teams have to rely on manual processes that prevent agile responses to Finance and Business requirements.

Covid-19 has intensified the need for digital skills. On the most basic level, Finance had to quickly grasp remote working, spending a lot of time on daily Zoom/Teams calls. For many organisations, Covid has also accelerated the digitisation process, from finance transformation initiatives to scaled-up scenario modelling.

The CFO needs to be driving digital change efforts through process efficiency and technology enablement. The Finance function must now step up and help.

Driving insight and commercial decision-making through growing skills

Financial planning and data skills go hand in hand, but another key factor is a mindset, which is inextricably linked to all aspects of a high-performance Finance function. Mindset is particularly important when it comes to processing change and technology, and when building strong relationships with the business.

FP&A and Business Partners play a vital role in providing the key skills for the changing Finance function. Whether it be forecasting, performance management or commercial decision support, Finance now has a wonderful opportunity to partner with the business and bring value to the table. Who would not want to be part of that new operating model?!

For some time, CFOs and Business leaders have been asking for more from their FP&A teams. Given that many transformations have already occurred, why is FP&A still not seen to be delivering value?

FP&A teams can be criticised for not transforming data/information into valuable insights. Often, the problem is the skillset, the strength of business relationships, or technology. Finance can therefore defend against such criticism by embedding the growing skills.

In Summary:

The increasing demands on FP&A teams have meant that more and more skills are required, and this growth provides a baseline for targeted resource planning. Such planning must ensure the right mix of skills for commercial/business partnership, where the team is separated from transactional and low-value activities.

For the Finance function to deliver value, it must develop a clear roadmap of the skills the business needs, and of how to embed them successfully.

Finance will develop closer collaboration with technology specialists like data scientists and BI teams. But the key to success lies in understanding, interpreting and leveraging the data more than Finance has ever done so before.

Automation, driving of business insights, commercial decision making, the list is endless. FP&A should use the tools at its disposal to add value through business partnering, instead of processing and creating reports that do not contribute to value or decision making.

Technology is moving rapidly. We still do not know how fast AI and robotics will be adopted, but we already know what the growing skills are. The true test is whether Finance can take the next step.

It is highly likely that shared services will take a more active role in production, through automation of reporting, analysis, and even insight. This will support FP&A and Business Partners, whose own skills will develop according to the skills needed for the Finance function of the future. The impact on shared services should be to increase automation and lower costs. This will complement the FP&A and finance business partners, who will be at the heart of driving value.

The roles of Finance leaders are more engrained across the enterprise than ever before. With the added capability gained through developing the growing skills, Finance could not be in a better place.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.