What most FP&A leaders are thinking about today is FP&A Transformation, and more importantly, a very urgent one. As most of the current FP&A teams lack agility and strategic focus, we need to invest in people skills, improve processes and data management, and implement new technologies. What we need to ask ourselves is: are these efforts aligned across the whole organization or we are still operating in silos? If people, processes, data, and technology transform separately rather than as part of an aligned effort, we risk missing our transformation target.

This article explores how leading organizations are addressing this transformation challenge. It also highlights key insights and takeaways from The Digital North American FP&A Circle: Optimizing the FP&A Ecosystem: Streamlining Processes for Agility and Impact.

Streamlining Processes: Improving Agility through Breaking Silos

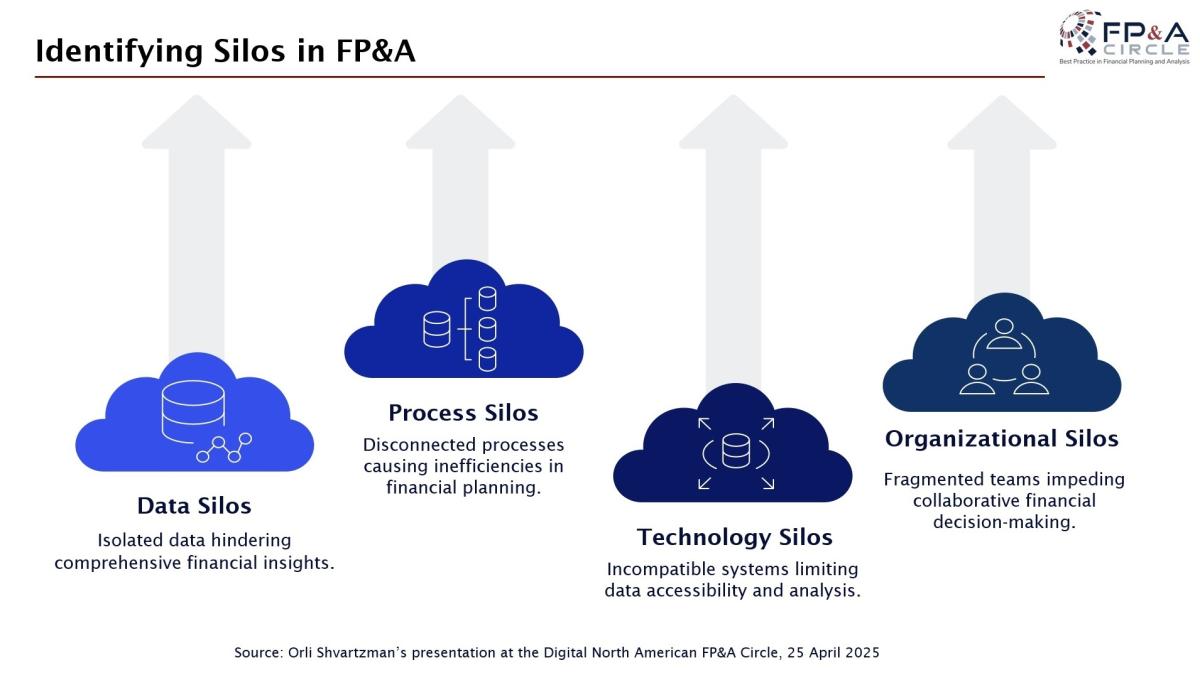

Orli Shvartzman, Director, Corporate Financial Planning & Analysis at Balt, delivered an insightful presentation on removing silos within FP&A and improving organizational agility. Balt is a global neurovascular medical device company with 910 employees in 15 locations. Orli explained that silos in data, processes, technology, and organizational structure can significantly limit visibility and lead to disconnected and even contradictory decisions.

At Bolt, Orli helps to identify such silos and solve them. That is extremely important at the corporate level, where fragmentation and lack of coordination can lead to dreadful results. Orli described common challenges such as inconsistent data across ERP systems, non-aligned approval processes, and outdated or incompatible technology.

To solve these problems, Balt implemented a data governance framework, invested in a centralized data warehouse, integrated data from various sources, and established a “single source of truth.“ On the process side, it has implemented standardized budgeting and forecasting processes and automated data entry and consolidation. From a technology perspective, it has migrated to the cloud and ensured seamless integration with other enterprise systems through APIs.

These efforts were reinforced through a people-focused approach, including onboarding programs, cross-functional teams and projects, a business partnering philosophy, and continuous training.

Orli also shared examples of practical tools such as real-time headcount visualizations, and she highlighted the importance of ongoing collaboration between FP&A and other departments, including HR, operations, and sales.

Figure 1

Her insights underscored that breaking down silos is not merely a technical challenge but a strategic imperative that supports better decision-making and sustainable cost management. FP&A can drive a more agile, transparent, and data-informed organization by fostering integration.

Poll Insight: How Standardized are your FP&A workflows?

The poll on FP&A workflow standardization revealed that most respondents operate in still-maturing environments regarding process consistency. The most common response, selected by 42%, was "ad hoc with some structure," indicating that while some frameworks exist, many workflows remain informal. Close behind, 36% reported their workflows as "mostly standardized," reflecting progress toward consistency. Meanwhile, 17% acknowledged having "no standardization yet," and only a small minority, just 6%, indicated their workflows are "fully standardized and documented." These results highlight a significant opportunity for improvement in establishing and formalizing FP&A processes across organizations.

Figure 2

Empowering People: Investing in Team Members to Achieve High FP&A Maturity

Fernanda Noronha, Director of Finance, Process Optimization at Grainger, delivered a focused presentation on talent development within FP&A. Currently leading process optimization and data analytics at Granger, a $17B distributor with 26,000 employees. According to Fernanda, three elements should be present for successful and agile FP&A teams:

- the right roles,

- the proper tools,

- development opportunities.

She identified three core areas for investment: collective hard skills training, a continuous improvement mindset, storytelling, and soft skills. Grainger trained the entire FP&A workforce in analytics, SQL, and BI tools.

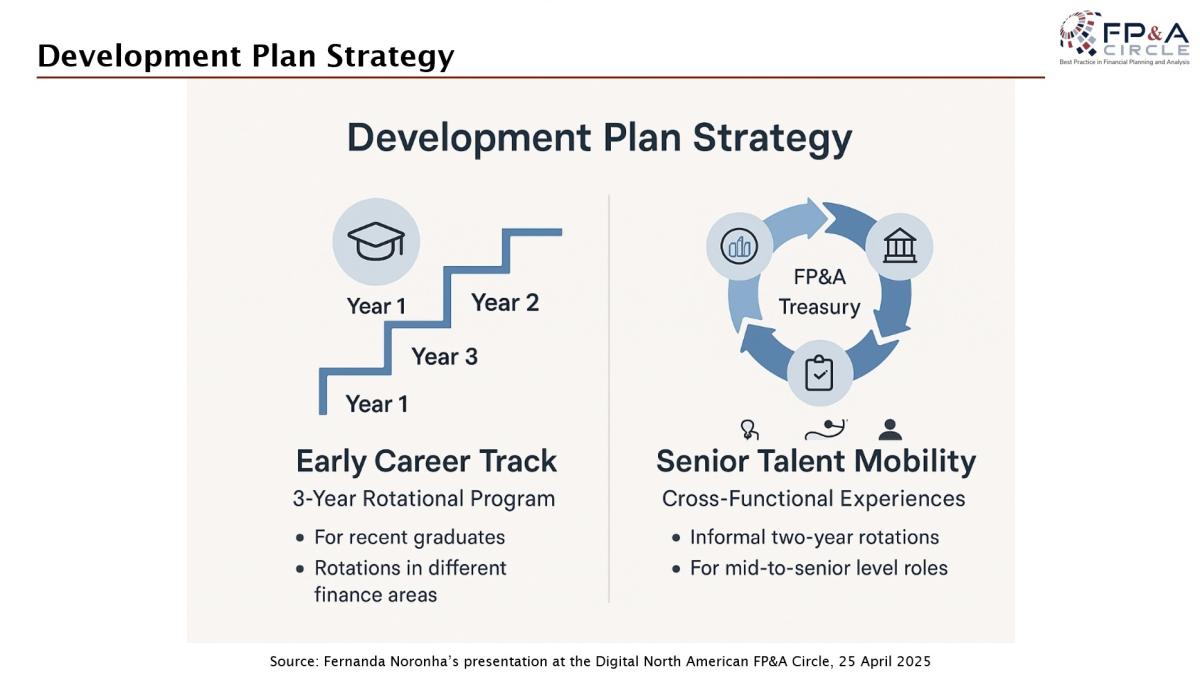

Fernanda also highlighted two talent development initiatives: a Finance Development Program for university graduates that includes rotational assignments, mentorship, training, and cross-functional career mobility that enriches finance with broader business perspectives. Granger's CFO, who was formerly in sales and pricing, exemplifies this strategy.

Figure 3

In conclusion, Fernanda stressed that the right support systems and structured approach are key to reaching strong FP&A teams. Fernanda’s team currently operates at level four regarding FP&A maturity and is constantly moving forward, now with generative AI.

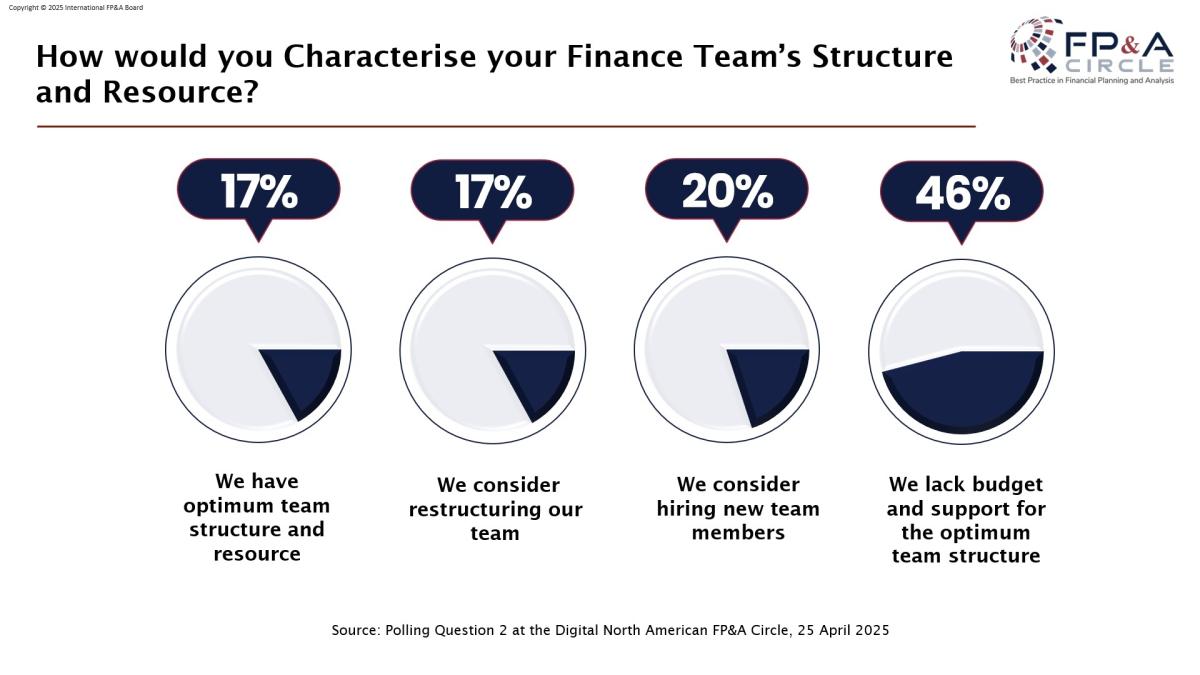

Poll Insight: How would you Characterize your Finance Team's Structure and Resource?

The poll results revealed a significant challenge facing many finance teams: nearly half of the respondents (46%) indicated they lack budget and support for an optimum team structure, highlighting a widespread resource constraint. The remaining responses were fairly evenly distributed, with 20% reporting they consider hiring new team members, and 17% each indicating either a need for team restructuring or that they already have an optimum team structure and resources. These results suggest that while some teams are adequately staffed and structured, the majority are either actively seeking improvements or facing financial and organizational barriers to achieving their ideal setup.

Figure 4

Leveraging Technology: Practical AI Use Cases for Finance Teams

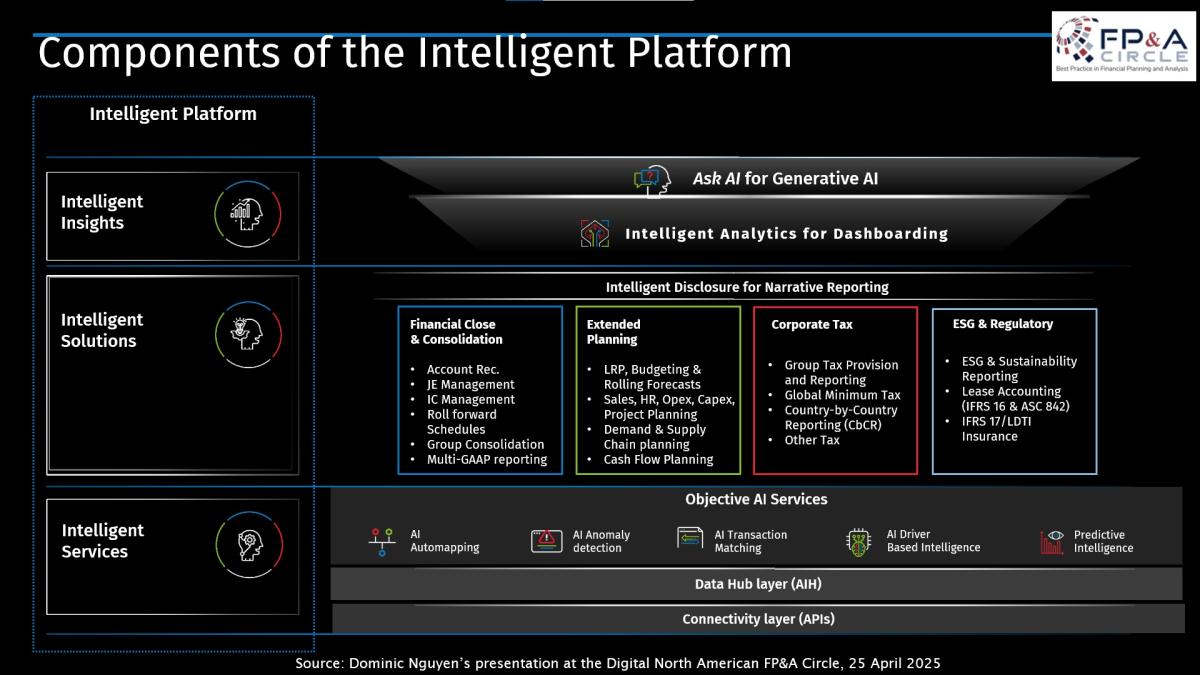

Dominic Nguyen, FP&A Technology Advisor at Wolters Kluwer CCH Tagetik, offered his perspective on the role of technology in transforming FP&A teams and processes. Based on his experience as a financial analyst, Dominic described how he shifted from manual, Excel-heavy work to more advanced platforms that use Artificial Intelligence and Machine Learning.

His presentation focused on three key areas: current trends, common challenges, and how technology is helping organizations address them.

He outlined major industry trends such as rapid market changes, rising regulatory demands, and increasing data volumes. Finance is also evolving from a support function to a strategic advisor role, emphasizing the need for long-term planning and real-time insights. However, Dominic noted that many teams still spend too much time manipulating data rather than analyzing it.

He illustrated how modern platforms streamline data ingestion, enhance forecasting accuracy, and support extended departmental planning. Real-world examples from Japanese automotive and Italian manufacturing firms demonstrated how automation and predictive planning significantly improved efficiency and accuracy.

Figure 5

Dominic emphasized the importance of a centralized data layer, integrated workflows, and AI-driven insights for achieving a mature, agile finance function. Intelligent platforms empower finance teams to shift from reactive reporting to proactive, value-adding analysis.

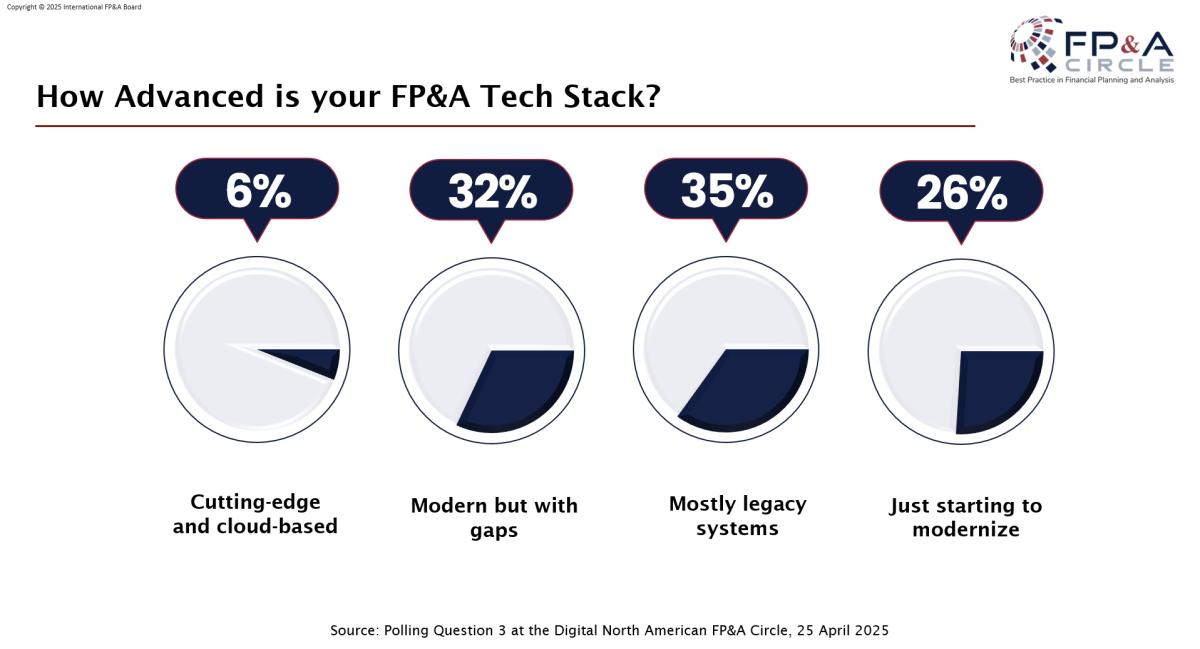

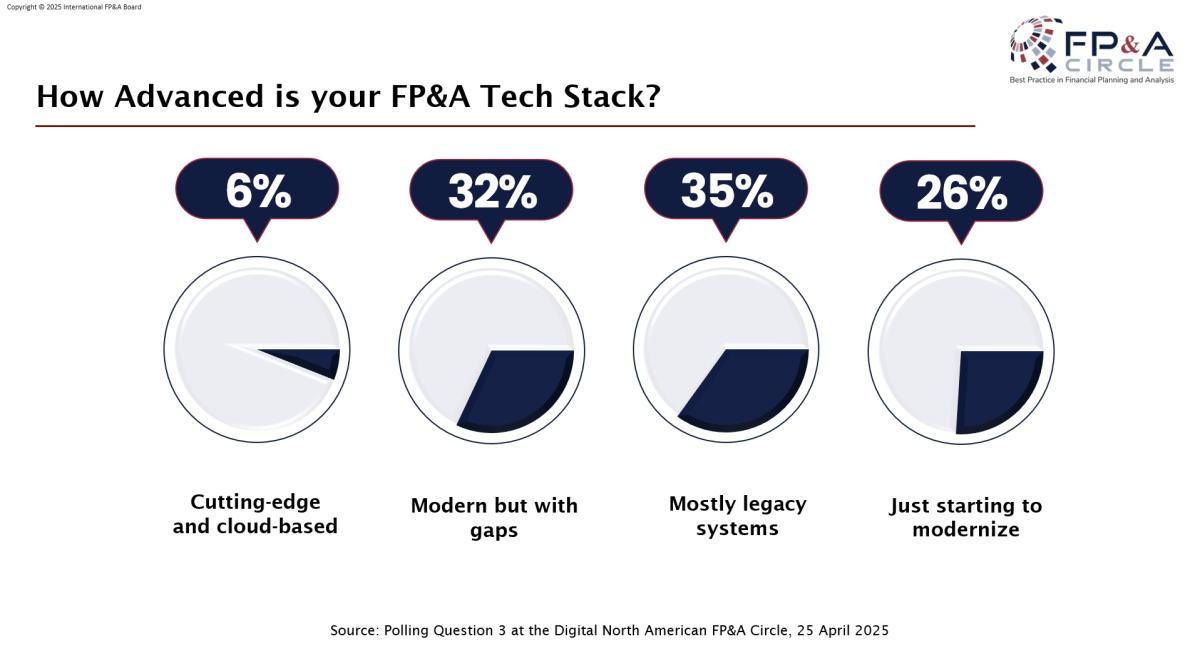

Poll Insight: How Advanced Is Your FP&A Tech Stack?

The poll results on the maturity of FP&A technology stacks revealed that most respondents are still in the early to mid stages of digital transformation. "Mostly legacy systems" led with 35% of the votes, closely followed by "modern but with some gaps" at 32%, indicating that while some modernization efforts are underway, many organizations continue to rely on outdated tools. Additionally, 26% of participants reported "just starting to modernize," highlighting a growing awareness of the need for technological advancement. Only a small fraction, 6%, indicated they have a "cutting-edge and cloud-based" tech stack, underscoring that few finance teams have fully transitioned to advanced, integrated solutions.

Figure 6

Conclusion

The insights shared across the webinar underscore a central theme: FP&A excellence cannot be achieved through isolated efforts. People, processes, data, and technology are deeply interconnected, and meaningful progress happens only when these elements are aligned and working together.

Orli Shvartzman's focus on dismantling silos illustrated how disconnected systems and workflows disrupt agility and decision-making, while Fernanda Noronha demonstrated that investing in people is essential to building a capable and resilient finance function. Similarly, Dominic Nguyen emphasized that without the right technology infrastructure to centralize data and enable intelligent planning, even the best processes and talent are limited in their impact.

Together, these perspectives make a compelling case for viewing the FP&A function as an integrated system. Achieving FP&A maturity is not about optimizing individual components in isolation but building a cohesive ecosystem.

To watch the full webinar recording, please check out this link.

The Digital North American FP&A Circle was sponsored by Wolters Kluwer.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.