In this article, discover how FP&A professionals can lead digital transformation by blending human insight and...

Introduction: The Evolution of FP&A and Role of Business Partnering

Financial Planning and Analysis (FP&A) is no longer just about crunching numbers. It has evolved into a strategic business function that plays a pivotal role in decision-making. Business Partnering is integral to this change, in which FP&A teams engage as partners with the business to create better financial results. However, old-fashioned approaches to consolidating inputs, such as assumption-based forecasting, are usually labour-intensive, manual, and detached from the data. But that is changing, thanks to emerging technologies, most notably Artificial Intelligence and its hyper-growth.

Business Partnering in FP&A - Collaboration that Drives Financial Success

Efficient FP&A business partnering aligns the budgeting process with business operations realities. Closely collaborating with various organisations reduces reporting time from weeks to days, increasing the accuracy of revenue drivers, cost structures, forecasts, and budgets, and providing agility to react to market shifts.

Yet, business partnering is frequently underperformed due to inconsistent data inputs, time-consuming manual processes, and delays in consolidating information in the planning system. Adopting standard input methods using standardised forms and data systems is the first step to meeting these challenges.

According to the 2024 FP&A Trends Survey, business partnering is now the most sought-after skill for FP&A roles, with 50% of organisations prioritising it, up 9% from last year. This trend highlights the growing importance of FP&A Business Partnering, which is needed to create strategic value, enhance agility, and ensure organisational success. (FP&A Business Partnering in the Age of AI, 2024)

Real-Life Scenarios: How Agentic AI Transforms FP&A Business Partnering

Agentic AI is transforming FP&A business partnering by automating input collection, validating critical assumptions, and streamlining the forecasting and reporting lifecycle.

The following two real-life scenarios illustrate how AI can enhance the FP&A function through end-to-end automation:

From engaging stakeholders

Gathering data to generate insights and publishing reports

Some of the capabilities described below are already being adopted by advanced vendor forecasting solutions, while others are forward-looking enhancements which I am envisioning to create a seamless and intelligent FP&A ecosystem.

Scenario 1: Sales Forecasting & Revenue Planning

End-to-End AI-Driven Process

Identifying Input Providers: The FP&A team requires revenue projections from regional sales managers across multiple markets.

Engaging Stakeholders: Agentic AI chatbots send automated notifications to sales managers, requesting updated pipeline data, sales trends, and upcoming deals.

Helping Stakeholders Provide Inputs: AI-powered assistants suggest historical trends, competitor benchmarks, and seasonal patterns to help managers refine their forecasts.

Receiving and Validating Inputs: AI cross-checks submitted data against CRM or other enabling systems, past revenue trends, and external market data to identify anomalies. If a sales projection appears unrealistic, AI prompts the manager for clarification or adjusts assumptions accordingly.

Incorporating Data into the FP&A Model: AI integrates the final revenue assumptions into the forecasting model and dynamically adjusts revenue projections based on validated data.

Variance Commentary & Feedback: AI produces reports highlighting revenue variances versus prior forecasts, automatically generating commentary (e.g., Q2 revenue is 5% higher than expected due to increased enterprise sales in North America). The sales team reviews and provides feedback if necessary.

Final Report Publication: AI formats the sales forecast into a financial dashboard by summarising trends, risks, and opportunities for leadership review.

Scenario 2: OPEX & Corporate Expense Management

End-to-End AI-Driven Process

Identifying Input Providers: The FP&A team needs corporate function heads (Marketing, IT, HR, Facilities) to submit operational expense forecasts.

Engaging Stakeholders: AI sends personalised notifications requesting updates on planned expenses (e.g., marketing campaigns, IT investments, office leases).

Helping Stakeholders Provide Inputs: AI provides spending patterns, past budget utilisation, and expected ROI calculations to assist decision-making.

Receiving and Validating Inputs: AI cross-references submissions with actual spend data from ERP systems. If Marketing’s digital ad spend projections appear inflated compared to historical ROI, AI suggests adjustments.

Incorporating Data into the FP&A Model: AI integrates validated inputs into the operating expense model, dynamically adjusting cost allocations.

Variance Commentary & Feedback: AI auto-generates variance explanations, identifying discretionary vs. essential expenses (e.g., “IT expenses rose 10% due to cybersecurity enhancements”). Department heads review and refine the commentary.

Final Report Publication: AI consolidates operating expense insights into a CFO-ready financial report, highlighting strategic spending areas and potential cost optimisations.

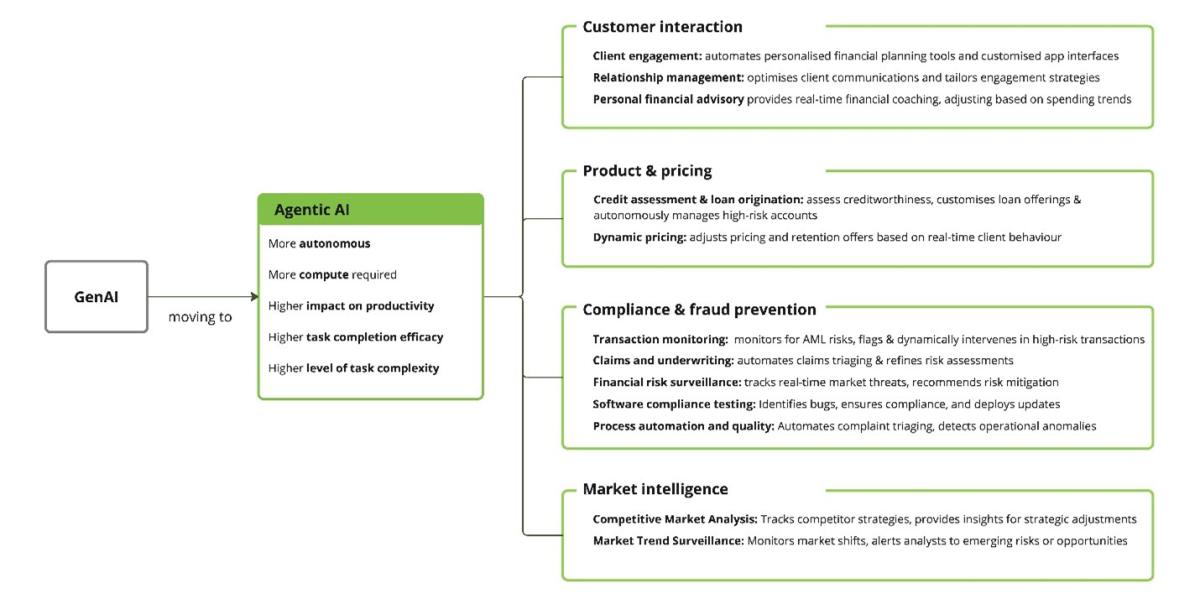

More Industry Scenarios for Agentic Solutions

Figure: WEF | Cambridge Centre For Alternative Finance

Checklist: How FP&A Teams Can Get Started with Agentic AI

1. Assess FP&A Maturity and Identify Gaps

Evaluate your current processes, tools, and stakeholder engagement levels to understand where AI can add the most value.

2. Prioritise Quick Wins

Automate repetitive tasks such as data collection and variance analysis to save time for strategic activities.

3. Align Long-Term Goals with Strategy

Define a transformation roadmap integrating AI adoption with the broader organisational vision and financial planning objectives.

4. Evaluate Investment and ROI

Conduct a cost/benefit analysis to justify AI implementation by considering efficiency gains, forecast accuracy, and faster decision-making.

5. Engage Experts and Upskill Teams

Partner with AI consulting firms for readiness assessments and invest in training to help your teams embrace new AI-powered working methods.

Conclusion: Strategic Value Through Enhanced Partnering

Agentic AI helps elevate FP&A from a support function to a strategic partner. Companies are advised to engage consulting experts to assess AI readiness and develop an implementation plan. Forward-thinking companies believe Agentic AI will help the FP&A function transform from a reactionary partner to a strategic one by making that happen through automating assumptions, course-correcting variance analysis, and facilitating real-time collaboration with stakeholders. The result is a data-driven, insight-rich environment where management reporting is timely and action-oriented. Investing in training and change management will ensure your staff can follow new ways of working in an accelerated, AI-empowered world. This transition is not a distant vision — it’s an achievable and essential next step for FP&A.

References

Empowering Decisions with Data. (2024). FP&A TRENDS SURVEY. Retrieved from https://fpa-trends.com/sites/default/files/docs/FPA-Trends-Survey-2024.pdf

FP&A Business Partnering in the Age of AI. (2024). FP&A Trends Insights Paper. Retrieved from https://fpa-trends.com/sites/default/files/docs/FPA-Trends-Insights-Paper-2024-FPA-Business-Partnering-in-Age-of-AI.pdf

How Agentic AI will transform financial services with autonomy, efficiency and inclusion. (2024). Retrieved from World Eonomic Forum: https://www.weforum.org/stories/2024/12/agentic-ai-financial-services-autonomy-efficiency-and-inclusion/

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.