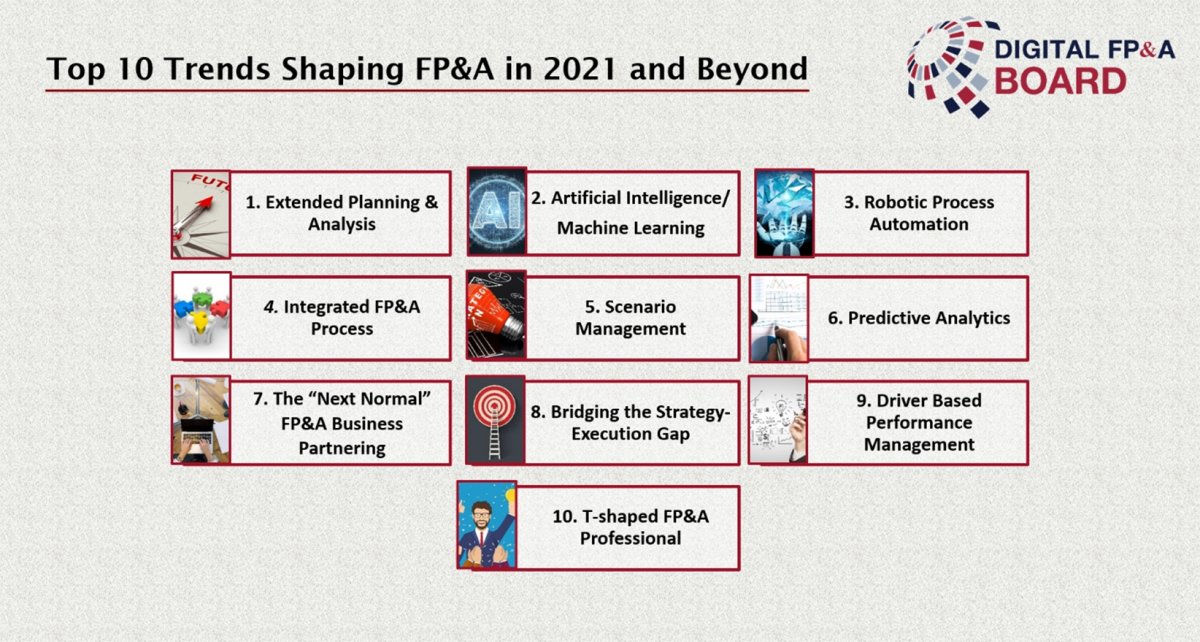

The Digital North American FP&A Board identified the top 10 trends shaping FP&A in 2021 and beyond. The discussion was led by an experienced panel of senior FP&A professionals from across multiple industries. This article summarizes all featured presentations.

The Role of FP&A Technology: Taking confident decisions

Pras Chaterjee, Senior Director at SAP, kicked off the discussion and talked about extended planning and analysis (xP&A) and the role of technology (specifically artificial intelligence (AI) and machine learning (ML)) in FP&A and forecasting.

Currently, Corporate Performance Management is a top-down driven planning strategy that focuses on management of performance and is entrenched in the office of the CFO. Pras defined xP&A as the ability to integrate and bridge financial & operational plans. Every department plans – marketers, HR, operations – but FP&A should bring all the plans together.

Integrated planning and forecasting will be much stronger with AI & ML tools. Using the business acumen that FP&A professionals have and marrying that with historical data and machine learning algorithms will produce data-driven forecasts that can be updated continuously. Such tools will also be able to drive a higher degree of scenario planning.

Pras also talked about robotic process automation (RPA). RPA can help automate repetitive planning processes. It can take data files from different actual systems and bring them into a planning tool. This will help free up the time of FP&A professional to focus on the analysis and spend less time on repetitive tasks. Ultimately automation in all forms will enable human beings to focus on high value-added tasks.

Three Key Forces Shaping FP&A Digital Transformation

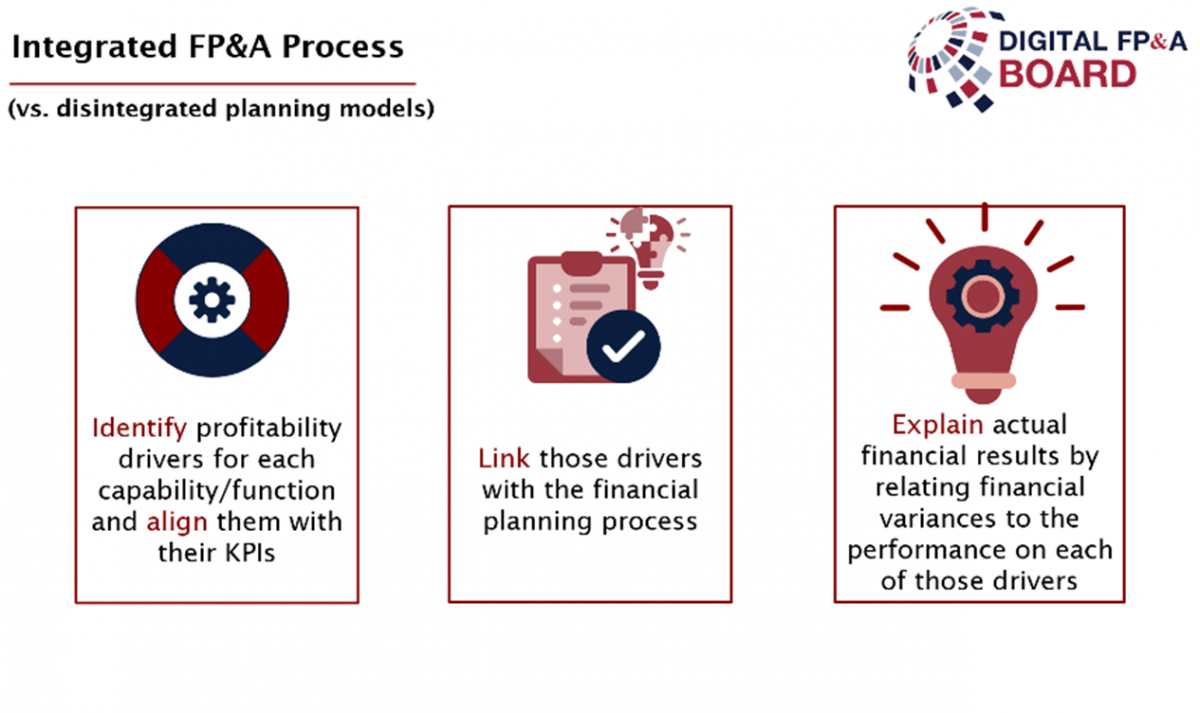

Alex Beired, Global Director Financial Planning & Analysis at Guardian Industries, talked about Integration, Scenario Management and Predictive Analysis. He emphasized the importance of integrated financial planning as opposed to financial planning and analysis in silos. Integrated financial planning can help identify profitability drivers for each function, link those drivers with the right financial processes and KPIs and finally explain the financial results by relating the variances to the performance on each of those drivers.

According to Alex, the main purpose of a successful FP&A professional is to be a business partner to the various capabilities in the organization and help the owners of the capabilities understand the impact of everything they do considering the limited resources that they have. A key input for being a successful business partner is to plan for various scenarios instead of one single financial forecast. Financial forecasts have a risk of becoming obsolete soon. As opposed to that, developing different plans for different scenarios using predictive models and key input drivers will deliver better predictive analytics and forward-looking insights to partners.

FP&A Business Partnering in the Next Normal

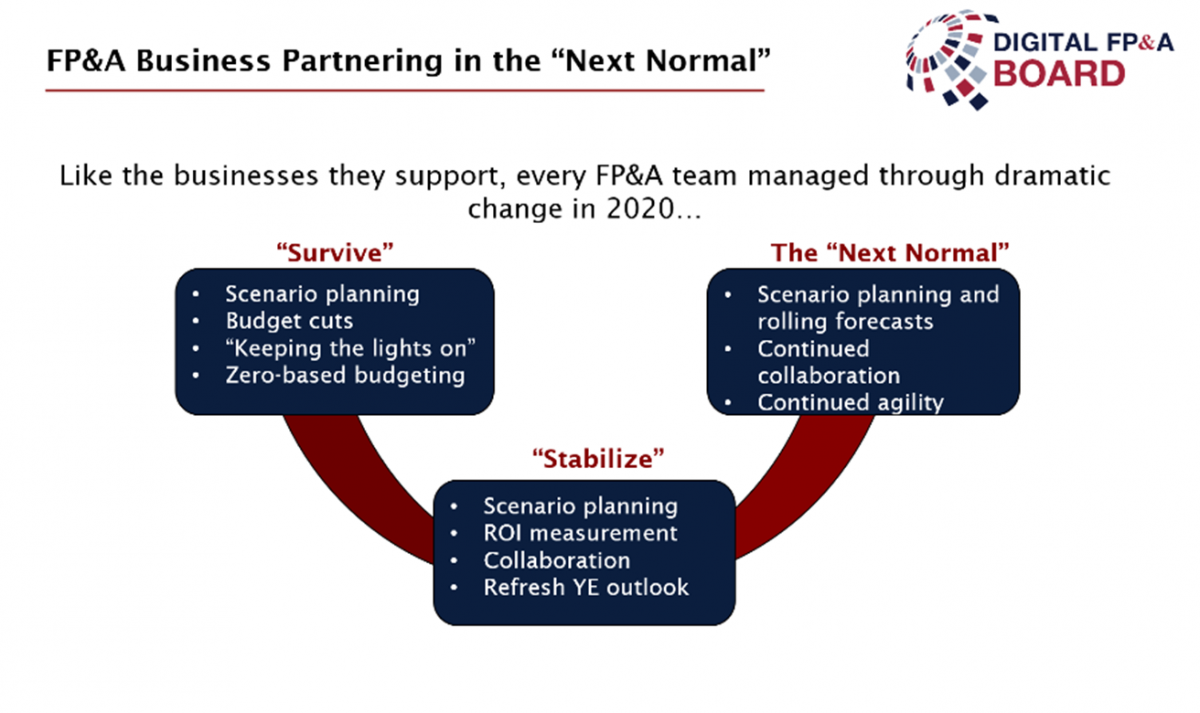

Christopher Saxe, Chief Financial Officer at SecZetta, talked about business partnering in the New Normal, especially in the context of the pandemic in 2020. Christopher started reflecting on 2020 by dividing it into three phases.

Phase 1 was the start of the pandemic. Everyone was in the ‘Survive’ phase which was characterized by a lot of scenario planning and a focus on keeping the lights on. This phase then transitioned into Phase 2, the ‘Stabilize’ phase which included taking a fresh look at the year-end outlook and reassessing the returns on investment on some projects which looked lucrative in a pre-pandemic era. These two phases saw FP&A professional display a lot of adaptability and this should help us transition into Phase 3, the New Normal phase where FP&A professionals add value via continued collaboration and continued agility in delivering scenario planning and rolling forecasts.

All FP&A professionals operated in a crisis mode through 2020 but we cannot do that forever. The answer to delivering more value in uncertain situations is therefore automation. FP&A professionals need to ensure that data warehouses and processes are mature, and the change is being driven cross-functionally.

Integrated Business Planning at Cargill Cocoa & Chocolate

Marc de Haas, Global Finance Director – Cocoa & Chocolate at Cargill, talked about two trends that he identified in FP&A and integrated business planning.

Trend #1. The strategy execution gap

Strategies are often presented and approved based on multi-year plans an earnings projection. When the forecast cycles hit, the organization ends up focusing on the annual targets for the year and the ambitious targets that were set during the multi-year strategy do not stay so relevant.

To address this gap, organizations need to develop intermediate goals. After defining these intermediate goals, they need to set specific deliverables and accountability to these goals. These intermediate goals can help motivate the organization. By tying these goals into the annual operating plans, companies will help achieve the annual plans without deviating from the multi-year strategy.

Trend #2. Driver Based Performance Management

There is a bias in developing budgets and the tendency to under promise and over deliver on budgets. One way to move away from such budgeting processes is to have a discussion on fact-based input drivers. This ultimately results in a much richer discussion and gives a better outlook of the business.

Combining the trends

To tie in these two trends together successfully, it is necessary to step out of your comfort zone and build a model addressing these concerns. Marc led the development of such a model at Cargill, the model is called the Holistic Failure Management. It is a tool to collect and define all the capabilities and resources that are required to achieve holistic value delivery for the organization. From an FP&A perspective, the ability to develop and deliver such a model is dependent on achieving automation in repetitive tasks and greater accuracy in forecasting using machine learning and artificial intelligence inputs.

The Rise of the T-shaped Professional

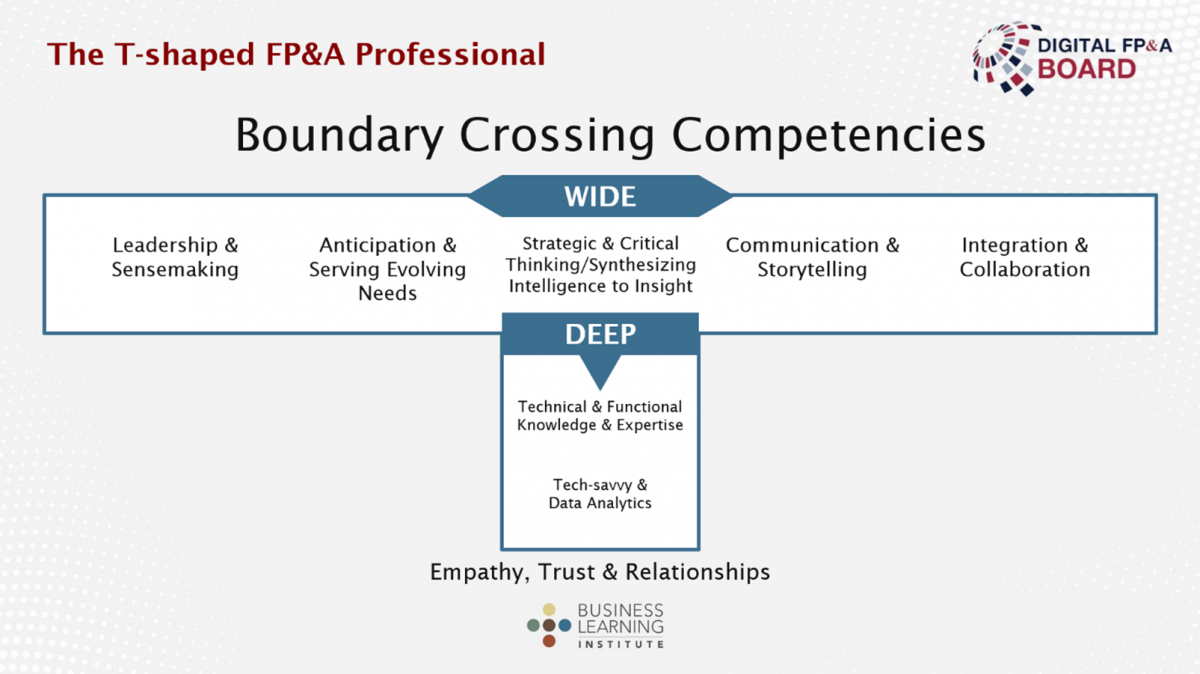

The concluding session was conducted by Tom Hood, Chief Executive Officer at Maryland Association of CPAs & Business Learning Institute.

A T-shaped FP&A professional is an FP&A professional who has boundary-crossing competencies. The core competencies that form the deep vertical part of the T are the core competencies of any FP&A professional and they include technical knowledge, functional expertise and technological savvy combined with data analytics.

However, it is equally critical for an FP&A professional to develop boundary-crossing competencies across leadership, and sense-making anticipation, serving, evolving needs, strategic, and critical thinking. The next step after developing these skills is then synthesizing that intelligence to insight communication and storytelling and then integrating collaborations. All of this has to be done in the context of the fundamental notion of empathy, trust, and relationships.

In summary

The FP&A Board ended with the panellists combining the threads of each of their presentations into one unified conversation that helped the audience paint a picture of what a successful FP&A professional will look like in 2021 and beyond.

We would like to thank our global sponsors and partners SAP and Business Learning Institute for their great support with this Digital FP&A Board.