In this article, the author explains how Artificial Intelligence (AI) can help FP&A professionals become invaluable...

In an era marked by rapid technological advancements, the intersection of Artificial Intelligence (AI) and Financial Planning and Analysis (FP&A) is redefining how we work. The recent FP&A Trends webinar, “Human & AI Synergy in FP&A”, shed light on how it would be best to combine AI insights with human expertise. As AI continues to evolve, its integration into FP&A is not only enhancing analytical capabilities but also setting the stage for more innovative and efficient financial practices.

This article dives into the practical applications of AI in FP&A, exploring the opportunities and challenges of adopting this cutting-edge technology in corporate finance.

VMware Case Study: Practical AI Application in FP&A

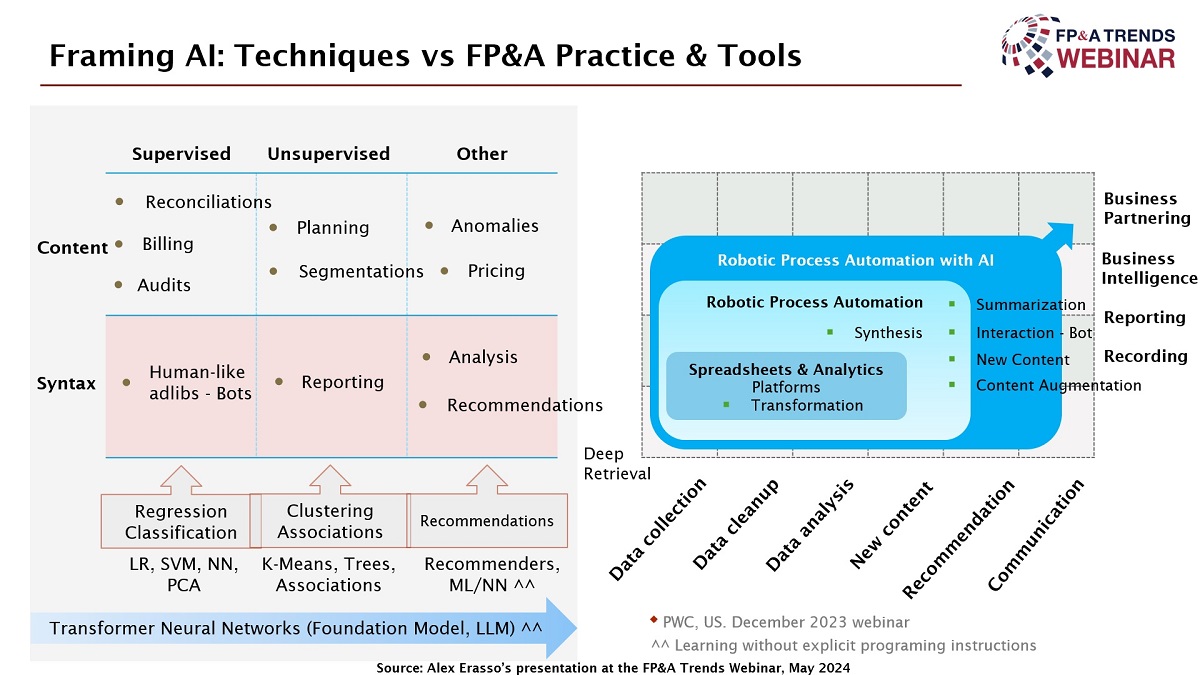

In his presentation, Alex Erasso, Former Sr. Director, Global Business Unit FP&A Finance at Broadcom (VMware), provided an extensive overview of AI applications within FP&A. Initially, Alex discussed different AI techniques, highlighting supervised and unsupervised learning. Supervised learning utilises known data labels to identify patterns, which can be beneficial in tasks like invoice processing. Unsupervised learning, on the other hand, detects patterns without predefined labels, which are useful for tasks such as customer segmentation.

Figure 1

Alex then introduced transformer architecture for neural networks, which is the cutting-edge AI architecture in vogue today. It learns without explicitly programmed rules, demonstrating significant advancements in how AI autonomously processes and analyses data. The practical application of these technologies in FP&A encompasses everything from data collection and analysis to generating actionable business insights.

Throughout the session, Alex emphasized the integration of robotic process automation (RPA) with AI to enhance various aspects of FP&A, including automating data collection and improving the granularity and relevance of financial advice. By leveraging AI, FP&A can now perform more sophisticated data analysis, leading to better strategic decisions and more effective Business Partnering.

Alex has demonstrated multiple practical cases of AI usage in VMware, including but not limited to:

- Pattern Recognition (market basket analysis),

- Segmentation (customer and partner behaviours: buying preferences and pricing),

- Deal simulations (price x volume scenarios),

- Deal discounting (line item, total deal),

- Monitoring anomalies (sales audits).

Moreover, Alex touched on the importance of regulatory and business practice adjustments needed to harness AI effectively, addressing potential risks and the need for standardised protocols to manage and protect data securely. His session concluded with a nod to the ongoing evolution and potential of AI technologies. He mentioned the example of Tesla Autopilot, underscoring the balance between technological hype and practical implementation.

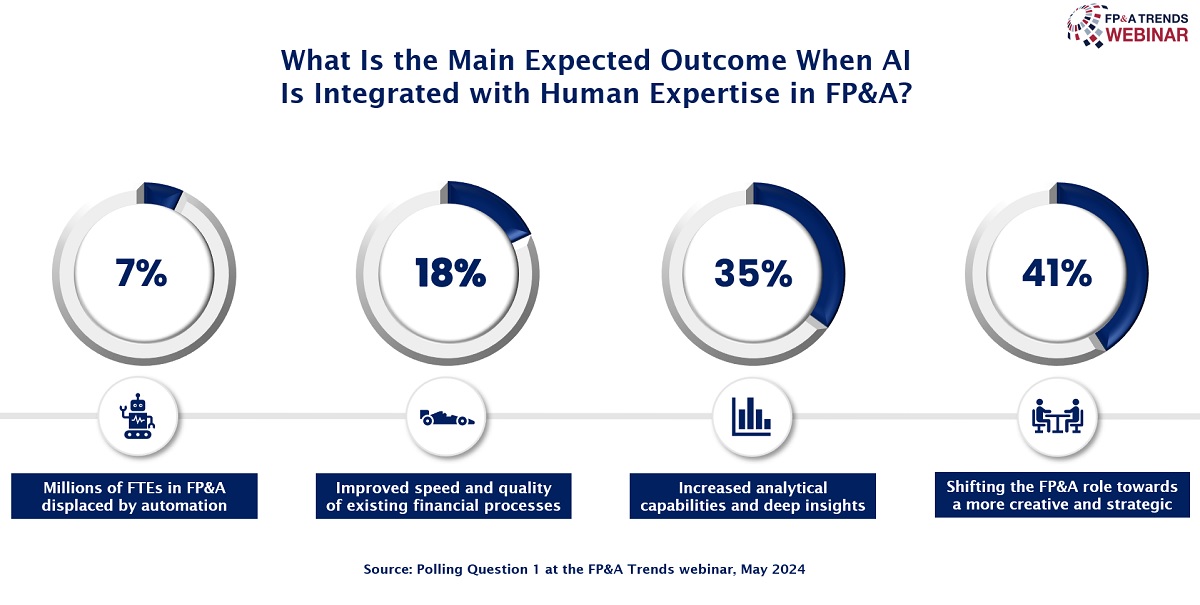

What Do We Expect from Merging AI and Human Expertise in FP&A?

Most of the webinar audience (41%) sees shifting the FP&A role towards more creative and strategic tasks as a main expected outcome. Meanwhile, another large chunk of the audience (35%) believes that the integration will lead to increased analytical capabilities and deeper insights. Another 18% hope for improved speed and quality of existing financial processes, and 7% of the audience fear that millions of FTEs in FP&A will be displaced by automation.

Figure 2

ETH Zurich Case Study: Leveraging AI for Business Steering

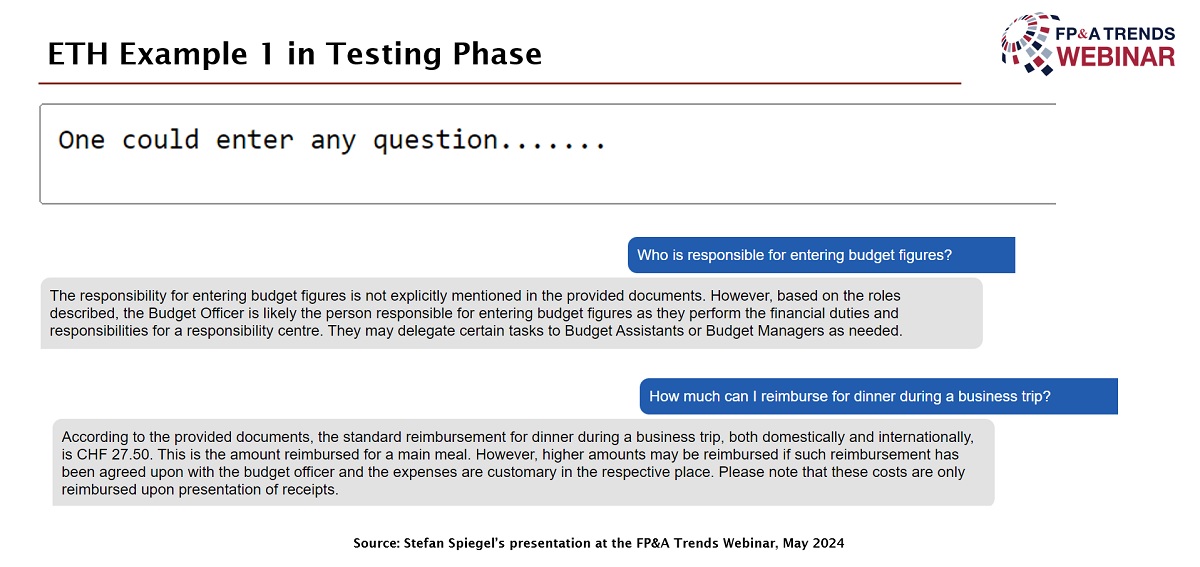

In his compelling presentation, Stefan Spiegel, CFO at ETH Zurich, highlighted practical applications of AI in Financial Planning and Analysis, focusing on business steering and administration. Stefan demonstrated how large language models (LLMs) can streamline the management of internal guidelines and regulations within organisations. By integrating these AI tools, companies can maintain all critical information securely in-house, ensuring it remains confidential.

Stefan pointed out a significant challenge with language models – dealing with inaccuracies or "hallucinations." To address this, he underscored the importance of linking AI-generated answers to the reference documents for verification, enhancing reliability and transparency.

The primary example Stefan shared revolved around simplifying corporate procedures. He explained a scenario where employees could query a language model about permissible expenses, such as dining costs, during business trips. This AI application provides immediate, specific answers, potentially including conditions under which expenses might exceed standard limits.

Figure 3

Moreover, Stefan outlined how this technology can handle complex, dynamic regulations across different countries, updating responses as rules change without the need for manual reprogramming. This approach significantly reduces the time and effort traditionally required to navigate corporate documentation.

Stefan's presentation illustrated the transformative potential of AI for optimising business operations and decision-making processes within FP&A, improving its efficiency.

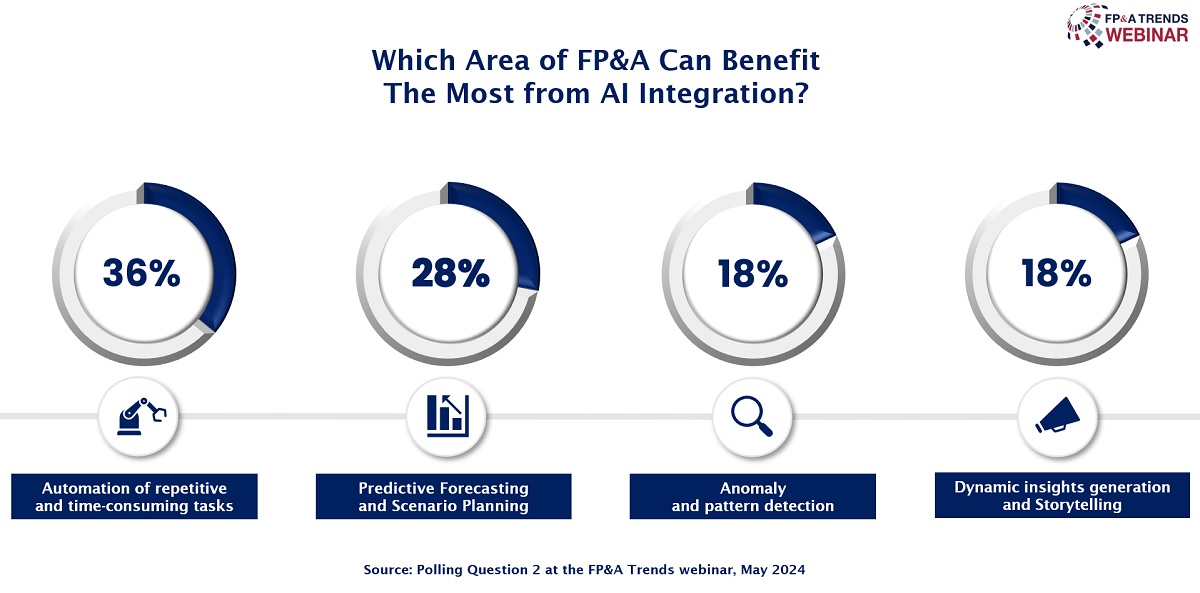

Which Area of FP&A Can Benefit the Most from AI Integration?

Most of the audience (36%) believes that AI can be most helpful in automating repetitive and time-consuming tasks. 28% see the biggest benefit coming to the area of Predictive Forecasting and Scenario Planning. The last two options, anomaly and pattern detection and dynamic insights generation and Storytelling gained 18% of responses each.

Figure 4

Technology’s Role in Enhancing AI

During his presentation, Greg Volpe, Solution Marketing Director at Workday, discussed the evolving role of FP&A driven by advancements in AI. He emphasised how AI is transforming FP&A from traditional number crunching to a more strategic advisory role within businesses. This shift means FP&A professionals will need to adapt to new technologies, moving away from manual tasks to more automated, efficient processes.

Greg outlined how AI enhances the FP&A function by automating tasks like report generation, variance analysis, and forecasting. It speeds up operations and enables FP&A teams to focus on more value-added activities, such as strategic decision-making and Scenario Planning. He highlighted the trend towards data-driven and exception-based planning, where AI tools play a crucial role in Predictive Forecasting and anomaly detection.

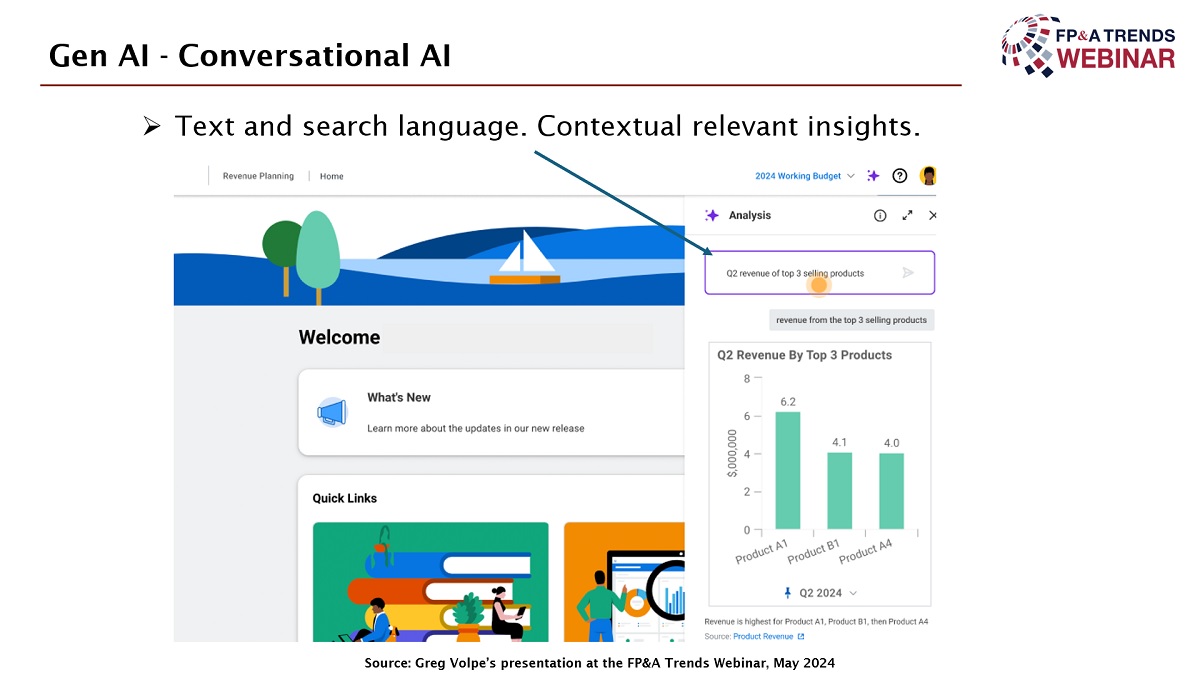

He also touched on broader AI applications, such as data anomaly detection and analysis, Predictive Forecasting and Generative AI, which can significantly impact future FP&A activities by enabling more interactive and dynamic planning processes. For instance, conversational AI can facilitate quick access to data insights through simple text queries within planning applications, enhancing the user experience and decision-making.

Figure 5

Overall, Greg portrayed AI as a tool for augmenting the FP&A role, making it more strategic while ensuring the technology remains responsible and trustworthy. This adaptation aims to fundamentally improve business operations and the nature of work in FP&A.

Conclusions

In conclusion, the integration of AI into FP&A processes promises a significant transformation in how finance teams operate. As seen in the insightful discussions from VMware and ETH Zurich case studies and further reinforced by technology expert Greg Volpe, AI is not poised to replace human roles but to enhance them. This technological evolution allows finance professionals to transition from traditional tasks to roles that require more strategic thinking and creativity. However, as AI reshapes the landscape, there is a crucial need for upskilling. Professionals must become adept at working alongside AI, understanding its capabilities, and leveraging its insights effectively.

As we forge ahead, the key to success will be continuous learning and adaptation. We will have to ensure that teams are equipped to meet the demands of an increasingly automated and data-driven world.

To watch the full webinar recording, please check out this link.

This webinar was proudly sponsored by Workday.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.