This article aims to share some insights on why digital transformation in finance has failed in...

Introduction: Navigating the Challenges of Transformation

In today’s dynamic business landscape, FP&A teams are increasingly tasked with driving digital transformation — from traditional Business Intelligence (BI) to cloud-based platforms and AI/ML-driven solutions. These initiatives promise to boost operational and analytical efficiency while enabling data-driven decisions to tackle volatile economic conditions. Yet, the road to success is fraught with obstacles.

A 2020 study by Boston Consulting Group (BCG) revealed that around 70% of digital transformation failed to meet their goals (1). By 2024, Bain & Company reported that 88% failed to achieve their original ambitions (2). These failures are often rooted in a combination of strategic missteps, organisational inertia and a failure to address operational complexities. Such findings underscore a persistent gap between innovation and execution, leaving many companies unable to unlock the full potential of their ambitious initiatives.

The question remains - why do so many FP&A teams, particularly in fast-paced environments, struggle to adapt? Insights from industry leaders like Suneet Pal Singh, Director of FP&A at SE Health, point to common pitfalls: unclear strategic goals, lack of executive support and neglect of people-centric strategies (3). Similarly, the London FP&A Board (2024) highlights issues such as skill gaps, time constraints and resistance to change. (4)

Drawing from my experience leading digital transformation projects across diverse sectors, I have observed a frequently overlooked issue: the misalignment of methodologies with the unique dynamics of startups. This article explores the lessons learned from my first attempt at driving transformation in a startup environment during the COVID-19 pandemic. It also outlines key strategies that helped overcome common barriers to change management.

From a Big Mature Organisation to a Small Startup

Large, mature organisations often approach digital transformation methodically. FP&A and IT professionals collaborate with executives and team leads to set goals, design processes and implement solutions like automated reporting systems and planning and analytical tools, sometimes lasting several months or even longer. This structured approach allows ample time for testing, skill-building and refining internal controls, often leading to successful outcomes.

In contrast, when I joined a digital media startup with a flat hierarchy, the dynamics were vastly different. My immediate challenge was to streamline reporting processes to deliver real-time financial insights to teams like sales and marketing. The pandemic intensified these challenges, with chaotic data management adding further pressure.

Initially, I applied the corporate playbook: aligning goals with executives, streamlining reporting processes using Excel and BI tools I was familiar with and providing training and Standard Operating Procedures (SOPs) for users. At first glance, the project seemed successful. It met all planned objectives and received no negative feedback. Yet, shortly after deployment, it became evident that most end users — especially frontline sales, marketers and editors — continued relying on the FP&A team for data requests instead of adopting the new tools.

Understanding the Hidden Resistance

To pinpoint the root causes, I conducted one-on-one discussions with frontline staff, focusing on their work behaviours, priorities and data needs. These candid conversations revealed a few critical top insights:

- Conflicting Priorities: End users prioritised short-term KPIs over learning new tools. While they acknowledged the tools' usefulness, they viewed adoption as time-consuming and opted for faster, familiar processes, particularly since they could still obtain the required data quickly through the FP&A team with no obvious elevation.

- Rapidly Evolving Demands: In a fast-changing business landscape, new tools risk becoming obsolete as management demands evolve. Users preferred familiar methods that were adaptable to changing requirements.

- External Reporting Pressures: Teams like sales, marketers and editors frequently needed to share reports with external stakeholders, such as clients, agents and authors. Compatibility issues with new tools created additional effort and complexity, leading them to favour existing methods. Moreover, they preferred consolidated systems for internal and external reporting to avoid confusion, especially with harsh deadlines.

A User-Centric Approach to Transformation

Armed with these insights, I re-engineered the transformation strategy to prioritise end-user needs, resulting in the following improvements:

1. Enhanced Communication: Effective communication is the cornerstone of any successful transformation effort. It’s not just about aligning with management on goals, expectations and budgets — it’s equally important to connect with end users to understand their daily workflows, challenges and perspectives. One-on-one meetings but not group meetings with their leads proved invaluable in this process, providing insights that streamlined execution, minimised discrepancies between leadership’s vision and operational realities and significantly reduced the risk of adoption failures. In these conversations, I focused on uncovering specific details about current processes, identifying pain points, such as external communication challenges or time-consuming tasks, and gathering suggestions for tools or systems that could enhance their efficiency. This collaborative approach not only accelerated implementation but also ensured that solutions were tailored to meet both immediate and future needs.

2. Iterative Engagement: I also maintained ongoing communication with end users more deeply, from data collection and system integration to process design and dashboard development. Their feedback not only shaped iterative improvements but also served as a key measure of success. I assessed whether their workflows had become more efficient and collaborated with their stakeholders, providing support to monitor reductions in manual data requests. This approach ensured the change was not just implemented but truly adopted, delivering tangible value to the team.

3. Simplified Tools: To minimise resistance and reduce transition costs, I began by building solutions that extended the existing system framework. This approach allowed teams to adapt without overhauling familiar processes. However, when existing systems fell short after thorough evaluation, I shifted focus to cloud-based solutions with low-code or no-code configurations, leveraging predefined functions and templates. These options not only streamlined adoption but also aligned seamlessly with users’ workflows. Given the fast-paced, high-growth and high-risk nature of startups, simplicity and scalability were critical. Solutions needed to be flexible enough to accommodate future changes without incurring excessive costs or requiring lengthy implementation cycles. While advanced systems might appear attractive, their complexity and high investment often prove impractical in dynamic startup environments. Instead, prioritising agile, cost-effective tools ensured smoother transitions and long-term adaptability.

4. Flexible Reporting: In designing reporting solutions, I prioritised flexibility to meet the diverse needs of both internal and external audiences — all based on a single dataset. Unlike larger organisations with dedicated teams to handle separate reporting requirements, startups often rely on a leaner structure. This made it essential to create predefined reports and dashboards that could be easily adjusted and managed by a single user. Recognising the fast-paced nature of sales and marketing teams, I also ensured the new processes supported seamless sharing of external reports. By integrating internal and external reporting within the same cloud-service platform, users could quickly generate shareable links or screenshots directly from dashboards. This approach not only reduced manual effort but also improved efficiency, enabling teams to meet tight deadlines without sacrificing data accuracy or consistency.

This revised approach led to a significant decline in post-implementation queries and higher adoption rates with improved flexibility.

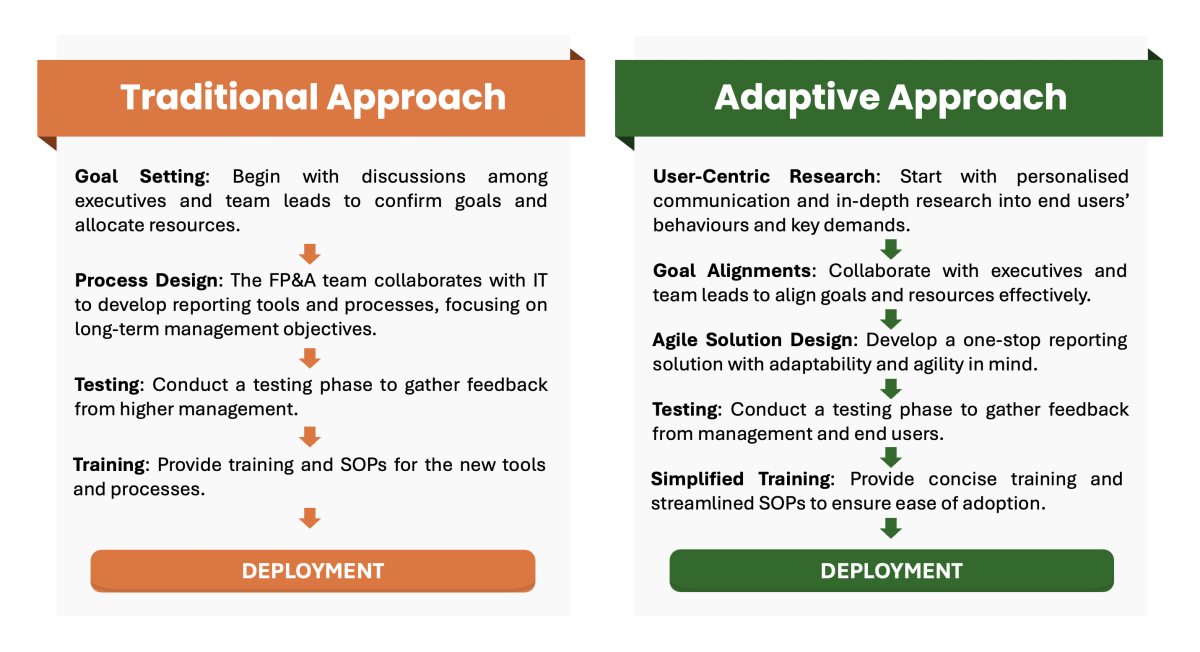

Figure 1. The Change of Transformation Approaches

Conclusion: Bridging Strategy and Execution

Successful digital transformation in FP&A teams requires more than deploying advanced tools or aligning with executive objectives. It hinges on a deep understanding of end-user priorities and workflows. By adopting a user-centric, adaptive methodology, FP&A professionals can bridge the gap between strategy and execution. Key strategies include:

- Direct engagement with end users to understand their needs.

- Designing flexible, user-friendly solutions minimising learning efforts.

- Ensuring compatibility with both internal and external demands.

Such an approach not only reduces hidden resistance but fosters meaningful adoption, driving greater efficiency and value in fast-paced, dynamic business environments.

References:

- BCG (2020). “Flipping the Odds of Digital Transformation Success” bcg.com. October 29, 2020. Accessed November 18, 2024 https://www.bcg.com/publications/2020/increasing-odds-of-success-in-digital-transformation

- BAIN. (2024). “88% of business transformations fail to achieve their original ambitions; those that succeed avoid overloading top talent” bain.com. April 15, 2024. Accessed November 18, 2024 https://www.bain.com/about/media-center/press-releases/2024/88-of-business-transformations-fail-to-achieve-their-original-ambitions-those-that-succeed-avoid-overloading-top-talent/

- Nitin Kumar Wadhwa (2024). “Agile Strategies for Forecasts and Scenarios: Insights from London FP&A Board” FP&A Trends Group. September 24, 2024. Accessed November 18, 2024 https://fpa-trends.com/report/agile-strategies-forecasts-and-scenarios-london-fpa-board

- Suneet Pal Singh (2024). “A Sure Shot Strategy to Fail at Finance Transformation” FP&A Trends Group. March 19, 2024. Accessed November 18, 2024 https://fpa-trends.com/article/sure-shot-strategy-fail-finance-transformation

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.