The Stockholm FP&A Board met on September 19, 2023. The event was attended by 26 finance leaders and senior FP&A practitioners. The attendees, representing leading global and local companies such as Google, Microsoft, Apple, Amazon, Electrolux, Scania, MediaMarkt, SEB and many others, discussed moving to the concept of Extended Planning and Analysis (xP&A) and how it can be utilised when organisations need to respond quickly to fast-moving events.

The event was sponsored by Pigment, InHouse and IWG.

This article summarises some key takeaways from the meeting.

Figure 1: Stockholm FP&A Board Members, September 2023

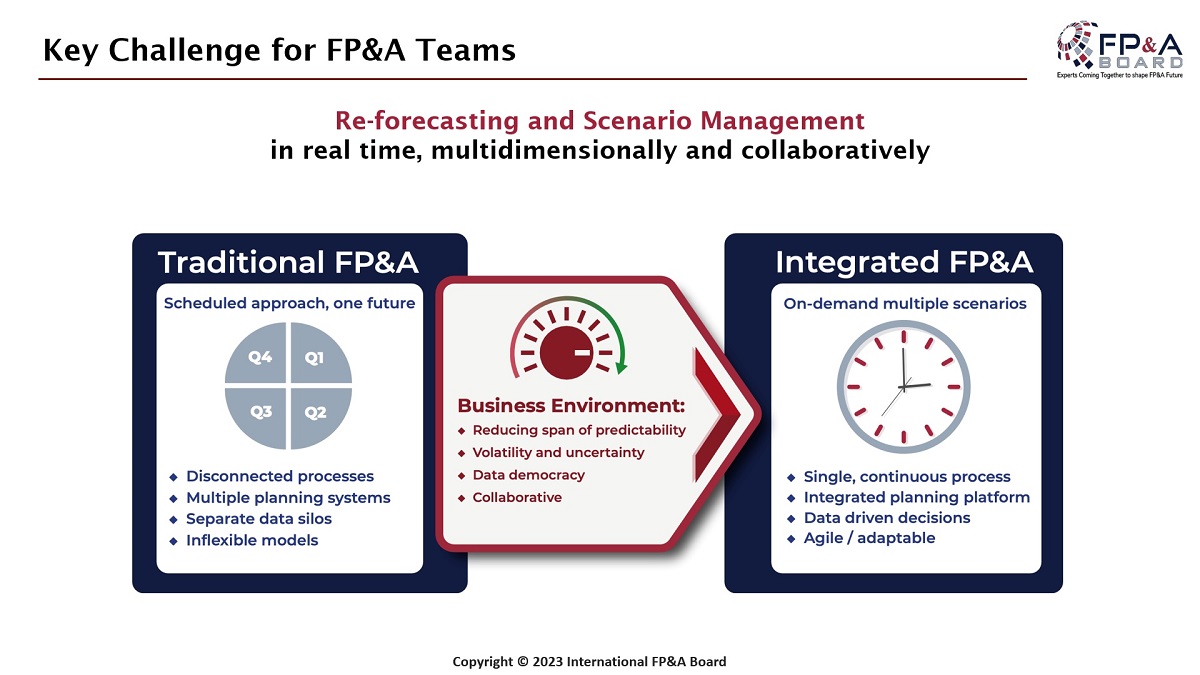

Key Challenge for FP&A Teams

At the start of the meeting, the participants shared their thoughts on the key challenges that FP&A teams face.

The most cited challenges include:

- Collaboration

- Complexity

- Time constraints

- Uncertain market conditions and scenarios

- Change Management

The challenges faced by the participants of the Stockholm FP&A Board are well aligned with those of thought leaders in other regions. Then, the forum transitioned to the discussion about Integrated FP&A.

Figure 2: Development of FP&A: from Traditional to Integrated FP&A

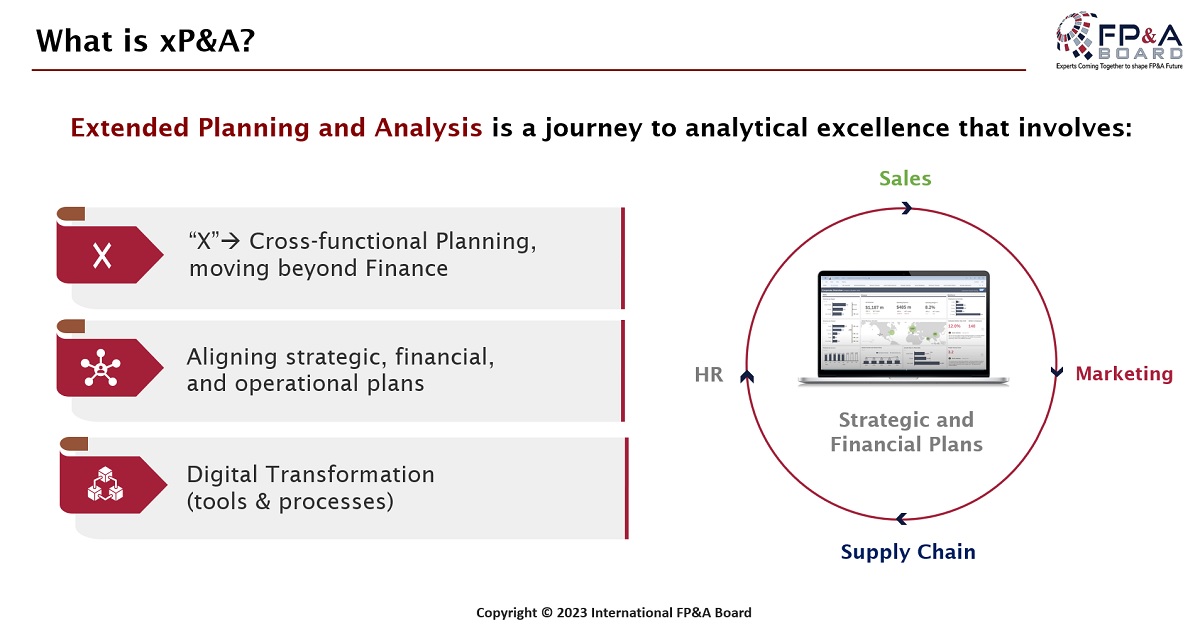

Extended Planning & Analysis (xP&A): Key Concepts and Definitions

The concept of Extended Planning & Analysis (xP&A) goes beyond the concept of FP&A by aligning the three key planning processes within the organisation:

- Strategic Planning,

- Financial Planning,

- Operational Planning.

XP&A integrates these planning activities horizontally and vertically as one single continuous process.

Figure 3: Concept of xP&A

The members of the Stockholm FP&A Board discussed their experiences with xP&A. Some of the major benefits are the increased focus on profitability drivers and cross-functional involvement. This leads to:

- Focus on leading rather than lagging KPIs and will thus put the spotlight on the areas that drive value creation.

- Improved collaboration and inclusion, resulting in higher ownership and accountability.

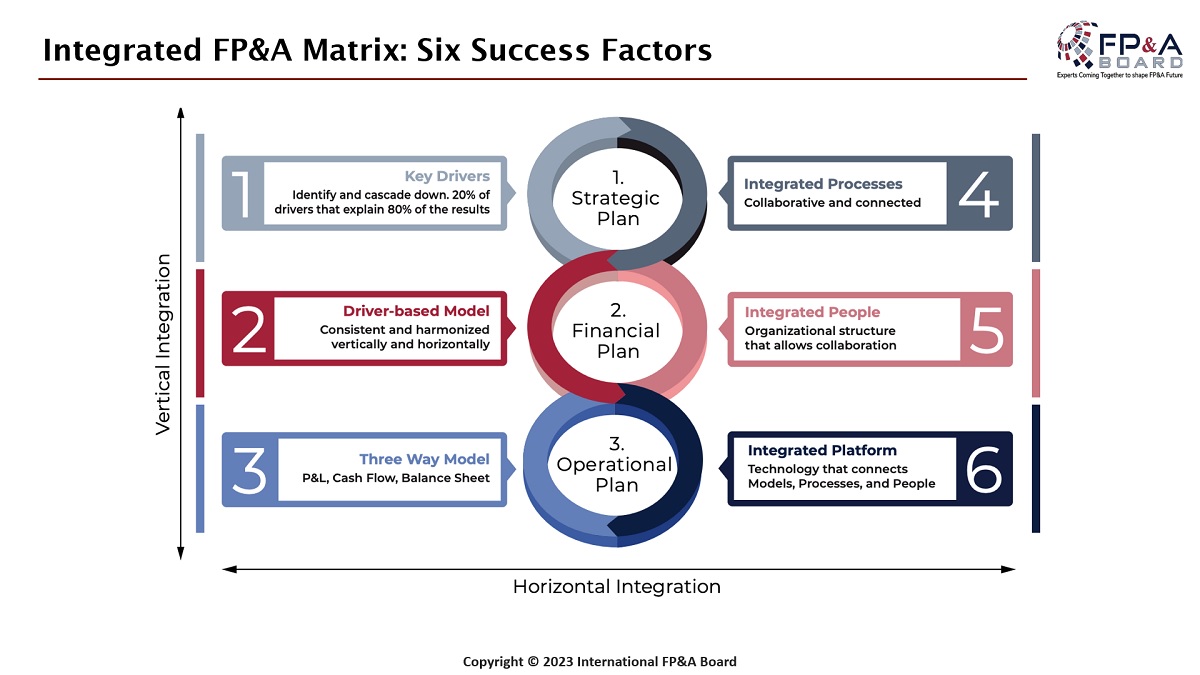

Key Success Factors of Integrated FP&A

Larysa Melnychuk, the MD of the International FP&A Board, presented the six key success factors for achieving integration. These involve the three planning processes in the organisation (strategic, financial and operational) and require a sound understanding of the business and its key drivers and a driver-based model that will translate activities and assumptions into a three-way financial model (P&L, BS and Cash Flow). It must be integrated in terms of process, people and platforms in order to make it work.

Figure 4: Key Success Factors to Implement xP&A

Practical Experience from the Field

Carl Stiller, Senior Business Controller Finance Transformation (Interim) at Transdev Sverige AB, shared his practical experience from one of his assignments with a Swedish taxi company. For the company’s planning, it was critical to include key drivers and non-financial KPIs in their FP&A. Drivers critical to their financial performance included weather-related data and predictions on where demand for taxis would occur. They also developed predictive models in order to manage staffing and training of new drivers.

Initially, the concept was very challenging to manage. They did not have appropriate IT tools and relied heavily on a few individuals and a complex set-up of spreadsheets. Once they implemented relevant IT tools, they could pave the way to significant improvements and integrate processes, people and platforms. Finally, they managed to add significant value in terms of improved planning and decision support.

Conclusions and Recommendations

Figure 5: Group Work during the Stockholm FP&A Board, September 2023.

The meeting was concluded with a break-out session and a discussion on how to best implement xP&A.

Through a lively discussion, the attendees identified the key steps/factors to consider before implementing xP&A in the three categories: Data & Models, Systems & Processes, and People & Culture. The key takeaways from the group work are summarised below.

Data & Models:

Pain points:

- Lack of relevant data (key drivers and data integrity)

- Slow and inflexible models

- Lack of ownership (blaming finance)

Solutions:

- Accountability & Follow-up

- Feedback loop

- Keep calm & simplify

Systems & Processes:

- Integrating systems (CRM, HRIS, ERP, etc.)

- Getting the “basics” in place

- Alignment across processes

- Keep it simple!

- Information flow across systems

People & Culture:

- Buy-in from management

- The right people in the process

- Push from management

- Culture of learning

- Create ownership/accountability

After the meeting, the participants could engage in an informal discussion and share their thoughts with like-minded colleagues. We look forward to the next FP&A Board in Stockholm, centring on crucial FP&A Team Roles.