The Launch of the Copenhagen FP&A Board took place on 2 April 2019. The first discussion...

Senior finance leaders met at the 4th face-to-face Copenhagen FP&A Board on April 27th 2023. This meeting signified the restart of the International FP&A Board in the capital of Denmark after the Pandemic. Together they discussed the lessons the COVID-19 pandemic has taught us.

Larysa Melnychuk, CEO and Founder of the International FP&A Board and FP&A Trends Group, chaired the discussion.

The Copenhagen FP&A Board welcomed 28 experienced FP&A professionals representing major international companies, such as Carlsberg, Nilfisk, AIG, Ascendis Pharma, Svitzer, Maersk Drilling (Noble), WTW, Falck, Tryg Forsikring.

Figure 1: International FP&A Board in Copenhagen (April 2023)

Introduction

As part of the introduction round, each member gave their view on the biggest FP&A lesson learned from the Pandemic. The main learnings cited were as follows:

- Flexibility of workplace,

- Agility is critical, also for FP&A teams,

- Remote work can be effective,

- Social interaction can be challenging,

- Work-Life balance has increased,

- Evolution of ways of working,

- Solid systems are key to success,

- The annual budget process is outdated.

The Key Challenges for FP&A Teams

The Board then moved to the main agenda to discuss the impact on FP&A teams caused by the Pandemic. Also, the think-tank discussed the high inflation rates, showing that the traditional Budgeting and Planning process does not work as well today as before the Pandemic.

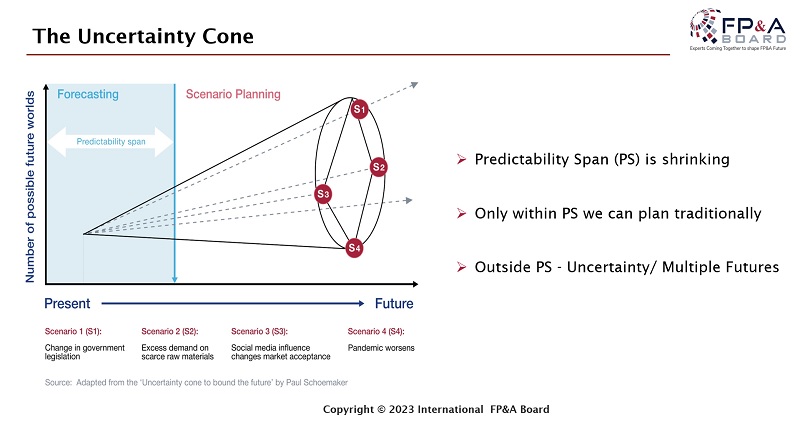

The facilitator of the meeting, Larysa Melnychuk, described “The Uncertainty Cone“, visualising that the Predictability Span (PS) is shrinking. Only within PS we can plan traditionally. A more sophisticated approach is required to handle uncertainty and multiple futures outside this span.

Figure 2: We have to deal with different futures outside the shrinking Predictability Span (PS)

This uncertainty has led to a requirement for frequent re-forecasting and Scenario Management.

Scenario Management

Scenario Management is a planning method that deals with uncertainties by considering many alternative futures and their possible effects on the organisation. As there is no perfect scenario, it is important to think multi-dimensionally, constantly focus on screening for threats and opportunities, and implement systems to run the scenarios in real-time.

The FP&A Trends Group has performed a survey based on 375 responses showing that 26% of respondents could not run scenarios at all (as per the 2022 Survey). 23% find scenarios time-consuming and spend more than a week on running scenarios. What is worse, only 6% of respondents can run scenarios in real-time, while 13% are able to run them in less than a day. This is another challenge that FP&A professionals should overcome. Indeed, only a few of the event attendees could run scenarios. It matches the results of the previous survey.

While many organisations still have not reached analytical excellence, the Board discussed frameworks that can foster the adoption of Scenario Management and Extended Planning and Analysis (xP&A). It was the next point on the meeting agenda.

xP&A (Extended Planning & Analysis)

Extended Planning and Analysis is a journey to analytical excellence that involves the following:

- Cross-functional planning, which goes beyond Finance.

- Aligning strategic, financial and operational plans and,

- Digital Transformation.

A traditional FP&A function requires balancing and synchronising all organisational plans to move towards Extended Planning and Analysis. Having a single and trusted source of data and investing in a flexible platform to be ready to react to changes quickly has also become essential.

FP&A Team Roles

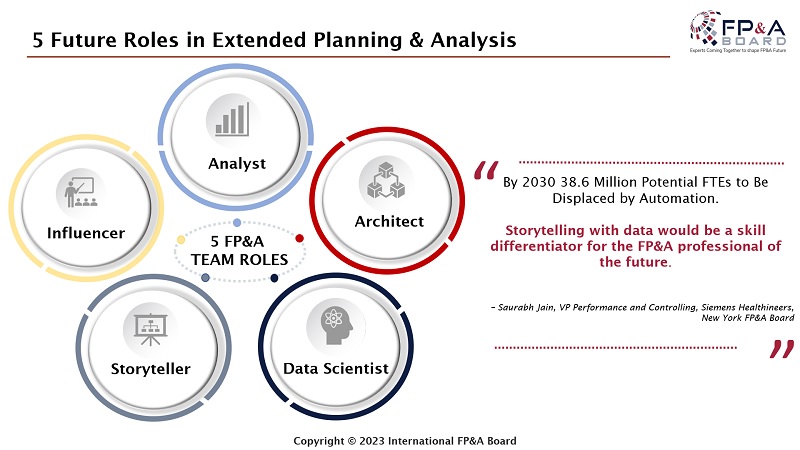

Larysa Melnychuk then showed 5 overall roles that the FP&A team should cover to be successful:

Figure 3: 5 FP&A Roles Discussed during the Copenhagen FP&A Board

The Data Scientist bridges Finance and the Data Science function. Also, this role would typically own Master Data and provide data to other specialists.

The Architect is bridging IT and Finance and owns Data Warehouse development.

The Analyst is the role that oversees the planning and forecasting process and analyses/produces reports.

The Storyteller delivers compelling insights and visualisation to support the story.

The Influencers use their leadership characteristics to build networks with stakeholders.

Digital FP&A

After this, the attendees discussed the latest Digital FP&A trends.

Digital FP&A generates real-time analytics insights using internal and external data with minimal manual effort.

An annual FP&A Trends Survey carried out annually since 2017 shows an encouraging trend towards more time available to Insight Generation and Driving Actions (33% in 2022 vs 26% in 2019) and less time spent on Data Collection/Validation (67% in 2022 vs 74% in 2019). However, poor data quality is still the reason behind inefficiencies, as FP&A teams spend as much as 45% of their time on low-value activities such as data validation.

Further, those companies that utilise more advanced technology like Artificial Intelligence (AI) and Machine Learning (ML) can allocate 49% of the total time available for Insight Generation and Driving Actions (in 2022), which is 16% higher than the industry average.

FP&A Trends Maturity Model Assessment

As a last point, Larysa Melnychuk went through the FP&A Maturity Model before the small groups work.

The FP&A Trends Maturity Model was created by the International FP&A Board. It was conceived by the London FP&A Board and further developed by hundreds of practitioners in all 29 chapters in 16 countries across four continents. The model reflects extensive research, current realities, and the latest developments in FP&A best practices.

FP&A Trends Maturity Model Assessment is a tool based on the FP&A Trends Maturity Model. This tool allows organisations of any size, industry, and geography to identify the stage of their FP&A maturity compared to the leading stage. It also allows them to create their own transformation journey to improve their FP&A.

The tool is an interactive assessment questionnaire that covers 6 categories:

- Leadership,

- Functional Skills & Roles,

- Business Partnering and Collaboration,

- Process,

- FP&A Data & Analytics,

- and technology.

Five maturity levels are identified within each category - from Level 1, the most basic, to Level 5, where FP&A aspires to be. At this level, planning and analysis add real value to the organisation and allow it to cope with a future that is difficult to predict.

Small Groups Work

Figure 4: Group work during the Copenhagen FP&A Board (April 2023)

The session ended with all the FP&A participants breaking out into discussion groups to elaborate on the following:

- How to move from traditional planning to Scenario Management?

- What are the practical steps in implementing xP&A?

- How can organisations prepare themselves for successful analytical transformation?

Figure 5: One of the event attendees presents the group work results during the Copenhagen FP&A Board in April 2023

We would like to thank Pigment for sponsoring the meeting and IWG for their tremendous support with the organisation.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.