FP&A professionals are in demand as financial data is becoming more complex. Besides, the FP&A field is constantly changing. To improve the quality of work in the FP&A department a mere analysis of different scenarios is not enough, collaboration and discussion are also required.

FP&A professionals are in demand as financial data is becoming more complex. Besides, the FP&A field is constantly changing. To improve the quality of work in the FP&A department a mere analysis of different scenarios is not enough, collaboration and discussion are also required.

The International FP&A Board enables members from all over the world to discuss trending topics and to work together to find solutions to burning questions. During the Board meetings new trends, skillsets and innovations are presented and analysed and the conclusions are shared with the global FP&A community.

The Launch of New Chapters

In July 2017, the International FP&A Board expanded to Australia to look closely into the key trends and challenges of modern financial planning and analytics in this country. The Board successfully launched three new chapters in Sydney, Perth and Melbourne to become a community of passionate professionals spanning 11 countries, 15 cities and 4 continents.

The latest trends in Financial Planning and Analysis were the main focus of the FP&A Board meetings in Australia. And if in Europe and North America it was a “sleepy business month” with many going on holiday, in Australia it was winter – with business in full swing.

The FP&A Business Environment

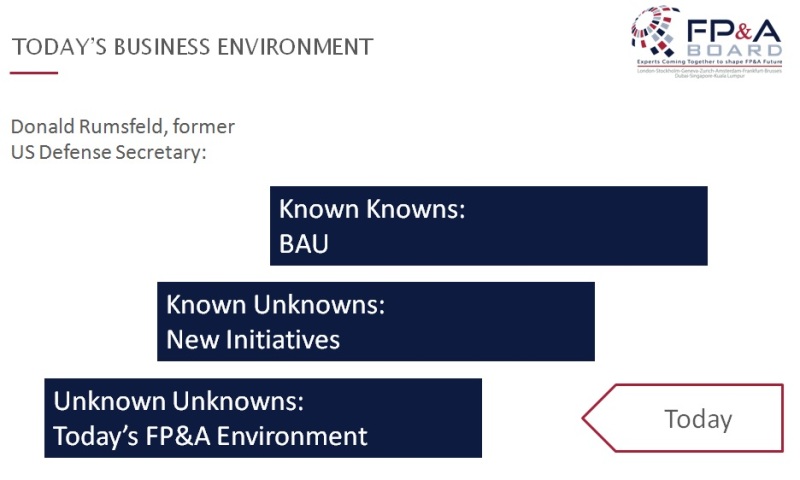

During the meetings Larysa Melnychuk, MD at FP&A Trends Group and Founder of the International FP&A Board, quoted Donald Rumsfeld in order to describe today’s business environment: “There are known knowns; there are things we know we know. We also know there are known unknowns”.

FP&A is very good with dealing with the Known Knowns – this is business as usual or the baseline that can be easily forecasted from the historical trends. The Known Unknowns are a bit more complex, but FP&A is dealing with them reasonably well – these are new projects and initiatives.

However, the FP&A world operates increasingly in the Unknown Unknowns or Black Swans field. A growing percentage of the Board members report that they have had an increasing number of events in their business that could be described as Black Swans (the events of low probability and incredibly high impact).

The Latest Trends in FP&A

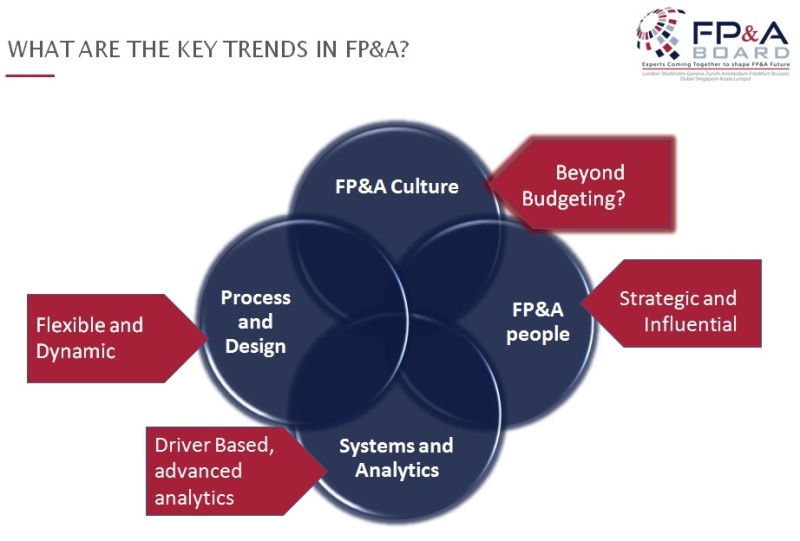

FP&A is constantly changing. So, what are the latest trends in modern FP&A? Let’s take a closer look at each of the trends discussed in Perth, Sydney and Melbourne. As anywhere in the world, Australian finance practitioners see increasing challenges and opportunities of big data in FP&A. However, data quality continues to be the number one challenge. Analytics is becoming more forward-looking, it challenges the traditional culture of judgment and political gaming. The FP&A people are becoming strategic and influential business partners. The level of details is not so important anymore: simplification drives better understanding and quicker decision-making process.

FP&A Culture. As Budgeting does not deliver the results that are expected of it in the modern business environment, FP&A professionals are moving to Beyond Budgeting. It does not mean they are abandoning the budget. Literally, they are transforming the process with flexible budgeting practices, more sophisticated target evaluation and corporate performance management tools. Rolling Forecast that is based on the key business drivers and is implemented through a flexible collaborative system is a good tool that helps to challenge the traditional budgeting culture.

FP&A People. A modern FP&A professional is expected to wear many hats. However, it is next to impossible to find a person who can play the roles of the Architect, the Analyst, the Storyteller and the Influencer at the same time. This makes the hiring process difficult and many companies choose to build FP&A teams where all these roles are executed by the team members. The above-mentioned roles were modified from Mark Gandy’s model. The role of the Influencer was added by the Geneva FP&A Board as one essential in the context of FP&A Business Partnering.

Systems and Analytics. Analytics is not simple and historic anymore; advanced techniques are required as a result. Old models are being replaced by driver-based ones – Excel spreadsheets are not able to adapt to the pace of the changing market.

Process and Design. Processes and design are becoming more flexible and dynamic. There is no one correct recipe for all. the modern FP&A organizations are creative with transforming and designing their processes to meet the requirements of the modern world.

The FP&A Analytics Maturity Model

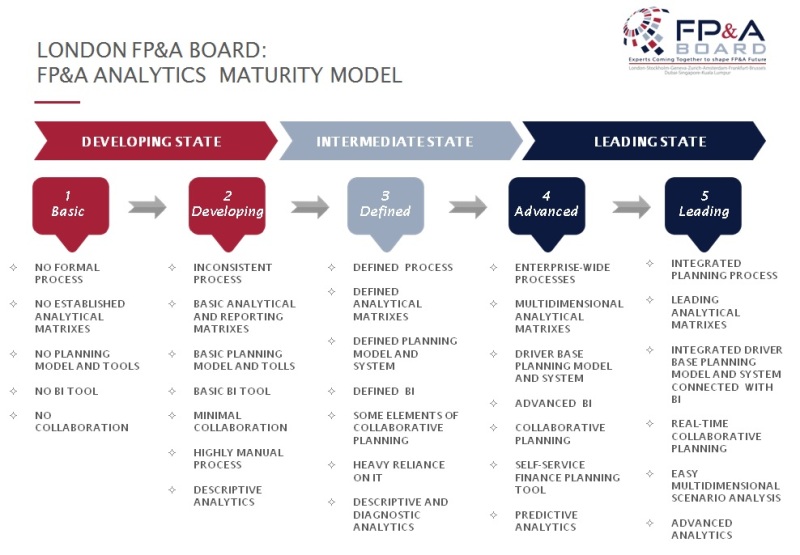

The model was originally developed by London FP&A Board and discussed in many chapters around the globe.

The Australian colleagues were very enthusiastic about the model and shared their thoughts about the key factors for successful analytical transformation. It was not surprising to see that many organizations are still seated somewhere in between of Developing and Defined stages. The key challenges of analytical transformations are traditional business cultures, lack of investments in analytical systems, overuse of Excel, the difficulty of finding and retaining analytical talents.

Afterwards, the FP&A Boards discusses the FP&A Analytics Maturity Model. It consists of three states:

- Developing. Start-ups and those organizations that are in the process of developing their FP&A framework belong to this state. Sometimes, due to “poor management” and other factors the development of an organization stagnates preventing it from evolving further.

- Intermediate. Analytical transformation can stay in this state for many years. At this state, descriptive and diagnostic analytics prevail.

- Leading. Analytics becomes more advanced. The planning system is flexible and driver-based.

Conclusions

The newly launched Australian FP&A Boards arrived at the following conclusions:

- New models are mostly driver-based and dynamic.

- To be quick, modern FP&A professionals lean towards the balanced level of details. The simplification is a big trend: it helps to drive quicker decisions

- Finance takes the responsibility for systems in order to enhance decision-making and forecasting. Heavy reliance on IT departments is one of the biggest barriers to the agile FP&A process

- More and more companies replace Excel-based planning with integrated planning platforms.

- Planning is no longer scheduled, it is on-demand and continuous.

- The Time Horizon is expanded as a result of the Rolling Forecast implementation that is based on a driver-based model and is implemented through a modern system.

The Australian FP&A Board

The Australian FP&A world is very diverse. Perth, located in Western Australia, is more traditional with many local businesses using titles such as “management accounting” and “budgeting and planning” for the function. The CFO is typically called a “General Manager Finance”. At the same time, there is a huge interest in modern FP&A trends, and best practices are utilised. The Perth FP&A Board was attended by 24 finance professionals from local and national companies, including IKEA, General Motors Holden, AGL Energy Ltd and many others.

Both Melbourne and Sydney are very dynamic and innovative with thriving FP&A communities. 23 representatives of such leading companies as GE Capital, ANZ Bank, NAB, etc. attended the Melbourne FP&A Board. In Sydney, 24 finance professionals – among them were representatives of Philips Lighting and Volvo Car Australia – gathered to discuss the latest trends in FP&A.

Rohan Liyanage, CFO at Philips Lighting, shared his insights on the latest trends and developments in modern FP&A. Karl Matacz, CFO at Synergy, delivered a presentation on Synergy’s post-merger planning, budgeting & forecasting journey. Ian Rodgers, CFO at Ramsetreid (ITW Construction), shared his understanding of the latest trends and developments in Financial Planning and Analytics.

About International FP&A Board

The London FP&A Board was created on 19th September 2013 to guide the development and promotion of best practices in financial planning and analysis (FP&A). FP&A Board chapters have successfully been established in 27 cities of 16 countries in Europe, the Middle East, Asia, Australia and North America in order to identify and support new global trends, skillsets, and thought leadership in FP&A.

Our Sponsors

We are very grateful to our global sponsors and partners at Michael Page, one of the world's leading professional recruitment consultancies, and Prevero, a leading Corporate Performance Management (CPM) provider, for supporting the opening of the FP&A Boards in Australia.

Stay in touch with our global FP&A community through the FP&A Club LinkedIn Group and the FP&A Trends resource.

Please do not hesitate to join and contribute to the discussions, posts, and commentaries.