In this video, Guilherme Saraiva, ex Senior Director, FP&A at Discovery Inc, Washington D.C. FP&A Board...

Much has been written about the importance of Strategic Planning in management1. After losing some popularity in the 1980s, it resurged in the late 1990s and early 2000s. Rolling plans and better forecasting were adopted to address the challenge of market unpredictability.

This article revisits how linking strategy to financial plans leads to successful execution at for-profit organisations, focusing on best practices regarding scope, processes and output.

What and How Do We Want to Achieve?

A firm’s strategy encompasses making deliberate choices to reach its goals. It does so while operating in an organisational “world order” and pursuing its mission, vision, and values. Google's Founders IPO letter2 is an excellent example of how a well-articulated strategy follows the mission in a “world order” of advertising-led Internet economics.

So, how do we build this “world order”? We choose what to do or not, when, where, and with whom. There are many frameworks to do so3: from focusing on an entire industry to a specific market, like the famous BCG Growth Share Portfolio Matrix, or concentrating on customer segments, stakeholders, value chains and product or technology cycles, such as Blue Ocean Strategy or SWOT. Determining the goal, scope, and time horizon is the key to properly choosing the parameters of the strategy. For instance, in Play to Win4, we follow an iterative process to refine the goal and the “barriers” to solve “the problem” while making a set of cascading choices that address the space, the way, and the capabilities and systems to execute.

The scope can be an entire company, a division, or a product line. Successful strategy creation requires input from all areas within the firm, avoiding conflict between enterprise and divisional or functional goals. Alignment enables success. For instance, Internet Explorer helped Microsoft dominate the early Internet to maintain Windows and Office supremacy in their markets. On the other hand, misalignment can lead to disruptions and failure, as with WorldCom’s and Nortel Networks’ bankruptcies after risky acquisitions and poor integration. Another type of alignment centres around value perceived by customers and compares it with the offering’s value proposition, the balance of revenue versus cost to generate profits, and stakeholders’ incentives to engage and act. Apple’s iPhone 3GS versus Cisco System’s Flip Video Camera, Regus versus WeWork, and SpaceX versus Boeing are examples of good and poor value, profit, and people alignment, respectively.

Scenario Planning versus Modelling

Strategy creation involves generating ideas, developing them, and selecting viable options. This requires building “strategic arguments”5 that use logic to test assumptions and possible futures, what we call scenarios. These arguments help assess the coherence of the strategic choices and identify the space, way, capabilities and systems. Best of all, they help us articulate the overall strategy and communicate it to all stakeholders.

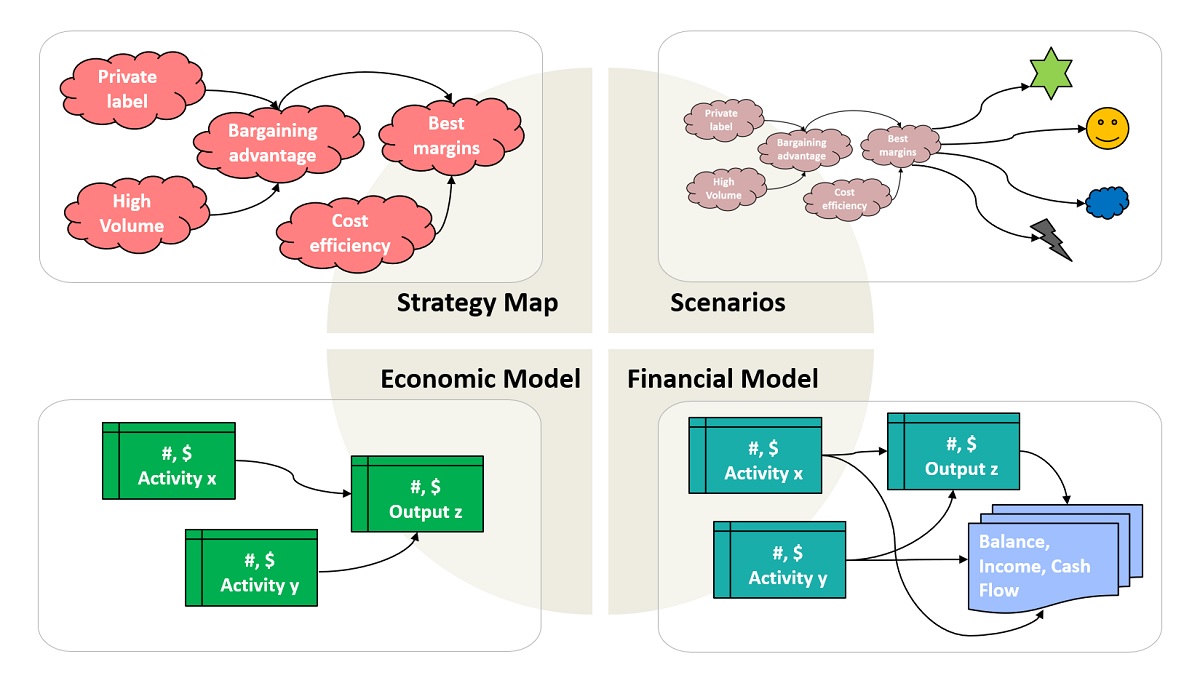

“Strategic maps” (Figure 1) show causal relationships between ideas, concepts, resources, and actions. These connections are performance drivers that, in turn, are captured as a model. When a model uses quantitative descriptors and mathematical relationships covering market analysis, resource allocation, and operational elements, we obtain an abstraction called an economic model. By quantifying these assumptions and the connections and changing their values, strategy crafters can explore possible scenarios and evaluate the impact of key drivers.

Figure 1: Strategy maps, scenarios, and economic & financial models

When these models include the main financial statements via capital budgeting, they are considered financial. Here, structured planning projections of key elements help us build the Income Statement, derive the Cash Flow, estimate Working Capital, and the Balance Sheet. Unlike Strategic Planning, where customer, process, learning and other considerations also demand non-financial metrics, financial modelling focuses on ROE, ROA, ROIC, and their components. For instance, my former colleagues at VMware used to get a robust Income Statement quickly, estimating revenues with Price multiplied by Quantity, using a profitability tree and evaluating COGS and OpEx as a percentage of revenue. In general, by projecting trends of DSO, DOH, and DPO, we can get a Working Capital Schedule. We are also able to get the final elements for updating the Balance Sheet along with assumptions for depreciation, amortisation, and debt.

The greatest value of modelling is the opportunity to ask interesting questions and evaluate assumptions. These assumptions may be explicit parameters and math mechanics or implicit mechanics plus what was not modelled.

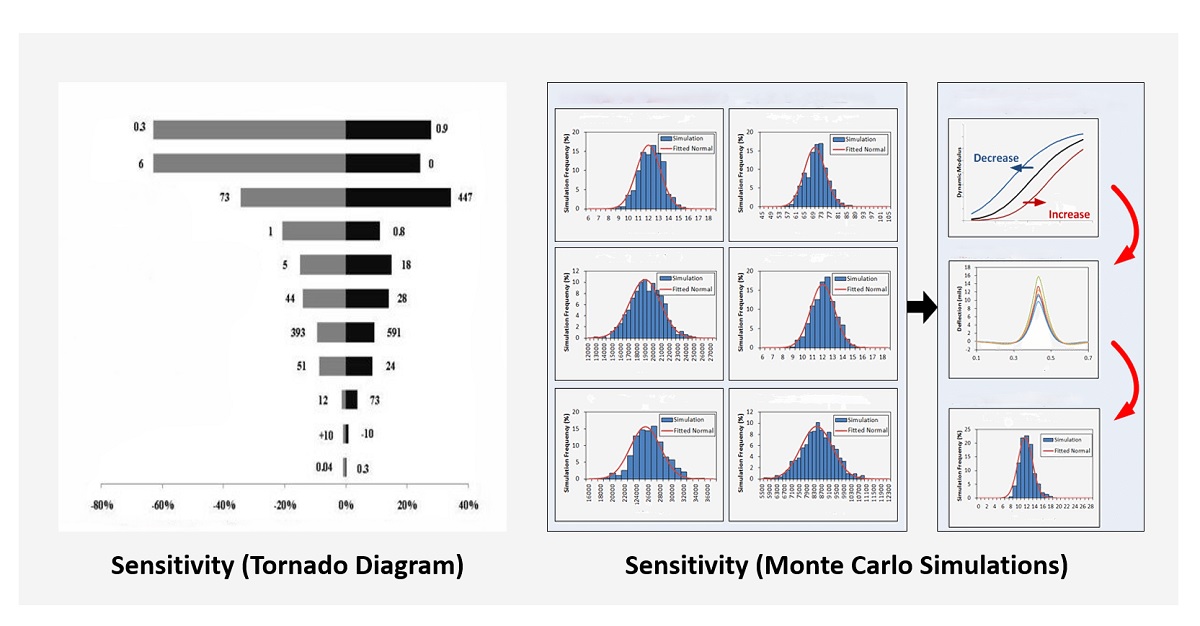

While complex models with sophisticated mathematics and statistical methods such as Monte Carlo simulations can provide insights, simpler models are often easier to maintain. Users may end up introducing mistakes without noticing them or depending on unique individuals to maintain such models and on those who may depart without training successors.

Adopting longer time horizons ensures strategic drivers and assumptions are better evaluated. Vetting the models and assumptions also requires checking feasible ranges, reasonable probabilities in simulations and weights in estimates of expected values of outcomes from all scenarios. Sensitivity analysis with tornado diagrams is also helpful in gauging the influence of drivers (Figure 2).

Bottom-up planning actively involves participants beyond the top echelons of the firm and can be very useful due to its inclusiveness and wealth of perspectives. However, large organisations are often prone to bringing many voices to the discussions and benefit from top-down prescriptive processes to maintain clarity and efficiency. As practised by Novartis6 during their centrally-driven planning process, their employees might have challenged the planning model but could not overrule it.

Figure 2: Tornados, Monte Carlo simulations

However, Strategy Is Neither Planning Nor Forecasting

“Strategy tells you what initiatives actually make sense and are likely to produce the result you actually want.”7 In contrast, “[a] plan is a detailed outline of the steps you need to take to achieve a specific goal.”8 Yet, planning is the key to executing strategy by setting a more objective reference for performance measurement.

Financial planning, which allocates resources, is a part of Strategic Planning, but it focuses on more immediate steps. Firms operationalise strategies with short-term operating plans, covering 12-18-month budget plans, product launches, marketing campaigns, etc.; and long-range plans, made of 3–5-year plans with expansion to new markets, acquisitions, etc., by breaking them down by division or function.

Modern firms are adopting Extended Planning and Analysis (xP&A) to synchronise plans across departments and functions in real time.9 Unfortunately, in practice, plans become outdated the moment they are published because the environment changes or the actions that the firm’s agents take are not executed as anticipated. Sometimes, the planning process can be incoherent: the long-term perspective deviates from the short-term. What can be done? One answer is frequently adjusting plans by adopting Rolling Forecasts. Another solution is placing strategic arguments at the centre of the planning process to prevent disconnections in time, scope, or means.

Forecasting to predict future performance can be based on quantitative methods, such as time series, extrapolation, econometrics or regressions, or qualitative methods, such as surveys and opinions. However, they are rarely fully mastered, as was the case with Cisco Systems, which was considered a bellwether of the tech industry for decades.

How Often Shall We Update the Plans?

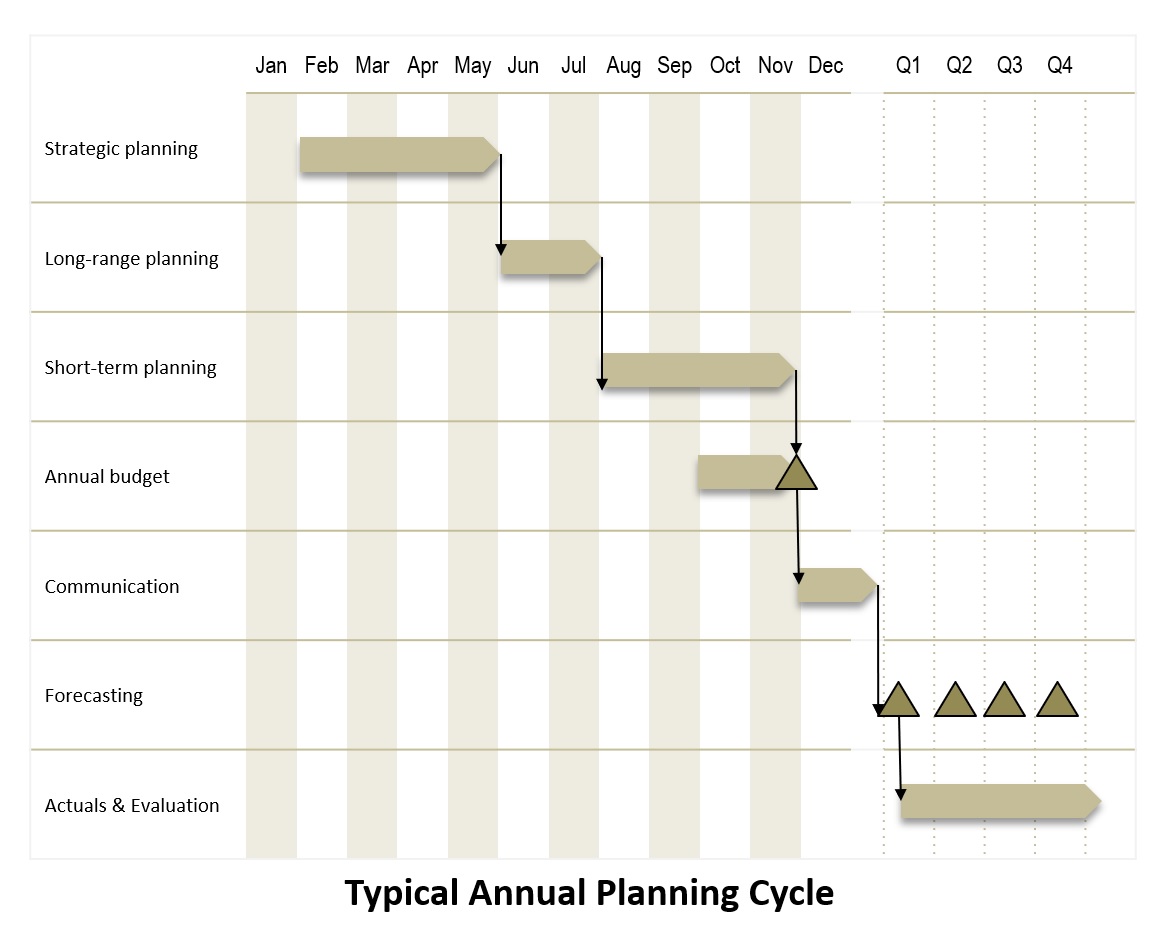

A yearly review of operating and long-range plans should be sufficient, but variations need to ensure it is still a practical effort. However, when conducted too frequently, reviews may lead to paralysis (Figure 3).

When comparing forecasts to actual results and planned expectations in the FP&A cycle, managers should avoid excessive backwards-looking reviews that fail to answer questions about what to do next.

If the organisational structure and the IT infrastructure allow it, the frequency of strategic and financial planning can be accelerated. Newer ERP systems and FP&A applications10 can help with it, provided the data set necessary to conduct it is complete, accurate, and timely. Otherwise, they become a drag for all participants.

Figure 3: Typical annual planning cycle

In summary, Be Thoughtful and Practical

While Strategic Planning requires careful alignment and common sense without compromising agility or clarity, it does not have to be time-consuming and costly. It can be an extension of the annual budgeting process. Our suggestion: don’t be a perfectionist or get distracted; instead, be pragmatic and deliberate.

Acronyms:

- IPO = Initial Public Offering

- SWOT = Strengths, Weaknesses, Opportunities, Threats analysis

- ROE = Return on Equity = Net Profit / Equity

- ROA = Return on Assets = Net Profit / Assets

- ROIC = Return on Invested Capital = Net Operating Profit After Tax / Average Cost of Capital (equity and debt)

- COGS = Cost of Goods Sold

- OpEx = Operating Expenses

- DSO = Days of Sales Outstanding = (Accounts Receivable / Sales) * 365

- DOH = Days of Inventory on Hand = (Inventory / COGS) * 365

- DPO = Days Payable Outstanding = (Accounts Payable / COGS) * 365

- ERP = Enterprise Resource Planning software

References:

HBS Online. "Why Is Strategic Planning Important?" Business Insights Blog, October 6, 2020. Accessed October 29, 2024. https://online.hbs.edu/blog/post/why-is-strategic-planning-important.

Alphabet Investor Relations. "Founders’ IPO Letter." Accessed October 29, 2024. https://abc.xyz/investor/founders-letters/ipo-letter/.

Athuraliya, Amanda. "The Top 7 Tried and Tested Strategy Frameworks for Businesses." Creately Blog, January 5, 2023. Accessed October 29, 2024. https://creately.com/blog/strategy-and-planning/top-strategy-frameworks-for-businesses/.

Mgoitein, Michael. "The ‘Playing to Win’ Framework — A Global Strategy Expert’s Proven Method." Michael Goitein, November 6, 2023. Accessed October 29, 2024. https://michaelgoitein.com/the-playing-to-win-framework-a-global-strategy-experts-proven-method/.

Carroll, Glenn R., and Jody B. Sørensen. Making Great Strategy: Arguing for Organizational Advantage. New York: Columbia Business School Publishing, 2021. Accessed October 29, 2024.

FP&A Trends. "Predictive Planning Implementation Journey & Learnings: A Case Study at Novartis." Accessed October 29, 2024. https://fpa-trends.com/tv-series/predictive-planning-implementation-journey-learnings-case-study-novartis.

Martin, Roger L. "Don’t Let Strategy Become Planning." Harvard Business Review, August 7, 2014. Accessed October 29, 2024. https://hbr.org/2013/02/dont-let-strategy-become-plann.

Athuraliya, Amanda, and Creately. "Strategy vs. Plan: Understanding the Key Differences." Creately, June 6, 2024. Accessed October 29, 2024. https://creately.com/guides/strategy-vs-plan-key-differences/.

Van Decker, John, and SAP Analytics Cloud. Extended Planning and Analysis with SAP Analytics Cloud. 2020. Accessed October 29, 2024. https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/alliances/ey-sap-extended-financial-planning-analysis-sap-cloud-analytics.pdf.

Gartner. "Financial Planning Software Reviews and Ratings." December 5, 2023. Accessed October 29, 2024. https://www.gartner.com/reviews/market/financial-planning-software

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.