Our research paper explores the combination of PA with xP&A and how organisations are using this...

In the fast-paced landscape of Financial Planning and Analysis (FP&A), traditional methods like budgeting and the "last year plus" approach have long been the pillars of our decision-making processes. However, we all recognise that these conventional methods are no longer sufficient to navigate the complexities of today's business environment. The constant fluctuations, market uncertainties, and the ever-evolving demands from stakeholders have driven us to seek more agile and data-driven solutions. That's where Predictive Planning with AI steps in as the game-changer.

FP&A Trends webinar has attempted to answer key questions related to AI-driven planning.

This article provides an overview of the topics and cases presented and discussed by the expert panellists in the "Using AI to Enhance Your Predictive Planning and Forecasting" webinar.

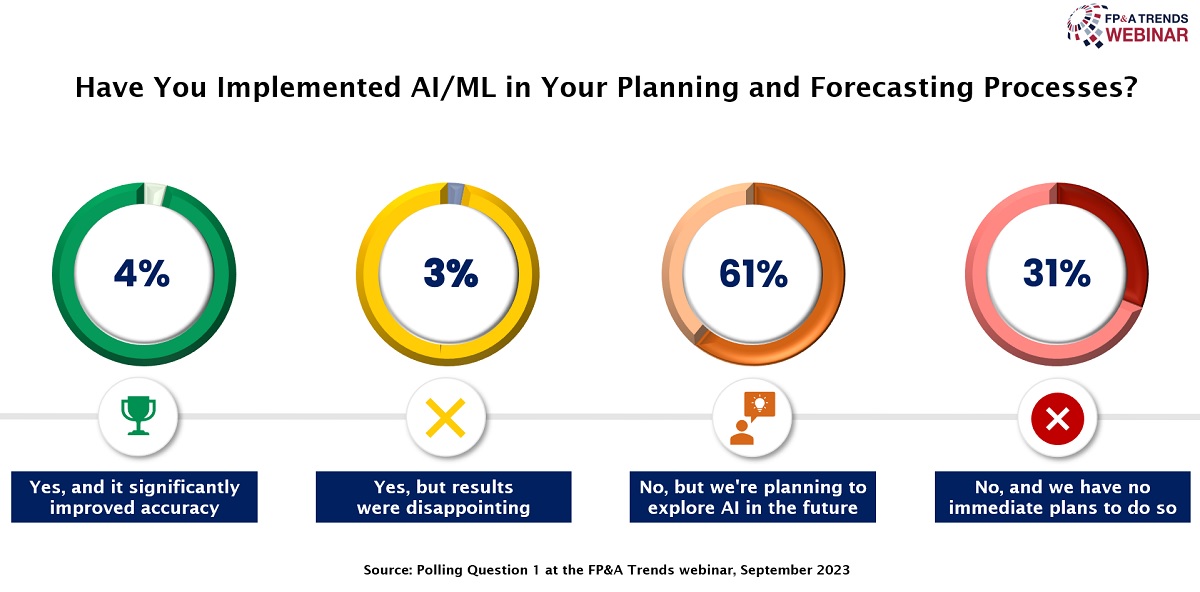

Do We Implement AI/ML in Planning and Forecasting Processes?

Most of the webinar audience (61%) is planning to explore AI in the future. In contrast, 31% of the audience has no immediate plans to do so. The remaining 8% have already implemented AI/ML in their planning and forecasting with different success rates.

Figure 1

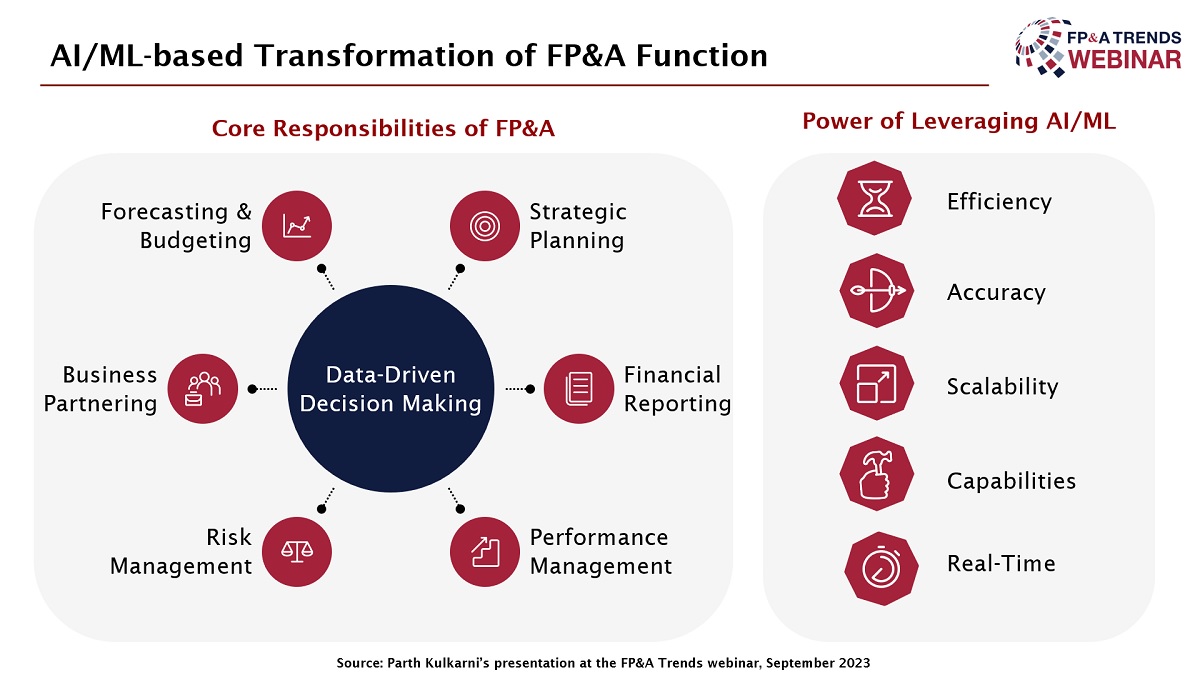

AI-Augmented FP&A Function: Longer-Term Vision

In a recent presentation, Parth Kulkarni, Director of Finance at Adobe, underscored the transformative impact of Artificial Intelligence (AI) and Machine Learning (ML) on FP&A. At the core of FP&A lies data-driven decision-making, a pivotal concept in modernising the finance function. Parth emphasised six key areas where AI and ML can revolutionise FP&A, elevating it from historical reporting to strategic Business Partnerships.

Figure 2

Parth also provided his insights regarding the power of leveraging AI/ML in FP&A.

Efficiency

AI and ML automate routine tasks, enabling professionals to focus on strategic activities. Automating processes like data reconciliation and report creation saves time and minimises errors.

Accuracy

Machines excel at repetitive tasks with precision. AI algorithms can identify anomalies in data sets, enhancing accuracy and reducing time spent on data analysis.

Scalability

AI and ML technologies handle vast datasets and complex calculations effortlessly. That makes them indispensable for large-scale financial planning, forecasting, and scenario analysis.

Capabilities

AI augments analytical and technical capabilities by identifying patterns in historical data, offering insights crucial for strategic decision-making. ML algorithms enhance detailed processes, spanning product categories, geographies, and customer segments.

Real-time

In today's fast-paced business environment, real-time data is invaluable. AI and ML continuously monitor financial metrics, market conditions, and external factors, enabling informed decisions on the fly.

Parth painted a vision where AI and ML could revolutionise FP&A further. It includes swift access to financial data akin to internet searches, actionable insights from massive datasets, enhanced forecasting and prediction, agile strategic decision-making, seamless collaboration, and accelerated automation.

By embracing these technologies, FP&A professionals can propel their roles from traditional financial management to strategic Business Partnerships. As AI and ML continue to evolve, they are set to shape a future where data-driven, intelligent, and articulate decision-making becomes the norm, with FP&A professionals leading the way.

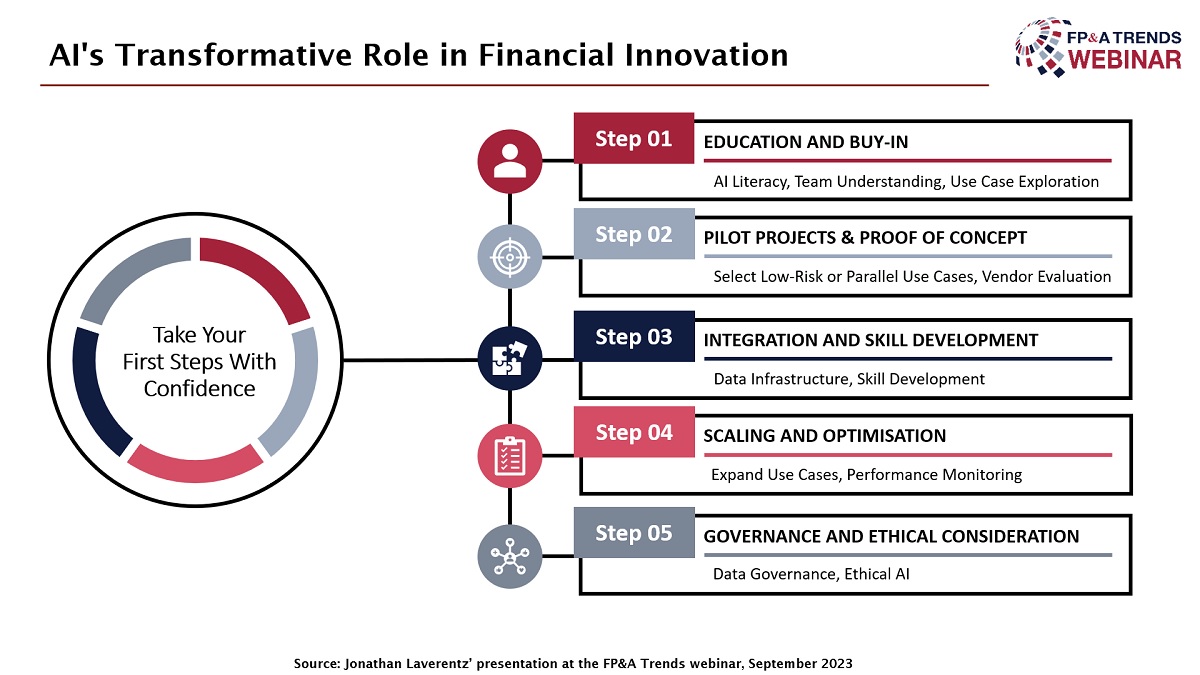

Charting a New Course: AI's Transformative Role in Financial Innovation

In his presentation, Jonathan Laverentz, Global Head of Planning Innovation, CCH® Tagetik, Wolters Kluwer, shed light on the profound impact of Artificial Intelligence (AI) on FP&A. He emphasised the symbiotic relationship between human expertise and AI, underlining that AI acts as a force multiplier, enhancing human capabilities rather than replacing them.

Jonathan highlighted the key benefits of AI adoption in FP&A, focusing on predictive planning and forecasting. By leveraging AI, financial professionals can significantly improve accuracy and reliability in predictions, enabling better-informed decisions. He stressed the importance of preserving the human element in financial strategy, emphasising nuanced judgment, ethics, and empathy - qualities AI cannot replicate.

Providing a structured approach, Jonathan outlined a five-step process for organisations to systematically adopt AI in financial planning. Starting with education and pilot projects, he underlined the significance of data quality, skill development, and continuous planning practices. Establishing robust data governance protocols and ethical frameworks is crucial to responsible AI usage.

Figure 3

In conclusion, Jonathan reiterated that, when integrated responsibly, AI empowers finance teams to work more efficiently, make informed decisions, manage risks effectively, and focus on strategic initiatives. Embracing AI, he argued, is not about replacing humans; it's about augmenting human potential and driving success in the ever-changing financial landscape.

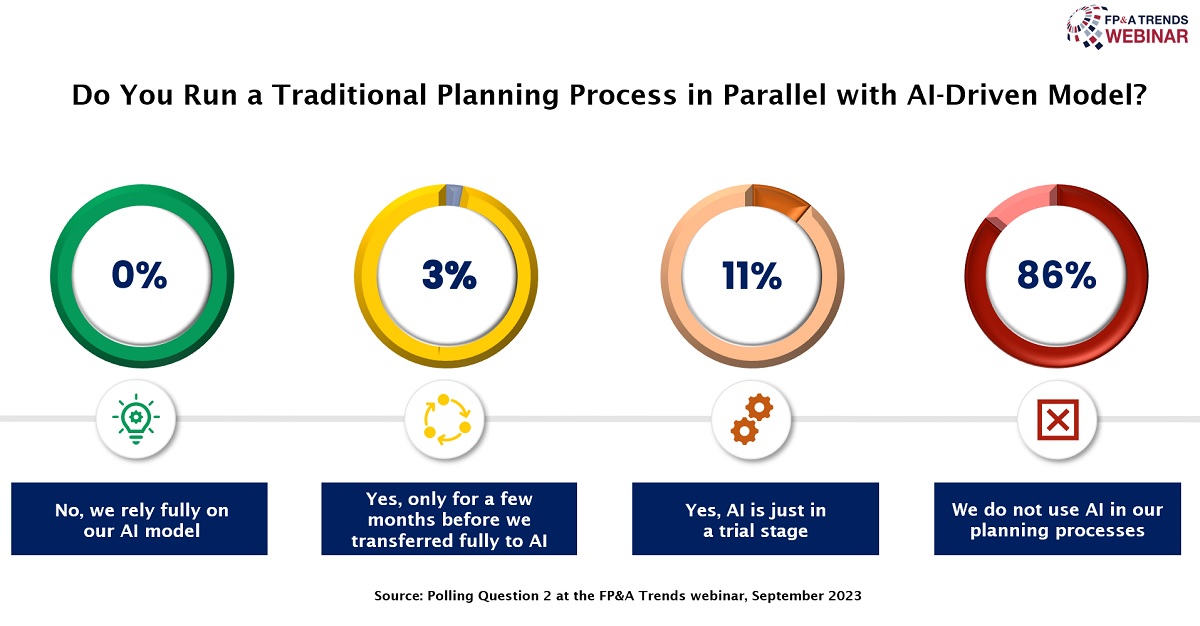

Should We Run a Traditional Planning Process in Parallel with AI-Driven Model?

86% of our audience is not using AI in planning and forecasting processes. 11% of the total audience, or the absolute majority of those who use AI, are running traditional processes in parallel as AI models are still in the early stages. The remaining 3% of the audience has fully transitioned to an AI-driven model.

Figure 4

Conclusions

AI, with its predictive prowess, doesn't eradicate human intuition. Instead, it enhances the quality, speed, and accuracy of predictive planning and forecasting. By automating repetitive tasks, identifying intricate patterns, and processing vast datasets swiftly, AI empowers finance professionals to focus on strategic analysis and creativity. This collaboration between human expertise and AI insights ensures that financial strategies remain ethical, contextual, and robust.

The future of FP&A lies in this synergy. As organisations explore AI, the narrative isn't one of replacement but enhancement. Professionals armed with AI-driven tools are better equipped to navigate the complexities of the modern financial landscape, fostering innovation, resilience, and strategic acumen. AI, as showcased in the webinar, is the cornerstone of a more efficient, informed, and agile FP&A landscape, where human intellect remains the guiding force.

To watch the full webinar recording, please check out this link.

We are grateful to Wolters Kluwer/CCH® Tagetik for sponsoring this webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.