xP&A is more than an attempt to ‘fix’ the planning process. It is a complete transformation...

Traditionally, the Financial Planning and Analysis (FP&A) team has been a finance function reporting to the group controller or the CFO and has been responsible for building financial plans and analysing the financial performance of the business. These plans were either cascaded down to different business units or consolidated from bottoms-up plans.

Unfortunately, this isolated planning approach does not provide the agility required to function in today’s volatile environment. That is why the subject of planning process integration, top-down and bottom-up, has been on the FP&A’s agenda for some time.

What Is xP&A?

The concept of Extended Planning and Analysis (xP&A) was introduced by Gartner in February 2020. According to FP&A Trends Group, this is a process where planning and analysis go beyond finance and traditional accounting to all functions of the entire organisation.

FP&A Trends Group identified several characteristics of xP&A:

- It is agile and collaborative;

- It integrates Strategic Planning, business planning and forecasting (FP&A) and operational planning and forecasting;

- It performs planning and forecasting on-demand and in real-time;

- It makes use of advanced analytical capabilities, such as Artificial Intelligence (AI), Machine Learning (ML), predictive and prescriptive analytics;

- It allows FP&A to play a key role in enabling fact-based decision-making.

Besides planning, xP&A can make reporting and analytics more holistic and actionable. For instance, by integrating non-financial data into traditional financial statements, FP&A can facilitate better-informed decision-making. Rather than simply monitoring the aggregate digital marketing spend versus budget, xP&A can integrate performance marketing metrics such as cost per click (CPC) or cost per acquisition (CPA) and make the analysis more meaningful to the business.

How Should FP&A Drive the xP&A Transformation?

FP&A teams, owing to their deep expertise in planning and analytics, are best suited to step up as a change agent during an organisation’s transformation journey.

Step 1: Identify the Current Level of the Existing FP&A Team

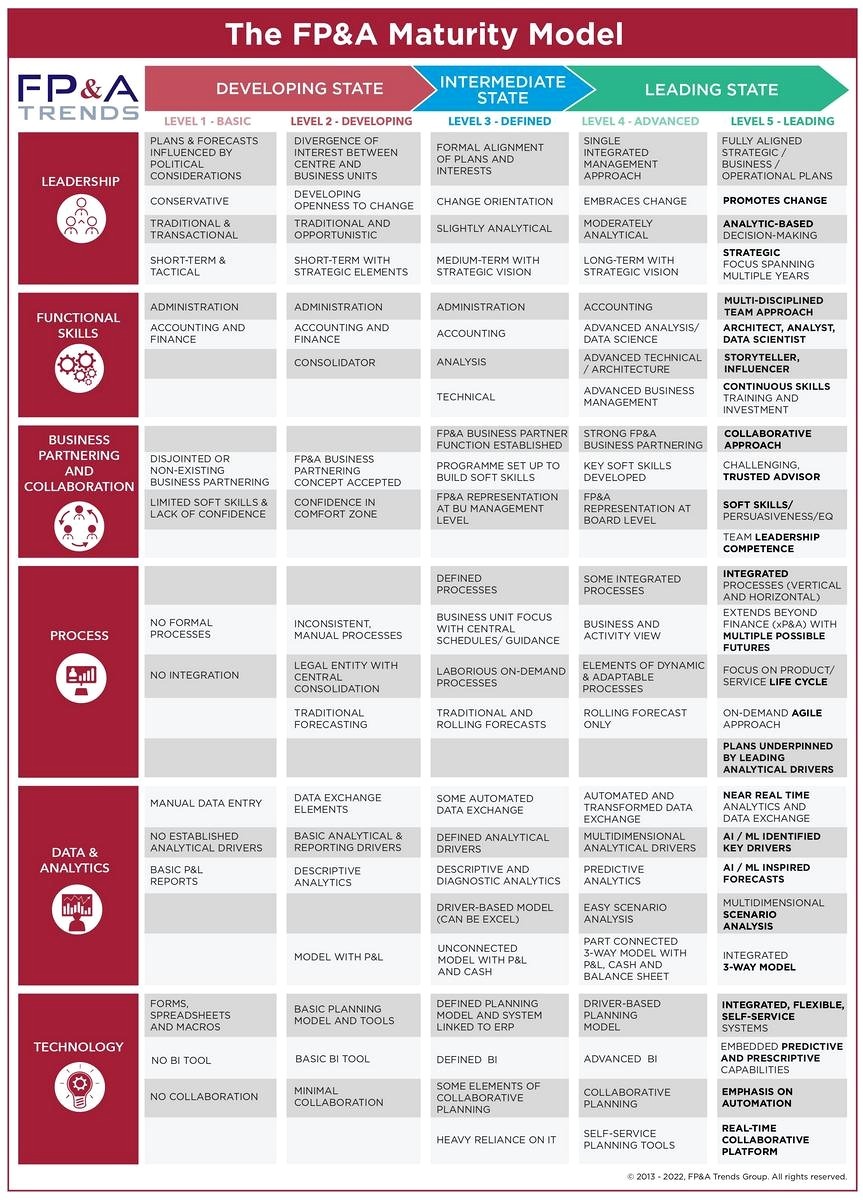

Figure 1: The FP&A Trends Maturity Model

The International FP&A Board conceived the FP&A Maturity Model through a global collaboration of senior finance professionals. It provides a clear roadmap towards building an FP&A function for the future. Being honest about where your team currently stands is the first step in this journey. Those organisations with teams that are in advanced and leading stages are those that have mastered the art and science of xP&A.

Step 2: Identify the Level Where Your FP&A Team Wants to Be

The next key step is to identify the targets of this transformation. Define how you envision the FP&A function for your organisation. What value is it expected to bring to the business? What are the key deliverables?

Step 3: Plan Your Actions Across Dimensions of the FP&A Maturity Model

Once your expectations have been mapped out and aligned with senior leaders, the components of the maturity model can be used as a framework to plan the necessary steps.

-

Culture and People

It is critical to establish a culture rooted in analytics-driven decision-making and embrace changes to facilitate a transformation. Teams need to be built with diverse, well-rounded skill sets to make it possible. A holistic xP&A team should have data science and technology expertise to truly facilitate this transformation. Also, given the recent pace of technology change, investment in continuous upskilling is critical.

-

Analytics, Processes and Technology

xP&A demands the integration of business processes and data from across all organisational functions. This means FP&A professionals need to handle much larger non-financial data together with the financial data with which they are used to working. Today, technology is the biggest enabler for better analytics, meaning that xP&A transformation is only possible by the digitisation of the entire planning and analysis process.

FP&A processes should no longer be formal and manually driven but integrated across the organisation, focusing on different life cycles. In xP&A, processes are driven by events and are based on a 3-way driver model that includes data from the profit and loss (P&L) statement, the balance sheet and the cash flow statement.

Many self-service modern solutions are easy to use and can even leverage Excel as an interface. Such solutions enable faster adoption across the business and better facilitate xP&A and Business Partnering across teams.

-

Business Partnering

While the advances in analytical technologies have changed the nature of the xP&A function considerably, the need for Business Partnering has always remained constant. Due to their analytical capabilities, xP&A teams can influence business decision-making and drive better business performance. However, this can only be achieved if the function truly acts as a Business Partner.

In Summary

The key outcome of the xP&A transformation is a changed cultural mindset within the organisation, focused on analytical insight-based decisions. The FP&A function is the best change agent for this transformation. FP&A leaders should start positioning the department as an organisational feature rather than a finance function and push for a direct reporting line to the CEO instead of the CFO. It would genuinely build organisation-wide acceptance of an xP&A function that integrates all business processes, not just financial ones.

This article was first published on Vena blog.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.