Traditional planning methods are well known for extracting insights and steering business decisions in short-term and...

As I walked down to the meeting location for the xP&A round table on the 5th of October, I wondered what I was getting myself into. It would be the first time I would participate in the FP&A Trends Group’s event in person though I have been a member for a while.

By 7 PM, there was already a good quorum of over 25 people. At 7.15 PM, the moderator of the event, Jennifer Wall (Senior Director FP&A at Tridel), called the house to order. We settled into our seats and introduced ourselves and our organizations to all and sundry, touching briefly on the challenges we currently face as we support the business.

It was interesting to note that the challenges the group faced in their various organizational FP&A processes were all similar. One of the consequences of the pandemic is that it has thrown all financial projections and planning out of sync. Hitherto trusted models and assumptions no longer make sense. Many members have resorted to offering different scenarios and outcomes to support the business. Planning projections is more to prepare the business rather than to guide. There is more emphasis on Scenario Planning. And, of course, each scenario has several different pathways and many different outcomes. How do you choose? What do you choose? How many iterations of good, better and best are acceptable?

The discussion on organizational challenges and Scenario Planning processes was a nice segue for the moderator (Jennifer Wall) to introduce the day’s topic, “Moving from FP&A to Extended Planning and Analysis (xP&A)”.

Figure 1: The Toronto FP&A Board Members (October 2022)

What is xP&A (Extended Planning and Analysis)?

We are all very familiar with our organizational FP&A, but do we know xP&A? Jennifer asked.

A person from SAP described it as using technology to leverage data available in day-to-day transactions. Some described it as moving beyond the traditional planning and analysis by focusing more on the “A”. Others described it as a continuous reforecasting process, constant changing of previously assumed variables as different economic uncertainties emerge.

xP&A means a combination of the following (according to the FP&A Trends Group and as presented by Jennifer Wall):

- X → Cross-functional Planning, moving beyond Finance;

- Aligning strategic, financial, and operational plans;

- Digital Transformation (tools & processes).

Making a Transition Towards xP&A

To move beyond traditional FP&A function to a more dynamic xP&A, organizational planning (a mix of strategic planning, business planning and forecasting, and operational planning) needs to embody the following success factors:

- Identify and cascade down key data and business drivers;

- Use consistent and harmonized driver-based models (vertically and horizontally);

- Have a three-way financial view (P&L; Cash Flow and Balance Sheet);

- Integrated and Collaborative processes;

- An organizational structure that allows for collaboration (integrated people);

- Use technology to connect processes and people (integrated platform).

The core takeaways from Daniel Smedley’s presentation were the importance of organizational buy-in and willingness to start from a blank spreadsheet. A zero-based budgeting approach where nothing is sacred; everything on cost and/or revenue line is up for a review; nothing is off the table.

Group Work During the Event

The FP&A Trends Group have also identified three practical aspects for “Moving from FP&A to Extended Planning and Analysis (xP&A).” The group considers the interaction of these aspects to be critical for xP&A. They are:

- Data and Models Aspect

- Systems and Processes Aspect

- People and Culture Aspect

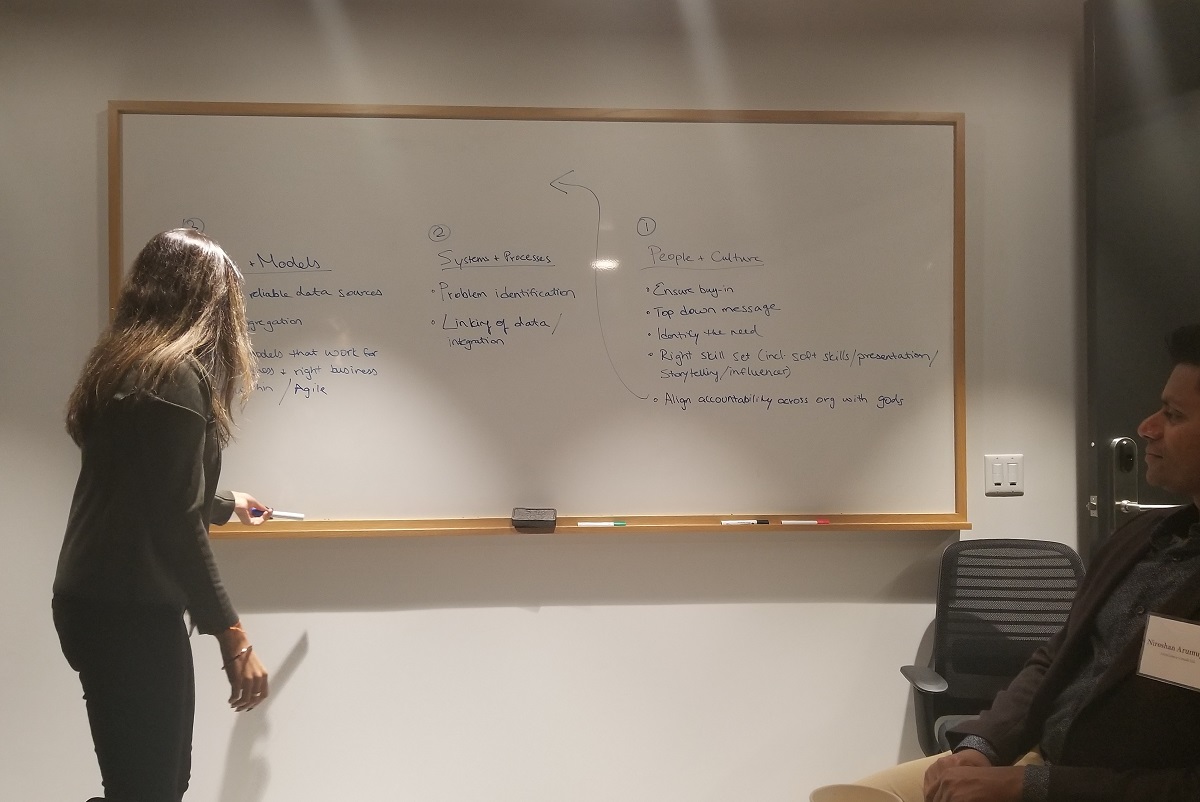

As an exercise, attendees for the day’s workshop were broken into three groups to discuss these topics. It was a fun exercise with active participation by all attendees. The task was to discuss what elements of these different aspects need to happen for FP&A to move beyond its traditional borders. The below picture shows what the second group presented.

Figure 2: Presenting The Results of Group Work (Toronto FP&A Board October 2022)

The first group agreed that organizational buy-in is critical to move from FP&A to xP&A. Data needs to be clean, governed and aggregated. In addition, systems and processes should be scalable with a good feedback loop for continual improvement. They also stressed that People and Culture (organizational buy-in) are the most important of all three aspects.

Moving to extended financial planning for the second group will require a trusted, reliable and harmonious data source. Systems need to be mapped to support and provide a self-service option for the people. They see a linkage between all three, with no aspect being the forerunner.

Figure 3: Group Work During the Toronto FP&A Board (October 2022)

The third group also identified the people aspect as the most important. Employees with the proper skill set are key to effectively implementing xP&A. Data also needs to be reliable and aggregated with systems and processes linked to data integration.

Conclusion

Ultimately, the right answer and/or approach to moving from FP&A to xP&A will be tailored to an organization. How and where each would be on the transformation journey will depend more on the leadership approach, data integration and processes established for continual improvement.

We are grateful to SAP for sponsoring this meeting. Thank you, IWG, and Michael Page for your help with the organization of this event.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.