In this episode of the FP&A Trends Video Series, Hyder Hasan, Global Finance...

An Insight into Lindström Oy’s Business Control Transformation

Lindström, established in 1848, is a family-owned textile service company headquartered in Finland. With a turnover of €518.1 million (2024) and operations in 24 countries, Lindström employs 4,900 people and serves 88,000 customers.

Introduction: Evolving the Role of the Business Controller

Several years ago, Lindström finance organisation underwent significant changes to support the strategy and restructuring. The finance transformation project was called “Finance Forrunner”.

The new operational regional structure included four regions, supported by regional heads of finance, who managed the country business controllers in the subsidiaries. Basic core processes, such as purchase to pay, order to cash, and record to report, were centralised in Helsinki.

The role of country controllers changed substantially. Previously focused on leading local accounting and reporting as a back-office function, they were now required to step forward to provide optimal financial support for the business. Business Partnering has become essential for success in this role.

Starting the Development Journey

A specialised stream of the “Finance Forerunner” project aimed to develop the country’s business controller role. During this period, both basic and advanced roles were defined, and the necessary capabilities for these positions were identified. Development plans and specific training were prepared accordingly. Every six months, the controllers’ progress was evaluated by collecting feedback from their business partners in all areas where the business controller was expected to provide support.

Identifying the Development Gap: Why a New Approach Was Needed

However, a further boost was required to help business controllers become frontline partners for country and global management teams. We needed to enable them to assist the organisation in making informed decisions, addressing organisational biases, and integrating strategic, operational, and financial planning. Business controllers were expected to understand business strategies, market dynamics, risks, and processes and to gain mastery over systems, analytic tools, and data management. Additionally, it was necessary to develop effective communication skills, proficiency in presenting and storytelling, and influencing abilities.

As a result, the idea of a comprehensive development program, “Business Partner Academy,” emerged.

Creating the Business Partner Academy (BPA)

BPA participant: “My biggest surprise– I knew we differ a lot from other departments, but couldn’t imagine that even in the finance department we can have such different views and thoughts – only by meeting, discussing & sharing can we find our best way how to act bringing the most value!”

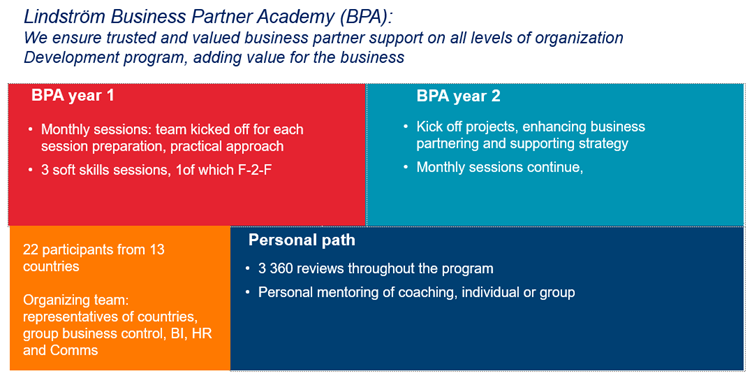

The chosen option was a 2-year program focused on developing Business Partnering and Soft Skills for country and group business controllers. The objective was to keep it practical and tailored to Lindström’s business needs. The program aimed for business controllers to become “trusted and valued business partners at all levels”.

The organising team included representatives from the country and group business control, BI, HR, and Communications. Over time, participants of the program became increasingly involved in session preparations.

It was agreed that there would be monthly sessions of approximately 4 hours with potential pre-work and homework assignments. The sessions would combine topic discussions with workshops and be as practical as possible, emphasising best practice sharing and ensuring participants can apply what they have learned directly to their roles. Pre-work and homework are essential to ensure the practical use of the knowledge received. All Pre-work, homework, and workshops were to be done in mixed teams or pairs to foster an environment for co-working and experience exchange among business controllers. Additionally, we would ensure business managers were invited to most sessions to ensure cooperation and provide business insights.

It was decided to hold at least three soft skills sessions annually, with one being conducted face-to-face to facilitate networking and cooperation.

Figure 1

Year 1 Focus: Foundational Business Partnering Skills

Head of regional finance: “ Specific to my region, the program was a gateway to connect different colleagues and stakeholders; networking around and learning from experiences is something that will excel our approaches to the next levels”.

The program was launched in May 2023. Almost all countries and group business controllers applied, and we ended up with 22 participants from 13 countries.

In the first year, we focused on pricing cases workshops, customer profitability, business cases for new business lines and countries, scenarios, strategy, data management, and AI development, with practical exercises and homework to add business value. Soft skills sessions aimed to enhance presenting, communication, and influencing skills.

As part of the homework, countries received profitability improvement plans at the country level and for specific customers. Additionally, business development cases were supported, and forecast trends were analysed.

After several months, we developed a plan to enhance the program with a personal development path supported by a mentoring culture within Lindström. Upon request, each participant received mentoring and coaching throughout the program, following an individual development path. The greatest interest was in understanding business processes and mastering presenting and influencing skills.

Year 2 Focus: Projects and Change Leadership

The program’s second year commenced in Helsinki in September 2024 during the formulation of our new “2X Strategy”. In the program’s second year, the aim was to add more value to the business while continuing to develop soft skills and focus on project management. In order to achieve that, five teams were formed to work on graduation development projects that support the strategy. Monthly sessions continued without homework assignments. Soft skills sessions were designed to support change and project management.

Project topics covered pricing, market share calculations, sales training, benchmarking, and AI in finance. The project results and graduation are expected in August 2025.

Conclusion: Program Feedback and Building a Community of Finance Business Partners

Head of regional finance: “As finance leaders, it’s our responsibility to drive strategic change and ensure our business is prepared for the future. With the insights gained from the Business Partner Program and a strong focus on technology, innovation, and continuous improvement, we are well-positioned to achieve our growth targets and redefine the role of finance in the coming decade.”

At this stage, I am confident that the BPA has succeeded. We have received a considerable amount of positive feedback through our internal employee satisfaction surveys and feedback collection processes. Two 360-degree assessments of participants from their business partners show notable progress compared to the original report across all review areas. The most significant improvements are observed in the areas of “Customer Needs and Quality,” “Adapting to Change,” “Leading People,” and “Deciding and Initiating.” Recent improvement comments have primarily focused on time management, in contrast to earlier comments on developing people skills.

I am also proud to say that we successfully created a strong community that fosters co-working, mutual support, and sharing best practices. Through practical sessions, soft skills development, and community-building activities, participants enhance their ability to strategically and operationally support the organisation. By cultivating a culture of continuous learning and collaboration, we at Lindström ensure that our business controllers are well-equipped to navigate the complexities of the modern business landscape and contribute significant value to the company.

Key Takeaways for Finance Leaders

To conclude, here are some key takeaways for finance leaders interested in enhancing the development of their teams toward business partnering.

Structured and Practical Continuous Learning: At Lindström Finance, we have implemented a tailored 2-year learning program to continuously develop our Business Controllers’ skills, aiming to make them trusted and valued business partners at all levels.

Emphasising Soft Skills and Cooperation: The Business Partner Academy program emphasises explicitly the development of essential soft skills for business partnering. These skills are cultivated through dedicated training sessions and coaching related to personal development paths. Furthermore, business leaders are invited to participate in most sessions to foster collaboration with them.

Leading Development and Adding Value through Learning: We aim to create additional value for the organisation beyond practical exercises in the countries. To achieve this, we have selected topics supporting the new strategy and organised five team projects around it.

Building a Community of Finance Business Partners: By collaborating on assignments and projects, we create a network of finance business partners who support each other and share best practices to improve their strategic and operational contributions to the organisation.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.