By FP&A suite, we shall understand here the different elements that are needed to manage a...

Among FP&A challenges understanding, explaining and forecasting revenues evolutions are one of the top items. It may be more or less difficult depending on the company business.

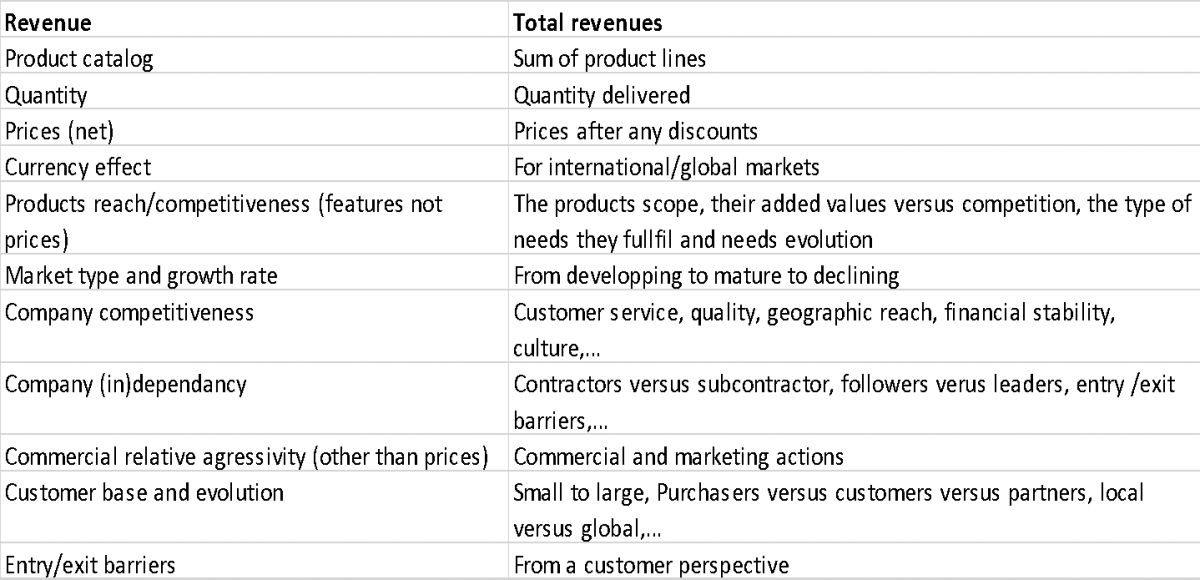

The key variables that are to be considered are:

Some variables are internal financial data that can easily be extracted from accounting and commercial data: products, quantity, prices, currencies, customers, etc. It requires proper data management and good quality as well as adapted analytics tools.

Other variables are external or result from a comparison between external and internal data: competitiveness, market, benchmark, etc. Those require proper competitive and business intelligence gathering and analysis. It is also where the dependency from other departments is the highest and where the true challenges reside for FP&A.

It also requires adapted processes.

1. Data management and analytic tools:

Over the past decades, the attention to those elements has regularly developed, increased and thus largely improved FP&A abilities not just to understand, explain and forecast but also help in business decision making and actions. Still, there are limits to what it can achieve in the absence of proper competitive and business intelligence.

2. Competitive and business intelligence:

This is largely a new and not widely used domain. Even if some of it exists in the company (at a strategy definition level), the systematic involvement of FP&A and integration in FP&A processes hardly exist or is quite new. It is a wide domain and I will not try to cover it holistically here. I will only give some tips on how to successfully use competitive and business intelligence coming from my experience.

- Product competitiveness is not just about price. In many cases, the default price level explanation is insufficient not to say irrelevant. The company needs to regularly perform comparative analysis (customer needs covered, our product features, main competitors' features). This analysis shall include evolution analysis (customer needs but also the competitor’s product launch and the company’s development plan). Ideally, the analysis should help create a sound vision of the company’s ability to perform against competition and explain revenue evolutions from past to future.

- Company competitiveness is a similar process but on a wider basis. It covers the assessment of the customer service quality, the completeness and complementarity of the product ranges, the geographic reach, etc. The assessment is done not just in absolute terms but compared to main competitors. Win/loss analysis is one of the tools relatively easy to implement. It requires FP&A involvement (at process definition and in the analysis of the data gathered).

- Customer base and its evolution. It’s a wide subject that requires types of analysis that can be very different. If a company serves a large purchaser base, it may require a big data type analysis whereas markets involving a small number of potential customers (repetitive purchasers) will require far more personalised approaches. Key customer partners shall be inquired in even more detail. Here again, FP&A needs to get involved not just in the analysis of the business data gathered but also in the financials of key customers accounts. Ideally, the elements gathered would permit us to picture what are the overall business evolutions of those customers, their needs evolution, their financials evolution, their strategic move, etc., and then based on this information, we will be able to understand the consequences for the company.

- Entry and exit barrier i.e. how much effort/cost is involved in changing a sourcing partner (for customers) and how much effort/cost is involved in gaining a new customer (from competition). This is another factor that should be understood by the company and FP&A in particular.

The higher (more precise) the level of competitive and business intelligence is, the better the quality of understanding, explaining and forecasting processes will be. This obviously is not only for the revenue domains. It will also impact the development and resource allocations.

3. Adapted processes:

Proper information gathering and analysis processes shall be put in place. It requires defining what information shall be researched, on what format and who shall be involved. In previous paragraph, I mention a few processes. They can take different forms, and there are others that could be looked at. Just a few tips again:

- The sales manager/director/CEO shall regularly meet with sales teams and customers to validate business information. Salespeople have consciously or unconsciously a lot of information as well as sales support, negotiation teams and distribution channels. In too many cases this information is kept private and not (or incompletely / occasionally) shared with the rest of the organisation. Organisation tends to be more interested in these individual’s performance than in the reasons for that performance. I would add that these individuals may hate a detailed form for reporting their activities. This needs to be taken care of. Information shall be structurally collected, controlled and analysed.

- Win/loss analysis needs a proper discussion with concerned customers. Why did we lose or win? What have we done correctly or wrong? Who was our competitor? Did we provide a comparative assessment of products? To be helpful this debrief needs to be kept non-conflictual and truly informative. This is not the place to have justifications (from one part or the other) but to gain true meaningful information. The individuals initially involved in the deal are not necessarily the best to perform this customer debrief.

- FP&A should collect and analyse financial results of large customers. The advantage of having large customers is that they publish more or less regularly financial results. The analysis should be shared with the sales team and management. This would give a perspective on their own business evolution. In the absence of such publications, annual reports should be collected.

- Comparing products functionalities. It can be more or less easy (services). Still, in many cases purchasing samples of competitor products is feasible. Access to their advertising or exhibition is available as well as an independent assessment. Let not oversee this information, collect it and properly fed back in the organisation.

FP&A is the key actor is orchestrating changes

It is important to note that FP&A will be one of the prime users of such “educated” assessment outputs. Therefore, FP&A should be a force that promotes or pushes for such processes to be defined.

This is a two-way impact. The intelligence gathered also impacts the pure FP&A suite (analysis, reporting, forecasting). This suite will have to be organised differently depending on a number of criteria:

- The type of revenue (one off, recurrent/contract, project)

- The key Time from proposals To orders To revenues (immediate, month, quarter, longer …)

- The markets stage (developing, growing, mature, declining)

- The type of product/services (new/innovation, new version, mature, obsolescence developing)

- The type of market (local or multi-local, international, global)

- The geographic reach

When major changes happen in those criteria, you need to consider circumstantial events

- A major crisis in one customer market or with one individual customer (Thomas cook type situation, customer M&A, …)

- A major change in the competition (new competitor, market globalisation, competitor product launch, competitor strategic move, …)

- Large contract won or lose, …

- …

All those elements influence both the timing and focus of analysis and reporting and the frequency/length of forecasting. FP&A is obviously the key actor in defining those changes and orchestrating the cultural changes that support it.

The theoretical concepts exist (Plan, budget, rolling forecast, scenario or project budget/forecast, driver base forecast, etc…). Yet, there is no on the shelf solution. It is one of the prime FP&A responsibilities to choose and customise the tools appropriate for the company's competitive situation.

The ultimate goal of this customisation is to be able to effectively and efficiently analyse, report and forecast based on the company-specific situation and through that to change from a “statistician watchdog” to a true business partner.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.