It is very important to have well-established mechanisms for planning and budget control. So, managers can...

A ‘financial’ strategist is a strategist first and a financial second. For decades financials have been applying solutions to become a strategic business partner for the C-suite, from financial engineering and tax planning to centralising (global) operations and deep analytics today. To avoid drilling deeper and still finding nothing, reverse engineering the strategic role of the financial will show another route to be of value and increase the yield on IRR or profits with double digits…

Reality Check

If CFOs and FDs aim to improve the decision-making process by the C-suite, meaning add value to the business, accounting and compliance aren't helping this quest. In fact, if you read the report by the American Institute of CPAs (AICPA) and the Chartered Institute of Management Accountants (CIMA), Joining the Dots: Decision Making for a New Era, you’ll be in shock:

- “80% of respondents admit that their organisation used the flawed information to make a strategic decision at least once in the last three years. One-third (32%) of respondents say big data has made things worse, not better…”

- “72% of companies have had at least one strategic initiative fail in the last three years because of delays in decision-making, while 42% say they have lost competitive advantage because they have been slower to make decisions than more agile competitors.”

It is all about information, yet more details or more of the same data will give you the same answers, only in more detail or at a higher spend (CapEx). The trick is to reverse the direction the financial is looking: from ‘stargazing into a black hole’ to ‘storytelling based on facts’. For this to happen, the business's strategy needs to be placed into the ‘accounting’ systems.

A simplified example will show how this ‘street smart’ solution was encountered (step 1) and how it is set up (step 2).

Step 1. Talk to Sales & Operations

A strategy is often a group of plans where the numbers disappear in PowerPoint presentations, Excel sheets or BI software. Many financials are hooked by their screens, yet the story in the plans is ‘lost in translation’.

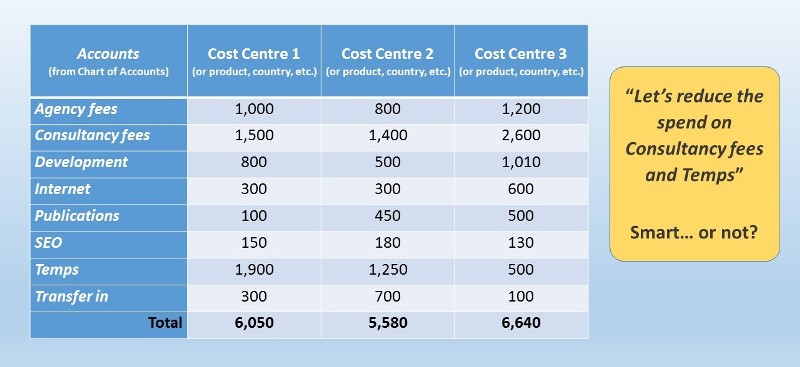

For example, what does the following overview tell you?

Figure 1

Not much; it just shows you the composition of spending, not the strategic intent. As a board member, you might even be tempted to reduce Consultancy fees and Temps as part of a company-wide ‘savings initiative’ in response to market pressures.

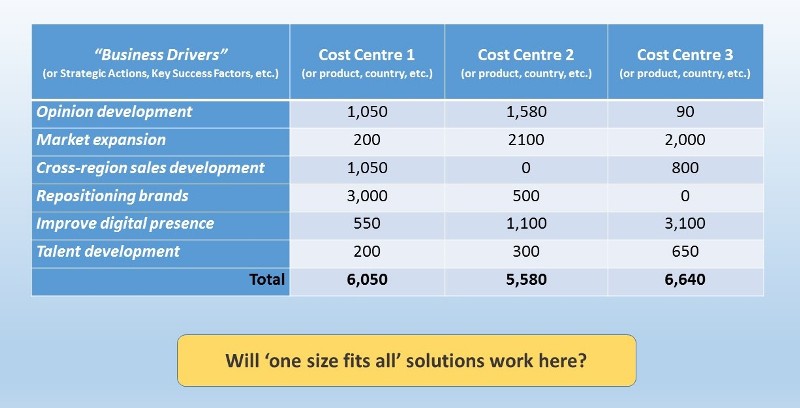

The first step to increasing your understanding is to talk to Sales & Operations and ask what drives and blocks their business. For the same example, the “Accounts” have been decomposed and reshuffled into the “Business Drivers”, showing how each business plan is to be developed.

When the result is lagging, which question will you ask now?

Figure 2

Of course, as a board member, you will ask where and why performance is lagging. This is how the decision quality is increased, avoiding ‘one size fits all’ solutions. And normally, it’s the financials that should have provided the CEO, CFO or GM with the right answer.

- In a real case, 14 companies worldwide were managed based on these kinds of expense reports, which built up into Return On Capital Employed (ROCE) and Value Added ratios. This was also enough for a local Finance Director to manage the expenses until the business focus changed from selling ‘bulk’ to ‘custom build’. Now, with a highly segmented market approach, a cost management system had to be devised to meet this differentiation and their reporting needs, meaning they had to get involved with Sales & Operations and monitor each segment.

Step 2. Implement Project Accounting

As a financial, you have talked to Sales & Operation (managers, directors, and global VPs), who have given you a jointly agreed list of key “business drivers” for each market. This list should match their business plans or strategy. One problem, there are no such descriptions in the Chart of Accounts or as Cost Centres. Here enters project accounting.

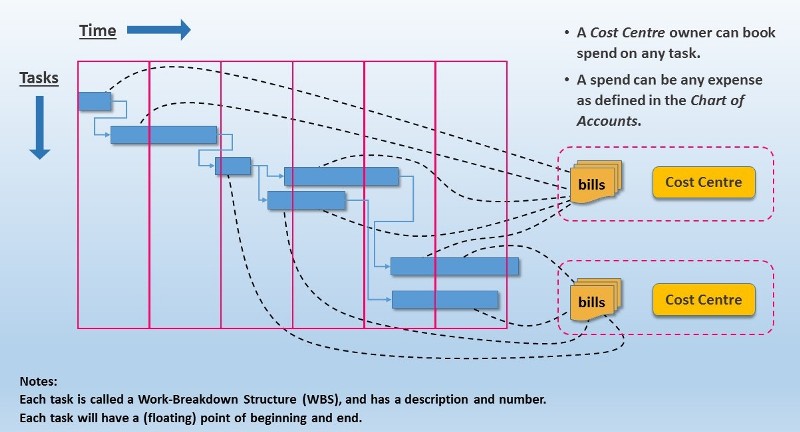

What is a project? Basically, it is a sequential flow of various tasks. Each project task can contain any kind of spending, following the Chart of Accounts, and different ‘Cost Centres’ can book a project activity when working (or purchasing) together.

Standard project:

Figure 3

Within project management, each project task or activity is called a Work-Breakdown-Structure (WBS), with a WBS description and WBS number. To transform project accounting into a strategy storyboard, you give each project task a WBS description of a “business driver” and have a term which lasts, e.g. 20 years or more. Now the strategy is in the accounting system!

Strategy storyboard:

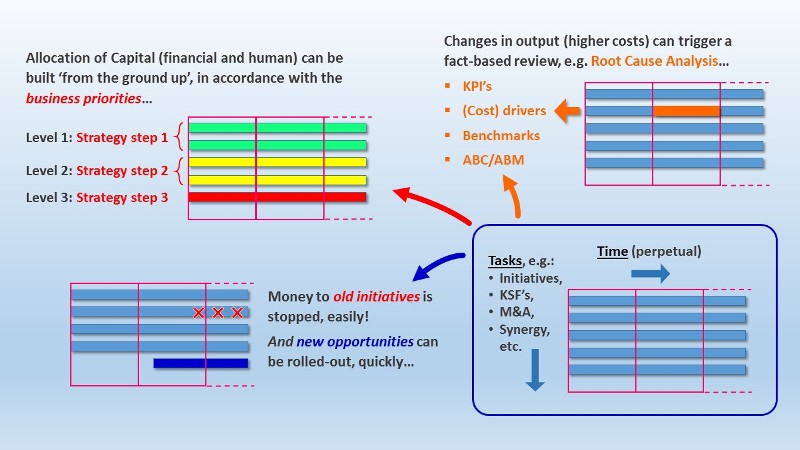

Figure 4

The only instruction you have to give the budget owners is that their assistant books each transaction and allocation with one additional code: the WBS number, which is given by the budget owner and related to one of the business drivers.

Now that you have the strategy translated into a storyboard in your accounting system and the amount is being booked, this is what you get:

- The local manager will get a report to tell the regional director the strategic story.

- The regional director can follow the roll-out and effectiveness of different strategies across the region and explain and advise the global VP where and how best to allocate or reduce spending going forward.

- Global VPs can present a ‘Use-of-Funds’ overview to their CEO, telling the real strategic story about how their business used the money (versus strategic intent) and which additional initiatives were taken to improve performance.

- The CEO will be able to match the initial detailed ‘Use-of-Funds’ overview (= the strategic plan or Pitchbook) presented to boards and investors with the quarterly updated ‘Use-of-Funds’ overviews, to defend any change (or not) in business focus and actions which are taken on major events impacting the company.

- Now, boards can constructively participate in discussing and making the strategy work without just trusting the CEO's PowerPoint or worrying about their Audit Committee's report.

Project accounting has more reporting advantages, e.g. it ‘overwrites’ / no cross-border limits, bookings can be split between different WBS numbers, and various consolidation hierarchies are possible.

- In another real case, around eight marketing managers had their marketing plan translated and linked to business drivers defined by their regional Marketing Director. The local FP&A specialist applied project accounting to all these plans and reporting needs. As a consequence, finance stopped receiving inquiries from Marketing Directors controlling the spending of their Marketing managers, and the Marketing Managers could deviate from global ‘reduction initiatives’, securing their prioritised spend and meeting or exceeding their targets.

How Does This Increase the Yield with Double Digits? Re-Allocation of Capital!

A company using a traditional business planning method will learn quickly. After management sees where the money really went and notices they spent less time understanding the numbers, they will permanently reduce spending on non-value-added activities and fund only the best new opportunities.

Those companies familiar with Beyond Budgeting, Driver-Based Planning, or (strategic) Zero-Based Budgeting will immediately see the real advantages:

- No strategic initiative will be wasted (= effectiveness of capital).

- The allocation of capital can easily be prioritised and changed in accordance with the business environment (= market leadership).

- Strategic changes will not be hindered by the planning cycle (= transparency and agility).

- Changing KPIs will result in faster solution finding and best practices (= cost savings).

- Re-assigning people to value-added activities increases motivation (= retention of talent).

- Business focus, growth and development will be watched closely by boards (= continuity).

- M&A must show where the synergy will be (or is) happening (= accountability, goodwill, impairment).

The increase in returns comes from the effective execution of the strategy and adapting it in accordance with the business environment. By linking the strategy with accounting, and not the other way around (!), project accounting is writing the real success story every month!

Epilogue: Strategic Planning Is About ‘Talks & Figures’

Independent of the accounting, ERP or BI system installed, using project accounting can turbocharge any financial into a strategic business partner without the need for any significant investment. The link to strategic planning becomes evident when FP&A is placed within this bigger picture. By translating the strategic intent of the company into business drivers made visible through the ‘use-of-funds’, the execution of the strategy becomes fact-based, transparent and verifiable: ‘talks & figures’. Just think about it, and add value to your role and company.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.