Without a doubt, artificial intelligence can improve the speed and quality of our work. To what...

With the increased macroeconomic uncertainties across multiple geographies and industries, companies are moving further away from the once-per-year budgeting season towards a quarterly and monthly Rolling Financial Forecast process.

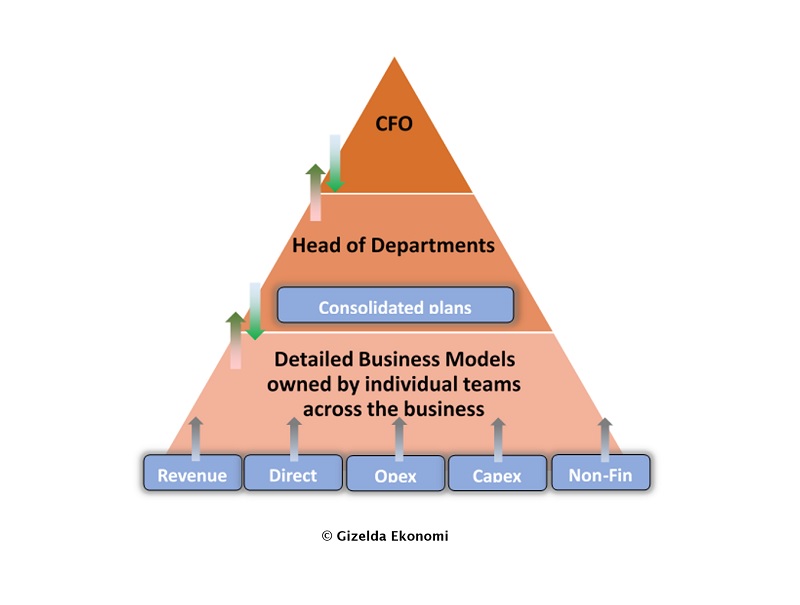

If the average time to consolidate and submit a full detailed budget ranges from 4-8 weeks, depending on the company’s size, introducing a more frequent financial forecast cycle at the same level of detail would mean that teams are constantly planning. That wouldn’t leave much room for taking action.

Therefore, in this new reality, teams need innovative tools and techniques to shorten the time taken to complete a financial forecasting cycle. This is where automation, data lineage and Machine Learning (ML) kick in.

The finance and technology community already know that Artificial Intelligence (AI) capabilities can aggregate and process data with far greater speed, accuracy, and scalability than is humanly possible. Yet, opinions among the finance community on adopting Machine Learning (ML) are still divided; some are sceptical or not planning to implement it, whereas others are embracing it and are sponsoring proof of concepts and transformational programmes.

Today, many companies are intrigued about what ML can do for their company and are waiting to know what it could mean for their finance function. Based on conversations held with many experts in the financial planning process, below are the top 5 desired outcomes that are cited as being necessary for ML to be perceived as adding value:

1. Accuracy of ML-enabled vs Humans Financial Forecasting

The accuracy of ML prediction is key for finance stakeholders to gain trust and enable them to understand the value of its outcomes. ML’s ability to predict accurately is inevitably compared to the human ability to do the same. Hence, what business stakeholders are looking for in an ML-enabled forecast is not only short-term accuracy (i.e. next month’s prediction) but also the sustainability of that accuracy across quarters and years. They want to understand ML’s ability to create multiple financial scenarios to manage performance.

2. Scenario-Based Planning – what if analysis

In a world of uncertainty, FP&A needs to look beyond the past. Relying on past trends and seasonality alone will mean that forecasts become irrelevant or outdated when faced with extreme scenarios such as pandemics, natural disasters, disruptions, or war. Therefore, ML applications need to evolve to incorporate external events and simulate how these events could affect the future.

3. Explainable AI – Deep understanding of the ML outcome

Understanding “why” ML models produce a certain outcome is essential for business owners. This is because they want to feel in control of that knowledge. A deeper understanding of the logic of modelling, the drivers for change and the relevance of seasonality allows for quicker adoption and higher reliance.

4. Actionable insight through data modelling and visualisation

More than just producing an ML outcome as part of a forecasting exercise is required. Teams involved in tackling the adoption of ML in financial forecasting need to constantly communicate and calibrate the need for insightful visualisation and data modelling in order to answer questions such as “what can be done to protect and retain value?”.

5. Independence and adaptation of FP&A teams in training and running ML models

The typical finance team will also need to evolve and adapt before adopting new technologies and tools. The finance community will need to nurture data scientist talent and collaborate with ML operation teams.

Drawing on my development experience with Machine Learning implementation in Financial Forecasting, below are some key learnings to help finance teams be adaptable:

A hybrid approach to ML outcome – Financial Modelling

Financial modelling must be delivered together with AI capabilities. There needs to be a thorough review of what the drivers and KPIs are that require the assistance of ML. The KPIs that can be calculated as an output need to be defined. This is essential to maintain compliance with KPI definition across the business and support the business’s understanding of the outcome.

Celebrate failures through an “Experimenting and learning fast” attitude

Throughout implementing ML in financial forecasting, the team needs to be prepared for failure. Through a trial-and-error approach, teams learn and understand data behaviours and interdependencies. Only by doing so and celebrating this learning can the delivery of valuable and customer-centred outcomes be accelerated.

Don’t underestimate the process transformation effort

Sometimes, the enthusiasm we as professionals show in grasping the opportunity that ML brings to the organisation undermines the effort and focus we need to show in managing the process change.

The expectations of relevant stakeholders need to be constantly managed - the question “what does this mean for the current process” and “how do employees need to adapt to the new ways of planning” are key questions in understanding the value of ML, as well as the process improvement imperative.

Build a strong cross-functional team to lead change and innovation

Innovation in the financial planning process requires strong competencies across various fields – such as business acumen, market understanding, data science, software development, and so on. Upskilling our finance teams is essential for us to be fit for the future.

Data quality and data quantity

To produce relevant and meaningful ML outcomes, do not underestimate the data quality and quantity prerequisites for success. In order to make a simple time-series forecasting with next month’s accuracy ranging around 97%-99%, the business would need a minimum of 24 months of data. In addition, the data must be accurate. Data scientists will tackle some of the accuracy issues through various statistical techniques.

Summary

Tackling the implementation and adoption of ML in a process requires:

- a solid understanding of processes

- open communication with the business owners

- availability of high-quality data

- courage to fail

- strong expertise.

It is a marathon, not a sprint! Getting to the finish line requires hunger for innovation, room and investment for learning, and, most importantly, the sponsorship of function leaders.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.