In this article, discover how FP&A professionals can lead digital transformation by blending human insight and...

I was an FP&A executive having a meeting with the $10B division CFO when he received an email from one of my colleagues. The CFO read it with bored eyes and told me, “Another email asking me to open an Excel and look at the report. I don’t want to look at reports. I want them to tell me what’s happening in their function!”

That scene, burned into my memory years later as a CFO, exemplifies what I call “the Scorekeeper Syndrome.”

The Scorekeeper Syndrome

Scorekeeper Syndrome professionals see their jobs as merely reporting numbers, performing reconciliations, and creating Excel reports. They produce trend-based forecasts without understanding the business drivers behind the numbers.

I have witnessed this syndrome at all levels, from analysts to CFOs of major functions who spend executive meetings hunting for decimal errors in slides rather than discussing strategy. It manifests as dashboards emailed with no insights, budget seasons becoming rituals of last year plus inflation, and growth investments rejected without understanding the business case.

It isn’t about people not being good at their jobs, but about the mindset our finance culture has built over time. They are not incompetent professionals; they’re skilled people operating in a paradigm that rewards precision over insight, compliance over strategy, history over foresight.

During my 20+ years across FP&A, Finance Operations, and CFO roles, I’ve witnessed how this approach fails businesses. More importantly, I’ve seen the transformative power when Finance evolves beyond this limited view.

Breaking Free: The Path to Transformation

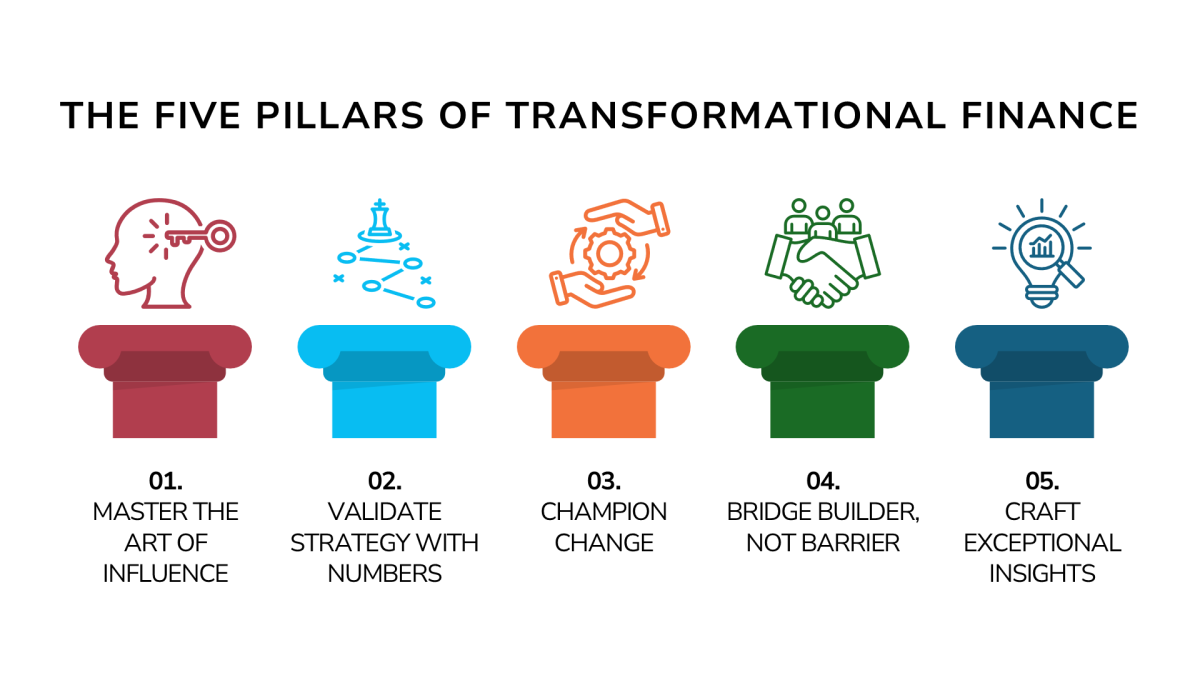

Moving from scorekeeper to strategic navigator requires a fundamental shift in approaching our roles. Based on my experience leading finance transformations at organisations from Fortune 100 companies to high-growth startups, I’ve identified five pillars that distinguish truly transformational Finance professionals.

The Five Pillars of Transformational Finance

Figure 1: The Five Pillars of Transformational Finance

1. Master the Art of Influence: Becoming a Trusted Advisor

The best finance professionals aren’t order-takers; they’re strategic advisors who influence without authority. It comes from understanding the business as deeply as your operational partners — speaking their language, understanding their pain points, and connecting financial decisions to business outcomes.

I became the CFO of GM Chile and Peru, a $1B division, without having much experience in sales, portfolio management, or manufacturing. I gained influence by understanding the business firsthand — conducting mystery shopping, meeting dealers directly, and travelling worldwide to engage with suppliers. This deep business immersion gave me the credibility to influence decisions far beyond traditional finance boundaries.

2. Validate Strategy with Numbers: Turning Data into Direction

Strategy means nothing without numbers, but numbers mean nothing without strategic context. I think it is irritating when finance people make opinions about sales trends without understanding market share, product portfolio, and pricing. In B2B contexts, the importance of pipeline, retention rates, or same-customer spending growth is not recognised.

Finance can quantify interconnections across functions — how customer satisfaction impacts retention, flows through to LTV, and ultimately affects shareholder value. Our analytical lens translates strategy into measurable outcomes and extracts strategic insights from numbers others see as just data.

3. Champion Change: From Process Guardian to Innovation Catalyst

Finance has been stereotyped as the department that says “no” and clings to established processes. In reality, we’re uniquely positioned as change catalysts. Our cross-functional visibility helps us see patterns others miss and quantify the cost of the status quo.

Analytics gives us the credibility to propose bold changes. When you demonstrate that restructuring will save $2M annually or automation will pay back in 8 months, scepticism turns to support. The key shifts from “we’ve always done it this way” to “what does the data tell us?”

At Coca-Cola, I led a restructuring of our marketing investment approach. By connecting marketing spend to consumer behaviour and ROI, we overcame decades of traditional allocation methods, ultimately delivering hundreds of millions in annual operating income gains.

4. Bridge Builder, not Barrier: Enabling Growth through Partnership

The transformational approach starts with “How can we make this work?” rather than “Why can’t we do this?” It means being a partner in strategic discussions from the beginning, not just a gatekeeper at the end.

Don’t be known solely as the cost-cutter. While supporting a purchasing organisation through inflation, the divisional president once called me “the cost cutter.” I told myself never again.

My recommendation: cut fat and build muscle. When I joined GAIN, we were burning cash unsustainably. Rather than implementing across-the-board cuts, we selectively invested in core capabilities while eliminating non-essential spending. The result: 30% cost reduction alongside 100% revenue growth.

5. Craft Exceptional Insights: Transforming Data into Narrative

If you’re a reporter, aspire to be a WSJ journalist, not a news aggregator. Provide insights, not just data; invest in presentation; anticipate questions; and tell stories that drive action.

The goal is to transform raw data into compelling narratives for executive decision-making. At Expedia, we shifted from spreadsheet-heavy decks to narrative-driven insights with visual data representation. Monthly reviews evolved from examining variances to discussing implications and actions. Meeting duration decreased while decision quality improved.

Where to Start: Taking the First Steps

Conduct a one-week personal audit: Track time spent creating reports versus generating insights. Calculate the ratio of backward-looking versus forward-looking analysis to identify your biggest opportunities.

Reimagine one recurring deliverable: Select a regular report and redesign it with the end user in mind. Start with the decisions they need to make, then determine what data and insights would best support them.

Schedule three business partnering meetings: Meet with key stakeholders to understand their strategic priorities, not to review financials. Ask what information would be most valuable to them and how they prefer to receive it.

The Path Forward

Transformational Finance means repositioning the finance function from back-office support to a central driver of business strategy. The CFO who dismissed that Excel report email wasn’t wrong to be frustrated. He was starved for insights, not more data dumps.

We’re at an inflexion point. Organisations don’t just need finance professionals who close books quickly or build complex models. They need strategic partners who navigate ambiguity, drive change, and translate data into action.

From my experience across Fortune 100 companies and rapid-growth startups, I’ve seen what happens when Finance embraces this transformation. Teams become energised, executives seek finance insights, and organisations make better decisions faster. However, when Finance remains stuck in the Scorekeeper Syndrome, the costs are substantial — missed opportunities, frustrated leadership, and underperformance.

The choice is stark: evolve or become irrelevant. The question isn’t whether Finance can drive C-suite decision-making. The evidence is clear here: when Finance steps up, organisations win. The real question is: Are you ready to lead that transformation in your organisation, starting today?

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.