To bring some perspective to this position of AI within the context of FP&A activities, the...

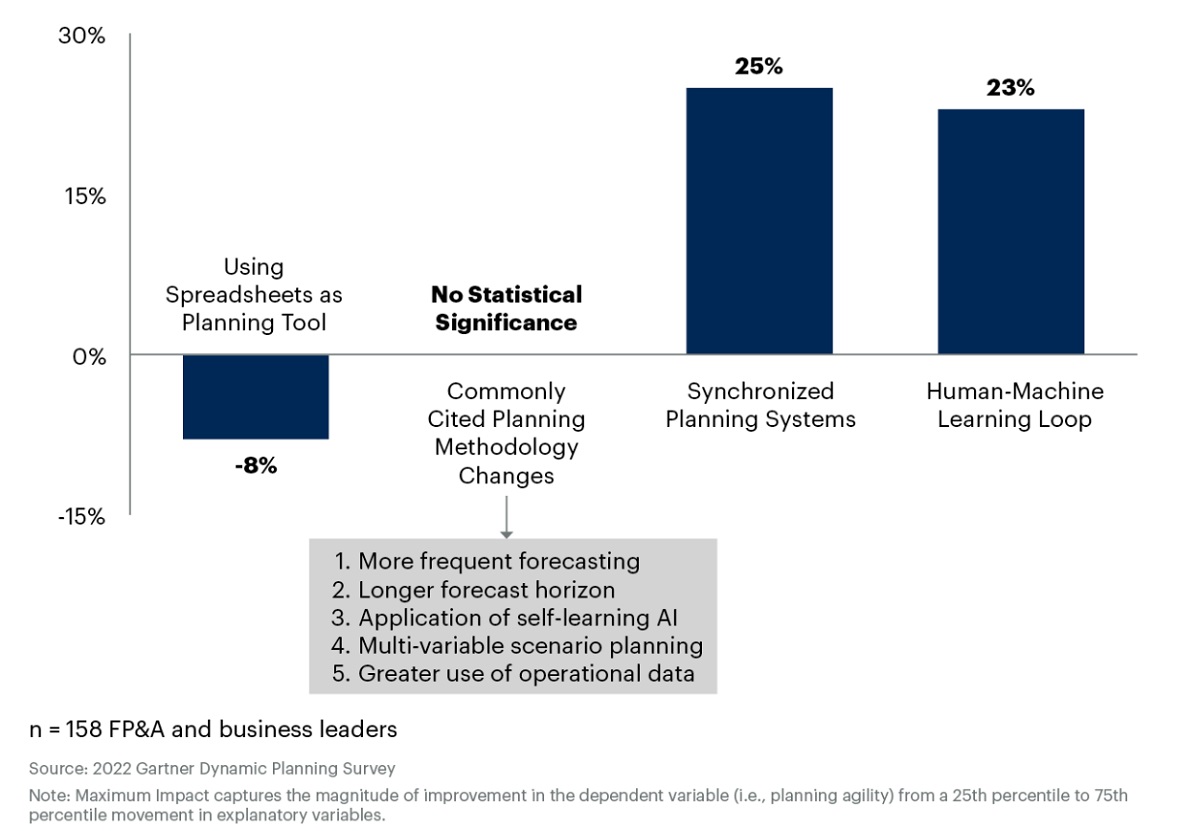

Recent events – such as war, new sanctions, supply chain shocks, a global pandemic, and high inflation – have demanded a level of agility that typical budgeting and forecasting processes have been unable to meet.

There’s no guarantee that current levels of volatility will subside anytime soon, and a majority of organisations are suffering from low planning agility that significantly hinders their ability to take advantage of opportunities or mitigate downside risks.

In fact, Gartner research finds that low-agility organisations capture, on average, 45% less financial upside of each opportunity and mitigate 36% less financial downside of each risk than high-agility organisations.

Moreover, commonly cited ways to improve financial planning processes, such as more frequent forecasting and greater use of operational data, do not drive financial planning agility on their own because they fail to improve the underlying planning methodology.

Digitally enabled planning methodologies drive the biggest impact on agility where, in contrast, relying on spreadsheets is a major drag on organisational agility (see Figure 1).

Figure 1: Impact of Financial Planning Transformation Actions on Planning Agility

Human-Machine Learning Loop

Planning digitalisation is critical to improve planning agility. Digitalisation matters in terms of not only the sophistication of planning tools but also how FP&A staff interact with and use them.

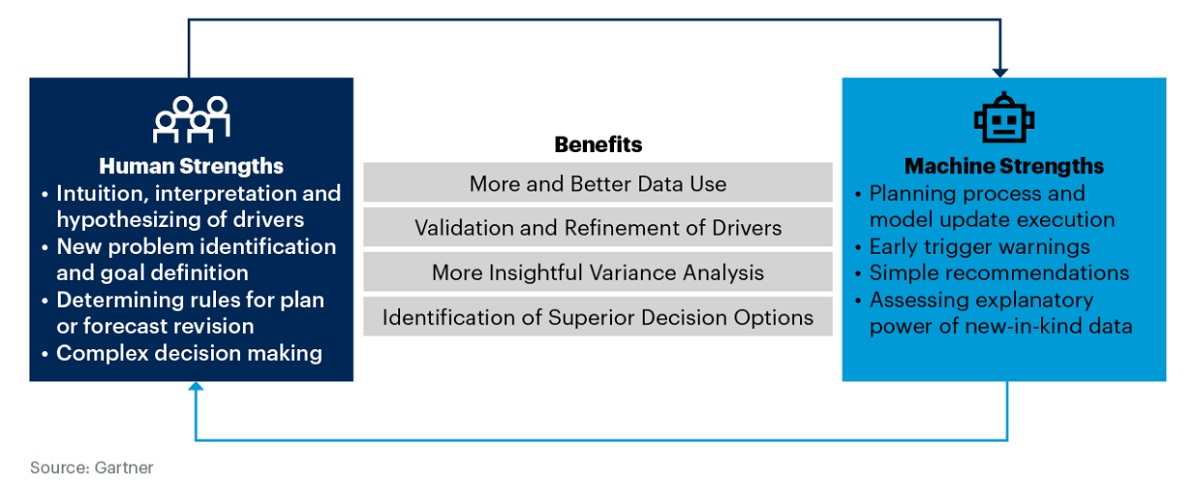

Specifically, a human-machine learning loop — collaborative and continuous learning between humans and Artificial Intelligence (AI) about assumptions, performance drivers and new forms of data — drives planning agility by increasing the organisation’s confidence and ability to respond to changes in the business environment.

One of the reasons for low planning agility is that too much planning time and effort are wasted in transferring data across systems, fixing errors, debating data quality, and determining a starting point for planning. Moving forecasting and budgeting out of error-prone, delay-causing spreadsheets into synchronised planning systems that automate data transfers and assumptions updates significantly improves planning agility. Many organisations realise this and are actively upgrading planning technology.

However, even if organisations improve the speed and quality of data transfers via synchronised planning systems, they will not see full agility benefits without three things:

- a comprehensive understanding of the environment;

- how the opportunities, risks and drivers of business performance may be changing;

- and the range of associated actions it is possible to take.

This is where a human-machine learning loop is critical. It creates collaborative and continuous learning between humans and AI about assumptions, performance drivers and new forms of data to establish early warning indicators, decision triggers and situational recommendations. This essentially turns FP&A improvements into an organisational capability that drives agile response.

A significant driver of a human-machine learning loop working well is an understanding of the respective strengths of humans and machines in financial planning (see Figure 2).

Figure 2: The Human-Machine Learning Loop in Financial Planning

Don’t Just Pick Low Hanging Fruit

Finance organisations often tend to rush for quick ROI in projects in order to show value. While nothing is wrong with that in principle, the biggest payoffs of a major digital transformation are unlikely to come in the form of quick wins alone. Think of implementing a new ERP system, for example, that can take years to come to fruition. A similar mindset will be required to make the biggest gains in forecasting and budgeting agility with Artificial Intelligence/Machine Learning (ML). Even putting the right team together could take a year or more.

Going back to the relative strengths and weaknesses of humans and machines, start with hard-to-diagnose problems that really have the potential to leverage the unique strengths of ML. In the early stages of ML deployment in financial planning, organisations typically make a few common mistakes that can stall momentum. These include overfitting models to historical performance, running ML models on purely financial data and undertraining ML models to secure quick wins when using them in areas that human strengths adequately serve.

To avoid these mistakes, firstly, use an iterative approach to deployment — that ensures the transformation uses a large amount of data and that humans become familiar with machine strengths and weaknesses for their organisation to have proper training and governance. It also allows for easier ML expansion to other financial planning processes, such as on-demand Scenario Analysis, as well as driver and planning assumption updates.

Secondly, use ML in areas it is best suited to! Most FP&A leaders believe the best places to start ML are in areas where they are more confident of success and the consequences of failure appear low: low-materiality, well-understood areas, frequently within the finance function. However, low business materiality reduces buy-in from the rest of the organisation, and well-understood areas make it hard for ML to generate novel insights. This is because traditional methods already deliver sufficient insights and diagnosis.

Create a Community of ML Users to Maintain Momentum

A key challenge in implementing the human-machine learning loop is getting stakeholders and users comfortable with a new division of responsibility and, in addition, how to use best and trust new tools’ outputs. Progressive FP&A organisations focus on user-level engagement and training to improve the quality of ML-based planning models and strengthen the human-machine learning loop.

One way to promote organic knowledge sharing about building and using ML models in planning is to train a community of analysts across FP&A and the business and catalogue their application of ML into a use-case library. This perpetuates best practices sharing and encourages continued iteration and development of models around the organisation.

FP&A leaders should reach out to other functional leaders using ML and coordinate to share best practices and build an organisation-wide community that can apply ML and share learnings.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.