What are the latest FP&A trends in Australia? Recently, Larysa Melnychuk, the founder and MD of...

We are thrilled to unveil the 2024 FP&A Trends Survey results: an in-depth exploration of the latest developments and trends in Financial Planning and Analysis (FP&A). Over the past eight years, this survey has gathered insights from more than 2,400 finance practitioners worldwide, providing a comprehensive view on the trends shaping FP&A teams.

This year's survey focuses on how FP&A teams help organisations navigate the rapidly changing business environment. These teams are driving more effective, data-driven decision-making by leveraging advanced technologies and data analytics.

On July 10th, the FP&A Trends webinar brought together senior practitioners and thought leaders, offering valuable insights for your organisations to keep ahead of the curve.

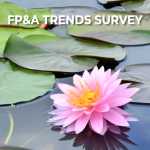

We started the webinar with a summary of the Survey's key findings:

Time Allocation

Only 35% of FP&A professionals' time is spent on high-value tasks like generating insights, while too much time is devoted to data collection and validation.

Data-Driven Decisions

64% of decisions are now data-driven, indicating a 12% increase from the last year. However, 9% of the respondents still face issues with poor data quality.

Forecasting Challenges

63% of respondents struggle to predict beyond six months. For 29%, finalising a forecast takes more than 10 days.

Planning Methods

Rolling Forecasts are gaining traction, and the percentage of companies using them is 49%, up by 2% from the previous year, even though 45% still rely on outdated static methods. Driver-based modelling adoption remains low, with only 9% fully automated.

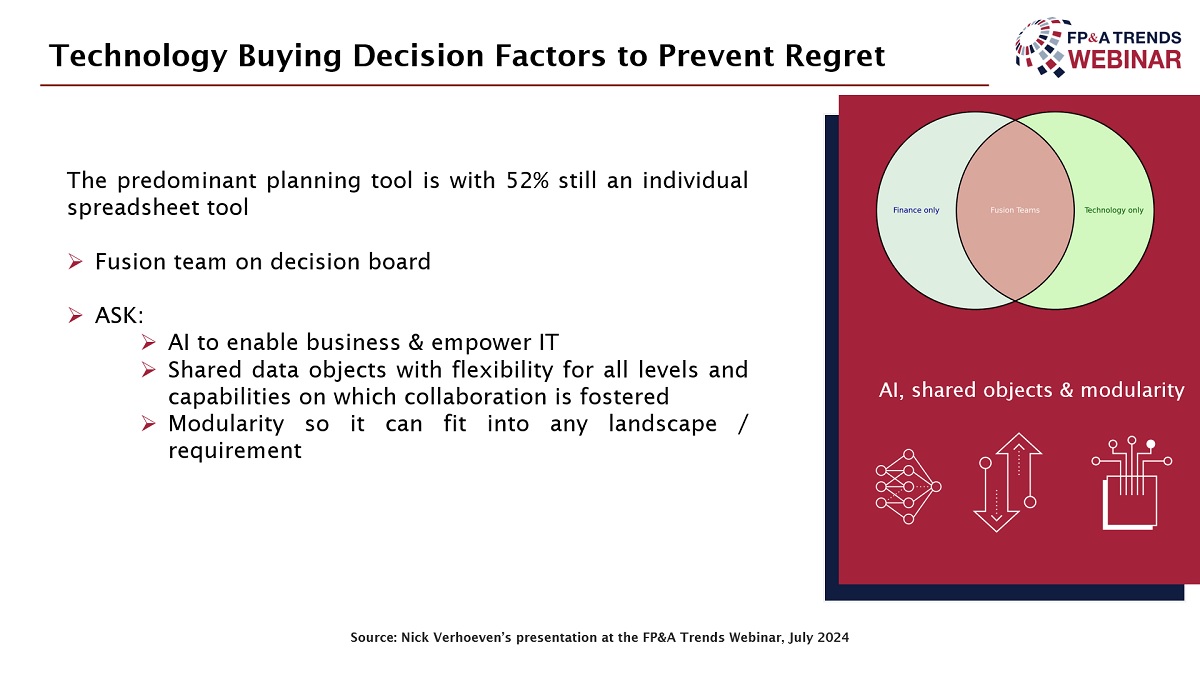

Scenario Planning and Technology

22% can run scenarios within a day, but 21% are still unable to run them at all. Despite technological advancements, 52% of FP&A teams still use Excel for planning, and the adoption of Artificial Intelligence (AI) is low at just 6%.

Team Performance and Skills

Only 19% of teams report to be optimised to perform. Demand for Business Partnering skills has increased by 9% to 50%, highlighting the importance of collaboration across functions.

Figure 1

Leveraging Product Management in Finance for Transformative Organisational Growth

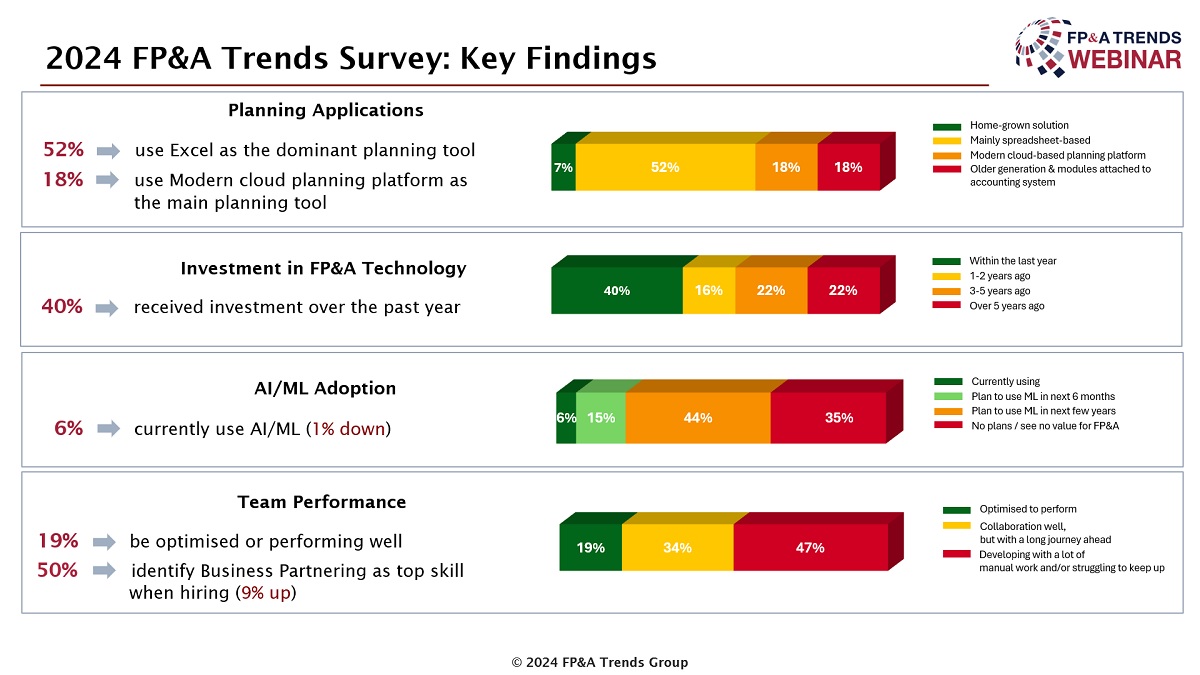

Data as an asset versus data as a product

Michael Huthwaite, Director of Product Management at Walmart, shared insights on how Walmart is applying product management methodologies within its Financial Planning and Analysis (FP&A) function. Over the past two years, this approach has helped Walmart innovate and streamline processes, resulting in improved data management and organisational growth.

Traditionally linked to software, product management has been applied internally at Walmart. Huthwaite’s team was responsible for managing 35 dashboards focused on sales and Profit & Loss (P&L) reports. Common challenges like inconsistent data, high maintenance costs, and long development times were addressed by treating these tools as "products" and adopting a customer-centric approach to improve user experiences.

Rethinking data management through two lenses below was key to this transformation:

- Data as an asset: they focused on standardising and cleaning data for broad use, with lower costs.

- Data as a product: It prioritised user experience, timely delivery, and support throughout the data lifecycle, driving greater engagement and value.

This shift to treating data as a product has helped Walmart reduce discrepancies and enhance efficiency.

Figure 2

Four-in-a-Box Methodology for Better Collaboration

Huthwaite introduced the Four-in-a-Box methodology, a product management framework that promotes collaboration by balancing short-term needs and long-term value creation. This model brings together four key stakeholders:

- Customer: Identifies pain points and defines success.

- Product Management: Develops long-term, sustainable solutions.

- Development: Ensures the product is delivered within available resources and timeframes.

- Certifier/UX Specialist: Validates product quality and ensures it meets immediate supply requirements.

Regular communication between these roles ensures the development of effective products that meet internal customer needs and drive growth.

Outcome-Oriented Success Measurement

He also emphasised the importance of measuring success through outcomes, not outputs. Instead of just delivering features, teams should aim to influence customer behaviours, such as reducing reliance on Excel by 80%. Grouping problem statements also helps Walmart manage its product portfolio by aligning new product introductions with clear stakeholder needs.

Key Metrics for Success

To measure product management success, Walmart tracks:

- Usage: Monitors engagement and identifies areas for improvement.

- Total Cost of Ownership (TCO): Manages the cost of maintaining products, including labour and cloud expenses.

- Defects and Issues: Tracks problems to prioritise the product roadmap.

- Ratings: Seeks five-star user feedback to identify gaps in product satisfaction.

This approach has enabled Walmart to build a more efficient and effective product portfolio.

Conclusion

Michael Huthwaite’s presentation offered valuable insights into how Walmart leverages product management principles to drive transformative growth. By treating data as a product, utilising the Four-in-a-Box methodology, and focusing on outcomes over outputs, Walmart has been able to overcome common data management challenges and set a strong foundation for continued innovation.

The polling result that followed Michael’s presentation showed strong support for FP&A Business Partnering, with 44% of participants already running integrated models and 34% planning to implement them. Huthwaite concluded by underscoring the importance of supporting customers and partners while acknowledging the challenges effectively.

Figure 3

Why Is FP&A Still Spending 45% of Their Time on Non-Value-Adding Activities?

Michael emphasised the need to focus on outcomes and Objectives and Key Results (OKRs) to reduce the number of non-value activities. By shifting to understanding customer and business user behaviour, FP&A can strategise product and service delivery to target meaningful results. However, despite incremental improvements, the increasing volume of data presents a continuous challenge.

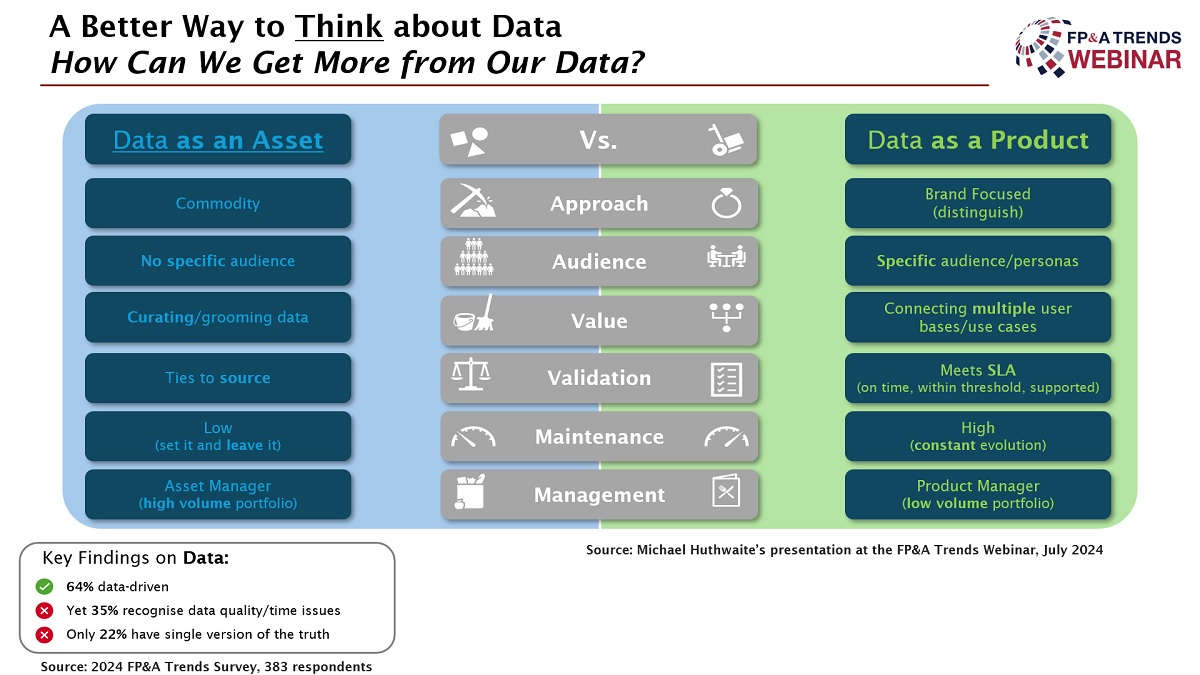

Nick Verhoeven, Solutions Manager in Planning and Analytics at SAP, highlighted that this issue persists because of human nature and the "can-do" mentality. People tend to solve problems individually, even if data collection and validation processes are inefficient. This approach delays larger organisational improvements, such as harmonising data collection, which could reduce non-value-adding activities over time. The tendency to prioritise immediate solutions over long-term efficiency is a key reason the statistic remains high.

Data-Driven Decision-Making

Nick delivered an insightful presentation on the history and future of data-driven decision-making. He kicked off his speech by reflecting on the pioneering work of Florence Nightingale in the 1800s, highlighting her use of data to improve hygiene and reduce mortality in hospitals. This historical example demonstrates the core of data-driven decision-making — using data insights to solve real problems and drive change.

Current Trends in Data-Driven Decision-Making

Nick emphasised that while organisations today have made significant progress in leveraging data for decision-making, many challenges remain. He cited the 2024 FP&A Trends Survey, indicating that 64% of respondents now rely on data for decision-making, a 12% uptick from the previous year. However, data quality continues to be a major hurdle.

Despite advances in technology, many companies still face barriers to improving the accuracy and usability of their data. Nick also highlighted a positive cultural shift: only 21% of respondents view cultural resistance as a barrier to data-driven decisions. This underscores the importance of fostering a data-centric culture to ensure organisational alignment.

Challenges and Opportunities

Nick pointed out that the real challenge is not the lack of data but ensuring its quality and developing a common taxonomy for its use. He urged a shift in mindset, stressing the need for better collaboration between finance and technology teams to improve data-driven processes. In addition, Nick cited that only 10% of organisations involve IT departments in managing data duties, while 49% assign this responsibility solely to finance.

Bridging the Gap Between Finance and Technology

To overcome these obstacles, Nick recommended creating fusion teams that unite finance and technology experts. This collaborative approach is critical for harnessing the full potential of advanced technologies like AI. By working together, finance and technology can co-own and improve data objects, enhancing data quality and decision-making processes.

Nick’s final advice was to ensure modularity in technological solutions, allowing organisations to integrate AI elements and connect to various data sources. This modular approach ensures that new tools fit seamlessly into existing infrastructures, enabling smoother execution of data-driven strategies.

Figure 4

Conclusion

Nick's presentation underscored the importance of integrating both finance and technology for decision-making. By fostering collaboration, improving data quality, and leveraging advanced technologies like AI, businesses can unlock the full potential of data-driven decision-making and drive better outcomes.

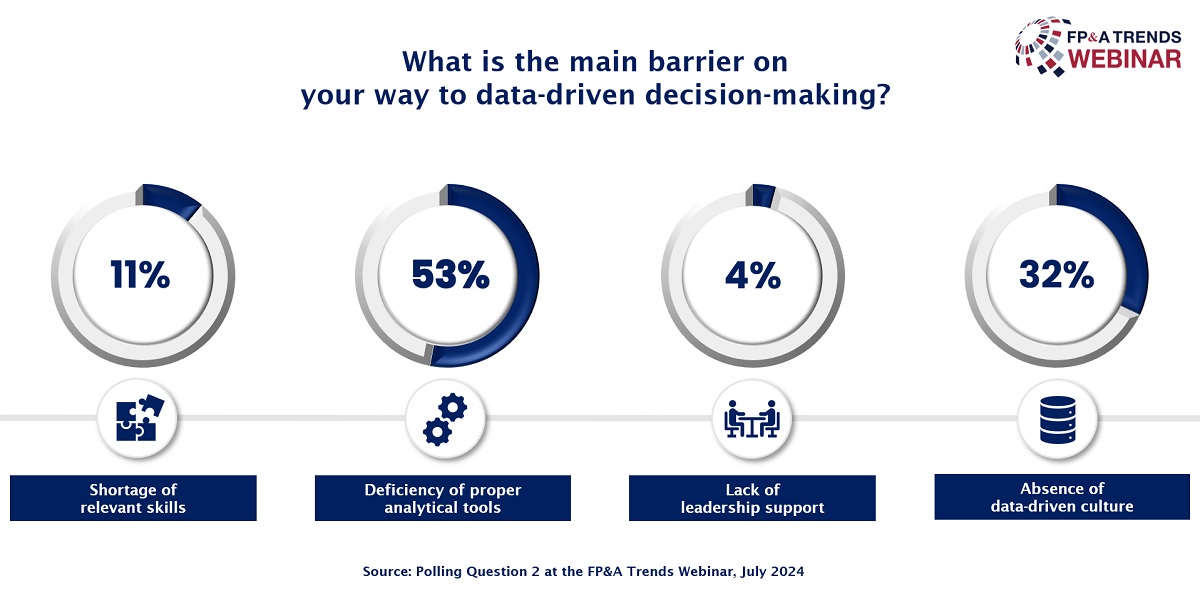

What Holds Us Back in Data-Driven Decision-Making?

In our second poll, participants were asked to identify the main barrier to data-driven decision-making. The results revealed that the lack of proper analytical tools was the biggest challenge, cited by 53% of respondents. Other barriers included the absence of a data-driven culture (32%), a shortage of relevant skills (11%), and a lack of leadership support (4%).

Figure 5

The Adoption of AI and Machine Learning (AI/ML)

The adoption of new technology, such as AI/ML, has slightly declined in recent years, dropping from 9% to 6%. Michael noted that AI/ML has likely passed its initial "hype cycle" and is now stabilising. While expectations were once inflated, the technology is now more mature and is being used in practical, scalable ways. He emphasised the importance of identifying the right use cases to drive adoption and build momentum, suggesting that AI/ML's future remains promising while organisations continue to integrate these technologies.

Nick agreed, highlighting that AI has moved beyond a specialised tool for data scientists. It’s becoming more widely adopted across industries. Nevertheless, companies need to standardise and document successful use cases to accelerate adoption. By showcasing these real-world applications, businesses can guide others toward practical AI/ML usage and foster broader adoption.

The discussion also touched on the "black box" issue, where AI's complexity and lack of transparency have deterred some organisations from fully embracing it. However, as AI becomes integrated into everyday tools like EPM (Enterprise Performance Management) software, this barrier is diminishing, offering hope for increased adoption in the future.

Conclusion

Michael Huthwaite expressed his gratitude for the comprehensive Survey by FP&A Trends Group, noting that the challenge now lies in increasing adoption and practical usage of data-led insights. He stressed that with some strategic adjustments, companies are well-placed on their way to fully leveraging data for decision-making and look forward to what the next year will bring.

Nick echoed Michael’s optimism, highlighting the upward trend in data-driven decision-making. He pointed out that culture is no longer a major barrier, signalling progress in how companies approach data. Nick suggested that refining collaboration across departments could further enhance the adoption of data practices, reinforcing a bright future ahead.

Both experts concluded with a positive outlook, emphasising that the shift towards data-driven operations is promising and that is the way forward to bucking the trend!

We would like to thank SAP for sponsoring this webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.