In this article, discover how FP&A professionals can lead digital transformation by blending human insight and...

Introduction

Great news for FBPs: Business Partnering has never been more in demand! According to the 2025 FP&A Trends Survey, 46% of respondents say it’s the most sought-after skill in new hires, and it ranks as a top priority for improving FP&A effectiveness. This sounds great, right?

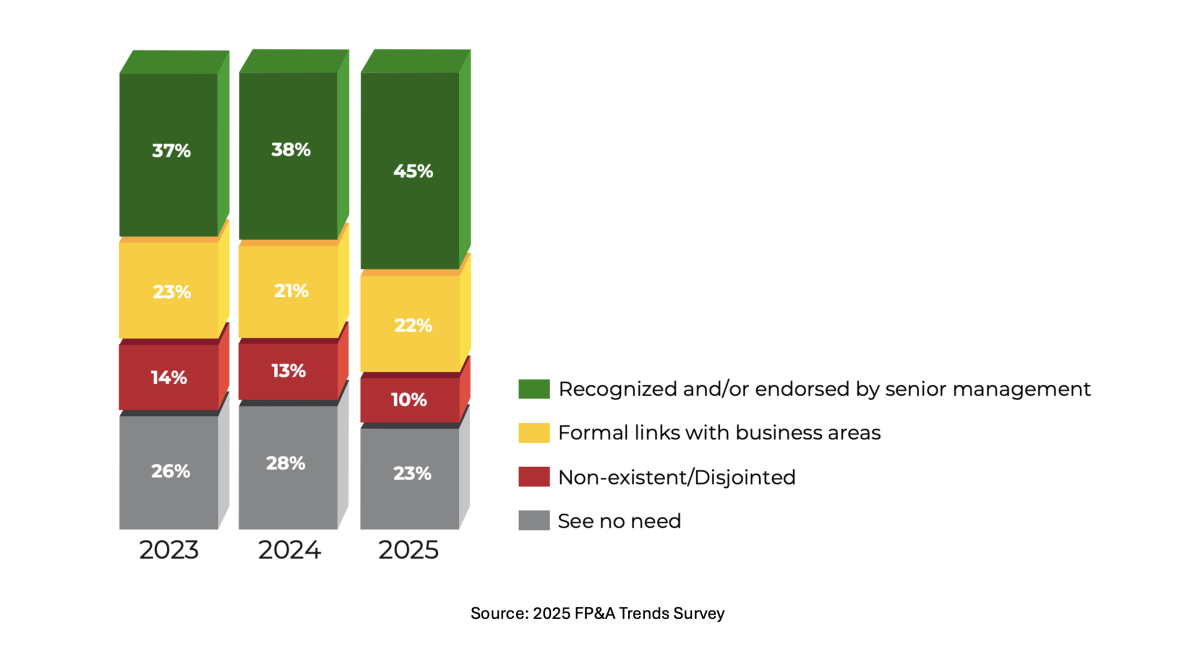

But look beneath, and a more sobering picture emerges: only 9% of FP&A teams believe they are truly acting as "Strategic Advisors". It really struck me to visualise that just 1 in 10 feel they are influencing business decisions at the strategic level. I've worked with plenty, and I’m convinced that most of them were breaking through here. Maybe I’ve been lucky? While 45% are now recognised as business partners (up 7% year-on-year), the gap between being called a partner and operating like one is still alarmingly wide.

Figure 1: FP&A as a Business Partner

From what I’ve seen, there’s a vast reservoir of talent, ambition, and capability in FP&A teams, but they are generally underutilised. So if ambition and talent are there, recognition is growing, but strategic impact is still lagging… what needs to change?

From Recognition to Influence

Early in my career, I was in a "Finance Business Partner" role, but I found it difficult to move beyond simply being a trusted analyst churning out pretty spreadsheets. My insights were valuable, but I wasn’t always given the opportunity to contribute in other ways. Some of this came down to confidence and experience — I was supporting highly seasoned senior leaders while still finding my footing. But some of it was cultural. The expectation was that finance would provide numbers, not shape direction.

That’s the trap so many FP&A professionals fall into. Recognition may come with a title, access to meetings, or requests for commentary, but unless finance is influencing decisions, highlighting new opportunities, and helping leaders act with clarity, it isn’t strategic partnering.

What Strategic Business Partnering Looks Like

In one of the most rewarding roles I’ve had, I wasn’t just invited to meetings after decisions were made — I was there from day one, helping to shape the direction of a major contract renegotiation well before the numbers were finalised.

It wasn’t luck, it was fundamental to how the business worked. It operated lean, margins were tight, and the pace was intense. There was no time for ornamental finance. You had to add value quickly, and the business expected you to do so. I actually didn’t like it to start off with, and thought I’d made a bad career move. But the culture demanded real partnership, and finance rose to the challenge.

Looking back, the keys to that influence were:

- A commercial mindset embedded across the team

- Strong subject matter knowledge that built credibility

- Confidence to speak up, but only after really understanding the context

- Open-minded forums where insight was welcomed, not resented — even from more junior team members

This is what strategic business partnering should look like: embedded early, influencing direction, and helping drive better decisions.

Breaking the Reporting Trap

In many organisations, the barrier isn’t intent but being stuck in their ways. FP&A teams are still buried churning out data, explaining variances, and running reforecasts. That work has value, but it’s not where the real impact lies.

The real opportunity is in stepping beyond the numbers:

- Answer the “why”, not just the “what”

- Tell the story behind the performance

- Look for opportunities and surface them

- Spot risks early, and drive actions to mitigate them

In my own teams, I’ve always encouraged analysts to focus less on explaining variances and more on what we’re going to do about them. Insight is the real lever of strategic influence. When FP&A teams bring clarity to complex issues and link data to actions, they become a valuable asset.

Systems and efficient data management play a big role here, too. The more we automate the manual spreadsheet work, the more we unlock creative problem-solving time. However, technology alone is not the solution; mindset and deliberate action matter more.

From Advisor to Operator

For many FBPs, the journey from trusted advisor to strategic operator comes down to confidence, timing, and depth of understanding. In my experience, I only began to offer real strategic input once I’d built enough context to spot problems or opportunities. I didn’t want to risk being shot-down or embarrassed, making a bad name for myself. So I waited for the right forums and picked my moments. That meant I was generally well-received, not undermining others, just contributing in a way that would make a difference and make my stakeholders look better.

It isn’t about being the loudest voice in the room but about understanding the business deeply enough to speak with credibility. The best strategic finance partners develop true business fluency. They know the context, the constraints, and the commercial levers — often spotting things their stakeholders haven’t considered. That’s where influence begins.

What Leaders Should Be Asking

As I mentioned earlier, ambition is clearly there, and recognition is growing, as seen in the FP&A Trends Survey results. However, real strategic influence from FP&A isn’t breaking through, and that needs to change.

If you’re a senior leader in finance, ask yourself these questions. It’s a simple task I use when stepping into a new leadership role, and I’ve found it to be quite revealing:

“Are we surfacing valuable hidden gems of insight, or just scratching the surface?”

“Are we helping the business realise a return on its investment in us — or are we becoming a cost our stakeholders are starting to question?”

You may still be in trusted advisor mode if the answers are not obvious. Respected, but replaceable if it came to it. The goal is to be needed not just for understanding the past, but for shaping the future.

Here is What Great Looks Like

You’re brought into the room before decisions are made, not because your stakeholders are told to include you, but because they want you there because you make them stronger.

Your team challenges (respectfully), brings new ideas, and even changes the minds of experienced business leaders.

You’re trusted because you understand the business, not just relaying anonymous numbers in a budget.You don’t need a restructure to achieve this. In my experience, I’ve found that genuine curiosity, a willingness to help on a few tasks which may not be in your job spec, supported by enough confidence to speak up when the time is right, go a long way.

Final Thought: The Leap Forward

Looking back at my younger self, keen to climb the ladder by finding that next step by any (ethical) means possible, the best advice I could have given myself would be to start by understanding what really keeps my stakeholders up at night, and then work hard to bring solutions, not just report problems.

The best FP&A teams I’ve worked with didn’t just interpret the numbers; they changed the outcome.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.