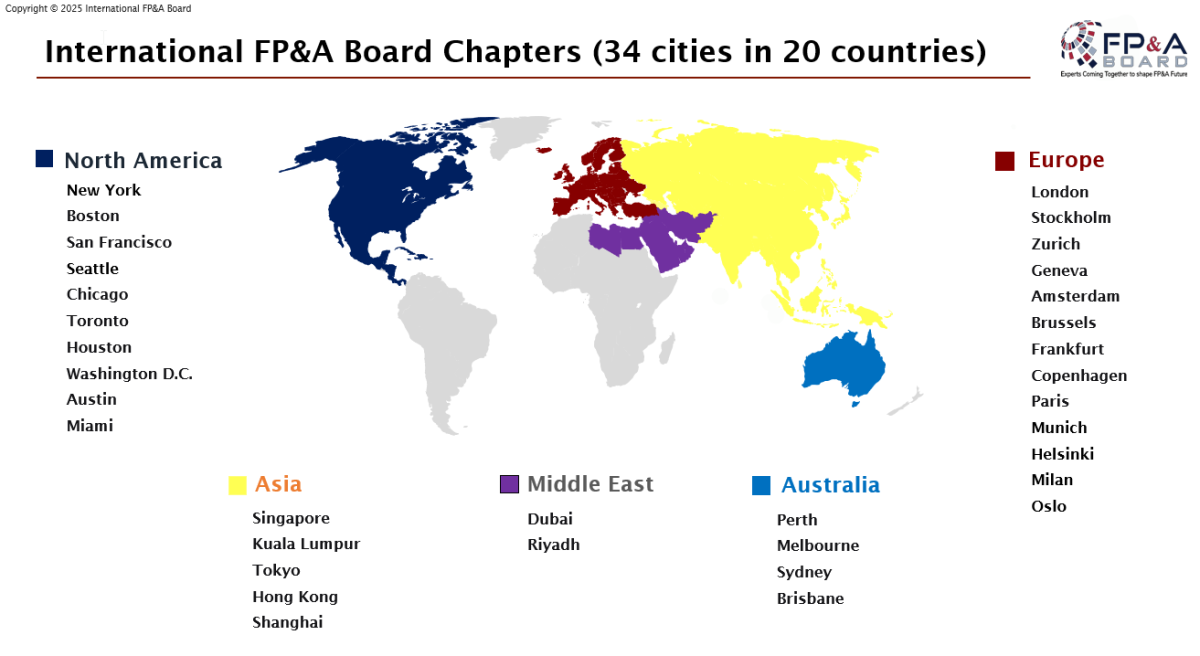

On 16 September 2025, the International FP&A Board launched its first chapter in Norway with the inaugural meeting of the Oslo FP&A Board. This historic event marked not only the 34th chapter worldwide and the fourth in the Nordic region, but also the expansion of the FP&A Board into its 20th country.

The event took place at the beautiful IWG venue and was supported by Wolters Kluwer CCH Tagetik, in partnership with EY and Stanton Chase. Senior finance leaders, CFOs, and Finance Directors from across Norway came together to exchange ideas and reflect on how FP&A is evolving in an increasingly uncertain environment.

Modern FP&A: The Central Theme

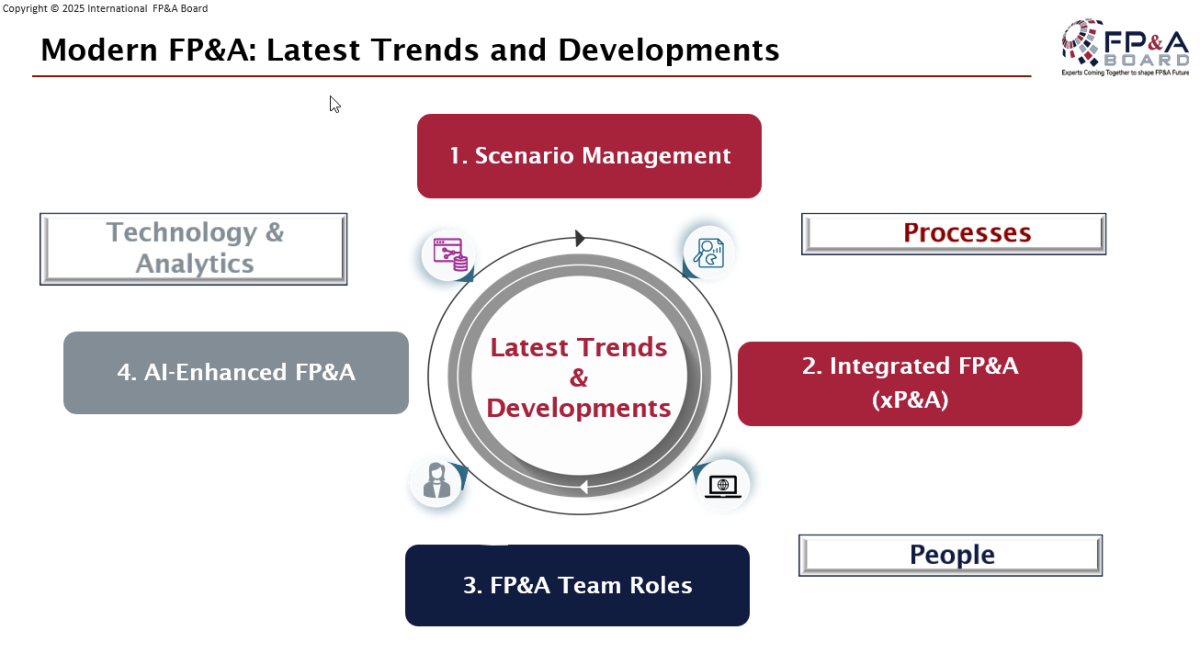

The session explored Modern FP&A: Latest Trends and Developments. This provided the framework for a rich and interactive conversation on the challenges finance teams face today and the opportunities offered by integration, new skills, and emerging technologies.

Figure 1

Scenario Management: Planning for Uncertainty

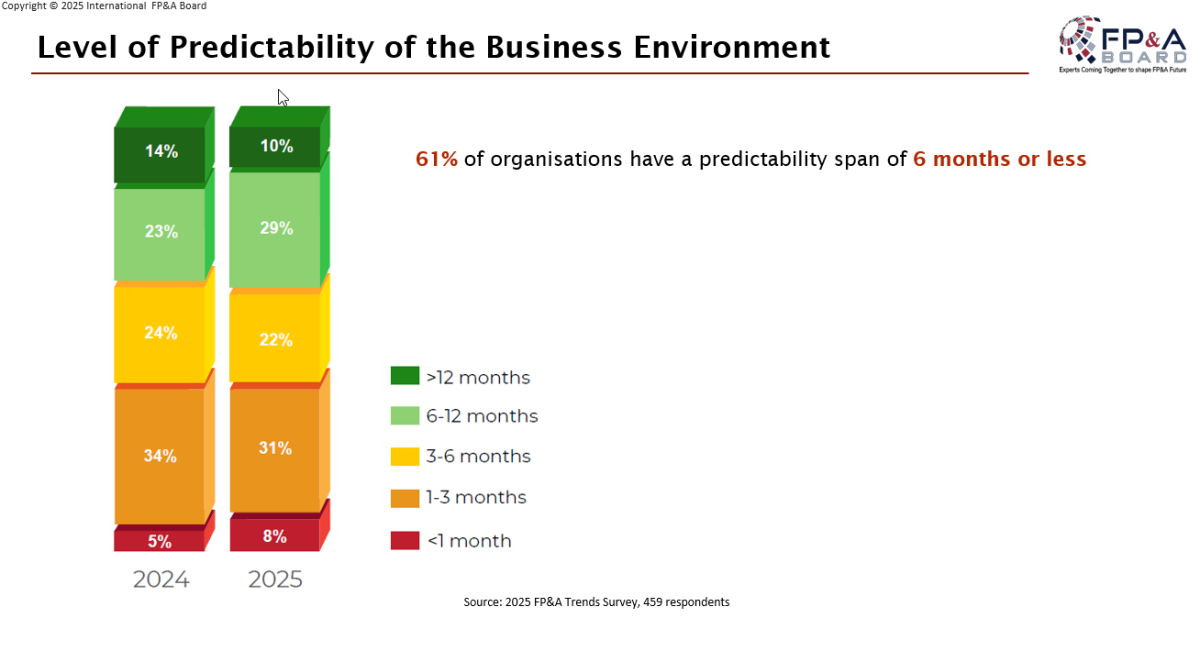

Traditional planning methods are under pressure. According to the latest FP&A Trends Survey, 61% of organisations now face a predictability span of six months or less. Scenario management is seen as the way forward, yet only 18 % of companies can run scenarios in under one day.

Figure 2

The debate in Oslo stressed that agility must be measured not only by speed but also by relevance. Scenarios add value only if they support decisions. One participant remarked:

“We can run scenarios faster than before, but if they don’t answer the questions our executives are asking, the work adds little value.”

Integration and xP&A: Breaking Down Silos

The second trend was Integration. While the concept of Extended Planning and Analysis (xP&A) is widely discussed, only 10% of organisations have fully integrated planning processes, and a quarter remain almost entirely siloed.

Oslo participants agreed that integration is not simply a technological exercise. People, governance, and processes are equally important.

A case study shared during the discussion illustrated how weekly joint meetings between finance and operations drove more impact than any new system.

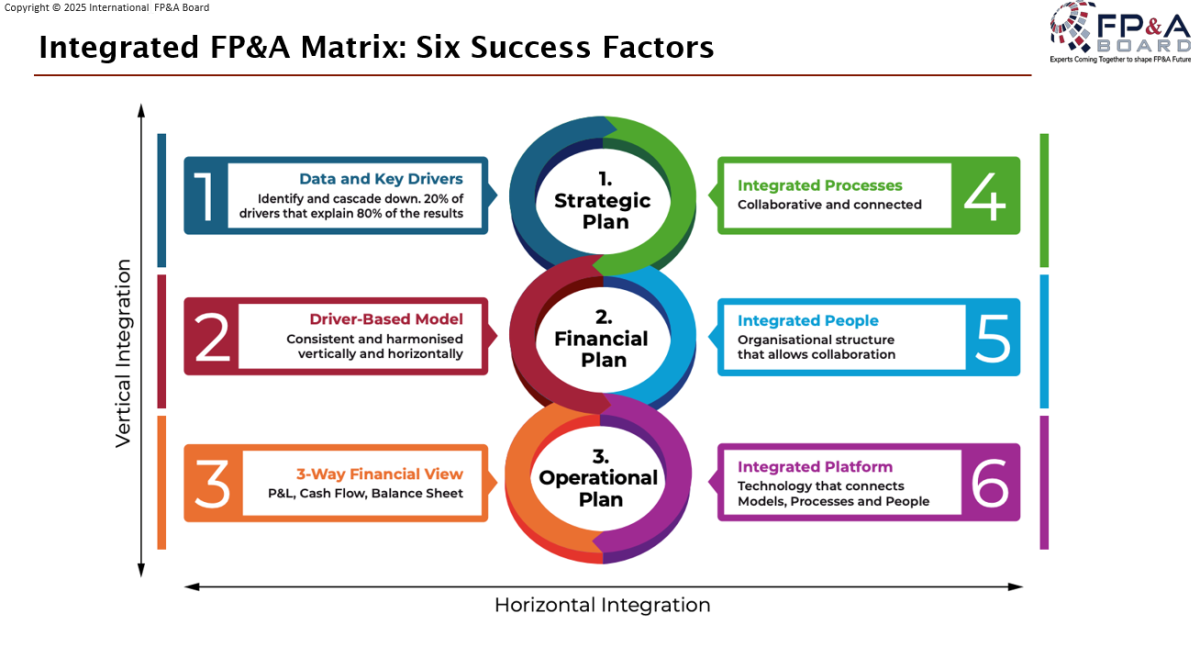

Figure 3

Six success factors were highlighted as common enablers: consistent data and key drivers, driver-based models, a three-way financial view, integrated processes, integrated people, and an enabling platform. These factors also underpin the FP&A Maturity Model, which helps organisations understand their current level and future pathway.

People, Skills, and the Changing FP&A Role

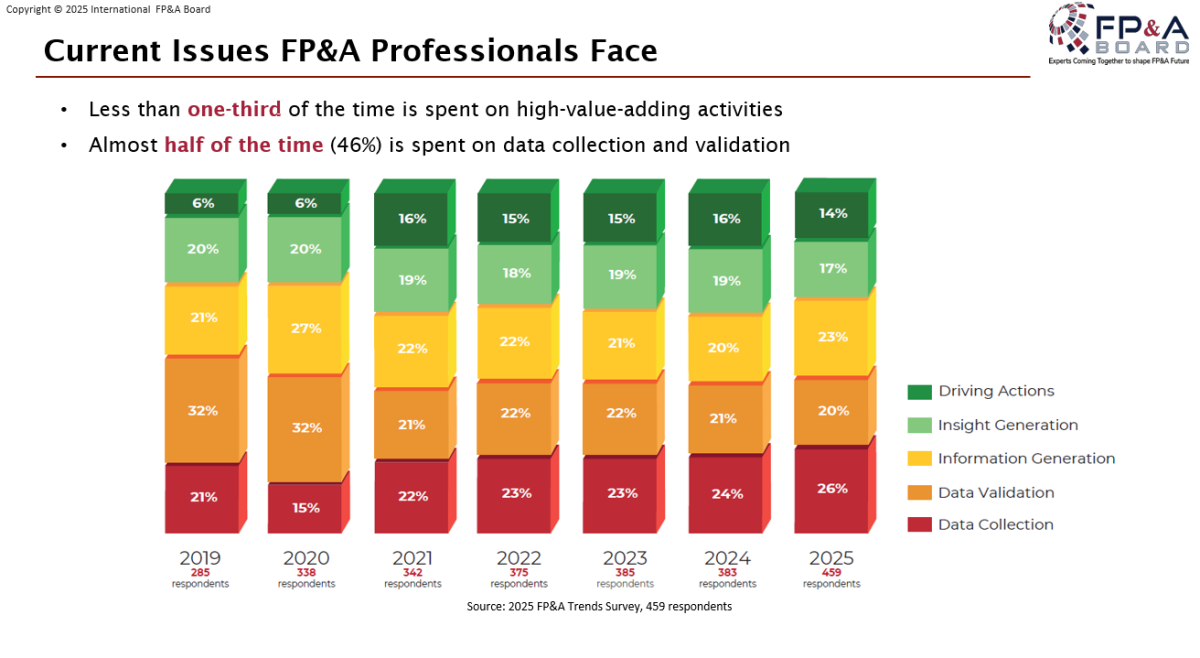

Technology and process matter, but FP&A ultimately depends on people. Globally, professionals still spend almost half their time on data collection and validation, with only about a third devoted to genuine value-adding activities.

Figure 4

This imbalance resonated strongly with the Oslo participants. At the same time, expectations are shifting.

As Siemens Healthineers’ Saurabh Jain put it:

“Storytelling with data will be the skill differentiator for FP&A professionals.”

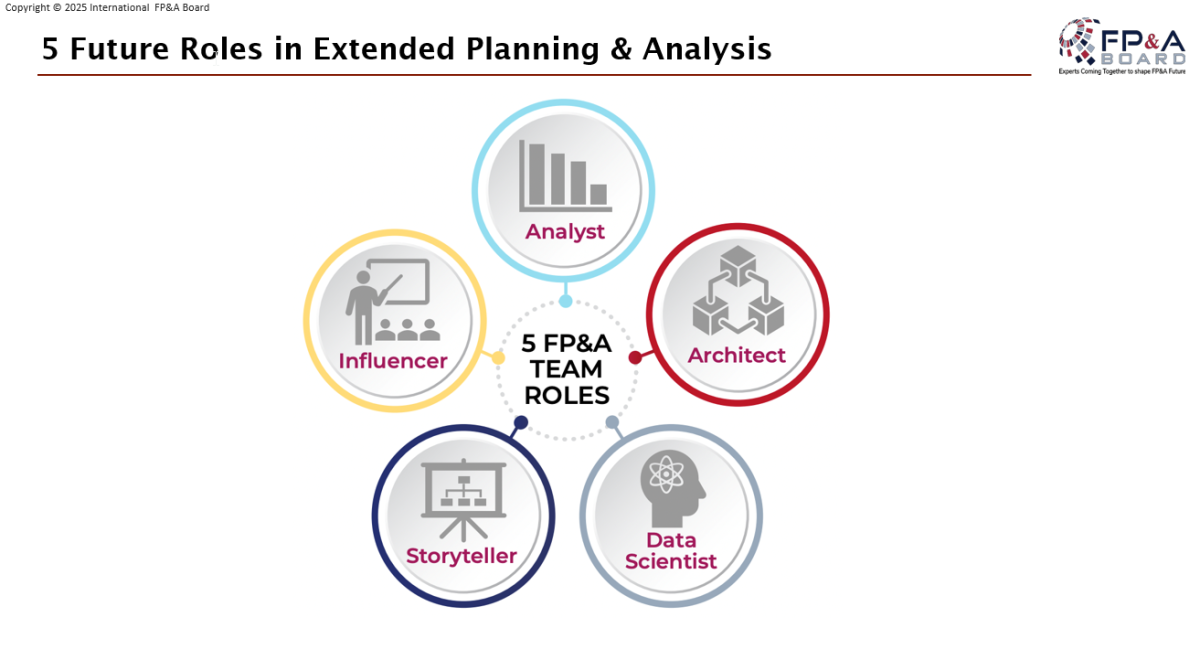

Figure 5

The meeting highlighted five emerging roles that are redefining FP&A: Business Partner, Data Scientist, Storyteller, Architect, and Visionary. Participants reflected on which of these roles they already see in their teams and which are still missing.

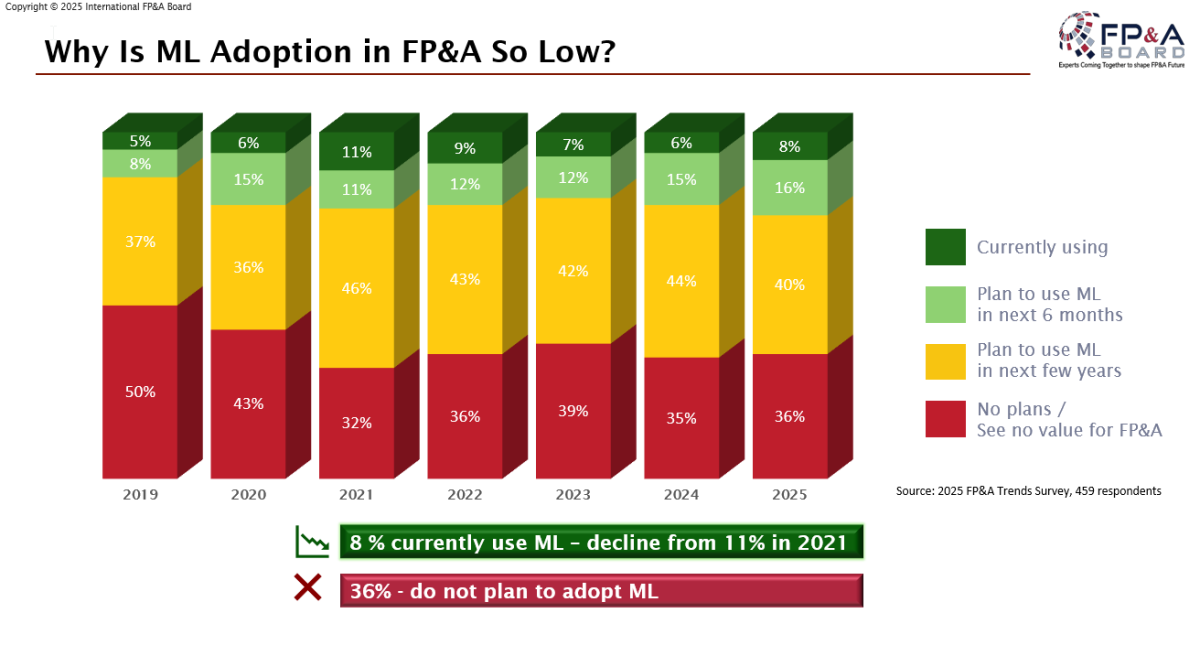

AI-Enhanced FP&A: From Hype to Practical Value

The final trend addressed AI and Generative AI. While hype is everywhere, adoption remains uneven. Only 8 % of FP&A teams currently use Machine Learning for forecasting, and a third have no plans to do so. Generative AI is moving faster: 18 % are experimenting, and 25 % are planning adoption, though more than half have not yet engaged with it.

Figure 6

Barriers include trust, skills, and data quality. One CFO described how an AI project delivered technically sound models but was abandoned because stakeholders did not believe the outputs.

At the same time, benefits are emerging. Organisations with AI-enabled platforms and strong processes report better performance and more accurate forecasts. A metaphor captured the contrast: some teams are still at the “Nokia stage”, while others have moved to the “iPhone stage” — predictive, AI-enabled, and integrated.

To close, participants were introduced to the FP&A AI Maturity Model, developed in partnership with EY. Time allowed only for a brief overview, but the recent research paper How AI is Transforming FP&A was shared as a resource for deeper exploration.

Case Insights

The Oslo launch was enriched by practical contributions.

Jon Christensen, Finance Director at OBOS, shared the company’s journey towards best-in-class FP&A, offering a local example of transformation in action.

Ville Aavikko, CPM Expert at CCH Tagetik, demonstrated What a World-Class FP&A System Can Do: Predictive Planning, Scenario Modelling & AI, showing how technology can support the shift from aspiration to reality.

Building a Global Community

The launch of the Oslo FP&A Board was possible thanks to the support of Wolters Kluwer CCH Tagetik, with EY, Stanton Chase, and IWG as valued partners. Their involvement reflects the shared belief that finance must evolve to guide organisations through uncertainty.

With Oslo, the FP&A Board is now active in 34 chapters across 20 countries.

What began in London in 2013 has grown into a global think tank where senior finance leaders share, debate, and shape the future of FP&A.

Figure 7

Conclusion

The inaugural Oslo FP&A Board captured both the urgency and the opportunity of modern FP&A. Scenario management, integration, people and skills, and AI are not abstract themes; they are live challenges shaping every finance function today.

The enthusiasm and openness of the Oslo participants showed that Norway is ready to play its part in the global FP&A conversation.

Global reach. Tangible impact. Human connection.