In this article, the author looks at the FP&A tools and explains why these tools must...

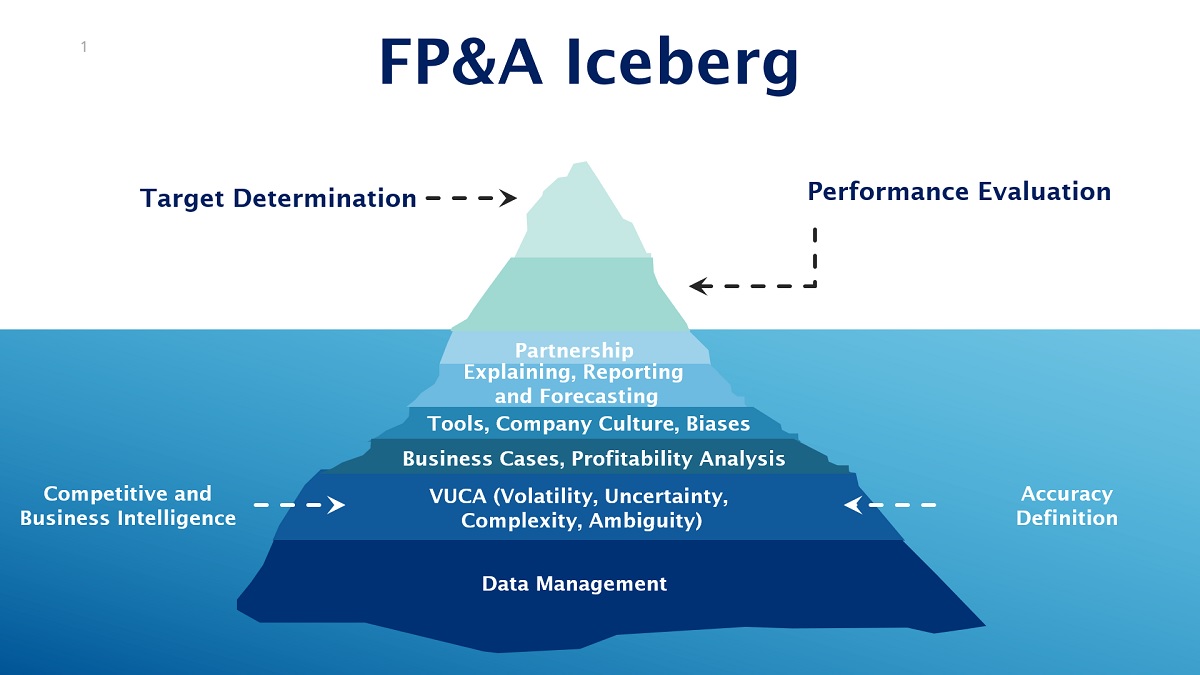

There are two aspects in the Financial Planning and Analysis (FP&A) life cycle that catch everyone’s eye within the company and its management: target determination and performance evaluation.

These high-visibility tasks are like the tip of an iceberg — obvious and essential to the company's direction. However, these components only represent a small part of our job and depend heavily on the other, less visible parts.

Figure 1: FP&A Iceberg

Target determination is generally associated with a subproduct of the forecast system adopted by the company, whereas performance evaluation is a subproduct of its reporting process.

Target finalisation, regardless of the forecasting process deployed, can be a tense time. However, when actual results differ from expectations, as they may inevitably do, FP&A’s evaluation often becomes a friction point for various management levels, specifically when compensation is tied to these forecasts.

Objectively, those variances may be caused by:

- Inaccuracy in the forecast taken as reference,

- External events or trends inherent to any forecast, compatible with the Volatility, Uncertainty, Complexity, Ambiguity (VUCA) profile of the entity,

- Management action/decision or lack of such decision,

- and other internal events.

Variances that lead to positive impacts on compensation or recognition are often readily claimed by owners, even when such variances are undeserved. However, those that bring negative impacts tend to be... "sensitive." These reactions are shaped mainly by the organisational culture and management biases.

FP&A is essential for uncovering and conveying the true drivers of results, as we have to distinguish between factors like luck and actual performance. This framework allows for a clear understanding of influencing outcomes, both good and bad.

Securing Its Own Area

It involves the following:

- Ensuring that company management has a clear definition and understanding of what accuracy means. In my previous article, I outline several different possible views, as some may be easier for FP&A to manage.

- Ensuring that your organisation has the right tools and processes to minimise cultural issues and eliminate biases.

- Developing proper competitive and Business Intelligence.

- And mastering the ecosystem complexity.

While establishing these foundations can be a lot of effort, they will allow the FP&A team to deliver real impacts in target determination and performance evaluation.

Even though financial figures and other internal data can show consequences, they rarely show the real causes. FP&A will have to extract such real causes and evaluate their effects on business. In order to do that, we should have an in-depth involvement with the teams supported. It should extend far further than a pure controlling role. FP&A has to participate in decision-making in order to gain good visibility on the relevant facts. Nevertheless, this involvement should remain independent. It is a difficult but essential balance to achieve.

Apprehending the VUCA Profile

The VUCA concept is relatively simple to understand, but its application to a particular company is a real challenge. The difficulty may vary due to the nature of the business and the lack of easily available data. Over time, a company’s management has probably developed a perception of the volatility or speed of change; uncertainty, or difficulty in predicting events or issues; complexity, or challenges in determining causality; and ambiguity, or contradictory signals within its environment, forming part of the company’s competitive and business acumen. This perception is informally embedded within the company culture. However, it is rarely explicitly defined and regularly reassessed, which makes it one of the elements that may generate management biases.

Making the VUCA profile more explicit allows FP&A teams to:

- improve its own tools (choosing what type of forecast or cause analysis to perform),

- provide context for evaluating a raw variance regardless of its nature and

- improve decision-making processes by running multiple scenarios.

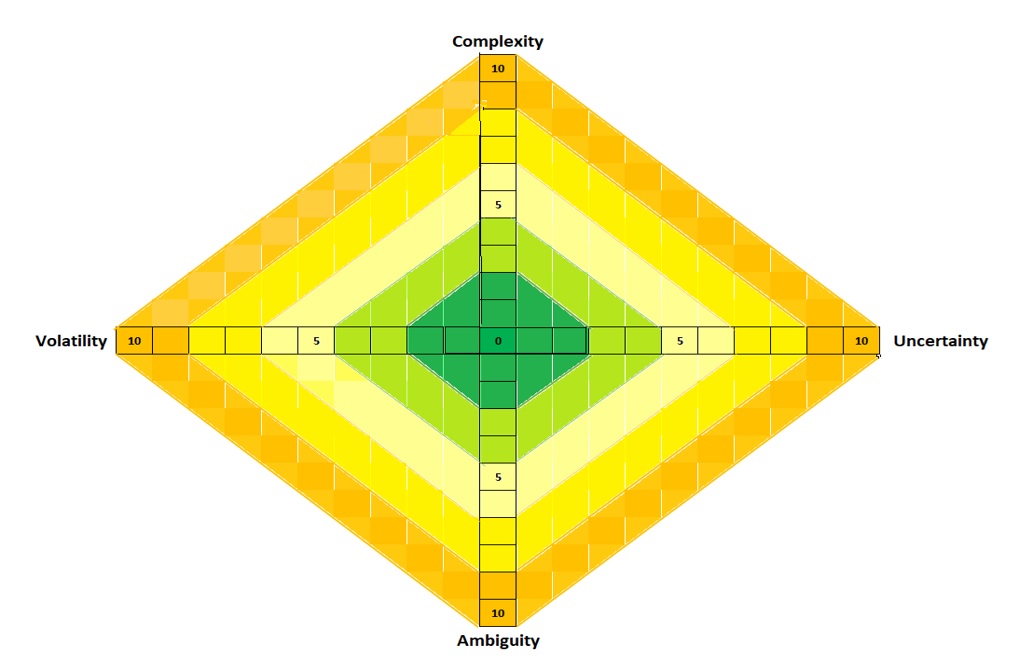

This, in turn, supports the organisation’s agility and resilience. We may look at the rational VUCA framework, where each dimension is measured from 0 to 10 on the scale from low to high, and imagine the entity’s position in one of the “standard” zones as below. Everyone would love to be in the green zone, as the lower the VUCA scale, the easier it can be managed. On the contrary, placing an entity in the orange zone is the most challenging.

Figure 2: A Sample VUCA Diagram

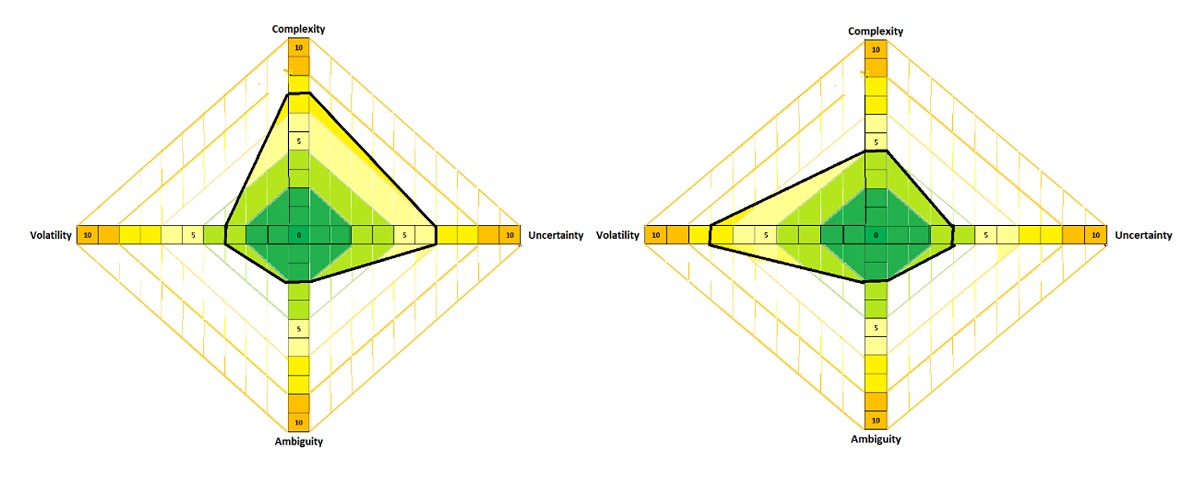

In practice, it will be less homogeneous. For example, it may appear in the two following pictures, where the levels for each of the four dimensions are materially different.

Figure 3: VUCA Diagrams with Different Dimensions

Defining the VUCA profile should also permit us to understand the issue’s impact and draw a plan to improve our perception or at least verify if the perception aligns with reality.

It may also help us better contextualise targets and performance, and variances in particular, by recognising that forecasts or targets can only be determined with a level of precision that aligns with the entity's VUCA profile.

Evaluating the Results of Management Actions

Here, we consider both actions included in the forecast or targets and those taken during execution, whether specifically planned within the forecast or not.

The preliminary step is to ensure that the forecast is not limited to sets of figures. The scenarios, decisions, action plans and assumptions shall be properly documented and considered as a part of the forecast. The main risk arises when management hasn’t fully considered or consciously decided on many elements included in a forecast. For example, they might have been aware of these factors but haven’t actively anticipated their consequences. FP&A must ensure that those decisions are properly highlighted and reviewed by the management and advocate for developing management ownership regarding the forecast build.

The assessment should then start with the review and evaluation of the different elements:

- Do we follow the scenarios/assumptions retained for the forecast? What are the causes for variances or changes in the scenarios or assumptions? Are there any potentially unidentified issues/scenarios?

- Are the decisions or action plans decided timely and correctly implemented?

- Did they bring the expected results?

This assessment can allow us to determine:

- What can be derived from the decisions made during the forecast preparation:

- Calculated risk when evaluating the different scenarios and assumptions,

- What issues were not considered during the preparation?

- How the execution performed.

Not all decisions can be included in the forecast. Some business decisions are made outside the forecast process through business cases. However, those also need to be captured and assessed.

In turn, it can also permit us to evaluate the managers’ responses or lack of these responses to changes in the assumptions, whether they actively undertake corrective actions, and the results of such reactions.

Other Internal Events

It may cover a variety of facts. Their occurrence and effects need to be assessed.

Conclusions

Target determination and performance evaluation are the most sensitive parts of FP&A’s role. That is why we compare them to the top of the iceberg. They are the convergence of many processes or subprocesses and are definitely not stand-alone ones. In order to perform this task, FP&A needs to have the different building blocks in place.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.