Stefan Spiegel, CFO at ETH Zurich, shared a compelling case study on integrating AI into finance...

The capability to rapidly analyse vast datasets, identify trends, and forecast future outcomes has shifted from a competitive advantage to an essential requirement. Artificial Intelligence (AI) is reshaping Financial Planning and Analysis (FP&A) by automating routine processes, delivering real-time insights, and enabling faster, more informed decision-making. It’s no longer about merely staying competitive; it’s about leading the way.

The key challenge lies in developing the expertise to fully leverage AI's potential. The panellists from Ion Beam Applications SA, DB Regio, Eurostyle Systems and Jedox discussed key strategies and practical tips for building this expertise during our recent Digital EMEA FP&A Circle. The article below covers key takeaways from this session.

Laying the Foundation for AI in Finance

In a recent presentation, Stephane Levratti, VP Group Financial Performance at Ion Beam Applications SA, shared an insightful case study on building a foundation for AI, drawing from his experience. With 25 years in FP&A across industries, including 15 years with a Belgian medical device company on the Euronext stock exchange, Stephane explored the essentials of implementing AI, focusing on the following pillars.

Three Core Pillars: People, Data, and Technology

Stephane began by outlining the three pillars crucial to AI implementation: people, data, and technology. Each area requires careful attention as AI adoption involves significant Change Management.

1. People: Preparing Teams for AI Adoption

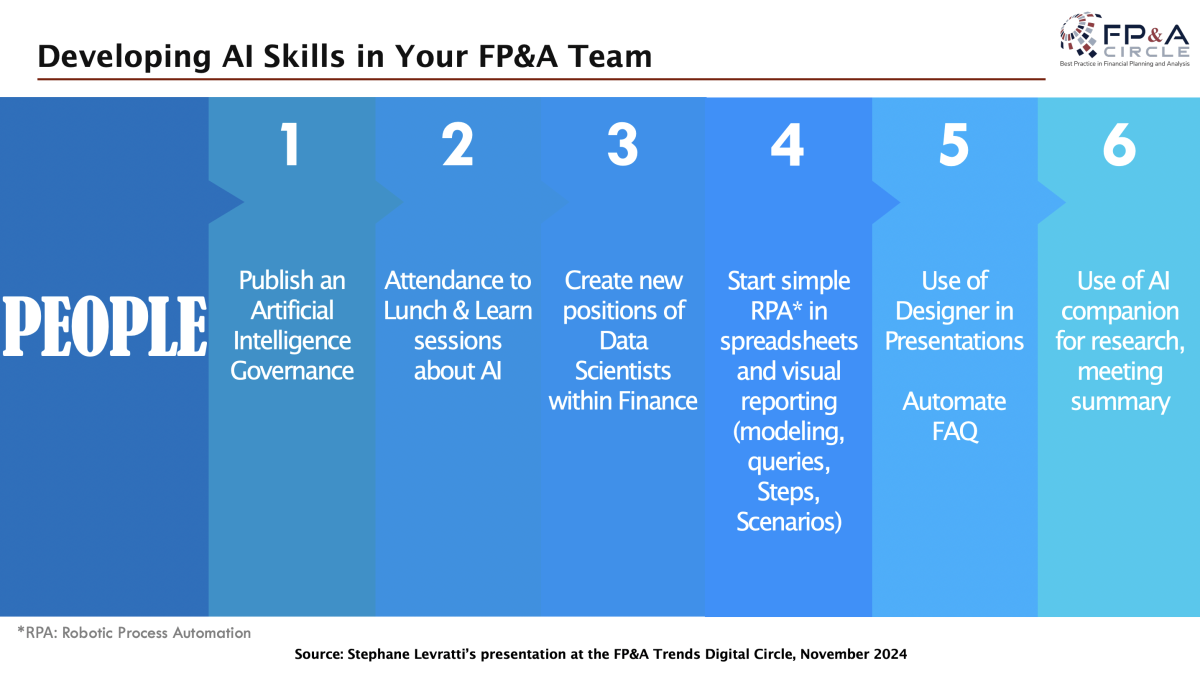

Figure 1

The human aspect of AI adoption cannot be overlooked. Stephane’s team took several steps to prepare employees for AI’s transformative effects:

- AI Governance: Establishing governance protocols was a priority. These protocols clarified acceptable uses of AI and restricted certain applications to ensure security and compliance.

- Education and Training: Stephane’s company introduced employees to the potential of AI through a partnership with the Vlerick Business School. It helped bridge knowledge gaps and foster a culture of curiosity and adaptability.

- New Roles: As AI brings new demands, they created roles like Data Scientists within the finance team to support the integration of AI.

- RPA Implementation: Implementing Robotic Process Automation (RPA) in FP&A processes allowed the team to streamline tasks, increasing efficiency. Despite a 13% annual growth rate, the team was able to maintain the same staff levels due to this automation.

- Leveraging AI Tools: AI tools for presentations, chatbots for FAQs, and other applications are now frequently used to boost productivity. AI even assists in meeting summaries, saving valuable time and helping FP&A professionals focus on strategic tasks.

2. Data: Ensuring Quality and Governance

Data forms the backbone of any AI initiative. Stephane emphasised the need for meticulous data management and outlined the following suggestions:

- Data Monitoring and Internet of Things (IoT): Most revenue in their company is service-driven, which means they start with the machines they monitor and sell. They introduced IoT on these machines to reduce failure rates, enabling preventive maintenance—a critical benefit for financial forecasting and model accuracy.

- Data Governance: By instituting clear responsibilities for master data, they enhanced data reliability, which was vital for ERP integration and financial forecasting.

- Financial Model Redesign: Transitioning from Excel-based models, Stephane’s team integrated their models into ERP systems. This shift enabled more sophisticated Scenario Analysis and data-driven decision-making.

- Data Cleaning: A common challenge in data-heavy environments, data cleaning, became a crucial focus. This approach minimised complications during ERP upgrades and ensured data integrity.

3. Technology: Enabling AI-Driven Transformation

With people and data management systems in place, Stephane’s team focused on the technological backbone of their AI strategy:

- ERP Upgrade: They embarked on an ERP upgrade to incorporate advanced planning, group consolidation, and scenario capabilities. This foundation supported other advanced AI integrations.

- HR System Upgrade: Workforce planning was added to the upgraded HR system to track costs and align with AI-driven financial planning.

- Chatbots for Efficiency: Chatbots now handle approximately 50% of recurring inquiries, allowing FP&A staff to focus on more strategic tasks.

- Enhanced FP&A Solutions: AI-automated variance analysis helps streamline processes while human oversight ensures accuracy. Such advancements free up time for high-value analysis while maintaining operational precision.

- Future Plans: Looking ahead, Stephane’s team is exploring the use of Generative AI (GNI) to provide personalised insights and Scenario Planning capabilities for internal stakeholders.

In conclusion, Stephane’s case study on AI implementation offered a structured approach to driving AI adoption in finance. With a clear vision and a commitment to continuous improvement, organisations can leverage AI to optimise operations, drive decision-making, and, ultimately, enhance their strategic positioning.

Which AI Tools Are the Most Used in FP&A?

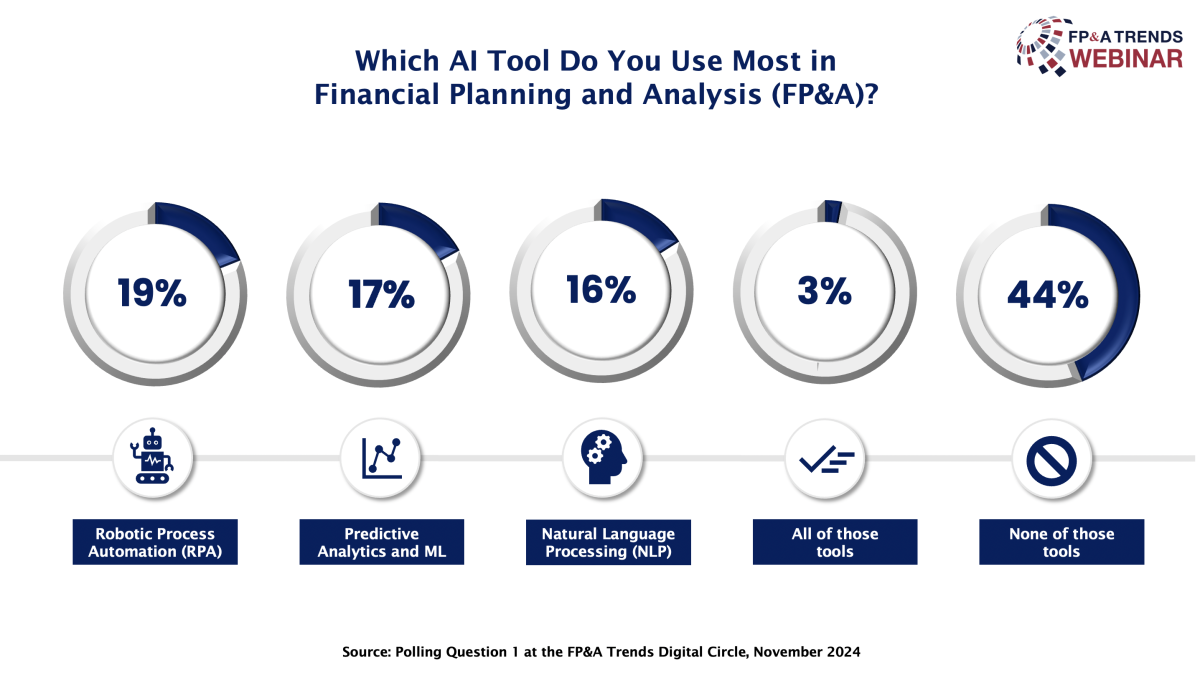

The first poll on the most-used AI tools in FP&A shows that:

- RPA (Robotic Process Automation) is used by 19% of respondents.

- Predictive Analytics and Machine Learning are used by 17%.

- Natural Language Processing is used by 16%.

- All of those tools are used by 19%.

- None of those tools is used by 44% of respondents

Figure 2

Navigating Change in AI for Finance: Insights from Eurostyle Systems

Mathieu Darne, CFO at Eurostyle Systems, discussed the challenges of implementing AI in finance, focusing on managing organisational change. Eurostyle Systems, an automotive company, exemplifies the impact of AI in finance. Mathieu explored strategies for aligning teams, executive leadership, and stakeholders toward the shared goal of AI integration. He likened this process to a significant shift beyond the digitalisation wave of recent years.

The Challenges of AI in FP&A

Introducing AI in FP&A presents unique challenges, especially concerning trust in data-driven forecasting. For CFOs, accustomed to setting precise financial guidance, transitioning to AI-generated budgets may cause unease. Employees who’ve followed traditional budgeting processes for years may feel similarly wary. Mathieu highlighted how this shift disrupts established workflows, creating mixed reactions and sometimes even resistance. He shared candid feedback from various CFOs on AI integration:

- One CFO viewed AI as a “black box,” emphasising the need for transparency and understanding before adoption.

- Another saw AI as “magical”, but expressed caution over its complexity.

- Some acknowledged AI as the future but preferred to let others adopt it first.

- One CFO firmly opposed AI, viewing the finance controller’s role as irreplaceable because of deep and nuanced understanding.

- In contrast, another CFO welcomed AI eagerly, envisioning it as a solution for real-time budget updates and efficient forecasting.

Mathieu’s findings underscore the variety of perspectives that AI evokes, reflecting the reality that each organisation will encounter diverse reactions.

Addressing Scepticism and Building Support

Mathieu recommended opening the “black box” by making AI processes more transparent for those sceptical about AI. He suggested enlisting AI experts to explain how algorithms work in accessible terms, sharing use cases, and allowing hands-on testing. By demystifying AI and showing its accuracy, finance teams may better appreciate its value. Mathieu stressed that AI, like human staff, improves over time and should be given room to evolve.

However, launching a large-scale AI initiative requires robust Change Management. Mathieu advised organisations to prepare meticulously when rolling out AI across multiple levels and regions, emphasising that cultural adjustments are crucial for success.

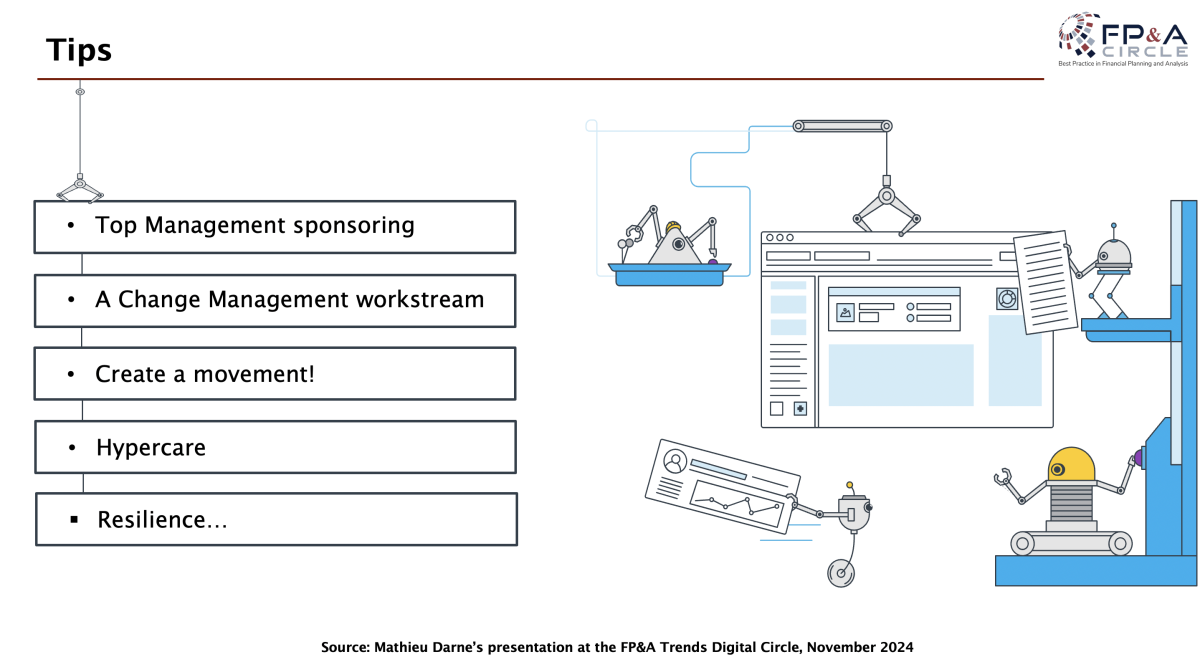

Change Management Tips for AI Integration

- Top Management Sponsorship: Gaining support from executive leadership is essential to legitimise and promote AI initiatives.

- Dedicated Change Management Team: Including a team focused on Change Management helps address resistance and supports a smoother transition.

- Creating a Movement: Promoting the AI project through internal networks and events helps build acceptance. Sharing success stories and highlighting AI’s benefits encourages a positive view.

- Reaching the Tipping Point: Engage at least 20% of the organisation to create momentum and drive overall alignment with AI objectives.

- Hypercare Service: Set up a monitoring and support system to quickly address issues during deployment, ensuring that teams feel supported.

Mathieu emphasised resilience as the key trait needed for success, as resistance and setbacks are inevitable. By fostering an open, supportive culture around AI, finance teams can overcome these challenges and achieve transformative results.

Figure 3

Mathieu concluded with optimism, asserting that AI’s role in FP&A is here to stay, and it will continue reshaping finance. With careful planning and a strong commitment to Change Management, organisations can navigate the journey to AI integration and harness its potential for improved forecasting and decision-making.

What Skills Won’t Be Replaced by AI?

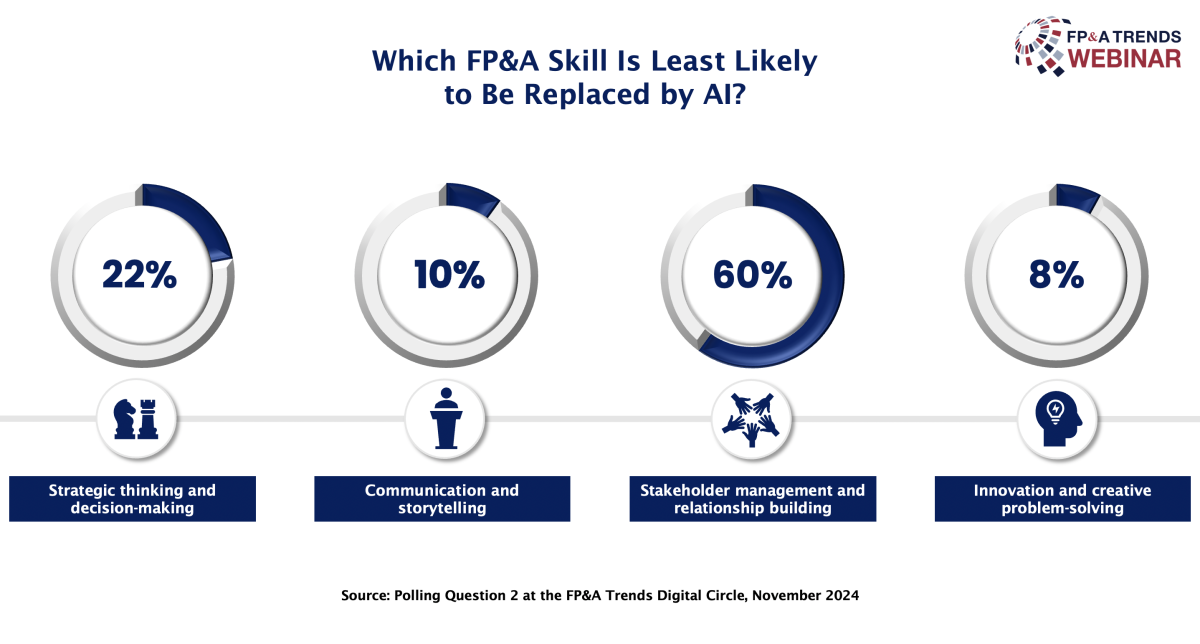

In our second poll, participants were asked which FP&A skill is least likely to be replaced by AI. The results were as follows:

- Stakeholder management and relationship building were seen as the least likely to be replaced, receiving 60% of the votes.

- Strategic thinking and decision-making came in second with 22%.

- Communication and storytelling received 10%.

- Innovation and creative problem-solving were viewed as the least at risk, with only 8% selecting it.

Figure 4

Leveraging Data for AI in a Legacy Company

Tanja Schlesinger, VP One Source at DB Regio Ag, a subsidiary of Deutsche Bahn, shared insights into the company’s journey toward AI adoption and the crucial role that data plays. DB Regio, a 190-year-old company with a turnover of €10 billion and 40,000 employees, provides mass public transportation through 22,000 trains for over 6 million passengers daily. Tanja highlighted the company’s evolution from steam engines to AI, underscoring the transformative impact of emerging technologies.

Adapting FP&A for the AI Era

Tanja explained that traditional reliance on ERP systems within DB Regio’s FP&A team has become insufficient in a rapidly changing world. The shift toward AI and analytics is necessary to keep pace with dynamic business demands. This transformation began with Business Partnering initiatives that sought to uncover key value drivers, generating vast quantities of data along the way. Transitioning from Excel-based data management to Machine Learning and generative AI, FP&A at DB Regio is now able to produce predictive insights that offer a competitive advantage.

AI’s Value Proposition and Investment Justification

Tanja underscored that AI’s adoption requires significant investment. However, the benefits, such as improved customer centricity, a stronger workforce, and progress toward sustainability goals, justify the cost. She likened AI to a car without fuel if data is absent, noting that high-quality data is essential to AI’s functionality. To fully leverage AI, organisations need to focus on three types of “fuel”: data, processes, and change.

Three Essential “Fuels” for AI Deployment

- Data Quality: Accurate, well-managed data is foundational for AI to yield reliable insights. Tanja questioned whether companies have a reliable metric system for data quality, urging FP&A professionals to adopt continuous improvement processes that ensure data integrity.

- Processes: Many assume data is created solely within applications, but Tanja highlighted that data quality also depends on well-defined, end-to-end processes. Using DB Regio’s train timetable as an example, she explained how punctuality data (a critical performance metric) is sourced from eight different applications. Establishing accountability for data quality across managerial processes ensures consistent and accurate insights.

- Change Management: The shift to AI demands organisational change. Data governance, for instance, is not just a technical endeavour but a transformation initiative. Tanja stressed the importance of having dedicated roles for data management, which help align people, processes, and technology within a coherent framework.

Figure 5

AI as a Catalyst for Organisational Transformation

Tanja likened AI’s impact on the business to the introduction of electricity, which required 30 years to fully integrate into production floors. Similarly, AI will reshape operations, but success hinges on embracing digital transformation holistically. For DB Regio, this journey means evolving into a "true digital champion", where data-driven insights inform decision-making at every level.

Concluding her presentation, Tanja encouraged the audience to guide their organisations through the AI transition, fostering a culture that values and leverages data as a critical asset for the future.

How Good Is Your Data Quality?

The third polling question was about measuring data quality as part of organisational performance management. The results revealed that:

- 32% already measure it and believe that it increases the value of data.

- 55% are in the process of adopting it.

- 13% do not see its importance and have no plans to implement it.

Figure 6

Accelerating AI and ML Evolution in Finance through Technology

In a compelling presentation, Dr. Rolf Gegenmantel, Chief Product Officer at Jedox, explored how AI and ML are transforming finance, emphasising technology's pivotal role in driving breakthroughs in FP&A. Dwelling on earlier discussions about people and data, his session focused on how technology supports these elements and accelerates progress in AI adoption.

An Analogy: Autonomous Driving and FP&A

He began by likening AI's integration into FP&A to autonomous driving. Rolf outlined stages of evolution from manual processes, akin to non-automated cars, to fully autonomous, AI-driven systems.

- Manual Processes: Traditional Excel-based workflows where data is manually collected, refined, and shared.

- Basic Automation: Automated data import, reporting, and workflow support to streamline operations and reduce errors.

- Predictive Analytics: Leveraging AI to identify patterns and generate forecasts, enabling forward-looking insights.

- Digital Twin: A virtual model of the organisation combining financial and operational data, empowering better decision-making by connecting financial outcomes to business drivers.

Three Pillars of AI-Driven Transformation

- Hyper-Automation:

AI and Robotic Process Automation (RPA) reduce manual workloads and improve efficiency. While 41% of FP&A professionals identify excessive manual effort as a major challenge, automation addresses this pain point by eliminating repetitive tasks and reducing errors. - Digital Twin Development:

By integrating financial and operational data, digital twins simulate business scenarios, revealing insights about revenue drivers, cost impacts, and operational efficiency. This holistic approach enables businesses to make informed, data-driven decisions. - Data Accessibility:

Advanced tools like Natural Language Processing (NLP) and AI chatbots democratise data access, allowing users to query systems in conversational language and receive actionable insights. For example, stakeholders can ask questions about performance metrics and receive instant, AI-generated visualisations or summaries.

Evolving Roles and Skills in FP&A

Dr Rolf Gegenmantel emphasised that AI adoption transforms the roles and skills required in finance. The shift from traditional spreadsheet tasks to data-driven modelling demands:

- Data Literacy: Understanding data patterns, identifying bias, and interpreting context.

- Systems Thinking: Developing insights from interconnected data systems.

- Advanced Tools Expertise: Familiarity with statistical tools, Python, and Machine Learning models.

Finance professionals must now master querying and refining data, anomaly detection, and insight generation. These expanded skillsets position FP&A teams as strategic Business Partners.

Current Applications of AI in FP&A

In conclusion, Rolf shared some real-world examples of AI applications that are already enhancing FP&A processes:

- Data Modelling Guidance: Step-by-step AI support to create data models from raw information.

- Time Series Analysis: Automated forecasting using historical data patterns.

- Natural Language Queries: Chatbot-enabled systems for intuitive data access and configuration.

- Generative AI Reports: Automated creation of summaries for dashboards, regulatory reports, and financial statements.

These innovations reduce complexity, empower users without technical expertise, and accelerate decision-making.

Key Takeaways on FP&A and AI Integration

This session highlighted the transformative potential of AI in FP&A, focusing on adaptability, collaboration, and strategic implementation.

- Take the First Step: Stephane emphasised the importance of starting small but deliberately, using AI to shift focus from routine tasks to value-adding activities. Early adoption can help identify gaps and accelerate decision-making, much like the internet did years ago.

- Align Data, People, and Technology: Mathieu stressed the need for seamless integration of these three pillars. While data and people are familiar, adapting to AI technology requires embracing change and fostering a smooth transition.

- Use Technology Wisely: Tanja advocated for strategic AI adoption, prioritising robust data management to mitigate risks and ensure quality-driven outcomes.

- Stay Adaptable: Rolf highlighted the importance of flexibility in education, data harmonisation, and technology integration to keep pace with rapid advancements and achieve meaningful results.

In essence, embracing AI with strategic foresight and adaptability enables organisations to unlock their full potential in transforming FP&A processes.

This Digital EMEA Circle was proudly sponsored by Jedox.

To watch the webinar recording, please follow this link.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.