The 13th New York FP&A Board convened on March 11, 2025, to explore the evolving synergy between Artificial Intelligence (AI) and human expertise in financial planning and analysis (FP&A). 27 finance leaders from Citizens, AB InBev, IQVIA, Omnicom Group, Ultimate Medical Academy, Colgate-Palmolive, Iberia Foods, and other leading companies gathered in the beautiful Michael Page Office. The discussion revolved around the potential, challenges, and real-world applications of AI in FP&A, highlighting diverse perspectives from industry professionals.

This meeting was proudly sponsored by SAP in partnership with Michael Page.

Introduction

The session began on a human note, with participants sharing a single word to describe their feelings about AI’s impact on FP&A. The responses revealed a wide range of emotions, from excitement and transformation to caution and anxiety. Notably, terms such as "productivity" and "transformation" reflected professional experiences, while the broader spectrum of words—from “exciting” and “inspiring” to “unknown” and “scary”—indicated concerns about AI’s broader implications.

Figure 1: New York FP&A Board №13, March 2025

Key Topics Discussed:

- Two Branches of AI for FP&A: Machine Learning & Generative AI

- Challenges and Opportunities in AI Adoption

- Human and AI Collaboration in FP&A

- Practical AI Applications and Case Studies

- Modern FP&A Technologies with Embedded AI Capabilities

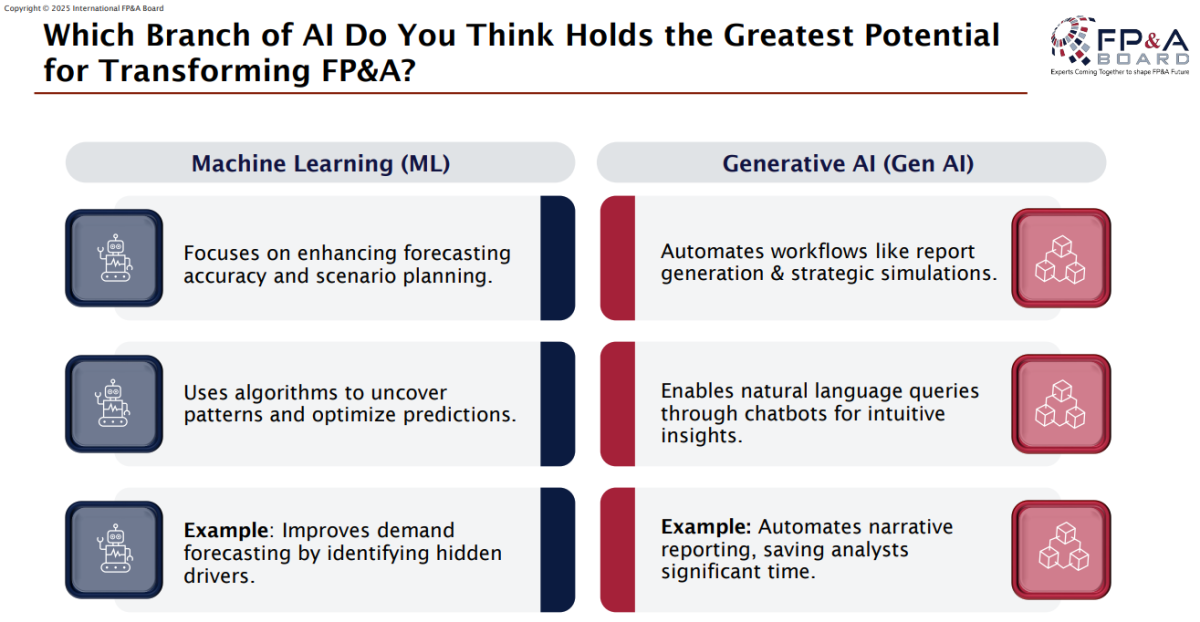

Before delving into a more detailed discussion, the participants established some definitions. To answer the question of which branch of AI holds the greatest potential for FP&A, they first needed to define the branches of AI—Machine Learning and Generative AI.

Figure 2

Challenges & Opportunities

The discussion identified key challenges and opportunities in AI adoption for FP&A:

Challenges:

- Adoption Variability: Companies vary significantly in their openness to AI, with some being early adopters while others remain cautious.

- Regulatory & Control Issues: AI’s "black box" nature raises concerns about control and governance.

- Data Requirements: Effective machine learning models require vast amounts of high-quality data, which many companies lack.

- Accountability for Errors: It remains unclear whether responsibility for AI errors lies with users, data scientists, or system designers.

- Forecasting Limitations: Identifying key drivers and analyzing AI-generated results poses challenges.

- Data Security Risks: AI implementation could expose sensitive financial data to breaches or unauthorized access.

- High Costs: The expense of AI tools and their integration remains a barrier for many businesses.

- Implementation Expertise: AI adoption requires a blend of data science and finance expertise, which is often scarce.

- Understanding AI’s True Value: AI should be leveraged not just for automation but for learning, creativity, and complex decision-making.

Opportunities:

- There has been more than significant progress. While early AI adoption focused on revenue forecasting, today’s AI-driven solutions can generate entire P&L statements.

- Advances in AI are improving predictive accuracy, freeing FP&A professionals for higher-value strategic work.

- AI’s role in risk assessment and anomaly detection is expanding, offering new ways to enhance financial decision-making.

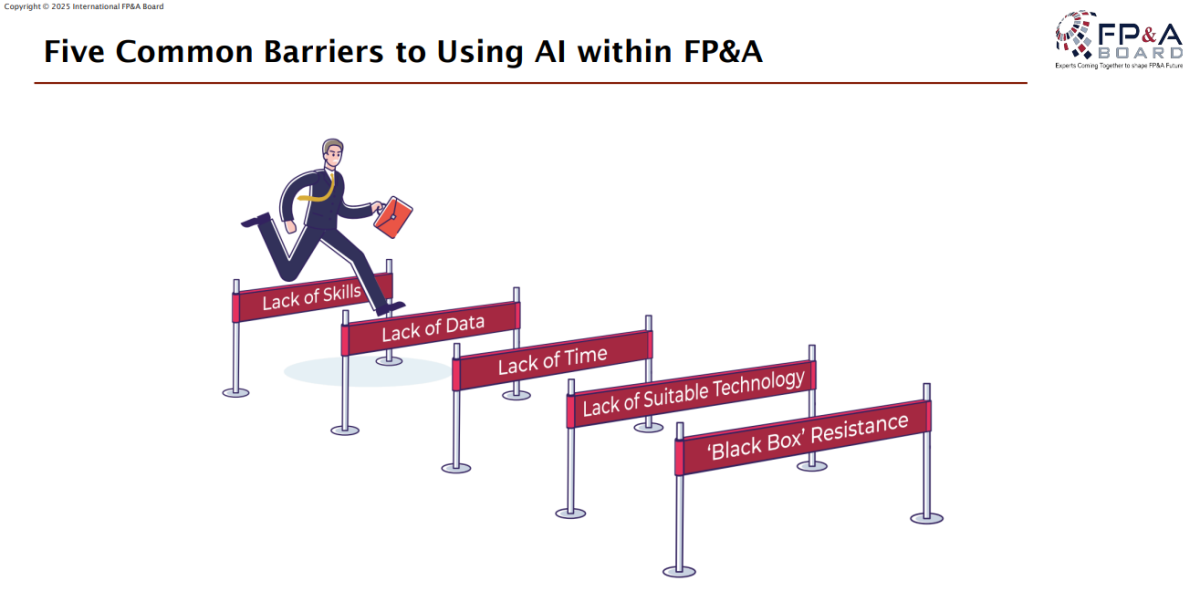

Figure 3

The meeting participants discussed various levels of AI implementation in their organizations.

Surprisingly, less than half of the organizations were estimated to be actively using AI in the FP&A process. The estimate by the New York FP&A Board members was similar to those made by other International FP&A Board chapters. However, the reasons varied, with one of the most significant being a lack of professionals. AI implementation in FP&A requires dual expertise in both finance and technology, a skill that is in growing demand.

Human and AI Together: Key Considerations

The discussion included real-world AI applications in FP&A, categorized into two primary functions:

- AI as a Business Partner: AI supports strategic decision-making, scenario planning, and forecasting.

- AI as a Back-office Function: AI optimizes accounts payable and receivable processes, automating routine financial tasks.

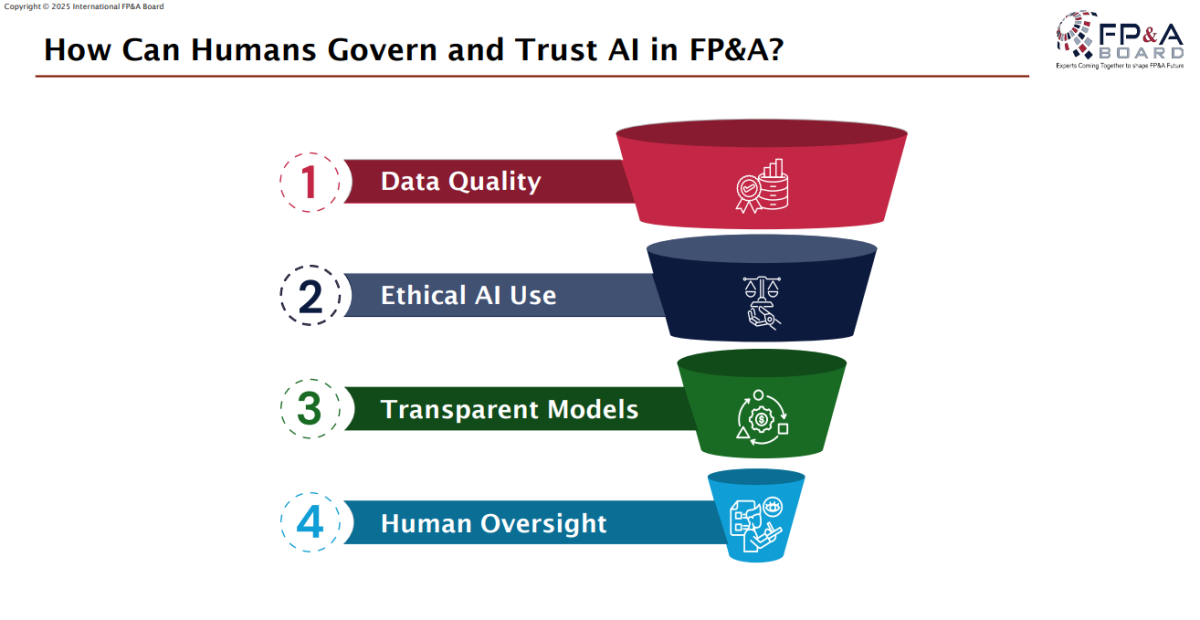

Modern FP&A tools are increasingly embedding AI capabilities, offering practical benefits in workflow automation, predictive analytics, and financial modeling. However, many believe that human-AI interaction should also include additional layers such as supervision, ethics, and risk control.

Figure 4

Small Group Discussions

Participants were divided into groups to discuss specific AI applications and challenges.

Figure 5: Group work, New York FP&A Board №13, March 2025

Group 1: Generative AI

Participants highlighted its potential in kickstarting financial planning processes, generating high-level analysis narratives, enhancing audit reports over time, managing data lakes, and providing targeted marketing insights. However, the discussion also underscored key challenges, including trust in data inputs, concerns over output quality, security risks, and the growing need for AI-trained finance professionals to ensure effective implementation and oversight.

Group 2: Machine Learning

Participants explored various ML use cases, highlighting its potential to enhance forecasting and decision-making. They discussed the importance of ensuring scalable historical data collection and implementing robust data warehousing solutions to support AI-driven insights. The group also stressed the value of partnering with AI solution providers to leverage their expertise and drive innovation. Overall, the discussion centered on how ML can create value-added advancements in financial planning and analysis.

Group 3: Human and AI Collaboration

Participants emphasized starting with "low-hanging fruit" AI applications that offer quick wins, such as automating routine tasks. They discussed using AI to validate and enhance human financial analysis, ensuring greater accuracy and efficiency. The group also explored identifying AI usage within different business units to maximize its potential across the organization. Balancing AI implementation with existing organizational processes was another key point, as the group recognized the importance of integrating AI smoothly without disrupting workflows.

Figure 6: Group work, New York FP&A Board №13, March 2025

Conclusion

AI is already reshaping FP&A, albeit at different levels of maturity across companies. While predictive modeling has shown early successes, the real return on AI investment will likely stem from the efficiency gains that free FP&A professionals for strategic decision-making.

Interestingly, similar themes and concerns emerged in prior FP&A Board discussions in London, suggesting that AI’s impact on finance is being perceived similarly across global markets.

Figure 7: New York FP&A Board №13, March 2025

The meeting concluded with a structured discussion led by the host, Larysa Melnychuk, CEO of FP&A Trends Group and Founder of the International FP&A Board, who guided participants through key takeaways and next steps for AI adoption in FP&A.

AI’s role in FP&A will continue to evolve, demanding a careful balance between technology and human expertise to maximize its potential.