This article provides an overview of the topics and cases presented and discussed by the expert...

Budgets were invented in the Industrial Age as an efficiency management tool. So why in this day and age of VUCA, most of the organisations around the world are still so hung up on traditional budgeting?

During the pandemic, budgets and forecasts were obsolete overnight. In times of Uncertainties, a much more agile planning tool is required. This is where Better and Beyond Budgeting comes into its own.

Members of the recent North American FP&A Board met digitally to explore how to move from Traditional Budgets to Better and Beyond Budgeting.

Beyond Budgeting - Business Agility in Practice

For Steve Player, Thought Leader and Program Director at Beyond Budgeting Round Table, “planning is the process of assessing a ship’s position and capabilities against where it is trying to go. Plans cannot be based on where the ship went last year; they need to be forward-looking.” We need to:

Start with a clean sheet or look at cumulative costs profile

Link your annual plans to your strategic plans

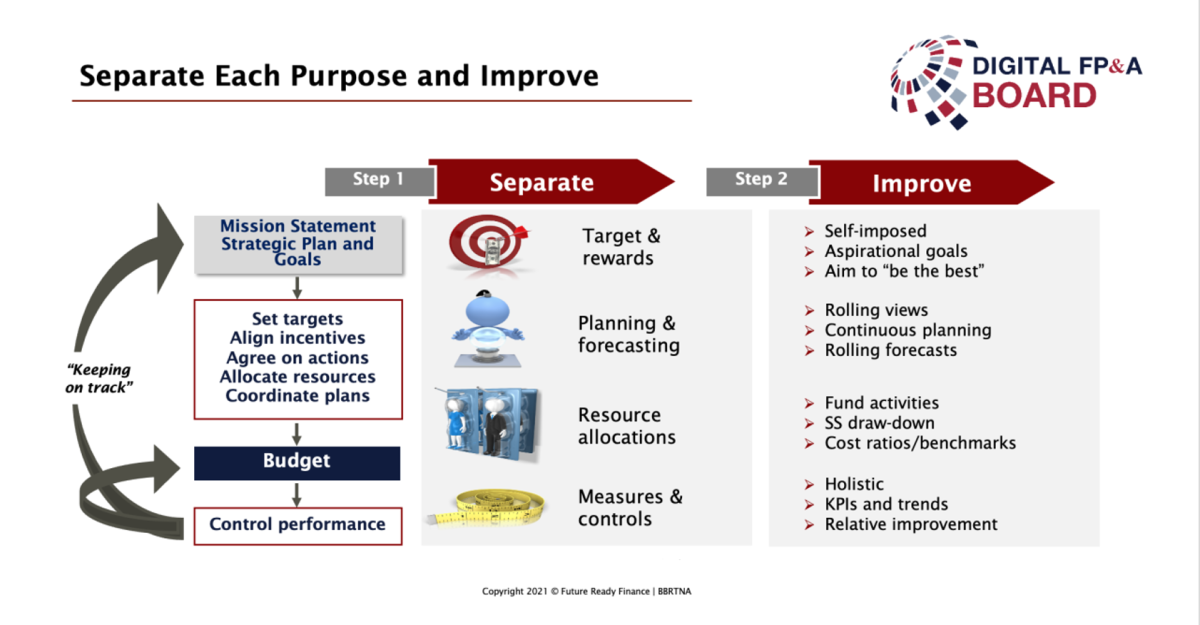

More importantly separate each purpose (Strategic Plans, Targets, Incentives, Resource allocations, Budgets and Performance Management) and Improve them (see below)

Figure 1

In conclusion, Budgets should be replaced with Continuous planning whereby it is an inclusive process and not a top-down annual event.

Our poll amazingly shows that only 5% annual budgeting is done in less that 1 month, 53% between 1-3 months and 41% take more than 4 months! This shows how much time, energy and resources are being thrown at budgeting which is most likely obsolete as soon as done in uncertain environment.

Case Study on Moving to Beyond Budgeting

Nevine White’s (VP Accounting at Hargray Communications) journey towards Beyond Budgeting started when her CFO came out of the budget board approval meeting, congratulated the team on 6 months of hard work and for producing a great budget pack going into 100’s of pages

BUT right in front of them threw it in the bin claiming “It’s already Obsolete, find a better way of working”.

Replacing budget with Rolling Forecast tactically seemed very easy. However, as the budget is inextricably intertwined all kind of business process (be it costs & spending approvals, target setting, compensation, resource allocation) eliminating it will break all of these. They had to slowly replace and rebuild all of these eliminating the complexity and bureaucracy surrounding these.

The three key important building blocks for starting on Beyond Budgeting journey were:

Executive sponsorship – embrace the idea of disruptive change

Change Management - build this as a cultural strength

Revolutionary Problem Solving and change – you have to be ready for the change

They moved to a five-quarter Rolling Forecast. Focus was on what was important and relevant with filed business unit forecasting 45 lines items, corporate only 18 lines and those only for 2 quarters as that’s the cadence the business was running on and finance then extrapolated them. All of this now took two weeks every quarter.

Rolling Forecast in Beyond Budgeting

For Matthew Mowbray ,Senior Finance Director at DAI, their journey towards Beyond Budgeting has only just begun. Echoing all the above that have been said by the other two panellists these are the four key pillars that DAI are concentrating on along their implementation:

Agile financial planning & BI systems implementation

Invest in techno-functional make up of team

Monthly reforecast methodology – baseline, revise, report and steer

Invest heavily in change management

Both Matthew and Nevine agreed that moving away from budget could not be done overnight. It is a long process where you may fail a few times. Learn quickly and move on and remember to continuously review.

Our poll interestingly suggested that only 1% have completely eliminated budgets, whilst 29% have started their beyond budgeting journey. The remaining 70% are not on the Beyond Budgeting journey.

The Importance of Technology for Better and Beyond Budgeting

Michael Lengenfelder, Head of FP&A Product Management an Unit4, talked about the importance of starting from Strategy:

Vision, mission and Values

Goals, Objectives and KPI’s

Reporting & Analytics

Social Responsibility

To help the Beyond Budgeting journey software should be :

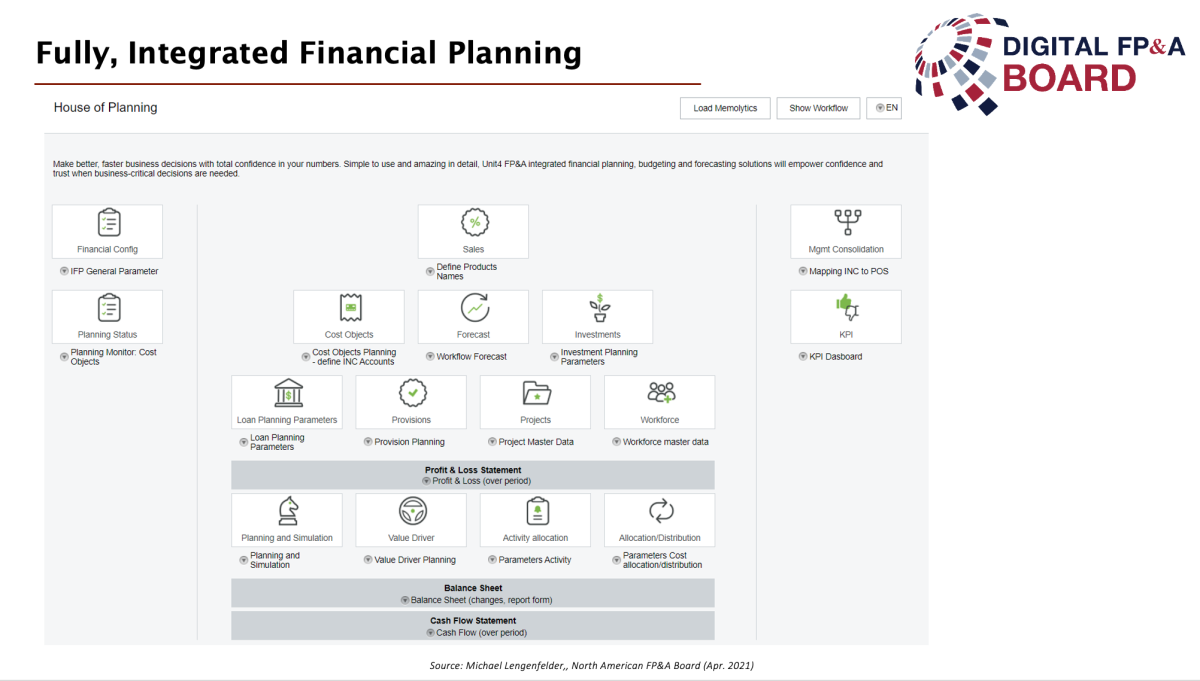

Fully Integrated Financial Planning – P&L, B/S & CF / xP&A / Use of AI & ML (see below)

Able to do Continuous or Constant Forecasting – prefilled based on past with options to change

Have workflow and status control so finance knows at all times where we are with our forecast

High level strategy simulations – immediately play scenarios and show us what that means to the organisation in reports

Enable easy and collaborative storytelling

Figure 2

Summary

In conclusion, it is high time to move away from traditional budgeting as it does not add value. Old ways of budgeting will not get us where we want especially in these days of uncertainties. Do not be afraid to start the journey as there is so many positives and advantages to be had. Even if you cannot eliminate the budget completely, take baby steps towards it as it will make a huge impact. People are key to the whole process change from senior management, the finance team and the operational team. Focus on them throughout the process. One size does not fit all. Look at what is the right way forward for you and build this with technology.

We would like to thank our global sponsor Unit4 for their great support with this Digital FP&A Board.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.