On the 17th of February 2021, the Middle Eastern FP&A Board hosted a very insightful debate on the subject of “The Future of FP&A: Moving from Traditional Management Accounting to Extended Planning and Analysis (xP&A)”. The discussion was delivered by a truly international board panel of 5 members based in Switzerland, Turkey, Dubai and the USA.

On the 17th of February 2021, the Middle Eastern FP&A Board hosted a very insightful debate on the subject of “The Future of FP&A: Moving from Traditional Management Accounting to Extended Planning and Analysis (xP&A)”. The discussion was delivered by a truly international board panel of 5 members based in Switzerland, Turkey, Dubai and the USA.

xP&A Evolution Model: Becoming agile

Based on the presentation by Vignesh Dumonceau, CFO Switzerland at Flex

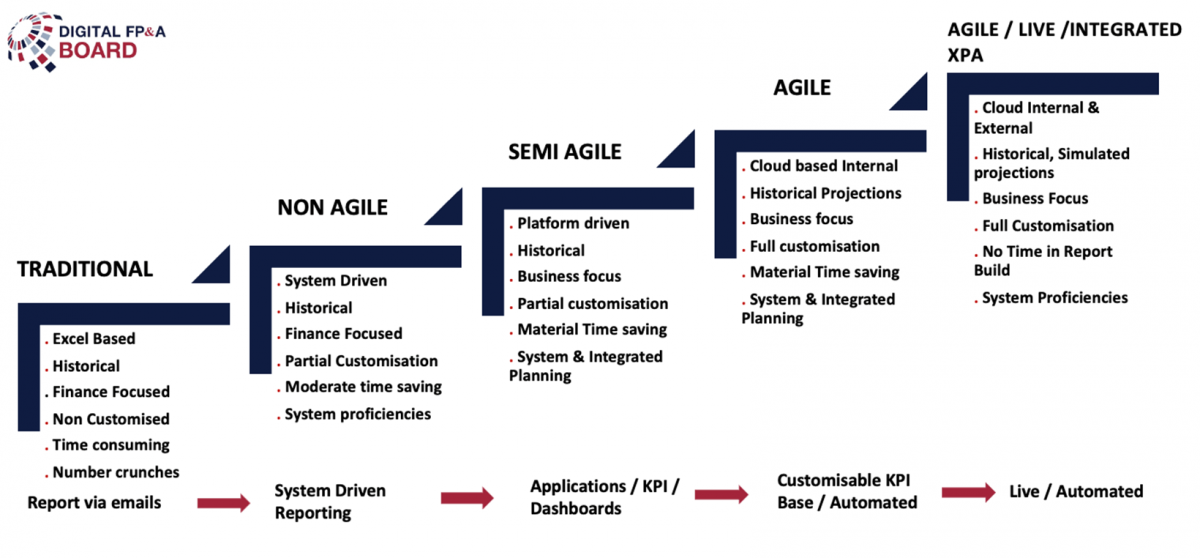

The new xP&A world is much more connected than before with the ability to assess the component of risk management, multiple scenarios, modulations, and simulations. All of them are integrated and require a much closer approach to the business intelligence range of new skillsets.

Artificial intelligence (AI) now takes xP&A to the next level and helps you identify the actions that you should take. However, there are some challenges in automation and AI:

Accountability, auditability & governance – you need to link decisions to people and get ownership.

Cost-benefit trade-offs – before investing, you need to assess the situation.

Blind spots – make sure that the data is good and your team has a good level of business understanding.

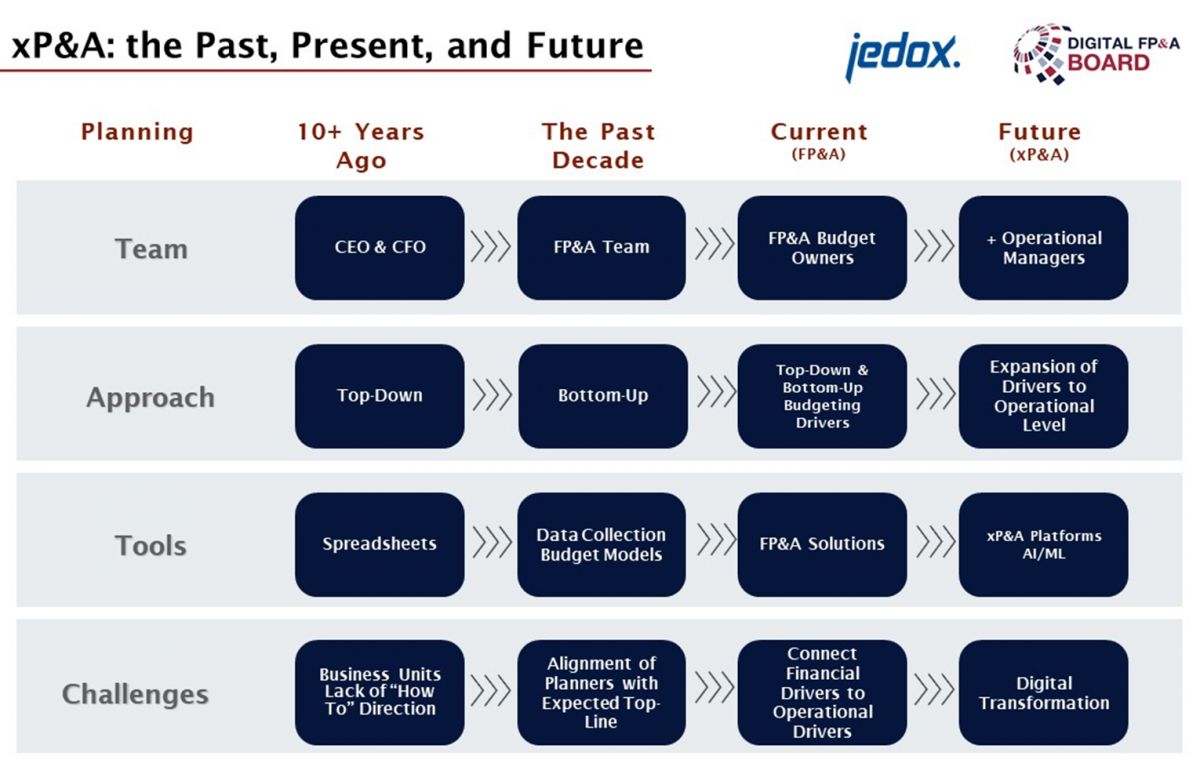

If you are wondering where you are on the transformation journey towards xP&A, Vignesh presented an xP&A evolution model, shown below.

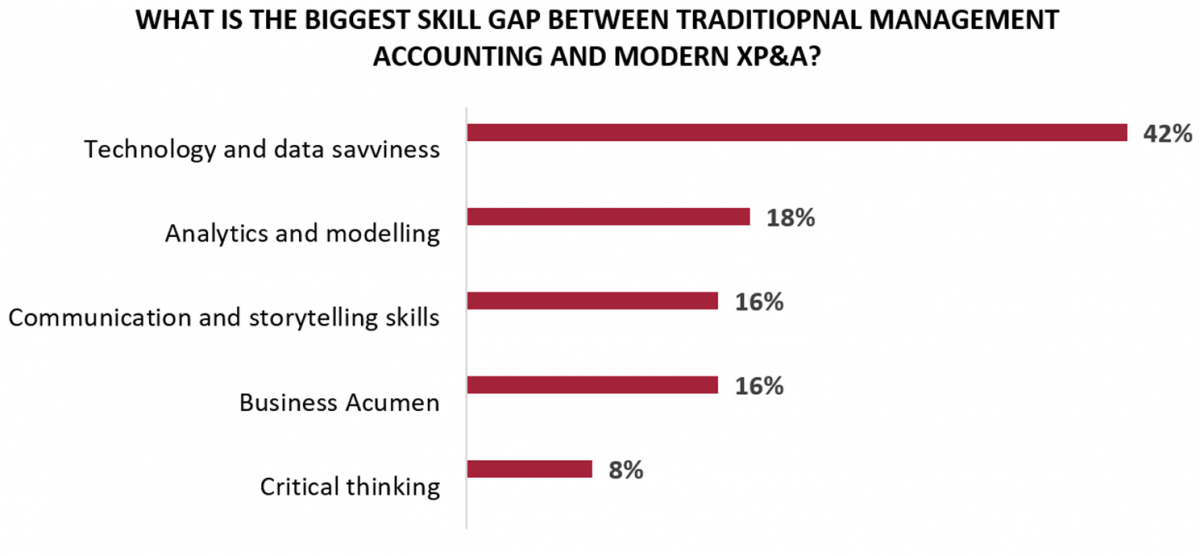

At the Digital FP&A Board, we also tried to find out what skills FP&A teams lack to make the transition from one stage to another. The key points here are to ensure we operate our data properly and take time to master new tech!

Business intelligence ≠ Data visualisation: A Case Study

Presentation by Tamer Abomosalam, Services Supply Chain Global CFO at NCR Corporation

For NCR, a 100-years-old company faced with the need for real-time business simulations, the rapid transition to business intelligence (BI) tools was key. BI can be split into smaller pieces to equip a finance department with the tools to solve current problems:

Eliminate data preparation and prep time

Provide data analysis and data at any time

Capacity to run and simulate real-time business scenario

Data visualisation is one of the benefits of implementing BI analytics, but business intelligence is not data visualisation. This is how NCR started and failed, and as they found out, you need to build a foundation and then grow to data visualisation.

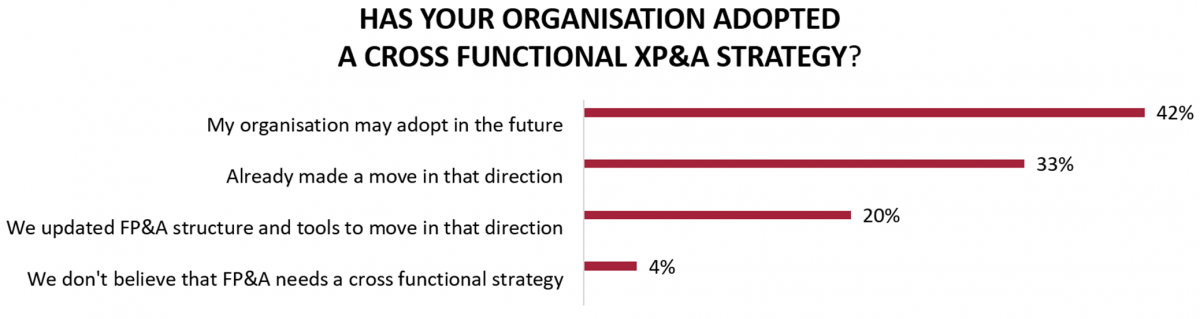

Only 4% of our audience believed FP&A didn’t need cross-function. Very encouraging to see 53% are adopting it. It is imperative that the 46% make a move towards xP&A. As we have seen during the uncertain environment caused by COVID-19, not having such a structure can lead to organisations going under and almost impossible to navigate!

Getting ready for xP&A

Based on the presentation by Burcu Kandemir, CFO Europe at Pepsi Lipton.

There are two steps finance professionals need to follow in this transition:

1. Utilisation of data and efficiency

Use the right technology

Free up resources

Eliminate non-essential activities

2. Leverage time for more Business Partnering

Finance organisations are moving from reactive planning to proactive and pre-active planning. We are not only responsible for reporting the data and financial statements, we are also now responsible for giving strategic insights to the organisation on time. If you look at the structure of big companies, you are starting to see a separate soft function business partnering activity under financial planning analysis. The key expectation of business and finance partners is to add value to the system.

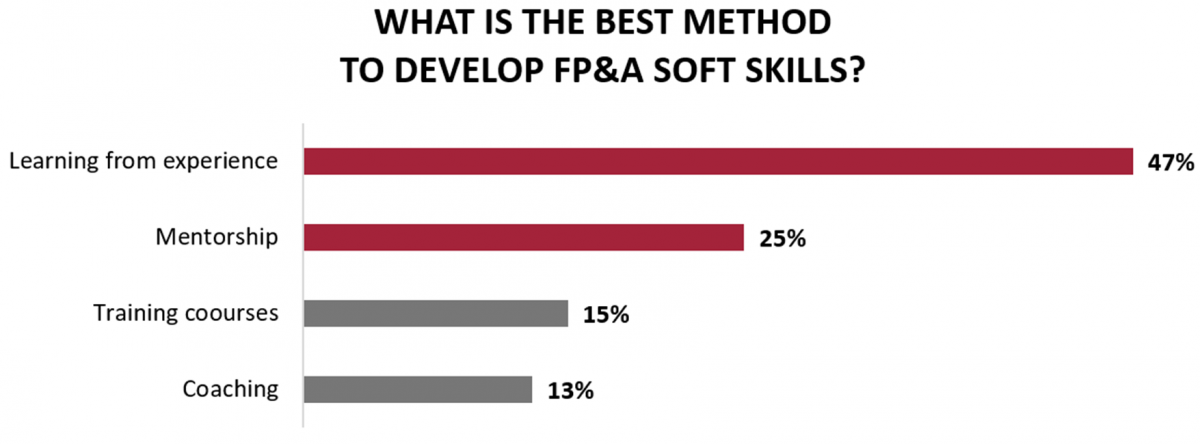

Finance business partners require a new skillset that goes beyond just numbers. Our third poll asked our audience their opinions on the best method to develop FP&A soft skills. It was split almost in half between taking active rolls in development and learning directly from experience:

Unlocking xP&A opportunities

Based on the presentation by Andreas Simon, Director EMEA at Jedox AG

When you have completely developed your FP&A, with the driver-based models and all the capabilities that you need, what is the next step for your department? xP&A is the answer.

xP&A is a journey to analytical excellence that involves:

“X” → Cross-Functional planning and analysis

Collaboration, Centre of Excellence

Moving beyond traditional finance

Digital transformation (tools & processes)

Moving from an existing FP&A team to a cross functioning FP&A team is an evolution, not a revolution.

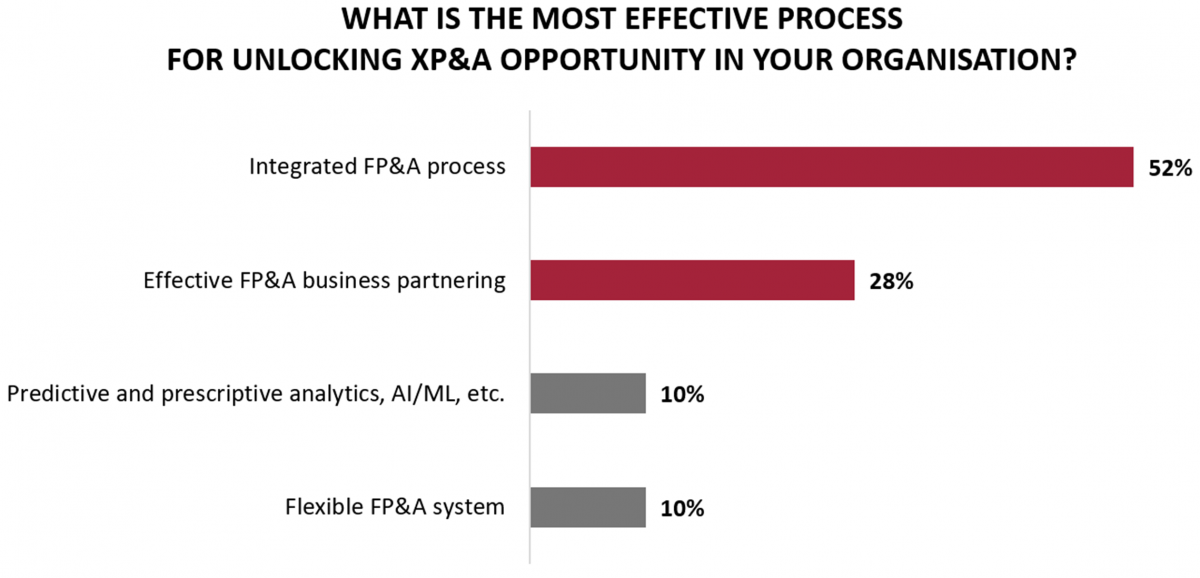

The final poll was about the most effective process for unlocking xP&A opportunities in organisations. Just over half believed integrating the FP&A Process was the way to go with another quarter voting for effective FP&A business partnering:

Interactive intelligence in xP&A

Based on the presentation by Bryan Lapidus, Director, FP&A Practice at the Association for Financial Professionals (AFP)

The concept of integrated intelligence is the idea of defining work and disseminating information across collaborative and fluid teams to drive a business decision. Through integrative intelligence, we can add value in five following areas:

Define shared value and create a shared focus for everyone in the xP&A ecosystem;

Build with modularity step by step and create standardisation around the enterprise of data and metrics;

Expand the view of the team – xP&A focuses on supplying information to all parts of the company;

Enhance project management skills – distributing work requires creating the cadence of operations;

Provide effective challenge – finance should take the finance view.

Conclusions

FP&A processes and roles have evolved and will carry on evolving in uncertain environments. Planning that goes beyond finance is the way forward. This is where xP&A comes into play. We risk being left behind if we do not start thinking about integrating our planning with all plans within the organisation.

We would like to thank our global sponsors and partners Jedox and AFP for their great support with this Digital FP&A Board.

Also, we are very grateful to our panel of experts for sharing with us their keen insights and to the FP&A Board attendees for their valued presence!

To watch the full webinar recording, check out this link.