We have launched the 33rd International FP&A Board chapter. Milan became the latest addition to this global think tank for modern finance practitioners and FP&A leaders.

Figure 1: The Inaugural Milan FP&A Board Participants, June 2024

The inaugural Milan FP&A Board hosted in Michael Page's office on June 5, 2024, brought together 46 senior FP&A practitioners from global and local companies, such as Coca-Cola, Gilead Sciences, Rodenstock, UniCredit, L'Oreal, Estee Lauder, Versace, Christian Louboutin, Danone, Sony, Burger King, BIC, and many others, who joined us on that day.

We discussed the latest trends and developments in our industry, such as Scenario Management, Integrated FP&A (xP&A), five FP&A Team Roles, and Digital FP&A.

OneStream Software proudly sponsored the inaugural Milan FP&A Board in partnership with Michael Page and PagePersonnel. In this article, we briefly recollect the key insights from this energetic and interesting meeting.

What Are the Trends Shaping Our Industry?

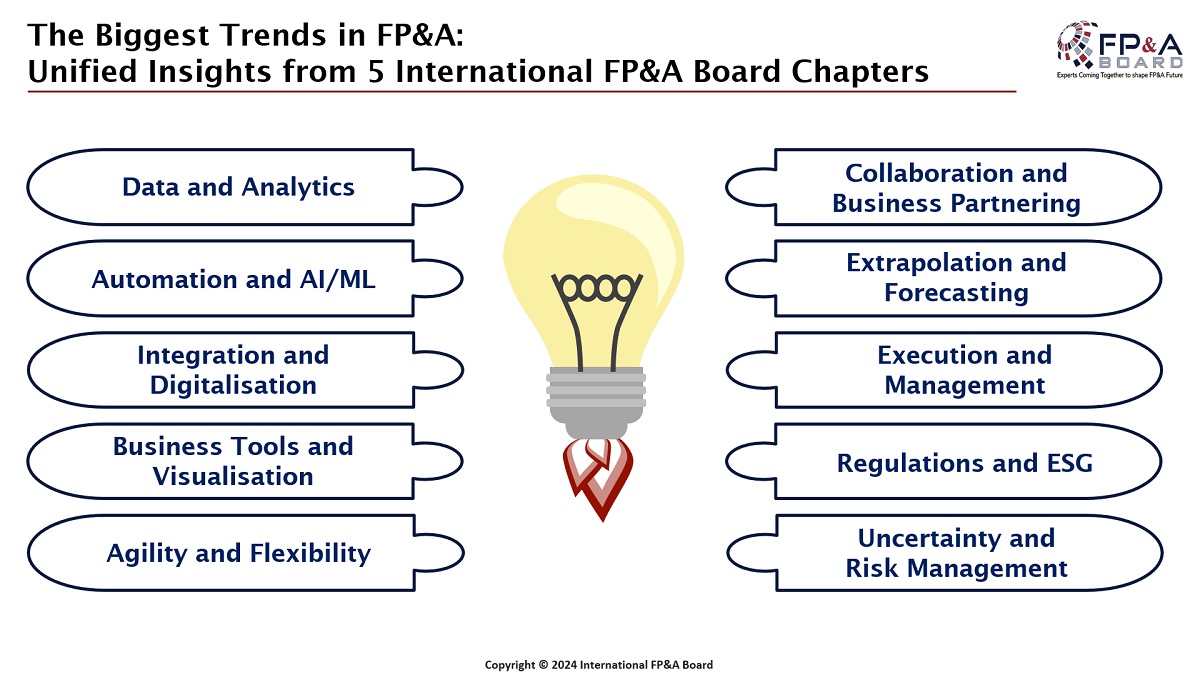

Figure 2

At the introductory part of the meeting, the attendees shared their thoughts on the most significant trends impacting our profession at the time. Artificial Intelligence (AI), data integration and automation topped the list of the most frequently shared insights. These insights were quite similar to ideas from the previous meetings.

However, the rising importance of Predictive Analysis, people transformation, and Business Partnering also resonated well with the Milan FP&A Board members. They underscored the cruciality of these concepts in modern FP&A practices. After hearing these insights, the forum transitioned to an in-depth discussion of today's trends shaping our industry. Scenario Management was the first item on our agenda.

Scenario Management: Is Your FP&A Team Ready for Uncertainty?

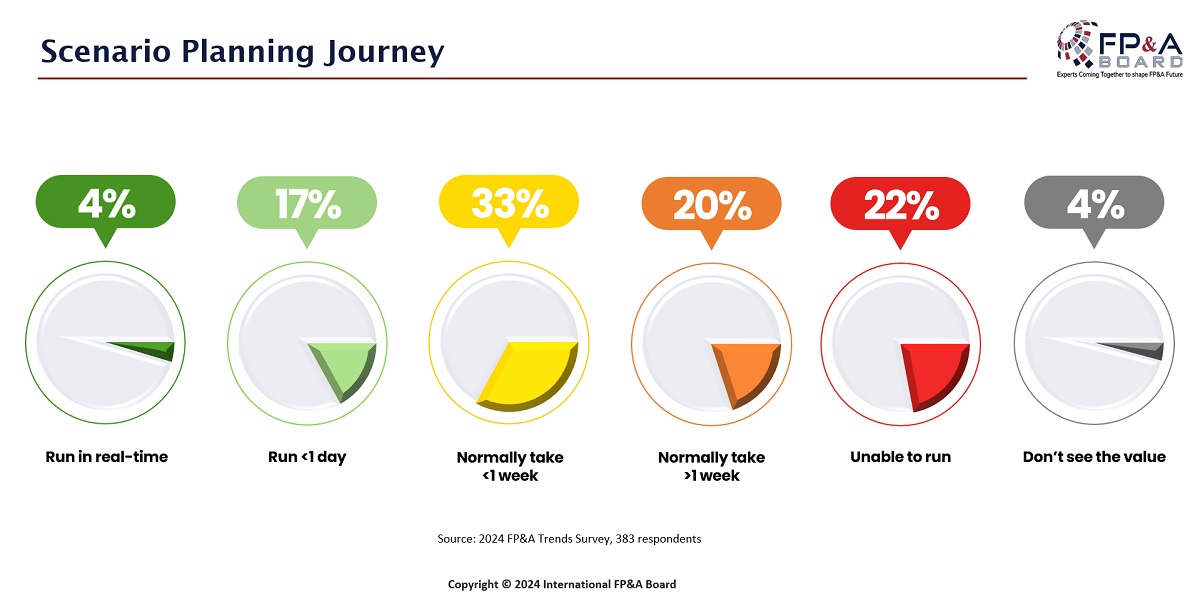

Scenario Management is a new planning and thinking method that deals with uncertainties by considering many alternative futures and their possible effects on the organisation. Larysa Melnychuk, who chaired this meeting, revealed the key findings from our 2024 FP&A Trends Survey and showed some stats to the Milan FP&A Board. Unfortunately, only 4% of organisations can run scenarios in real time, while 20% of companies cannot run them at all. For most businesses and practitioners surveyed (53%), scenarios can take a week or even longer. Delays or impossibility in deploying Scenario Management can negatively impact the business and hinder its agility.

Figure 3

Integrated FP&A Ensures Connectivity and Agility

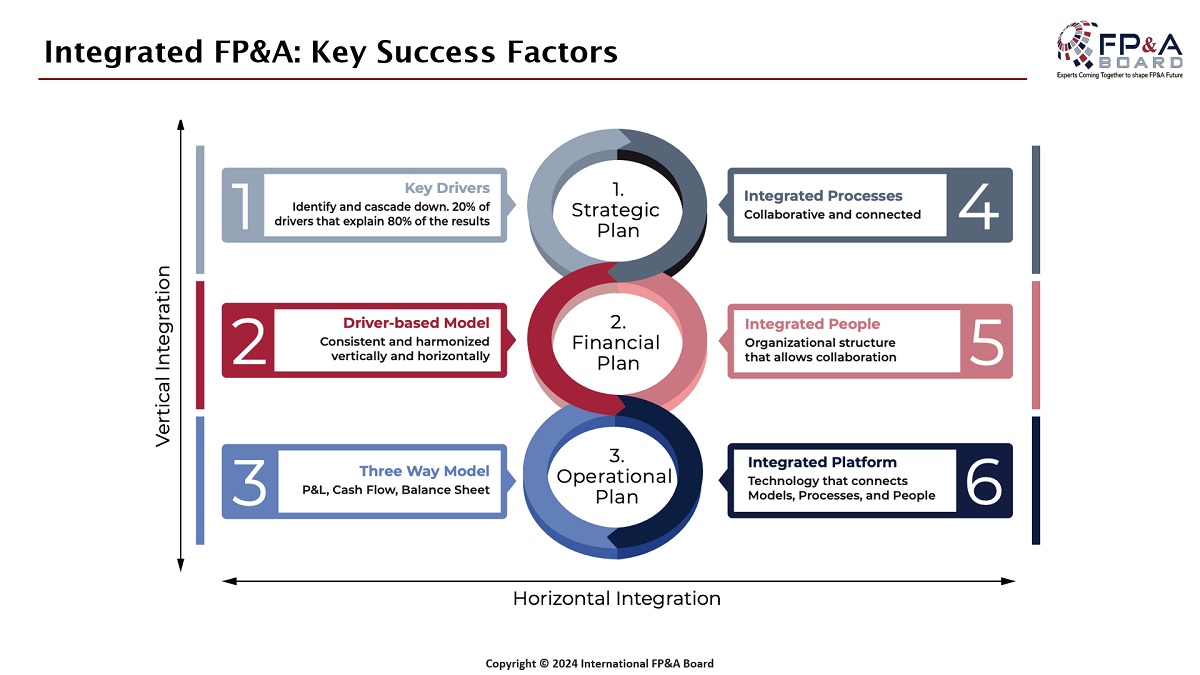

Milan FP&A Board members also touched upon the concept of Extended Planning and Analysis (xP&A). This term refers to a journey to analytical excellence spanning beyond finance. It involves the following aspects:

- Cross-functional planning

- Aligning strategic, operational and financial plans

- Digital transformation

Achieving Integrated FP&A or xP&A requires establishing alignment between top-down and bottom-up activities and cross-functional collaboration. Larysa Melnychuk also introduced the six essential pillars for Integrated FP&A, highlighting the importance of each building brick enumerated in the picture below.

Figure 4

FP&A Team Roles: Develop Your Team and Achieve Success

The audience anticipated the discussion on FP&A team roles and deep-dived into the essential skills and capabilities that modern finance professionals should develop to stay agile and relevant. We discussed the following FP&A team roles:

- Analyst

- Data Scientist

- Architect

- Storyteller

- Influencer

Milan FP&A Board members also discussed the core responsibilities of these roles and emphasised that not all organisations can allow such multi-disciplinary teams.

Digital FP&A: A Must-Have Approach in the Fast-Paced World

Figure 5: The Inaugural Milan FP&A Board Participants, June 2024

The last but not least trend in our agenda was digital FP&A. It can help us get real-time analytical insights by using internal and external data with minimal manual effort. This approach brings speed, agility, and exceptional granularity to organisational processes.

Our speaker, Matteo Baglioni, Finance Director Italy at Mastercard, delivered an insightful presentation on this subject. He presented an example of Digital FP&A in his company. Matteo also stated that such a massive digital approach was the only way to deliver effective planning with so many data points. During his presentation, he also outlined the importance of having a flexible FP&A playground and touched upon establishing a feedback look for forecasting. Finally, the speaker explained the interaction between digital FP&A roles within this environment in Mastercard.

Group Work Insights: Practical Steps for Embracing New Approaches to FP&A

Figure 6: Group work, the Inaugural Milan FP&A Board, June 2024

On hearing Matteo's insights, the audience was asked to brainstorm three questions:

- How to move from traditional planning to Scenario Management?

- What are the practical steps in implementing xP&A?

- How can organisations prepare themselves for successful analytical transformation?

The first group underscored the crucial role of people, models, business drivers, technology, and integration in moving to Scenario Management.

The second group highlighted that establishing data governance and aligning responsibilities to the business strategies can be essential steps in the transition to xP&A.

Finally, the third group presented their findings to the forum. They emphasised the importance of establishing a feedback loop with the top management to move towards transformation. We also need a creative commitment to streamline the transition.

Conclusions and Networking

Figure 7: Networking, the Inaugural Milan FP&A Board, June 2024

The meeting ended with a joyful networking session, where the participants could exchange their thoughts and impressions on the meeting and forge newly established connections with their colleagues.