The inaugural meeting of the Riyadh FP&A Board was held on the 27th of November, 2023. The event was held at beautiful Regus Esplanade, where 25 senior finance practitioners gathered to discuss the latest trends and developments in modern Financial Planning and Analysis (FP&A). Participants represented a diverse range of sectors and came from Airbus, Lucid Motors, Crayon, Signify, JLL, Al Safi Danone, Saudi Post, Nadec and many other companies.

Figure 1: the inaugural Riyadh FP&A Board, November 2023

The event was sponsored by Wolters Kluwer in partnership with Michael Page and IWG.

This article summarises some key takeaways from the meeting, including insights shared by participants during the session and group work.

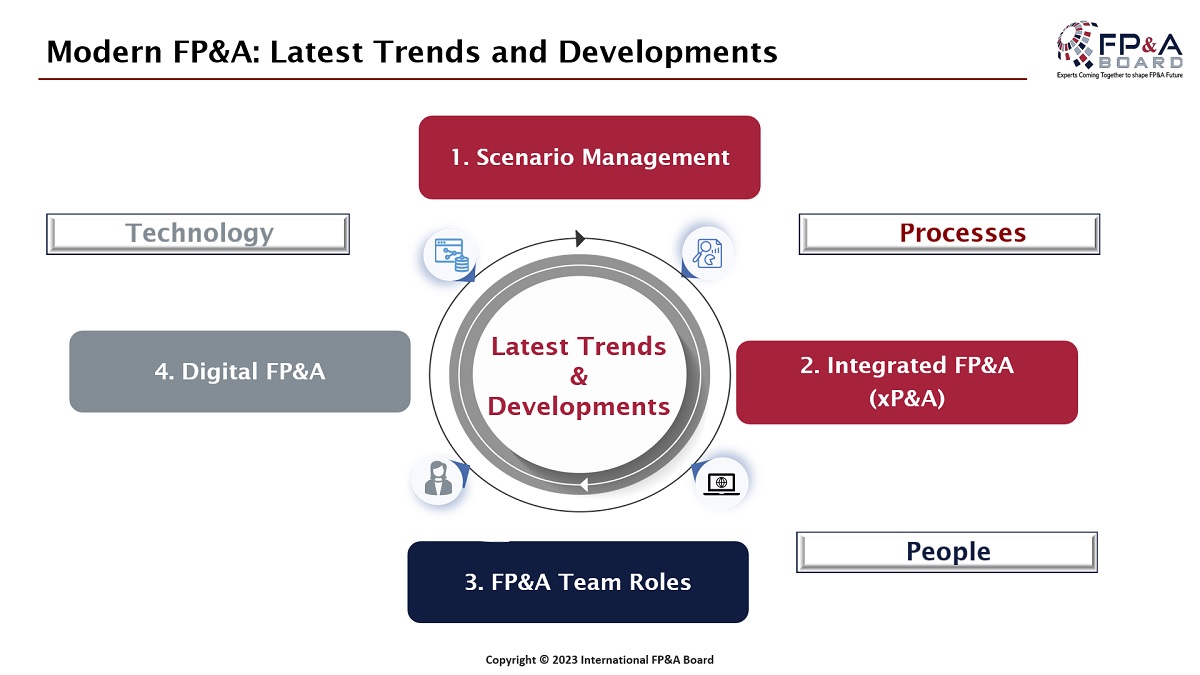

Modern FP&A: Latest and Developments

Figure 2

The meeting started with the participants’ introductions. Everyone named a trend impacting our profession. The following replies deserve the most attention and correlate with the responses from our peers in different chapters of the International FP&A Board:

The forum also addressed other common challenges faced by FP&A professionals, such as managing time efficiently and focusing more on high-value activities. It also touched on the impact of different technologies on forecast satisfaction.

Figure 3

On hearing these insights, Riyadh FP&A Board members discussed other important trends shaping our industry: Scenario Management, Integrated FP&A, FP&A Team Roles, and Digital FP&A.

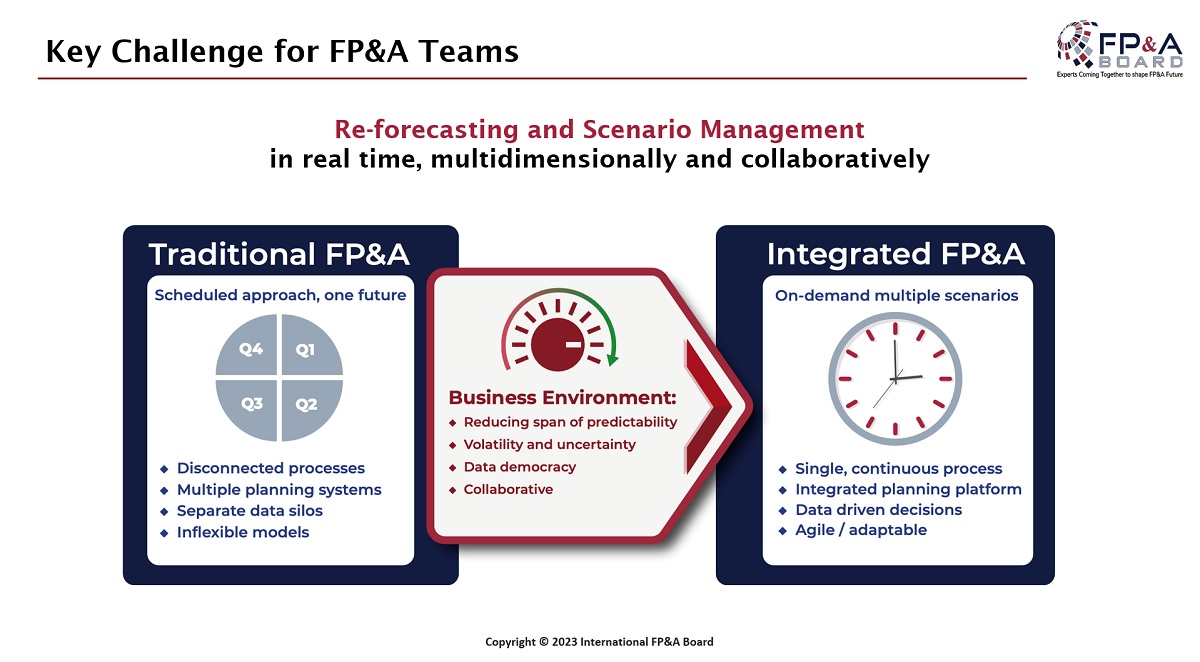

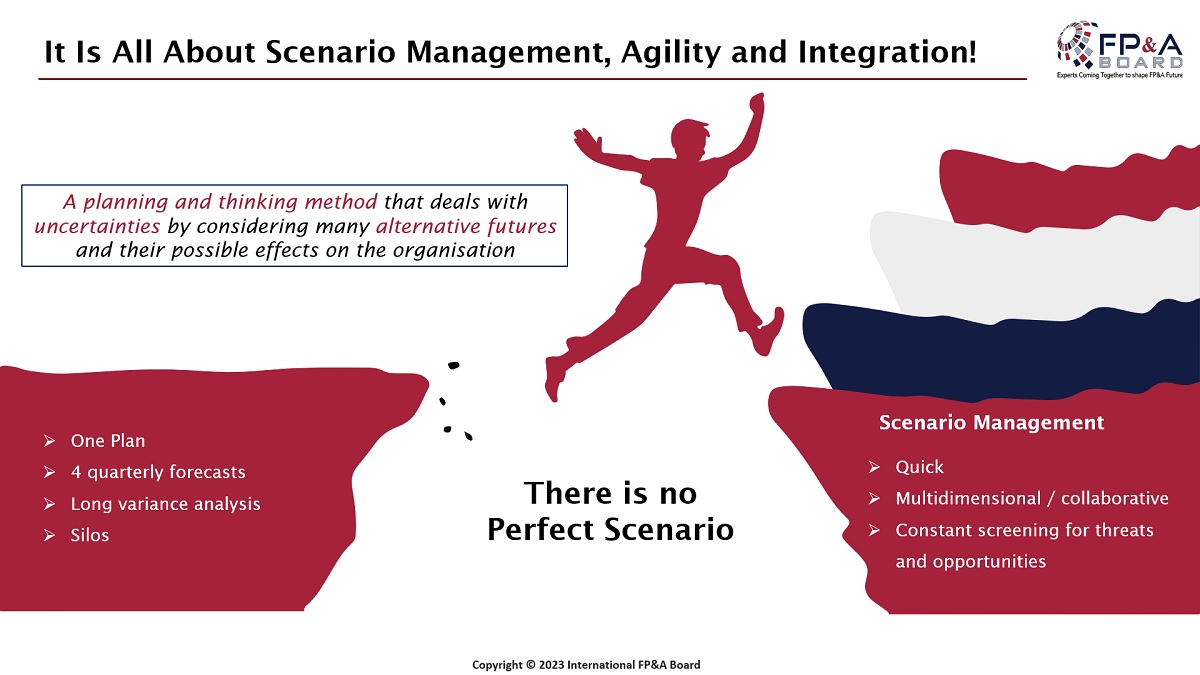

Scenario Management

It's a method for dealing with uncertainties by considering various alternative futures and their potential impacts. We need to implement agile and integrated Scenario Management to anticipate and plan for multiple future outcomes, as it enhances our ability to navigate uncertainties and make informed decisions.

Figure 4

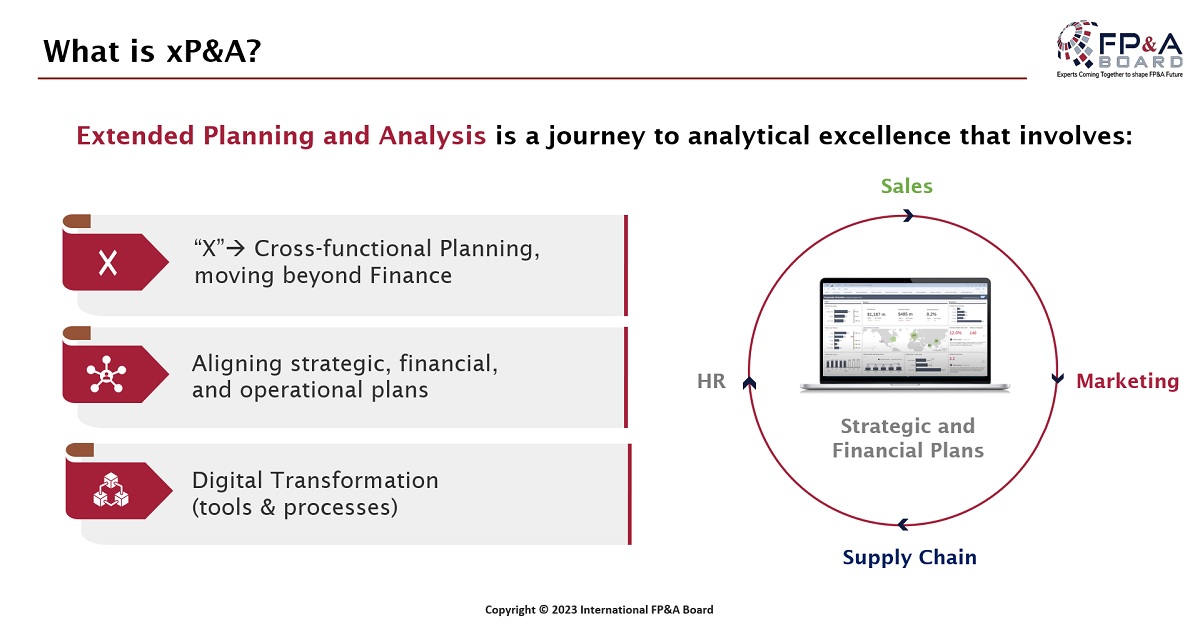

Integrated FP&A (xP&A)

It highlights the shift from traditional planning to Extended Planning and Analysis (xP&A), which involves reaching analytical excellence through cross-functional planning spanning beyond finance and aligning strategic, financial and operational plans. As a result of integrating planning processes, we can achieve a unified business strategy that aligns financial goals with operational tactics for improved performance and agility.

Figure 5

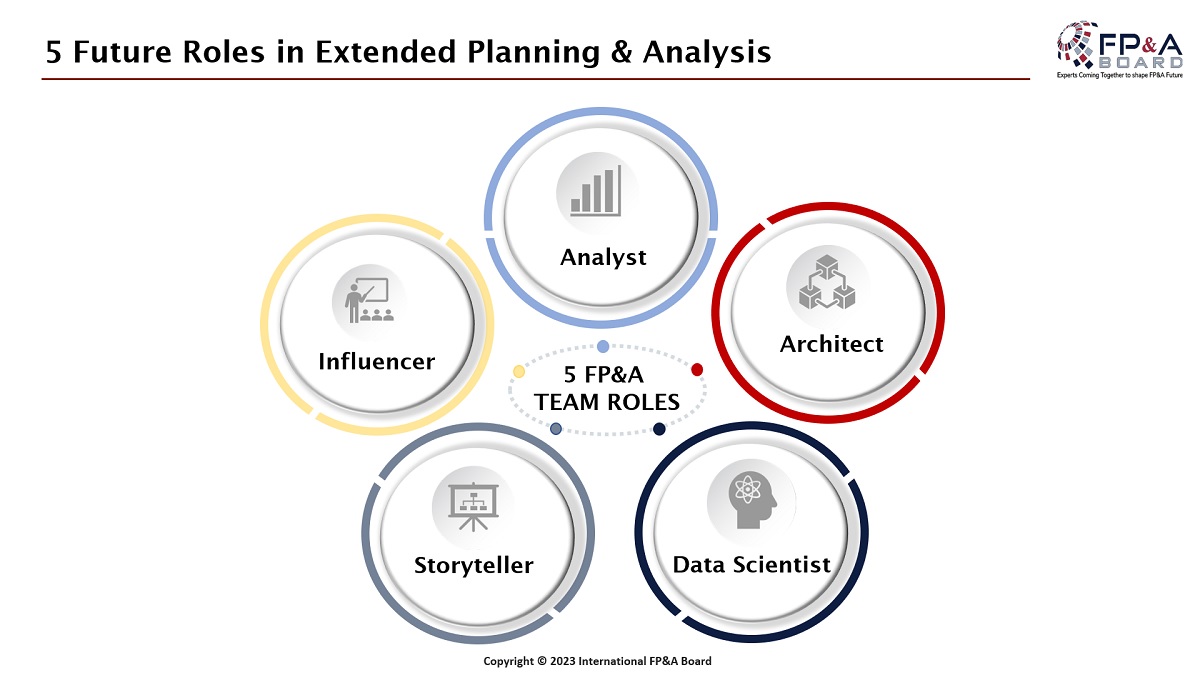

FP&A Team Roles

The attendees also discussed the evolving roles within FP&A teams, including Data Scientists, Analysts, Architects, Influencers, and Storytellers, each playing a critical role in the modern FP&A landscape.

Figure 6

Creating a dynamic team capable of driving insightful analysis and effective communication of financial narratives can help us get deeper insights. We have to recruit and develop a diverse skill set within FP&A teams to ensure we’re staying ahead of the curve.

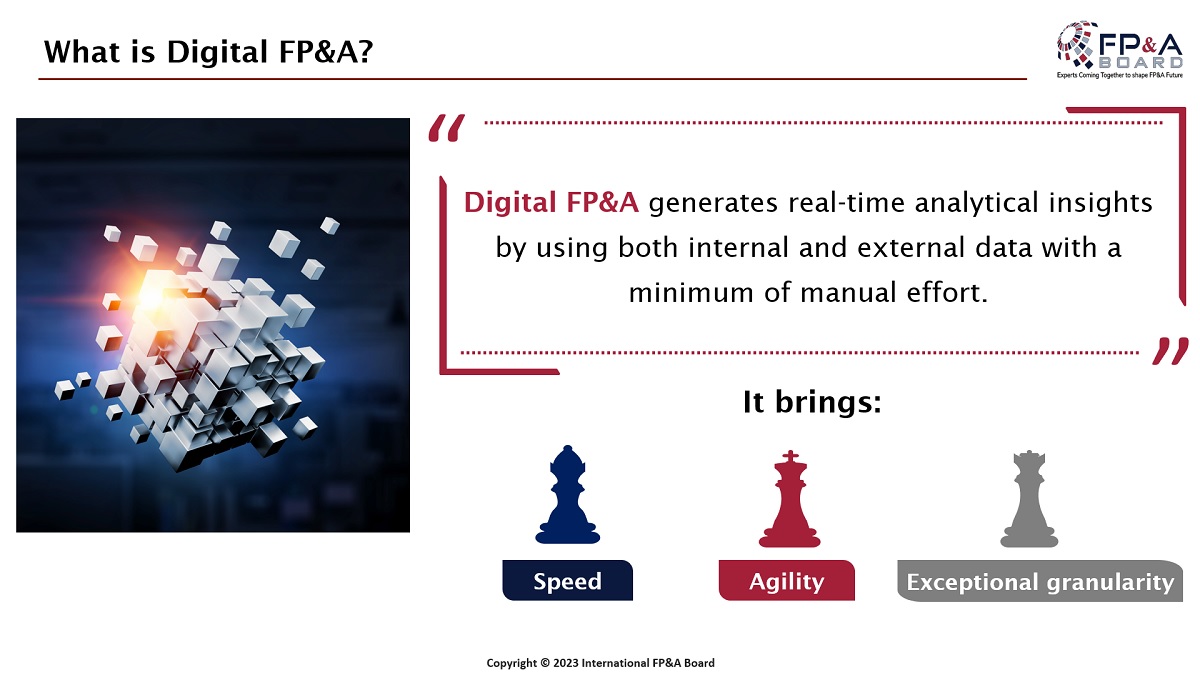

Digital FP&A

The first Riyadh FP&A Board also focused on the latest trends in digital FP&A, which provides us with real-time analytical insights with minimal manual effort. It emphasises the importance of speed, agility, and granular data analysis. Digital FP&A can help us achieve efficiency and deeper insight, enabling proactive financial management.

Figure 7

A successful implementation of digital FP&A allows us to have more streamlined processes and more accurate forecasts, leading to better financial control and decision-making.

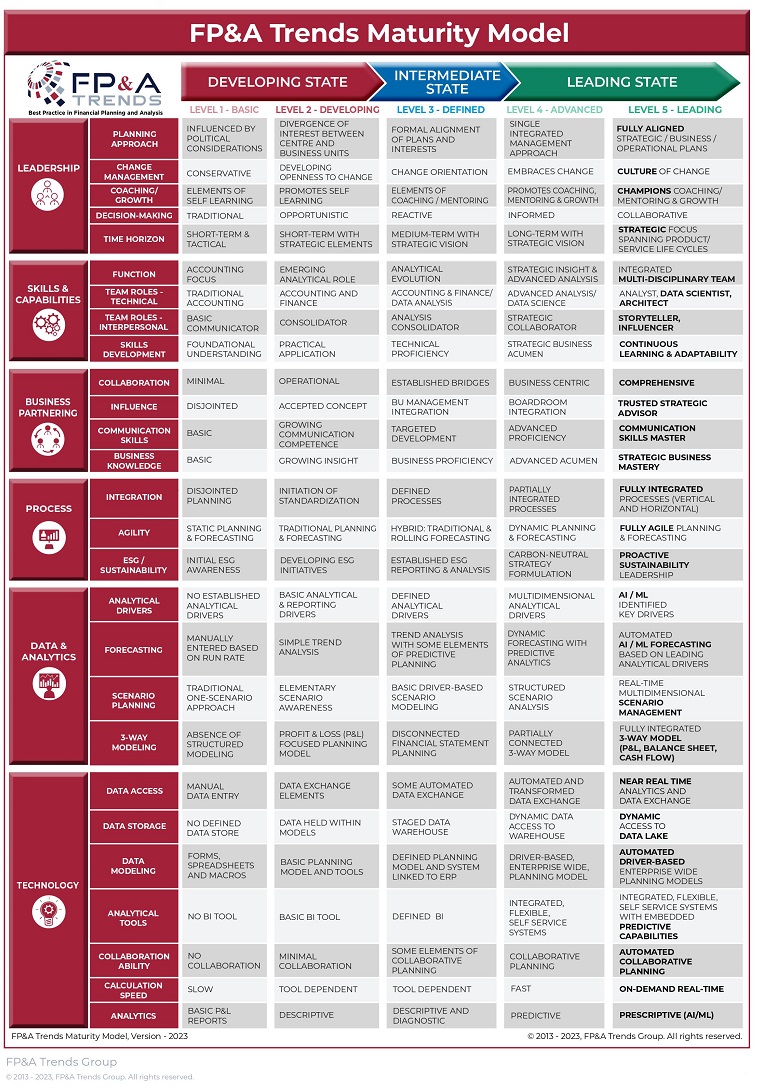

FP&A Trends Maturity Model

The FP&A Trends Maturity Model can help organisations get a future-ready FP&A function equipped with advanced tools and methodologies. We can guide the team through the stages of digital and intelligent transformation to ensure the team stays ahead in adopting advanced FP&A tools and practices.

Figure 8

Insights from Group Work

Figure 9: Group Work, the inaugural Riyadh FP&A Board, November 2023

An engaging workshop was conducted by splitting the participants into three groups. The members shared their insights on three following questions:

- How to move from traditional planning to Scenario Management?

- What are the practical steps in implementing xP&A?

- How can organisations prepare themselves for successful analytical transformation?

First, the forum provided guidance on implementing Scenario Management and xP&A frameworks.

The most notable insights on Scenario Management include the following:

- Identifying key drivers

- Having the right people

- Equip your team with the right technology

- Establish a cross-functional process

Following these insights, another group presented to the FP&A Board what they have discussed regarding xP&A:

- Simplify processes

- Find balance in resources

- Define objectives

Figure 10: Group Work, the inaugural Riyadh FP&A Board, November 2023

The Riyadh FP&A Board also suggested several ways for organisations to prepare for successful analytical transformation. The most interesting ideas focused on mindset shifts, aligning key drivers, and automation for generating insights. This transformation positions the organisation to effectively harness insights and drive strategic decisions through advanced analytics, leading to business growth.

Conclusion

The session provided a comprehensive guide for finance professionals seeking to understand and implement modern FP&A practices in their organisations, especially in areas of Scenario Management, Integrated Planning, digital transformation, and team role evolution. Moreover, it provided strategic insights and benefits for senior FP&A leaders, highlighting how to leverage the latest trends and developments in FP&A.