In this video, Michael Nudelmann, Director Controlling / Head of Corporate FP&A at SWAROVSKI, shares a...

Company culture and management biases impact how the FP&A team, their tools and effectiveness are perceived. Another way to look at it is to say that the FP&A tools must consider the company culture and factor in the management biases it generates.

The prime issue is generally the "effective" hierarchy of the different tools and the interactions with the compensation schemes. Another challenge is whether the FP&A department just follows or tries to positively impact the company and its management culture and operations. Simply put, we are dealing with the FP&A "ambitions": whether it wants to be a supportive or a driving force in terms of management practices (controller or active Business Partner).

Tools Hierarchy

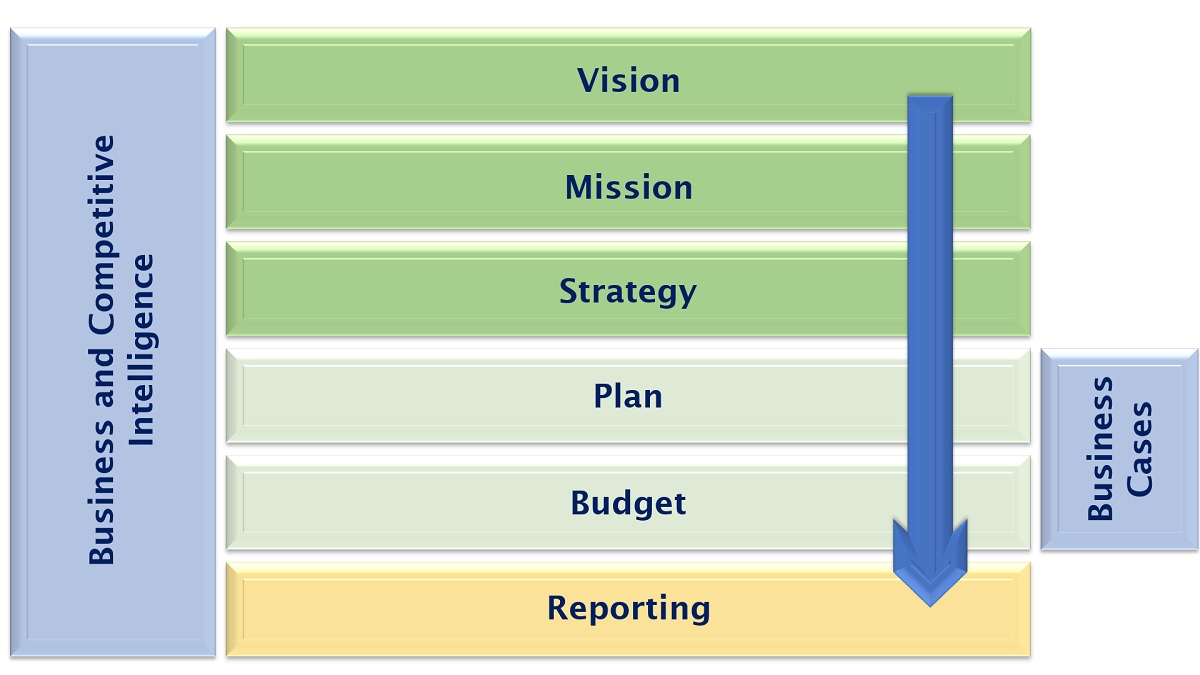

Ideally, it should follow those lines illustrated below.

Figure 1: FP&A Tools Hierarchy

On top should be the company strategy defining the long-term vision, missions and functional strategies for your business. Those should be detailed into plans that set the overall medium-term framework.

Further operational short-term details should be organised through budgets, and actual reporting will give you a comprehensive view of the achievements. Variances and Profitability Analysis allow us to go deeper into details and define corrective actions.

Supporting the whole process, business cases allow us to support and rationalise decision-making on specific subjects such as pricing, investments, the launch of a new or product end, etc.

We should note that strong business and competitive intelligence is key at all those levels.

Those tools can take different forms and contents depending on an industry or market type and the company's situation. The level of business visibility will give different periodic patterns, for instance, 2, 3, 4, 5-year plans; 3, 6, 12-month plans or seasonal budgets or Rolling Forecasts; Scenarios Planning; Zero-Based Budgeting (ZBB). By "business visibility" I mean the level of business and competitive intelligence available, the key from/to times and the revenue types. The geographic and product/market reach will bring a further level of detail/complexity. Considering the large diversity of business situations, this can give a wide spectrum of possible setups. The individual setup put in place should be tuned to respect those specificities, as the setup relevance largely conditions its further effectiveness.

While the first, potentially the second and the last may not be under the FP&A direct umbrella, all these tools must be considered as a coherent and complementary set. If this hierarchy is compromised, it may represent deeper cultural issues and can open the door to overwhelming management biases.

For example, a traditional issue is when budgeting and reporting get all the attention, and the organisation loses its focus on potentially weak or even non-existing strategies and plans, shortening the different analyses to a minimum without supporting the different management initiatives or decisions correctly. That's what I call "shooting from the hip". It widely opens the door for cultural and management biases. This can originate from how compensation and recognition schemes and practices work within the organisation. Finally, the leadership style is also determinant in such situations.

FP&A Role and Ambition

While FP&A people and those in charge of strategy and plans should work on enhancing their profile within the organisation, it does not solely depend on them. The leadership style and the company culture may pose some real challenges within "silo" organisations. The level of biases generated or tolerated by the company culture can be the source of difficulties in setting up a proper operation of the FP&A suite.

Furthermore, they have to avoid adding their biases into the process.

There is a relatively wide spectrum of roles for an FP&A team: from a pure controllership to a support role and to real Business Partnering. The FP&A function should aspire to be a Business Partner to each of the management layers, provided that the company culture and leadership allow it. It involves a whole set of technical and soft skills. The ability to recognise and assess the level and areas of cultural and management biases is key among these diverse skills.

Some Recommendations for Fighting Biases

My point is not to list or describe all the possible bias types and their impacts. There are numerous publications on the subject. A quick look at Wikipedia will give you some good synthesis and presentations. However, my point is to highlight a number of recommendations. Some consider creating an environment that limits the potential influence of biases, and some focus on exposing and fighting the biases.

a. Ensure that the different tools are in place and coherently structured. In particular,

- Budgets or forecasts should be driven by facts and data and should not be "manipulated" from the perspective of compensation and recognition scheme results.

- Budgets or forecasts have to support the strategy and plans, but they don't have to develop alternatives or variants. Strategy and plans must be clearly expressed and documented.

- Proper business and competitive intelligence should be gathered and analysed.

b. Develop both internal and external data management and data quality strategies

Missing, partial and poor-quality data negatively impact the quality of the decision made. Furthermore, it favours guesswork, which primarily reflects the biases of management (sunk cost, loss aversion, bandwagon effect, etc). Having to collect, structure and debug information on demand is inefficient; in most cases, the FP&A department does not have much time available for that.

In order to have data available, data collection should be organised. It means we should have a clear definition of the piece of data, and the information necessary must be established so a permanent gathering program can put it in place then. Provided a proper organisation, the internal data should not be too challenging. In many cases, the external data are more difficult to organise and obtain, making setting up it in advance even more important.

c. Enforce data-based analysis and decision-making

Furthermore, you need to systematically challenge "opinion or ego-based" analysis and decisions.

Making decisions prior to or without proper consideration of data is one of the areas where biases such as overconfidence, anchoring, confirmation, and escalation of commitment are the most common. Putting in place a process that structures decision-making is the key.

That should objectivise the decisions made. Still, FP&A should remain vigilant that the process privileges the "substance over the form". However, the process itself is not a guarantee of the absence of biases. Framing, confirmation and the representation of biases can corrupt the process's outcome.

d. Enhance timeliness, accuracy, relevance, flexibility, efficiency and transparency to help decision-making

Having clear and ambitious definitions and policies on each of those domains is important to channel expectations and then give a framework that limits the biases. For instance, consider the example of the forecasting accuracy within this domain. Obviously, accuracy is not limited to forecasting, and the other domains need the same level of structuring. Furthermore, those definitions and policies may vary depending on the company's characteristics.

e. Evaluate the impacts of compensation and recognition schemes/practices

That is an extremely sensitive area, focusing on many biases. Ideally, the schemes would privilege the substance over the form and qualitative over quantitative. Still, FP&A is usually not in charge of those schemes. It is important that the FP&A team understand how it works in order to identify where and how it plays with the biases running through the company.

Keep in mind the two following laws:

- Goodhart's law: "When a measure becomes a target, it ceases to be a good measure";

- Campbell's law: "The more any quantitative social indicator is used for social decision-making, the more subject it will be to corruption pressures and the more apt it will be to distort and corrupt the social processes it is intended to monitor."

f. Ensure that all reported figures and their interpretation do not include biases or fallacies, such as Berkson's or Simpson's paradox.

Finally, these reported figures respect the causality principle.

Conclusion

Fighting biases is a wide and complex domain where giving a precise and definitive modus operandi is difficult. So, with that in mind, FP&A teams should exercise interpersonal skills and remember that it is easier to detect others' biases than our own.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.