The vast majority of companies still rely on traditional organisational designs characterised by hierarchical structures, and...

While FP&A professionals have long been aware of the shortcomings of the Traditional Budgeting process, the pandemic and post-pandemic environment have made it clear that Traditional Budgeting is no longer fit for the task.

While FP&A professionals have long been aware of the shortcomings of the Traditional Budgeting process, the pandemic and post-pandemic environment have made it clear that Traditional Budgeting is no longer fit for the task.

The Digital UK & Ireland FP&A Board looked at the alternatives to Traditional Budgeting and shared practical experiences of moving away from it.

This article provides an overview of the topics and cases presented and discussed by the expert panellists at the webinar “From Traditional to Better and Beyond Budgeting”, as well as the results of our polling questions.

What the Beyond Budgeting Is

Dr Steve Morlidge, performance management thought leader and author, outlined the four main problems with Traditional Budgeting and shared the Beyond Budgeting principles with the key steps we need to master in order to make this transition from Traditional Budgeting to Beyond Budgeting.

The four main problems with budgeting are:

Bureaucratic and costly. Budgets are time-consuming and resource consuming.

Difficult to do the right thing. By having fixed budgets organisations lose the flexibility to respond to things, they haven’t anticipated.

Encourages people to do the wrong thing. The way to win in the budgeting system is to negotiate the lowest revenue target possible and not to exceed it or to negotiate the largest cost budget possible and spent it all.

Distorts perception of performance. Companies compare themselves against an arbitrary target that is outdated before the budget is finalised.

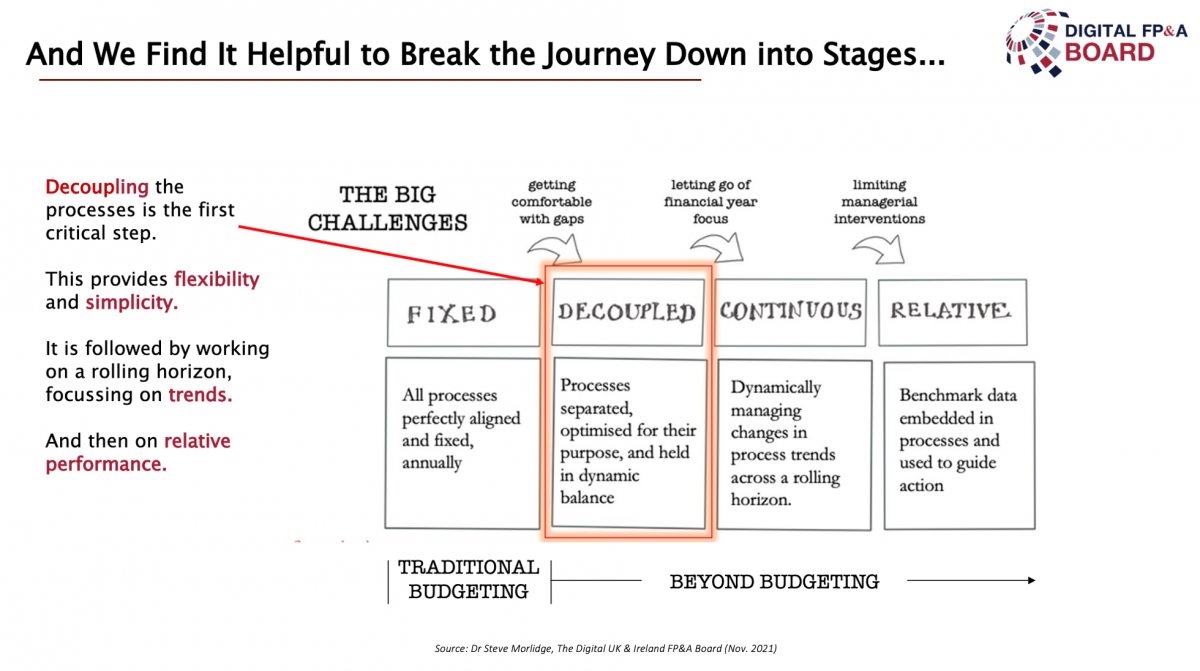

Some might think that moving away from traditional budgeting is an all-or-nothing process. On the contrary, the journey can be broken down into four manageable stages:

Fixed. All processes are perfectly aligned and fixed, annually.

Decoupled. Processes (Targets, Forecasts, Resource allocation) are separated, optimised for their purpose and held in dynamic balance.

Continuous. Dynamically managing changes in process trends across a rolling horizon.

Relative. Benchmark data embedded in-process and used to guide action. (Figure 1)

Figure 1

Dr Morlidge helped us understand, that eliminating budgets is not an end in itself – it is the most important means to the end of creating organisations that are more agile, less bureaucratic and less prone to dysfunctional patterns of behaviour.

Where We Are in Terms of Beyond Budgeting

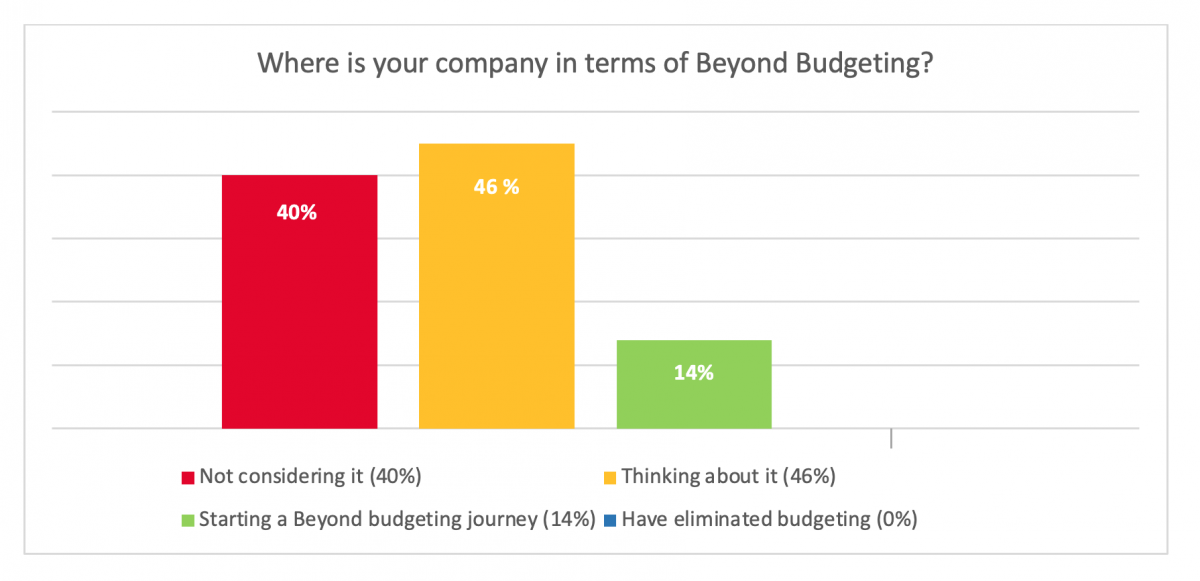

During the webinar, hundreds of attendees from the FP&A industry took part in the poll and stated where they are in terms of Beyond Budgeting. 14% of the organisations are already starting their Beyond Budgeting journey, while another 46% are thinking about it. (Figure 2)

Figure 2

Danone's Journey from Budget to Rolling Forecast & Beyond

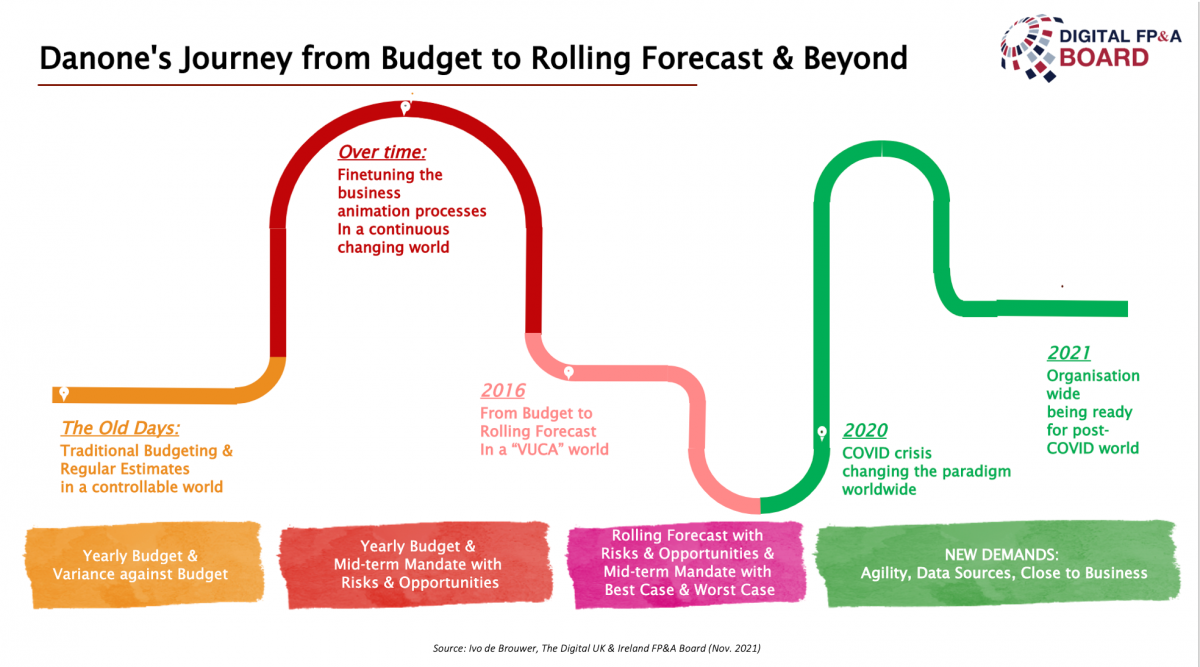

Ivo de Brower, Finance Director at Danone showed how a large multinational company like Danone was able to ditch budgets back in 2016 and move to Rolling Forecasts. After that, thanks to the strong push of the COVID-19 pandemic, it is moving beyond Rolling Forecasts, becoming more agile and getting even closer to business.

Figure 3

Ivo showed us the key points that the company focused on:

Combining internal and external data to drive business animation

Harmonised hierarchies on product, brand, customer and channel

Unified data definitions through functions and systems

Need to combine financial and non-financial data

Defined & integrated non-financial KPIs into the business animation process

Need to focus more locally

Decomplexified matrix organisation structure

Empowered “one country”

Need to focus on business

Reduced frequency & granularity of reporting

Increased focus on scenarios and next-generation business animation

HP's Journey Beyond Budget with Continuous Planning

A few years ago, HP began its Beyond Budgeting journey and has yet to completely get rid of the budget. But according to Manish Gundecha, FP&A Director at HP, the company manages to stay on top of its budget and continually check it through continuous planning.

This has three main aspects:

Following Leading Indicators, both external and internal

Constantly checking your Monthly forecast by keeping an eye on Headwinds (negative impact on the Income statement) and Tailwinds (positive impact on the Income statement)

Driver Based Planning with modern AI tools and smart and shock drivers in mind.

Technology for Better and Beyond Budgeting

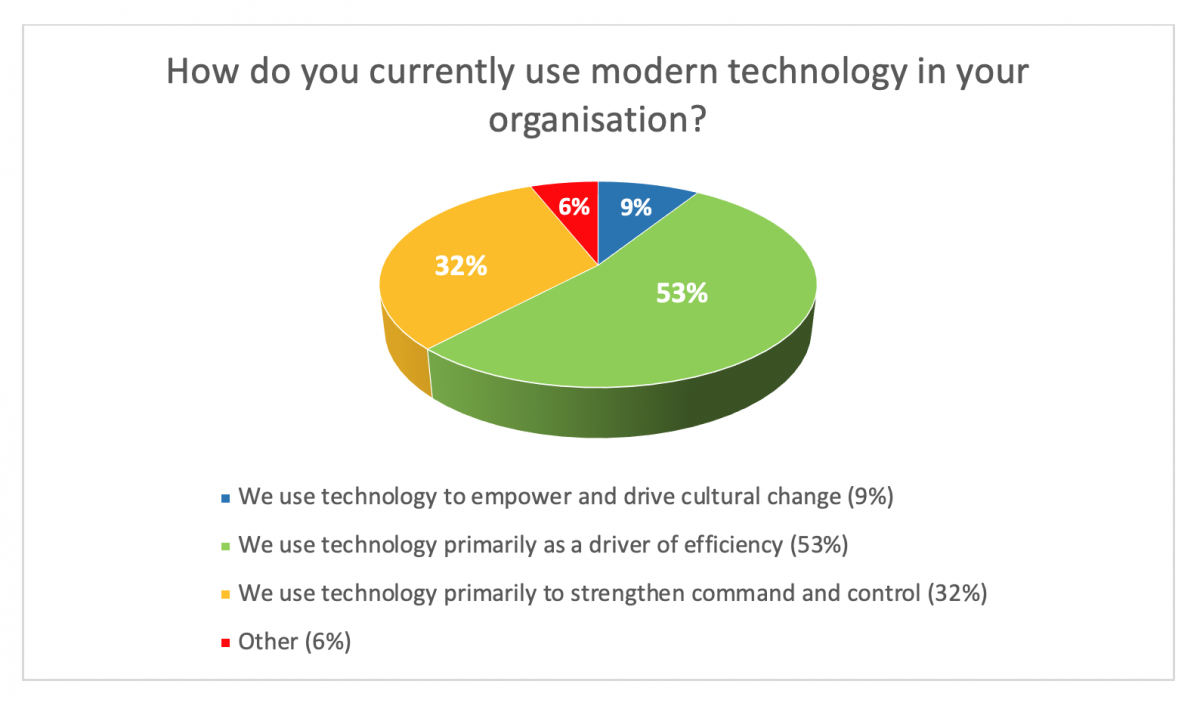

53% of webinar attendees acknowledge that they use technology primarily as a driver for efficiency. So far, only 9% are using technology to empower and drive cultural change. This is a tremendous opportunity for the FP&A industry to move towards intelligent solutions that enable organisations to communicate, collaborate and make better decisions. (Figure 4)

Figure 4

Pras Chatterjee, Senior Director at SAP, devoted his presentation to three areas:

How cloud-based planning can drive Beyond Budgeting

Planning is owned by Finance

Analytics tells better stories

The whole organisation collaborates in the context of your plans

How Agile & Predictive Planning can enhance Beyond Budgeting

Move away from scheduled plans and look at Rolling Forecasts

Uncover hidden Insights by Predictive Planning

Simulate future outcomes

How Beyond Budgeting can Align Plans with Technology

Align strategically with all the departments

Respond in the moment to market disruptions

Make faster, more confident decisions

Pras showed us how technology tools allow us to move away from scheduled plans to Rolling Forecasts, provide strategic alignment across all departments within an organisation, and ultimately lead to faster and better decisions.

Conclusions

The webinar speakers shared their key takeaways with us. As an FP&A community, we still have a long way to go in terms of Beyond Budgeting, as most of us are still budgeting.

In this webinar, a number of reasons were given that prompted audiences to try Beyond Budgeting. If you want to make a change, do it completely, don't just drop the budget, but make sure you have all the necessary components: qualified people, properly configured processes, and the necessary technology tools.

Beyond Budgeting Is Not a Destination - It is a journey, and it is about the right time to embark on it.

To watch the full webinar recording, please check out this link.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.