In this episode of the FP&A Trends Series, Maria Olsson, Group Head of FP&A at Coats Plc...

The first webinar by the FP&A Trends Group in 2023 was focused on identifying the top 7 trends shaping FP&A. The esteemed panellists led the session - Larysa Melnychuk, Diana Groschupp, Roberto Di Matteo, Abdel-Rahman Selmy and Thomas Peff.

The seven trends discussed were distributed across four functions of an organisation and were as follows.

Processes

Scenario Management

FP&A Trends Surveys brought to light that most FP&A departments faced two issues in this regard:

- spending greater amounts of time in low-value activities like data collection and data validation,

- and not being able to run scenarios in real time (or, in some cases, not being able to run them at all).

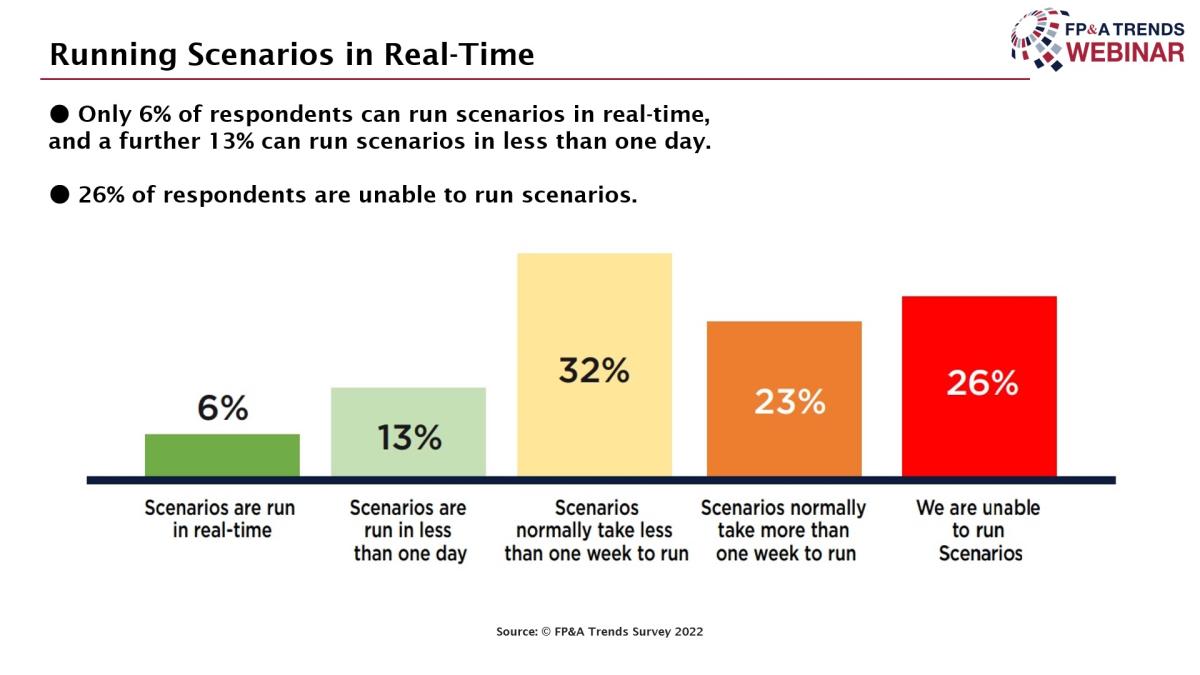

Figure 1

Statistics from surveys over the past four years have shown that high-value activities such as insight generation and driving actions have been devoted the least amount of time consistently over the years by the FP&A teams. Furthermore, only 6% of the FP&A teams worldwide can run scenarios in real time. These two issues combinedly have been affecting the agility of the teams. That makes increased agility a target for most FP&A professionals in the industry.

xP&A

Time of uncertainty is dominating currently. The environment is full of factors that require the FP&A teams to react and adapt quickly to the situations. Thus, organisations need to go beyond Financial Planning and Analysis to Extended Planning and Analysis (xP&A). This trend will help organisations become more agile, efficient, and communicative through the following:

- Monitoring external factors

- Providing speed, accuracy, and selectivity of data

- Human talent care

- Inter-department cooperation

- Simplification of business processes

Technology

Inside Analytics 2.0

Analytics will have to dive deeper into the drivers rather than relying on just the P&Ls and Balance sheets. These drivers can be identified using scope expansion to look beyond the current capabilities of FP&A. It will give rise to what will be called the Analytics 2.0 phase. In this phase, the key driver will be the sustainability of the business. The major challenge is that there is hardly any standardised method of measuring sustainability currently.

FP&A Technology 2.0

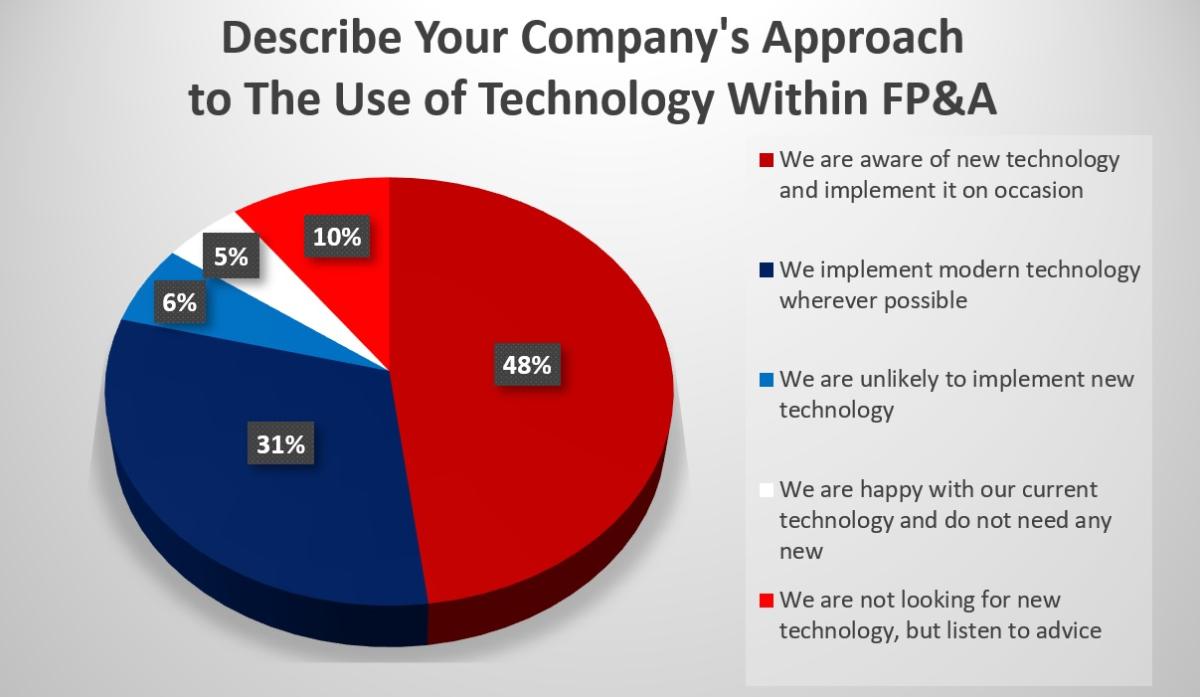

The upcoming technologies in Artificial Intelligence/Machine Learning will have to be used in the best ways possible to support FP&A. Technology will play a key role in Data Foundation, Decision Automation, and Decision Support. As per the responses, 48% of attendees are aware of the new technology for FP&A and implement it on occasion. 31% implement tech wherever possible. Only 5% of the respondents are happy with their current technology solutions. Interestingly, 10% of the webinar participants claimed they were not looking for the newest tech but wanted to listen to advice. The rest 6% are unfortunately unlikely to implement technological advancements in their FP&A departments.

Figure 2

People

Value and Values

The FP&A function will be required to collaborate with the People function in the following four areas to ensure growth:

- Hiring and retaining talent

- Dealing with the shift in job market dynamics

- Embracing more flexible ways of working

- Developing better in-person connections

T-Shaped FP&A Talent Profiles

The skills for FP&A can be broadly bucketed into the following categories:

- Architect,

- Analyst,

- Data Scientist,

- Storyteller,

- and Influencer.

Employees will have T-shaped profiles, where they will have expertise in one area of FP&A but will also be capable of demonstrating the other skills to some extent when needed. Those with T-Shaped skills will be the most sought in the FP&A industry in the coming times.

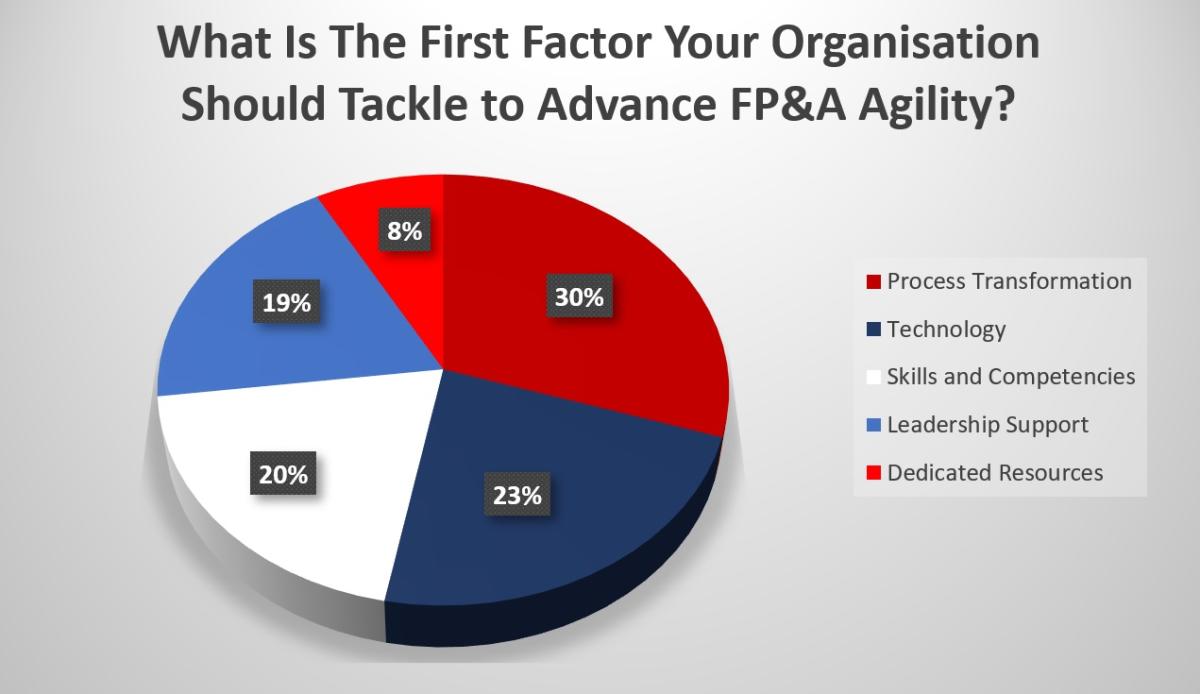

Having discussed the factors determining the agility of the FP&A teams in an organisation, the webinar attendees were asked to answer a polling question. For this purpose, a poll was circulated among the attendees to understand which factors were essential to advance the agility of the FP&A teams.

The poll results were as follows: most respondents (30%) believe that process transformation is crucial for FP&A agility. 23% of attendees voted that technology has the most important role, while 20% and 19% are sure that skills and leadership are the most vital factors contributing to organisational agility. Only 8% believe that dedicated resources are the #1 factor for agility.

Figure 3

Landscape

ESG for FP&A

In order to ensure sustainability, FP&A teams need to expand into and add value to the non-financial functions of the organisation as well. It will ensure greater financial transparency among the different functions of the organisation. The Environmental, Social and Governance (ESG) methodology can become one way to measure the sustainability of businesses. This will create an opportunity for Finance functions to lead the environmental reporting and initiatives.

Conclusion

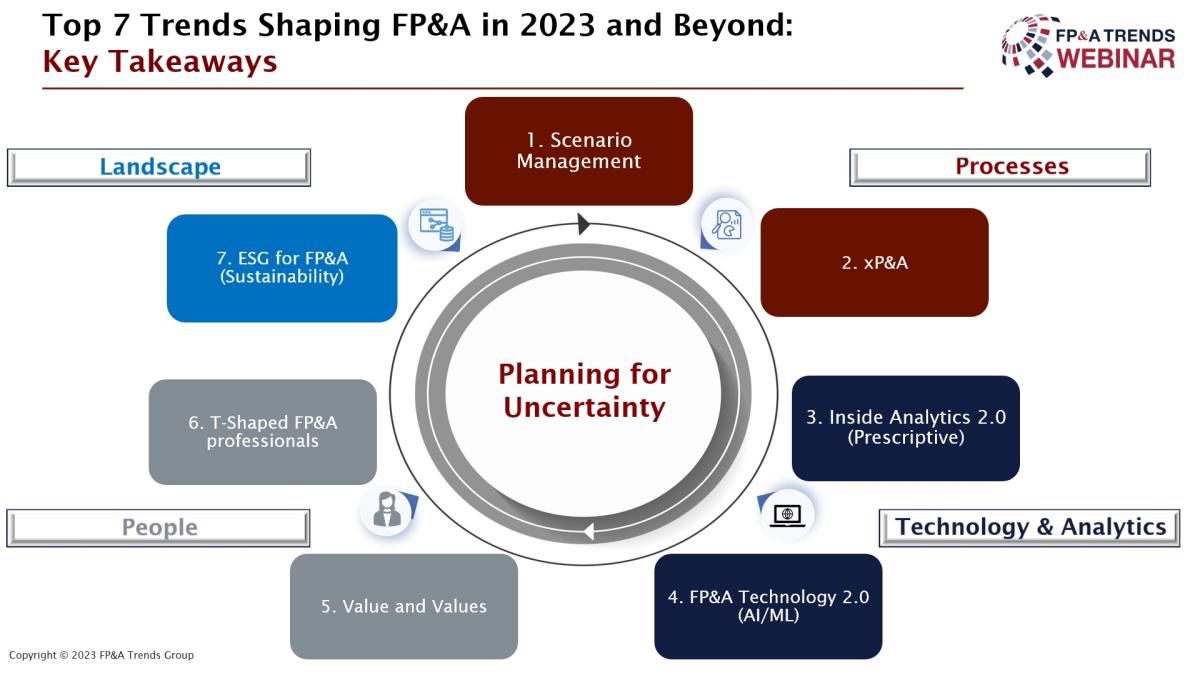

Figure 4

In the picture above, we see the trends shaping FP&A today:

- Scenario Management – the pandemic hit has increased the importance of Scenario Planning by 30X. Thus, running scenarios in as close to real-time as possible will be the goal for the FP&A teams. Running scenarios will not only help the teams analyse the outcomes of it but also help them determine the performance of their systems in these scenarios. It would require changes in the existing reporting infrastructures, adopting a more flexible model structure, and automating the reporting processes.

- xP&A – Extended Planning and Analysis (xP&A) will gain greater importance soon as the attainment of the organisational goals has gone beyond numbers. Organisations are looking to make an impact not just with their bottom line but also through various ideas and cultures that drive the organisation. Thus, the finance functions of the organisations will have to partner with other functions to ensure the synergy of attaining these organisational goals.

- Continued focus on People Planning – the Finance and HR functions of the organisations will have to collaborate to ensure reconciliation and variance analysis of the hiring plans. This analysis needs to be cross-functional and automated so that the scenarios are always considered. Indeed, it should also be made available to all key stakeholders for effective results.

- The growing role of Technology in Finance – the decision-making process in the FP&A teams will be supported by technology in three phases, mainly – Data Foundation, Decision Automation and Decision Support. Technology will provide the data necessary for making decisions, which will be suggested using algorithms that automate this process. Furthermore, technology will also be responsible for proving the decisions' validity by showing the alignment of the actuals with the forecast.

The webinar was insightful for FP&A professionals operating across all functions and levels, as the goal was to analyse the growth of the entire FP&A department. The session has marked the beginning of the year in a manner that will make the FP&A teams want to develop for the better.

We are grateful to Workday for sponsoring this webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.