Starting a business and sustaining one are two very different things that are both essential in...

Introduction

As an experienced practitioner and facilitator in financial planning and analysis (FP&A), I have been captivated by the power of this essential function in propelling businesses forward. During my extensive travels facilitating over 200 meetings of the International FP&A Board in 16 countries across four continents, I am frequently asked for the best definition of FP&A. There are many formal and informal definitions, but I would like to share my two favourite ones with you.

One striking informal analogy likens Finance to a car. Where Financial Reporting is the engine, and FP&A assumes the roles of the headlights (to see in front of you), the steering wheel (to set the direction), the seatbelt (to save you when things go wrong!), and the GPS (setting the options or scenarios to reach the destination). This vivid comparison captures the essence of FP&A and its importance in navigating the complexities of today's business landscape.

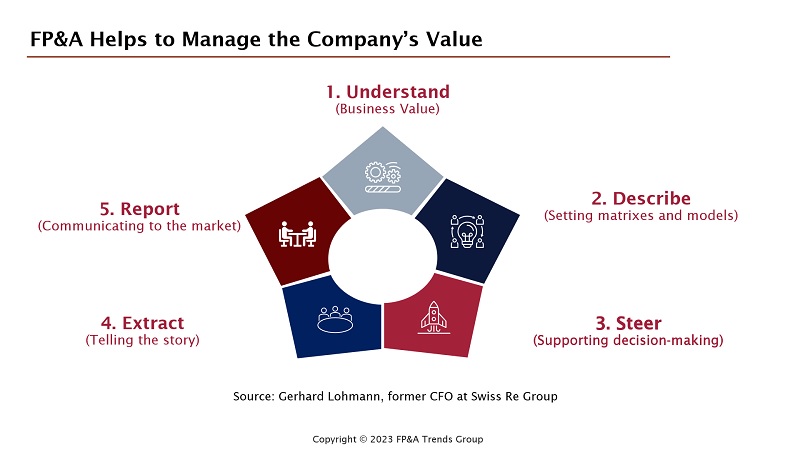

Figure 1: Five Pillars of FP&A

A more formal definition that resonates deeply with me comes from Gerhard Lohmann, former CFO at Swiss Re. Lohmann emphasises that FP&A helps to manage a company's value through five essential pillars that form the foundation of value-adding FP&A:

- Understanding business value

- Describing through matrixes and models

- Steering decisions

- Extracting insights and telling the story

- Reporting to the market

In this article, I will explore these pillars, demonstrating their importance in successful FP&A practices whilst drawing upon my extensive experience with the International FP&A Board to provide practical insights and inspiration.

1. Understanding Business Value

Understanding business value, which refers to the overall worth or desirability of a business to its stakeholders, entails comprehending the company's financial health, key performance indicators (KPIs), and operational performance. An FP&A professional investigates the company's current revenue growth, profit margins, and other critical factors while considering prospects for managing and enhancing its value.

This process demands business acumen, requiring comprehensive knowledge of the business model and the drivers that influence it, both internally and externally. FP&A professionals need to understand the value and play a vital role in sharing this knowledge across the entire organisation, empowering informed decision-making at all levels.

2. Describing Business Value

Describing organisational value through matrixes and models is a crucial aspect of FP&A. In practice, it involves actions to create comprehensive business models based on key internal and external drivers. By connecting these drivers and integrating the three core financial statements - Balance Sheet, Cash Flow, and Profit & Loss Account - FP&A professionals can effectively communicate an organisation's value to all internal and external stakeholders.

Take, for example, a mid-sized manufacturing company planning to expand its product line and enter new markets. An FP&A professional would develop a model incorporating various business drivers, such as production costs, sales volumes, supply chain efficiency, and market trends. The FP&A expert can project future cash flows, profits, and capital requirements by integrating these drivers with the company's financial statements. This holistic model not only guides the company's management in making informed strategic decisions on expansion and resource allocation but also helps stakeholders understand the potential risks, rewards, and overall value associated with the growth strategy.

3. Steering Decisions

Steering decisions involve providing strategic guidance, offering financial expertise, and identifying growth opportunities by leveraging data-driven insights. FP&A professionals are critical in helping companies make informed choices, optimise resources, and navigate the ever-changing business landscape.

For instance, consider a manufacturing company facing volatile market conditions and fluctuating customer demands. An FP&A professional would utilise data-driven scenario management to evaluate various possibilities, such as increasing the production of a successful product line, exploring new markets, or streamlining operations to reduce costs. By assessing the financial impact of each scenario, the FP&A expert can provide actionable insights and strategic guidance to the company's leadership.

In this way, FP&A professionals steer decisions crucial to a company's success, ensuring it remains agile and competitive in today's dynamic business environment.

4. Extracting Insights and Telling the Story

This pillar of FP&A involves analysing financial data, identifying trends, and pinpointing underlying causes for changes in performance. By extracting insights from data, FP&A professionals can tell a compelling story that guides decision-making and informs strategic direction. For instance, analysing a sudden increase in expenses could reveal higher raw material costs, enabling the company to take action to mitigate the impact. Storytelling with data is one of the most critical goals of FP&A, as it helps stakeholders understand the significance of the insights and take appropriate action.

5. Reporting to the Market

This pillar of FP&A highlights the critical role of financial planning and analysis in communicating an organisation's financial performance to investors, analysts, and other stakeholders. Reporting to the market involves preparing financial reports that accurately reflect the company's financial results and growth prospects, including quarterly earnings reports and annual financial statements. FP&A professionals must ensure that the reports comply with applicable accounting standards and regulations and are presented clearly and concisely.

For instance, an FP&A expert might prepare a quarterly earnings report that presents the company's revenue, profit margins, and other key performance indicators alongside management's outlook on the business's prospects. This reporting is essential to maintaining investors' trust and confidence in the organisation, enabling it to access capital and achieve long-term success.

Conclusion

In conclusion, the five pillars of FP&A provide a comprehensive framework for managing organisational value. Understanding business value, describing it through matrixes and models, steering decisions, extracting insights, telling the story, and reporting to the market are all essential components of successful FP&A practices. By leveraging data-driven insights and effective communication, FP&A professionals can guide informed decision-making at all levels of the organisation and propel it towards long-term success. To excel in FP&A, professionals must develop strong business acumen, stay up to date with industry trends and regulations, and possess excellent communication skills to tell compelling stories with data.

Learn more by accessing the related content below, and stay up-to-date on the latest FP&A best practices by following me on LinkedIn.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.